A closer look at giant VC Paradigm: a model of value in crypto investments

Paradigm positions itself as a research-driven technology investment firm focused on the crypto industry and other cutting-edge related technologies. Paradigms investment style often involves it in the early stages of projects, with investment amounts ranging from millions to hundreds of millions of dollars, and continues to provide support to the invested companies after the investment, including technology (mechanism design, safety, engineering ) to operations (recruiting, go-to-market, legal and regulatory strategy) and beyond.

After several years of development, according to public data, Paradigm’s employees have expanded to nearly a hundred employees, which is already a large scale for a crypto-native fund.

How did Paradigm grow into one of the top crypto funds?

Even in web3, financing or not is an important indicator to judge whether a project has potential, especially if it receives early investment from a leading fund like Paradigm, it will form strong positive feedback in the market (such as the previous Friend .tech), which stems from everyone’s trust in the leading crypto funds. So how did Paradigm make its fortune and grow into one of the most well-known crypto funds?

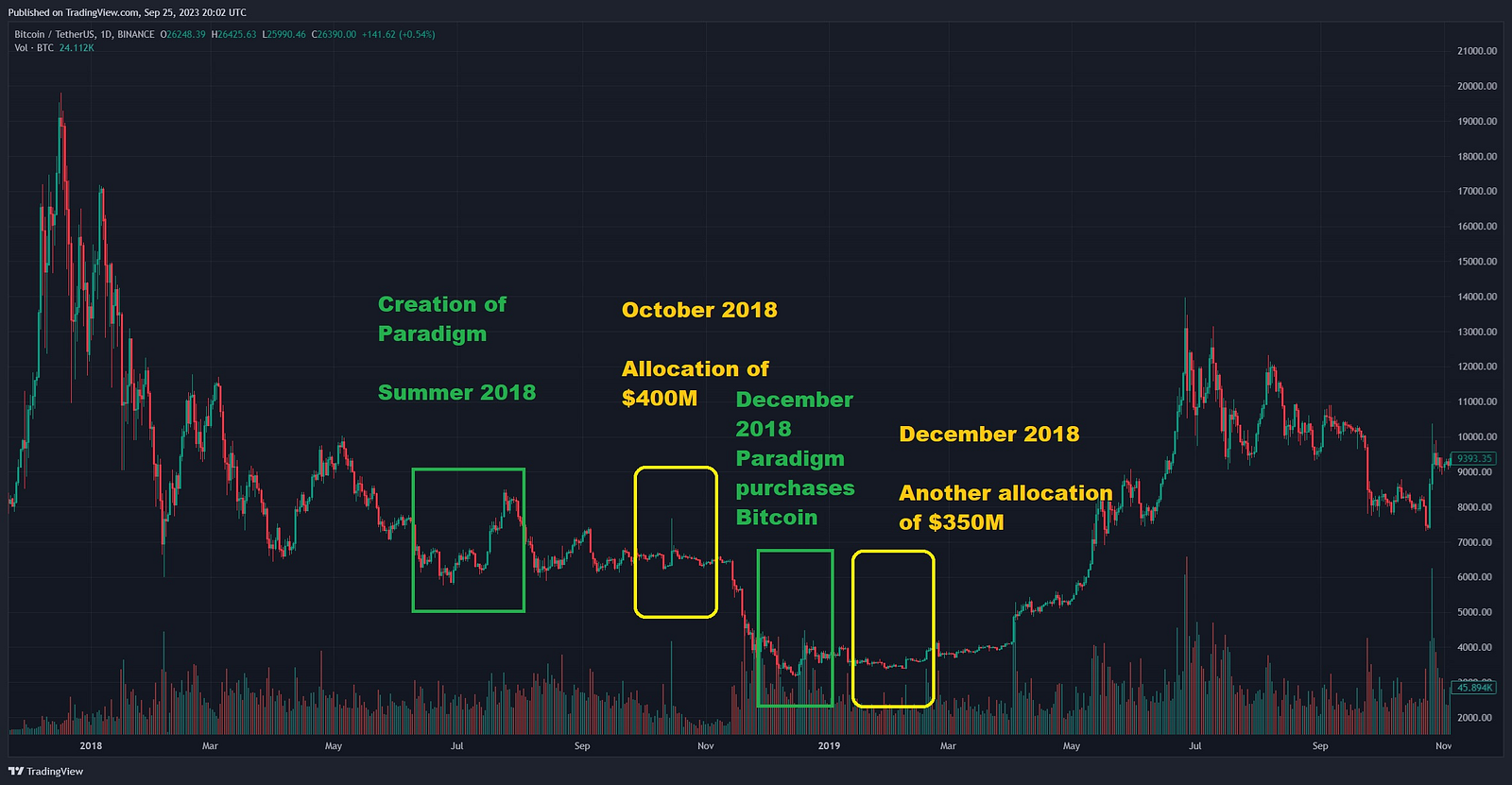

Paradigm was founded in 2018 and received $400 million in initial financing from Yale University’s endowment that year.

It can be said that Paradigm made its fortune in BTC. In the bear market of 2018, it chose to invest mainly in BTC and ETH. Whether it was based on strong judgment of the market or luck, Paradigm achieved a perfect bargain hunting in its first investment. After learning of the news, the endowments of Harvard and Yale invested an additional approximately $350 million in Paradigm.

Paradigm bargain hunting BTC timeline (Source: Twitter user: @splinter 0 n)

After successfully surviving the bear market, what really made Paradigm famous was the huge success it invested in Uniswap, which was incubated in 2019. People gradually paid attention to this crypto-native fund that adheres to the philosophy of research first and deep participation in investment. The success of the back-to-back investments led Paradigm to close another $2.5 billion fundraising round in November 2021.

If Uniswap is just a lucky bet by Paradigm, that doesn’t mean much. However, several other projects it invested in early on (such as Lido, Optimism, dYdX, and Blur) have also achieved success, making Paradigm a well-deserved growth into a top crypto fund as famous as a16z, Coinbase Venture, etc.

However, in May this year, Paradigm was also involved in a public opinion storm. The reason was that Paradigm silently deleted the content of Crypto when updating the company profile on its official website, and was questioned about abandoning the encryption industry and embracing the more popular AI industry.

Many people therefore accused Paradigm of treachery and that crypto-native funds should not have invested their money in other areas. Due to the pressure of public opinion, Paradigm had to add the sentence We focus on crypto and related technologies at the frontier (We focus on crypto and related technologies at the frontier) at the beginning of the new official website to calm the public outrage.

But judging from the facts, only one of Paradigm’s currently disclosed investment projects is related to AI (ArenaX Labs), and ArenaX Labs is making a Web3+AI game and has not completely separated from the encryption industry.

But even if we take a step back, facing the current mixed encryption market, it is understandable that Paradigm chooses to expand its investment areas. After all, for a large-scale fund that has passed through the initial stage, expanding the scope of investment and diversifying risks is a more common and sustainable strategy.

How does Paradigm integrate technology research into its organizational structure?

Paradigm was co-founded by Matt Huang and Fred Ehrsam. Matt Huang was previously a partner at Sequoia Capital. Matt Huang focuses on early-stage venture capital and has been an angel investor in companies such as ByteDance and Instacart (an American delivery company).

Fred Ehrsam was previously the co-founder of Coinbase and served as President of Coinbase from 2012 to 2017. He also worked at Goldman Sachs for a period of time before founding Coinbase. Fred Ehrsam has been paying attention to the crypto field since he bought his first Bitcoin in 2011, and has become an angel investor in some crypto high-growth companies, with rich investment experience.

Matt Huang (left) and Fred Ehrsam (right)

It is worth noting that in Paradigm’s team, in addition to employees with financial investment backgrounds and functional employees, cryptography-led researchers also account for a large proportion and some have high-level positions.

For example, Charlie Noyes, Paradigm’s No. 3 employee, is a crypto-technology-led researcher. He and his team have published papers on Uniswap, MEV, Cosmos and other fields; there is also general partner and research director Dan Robinson, who focuses on researching blockchain Chain protocols and smart contracts. During the investment incubation of Uniswap, Dan Robinson and his team helped solve many Uniswap liquidity and smart contract problems.

There are also other researchers in key positions, such as Georgios Konstantopoulos, research partner and chief technology officer, and samczsun, research partner and head of security. Paradigm’s technical research-driven investment philosophy is fully reflected in its organizational structure.

Matt Huang explained in an interview in the early years that Paradigm, as an investor, not only writes Twitter threads (long tweets) for the project, but also hopes to write contracts with the project.

What are the characteristics of Paradigm’s external investments?

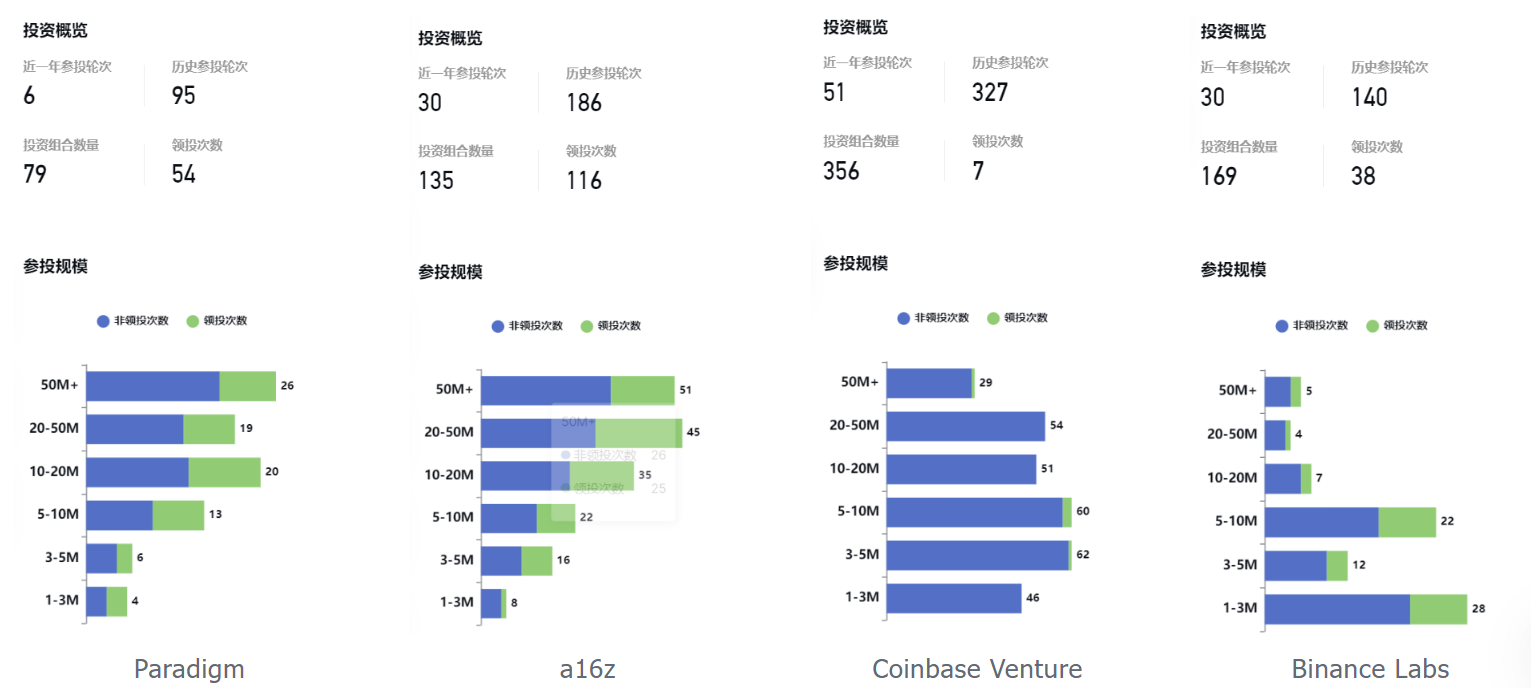

According to Rootdata data, Paradigm has publicly participated in a total of 95 rounds of investment, of which it has led 54 times, and the total number of investment projects in history is 79. The following is a comparison with several other head encryption institutions:

Compared with several other leading crypto institutions, Paradigm’s lead investment rate is 56.8%, second only to a16z’s 62.3%, and much higher than Coinbase Venture and Binance Labs;

Comparing the scale of investment participation, the native crypto funds Paradigm and a16z both have an inverted trapezoidal distribution, and participate in a larger proportion of large investment projects of more than 20 million, while Coinbase Venture and Binance Labs, which are the companys strategic investment departments, both have a positive trapezoidal distribution, showing The rain and dew style of play and the just throw a little bit of everything attitude;

But comparing the total number of shots taken, Paradigm is relatively restrained, taking only 6 shots this year. In summary, it can be seen that Paradigm investment also has the characteristics of weak water can only take a scoop and dare to make big bets.

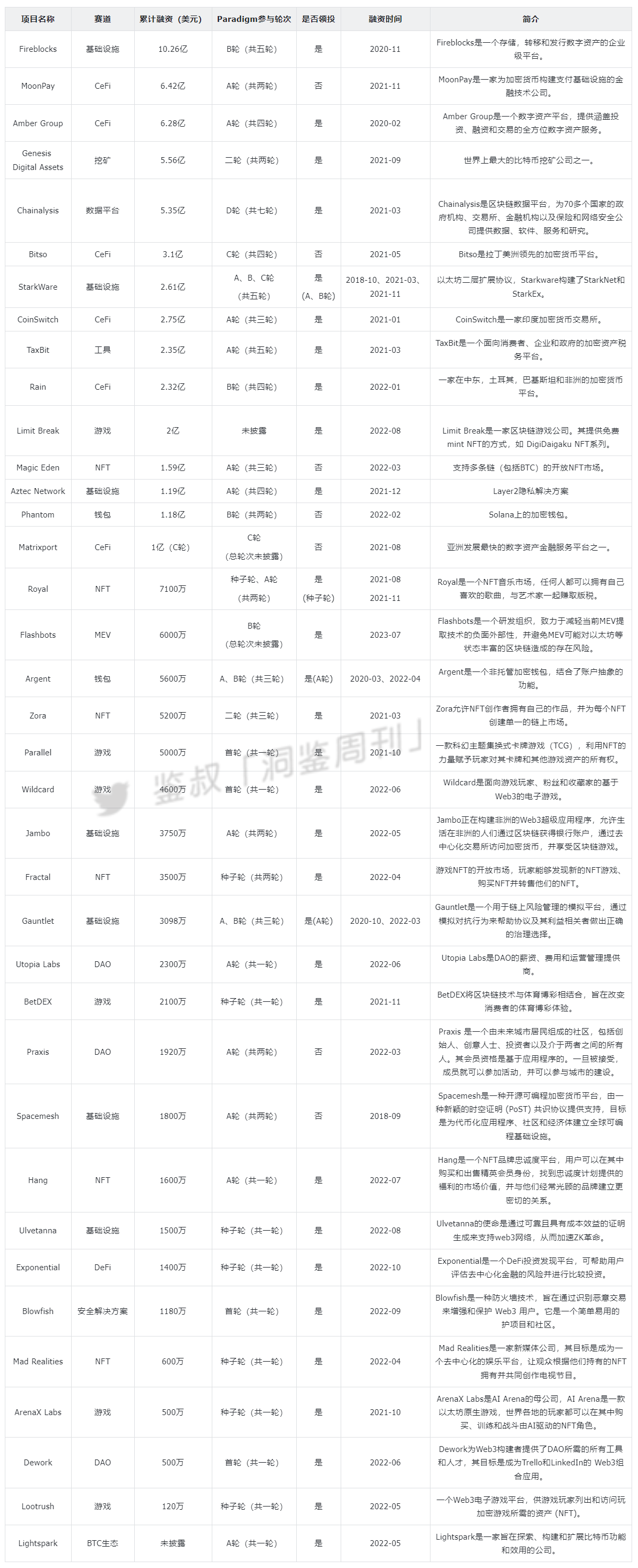

The following is a list of Paradigm investment projects compiled by the author, excluding projects that have already issued coins and RUGs, for readers and friends to make decisions as a reference (sorted by cumulative financing amount).

Of course, no investment institution in this world is always right. Even though Paradigm maintains a relatively restrained investment style, there are 10 to 15 projects in its portfolio that have been suspended. In particular, the FTX thunderstorm caused Paradigm to lose about 215 million in funds.

Summary and reflections

After understanding the development and investment situation of Paradigm, the author believes that Paradigms situation and investment style are very similar to that of a well-known investment institution in China - Hillhouse.

From the perspective of fortune, it is a coincidence that Hillhouse’s first capital also came from the Yale University Endowment Fund;

Judging from the performance, Paradigm became famous through in-depth incubation of Uniswap, and Hillhouse made a lot of money through its early heavy position in Tencent.

From the perspective of investment philosophy, Paradigm’s concept of deeply participating in project construction also coincides with the concept of “walking with entrepreneurs” once proposed by Hillhouse, but both parties have the characteristics of daring to make big bets.

Hillhouse and its founder Zhang Lei were once known as the godfather of value investing in China, focusing on investing in projects that have long-term value and are beneficial to society. In the crypto industry filled with impetuous emotions, Paradigm, which puts technical research first, seems to be setting a benchmark for value investment in the crypto industry.

Disclaimer: All contents on this website may involve project risk matters and are for science and reference purposes only and do not constitute any investment advice. Please treat it rationally, establish a correct investment philosophy, and increase your awareness of risk prevention. It is recommended to comprehensively consider various relevant factors, including but not limited to personal purchasing purpose and risk tolerance, before interacting and holding.

Copyright notice: The copyright of the quoted information belongs to the original media and author. Without the consent of Jian Shu J Club, other media, websites or individuals are not allowed to reprint the articles on this site. Jian Shu J Club reserves the right to pursue legal liability for the above-mentioned acts.