The adoption rate has ranked first in the world for two consecutive years, and crypto exchanges have seized the Vietnamese market

Original author: Xiyou, ChainCatcher

Favorable conditions created by potential population growth dividends, relatively tolerant regulatory policies and low operating costs have made Vietnam a gold-mining treasure in the eyes of people from all walks of life.

In 2021, the popularity of the chain game product Axie Infinity has successfully attracted the attention of the Web3 industry to the Vietnamese market. There are even many opinions that Vietnam may become an important driving force for the next wave of crypto bull market, and the focus of cryptocurrency transactions will also be From todays South Korea and Japan, it has slowly migrated to emerging Southeast Asian markets such as Vietnam and the Philippines.

In early August, the Wall Street Journal published a report onBinance China market operations》In an exclusive article, it was revealed that the Vietnamese market has been promoted to the top 5 countries in terms of Binance trading volume. According to internal information collected by the Wall Street Journal, in May 2023, Vietnamese investors’ trading volume on Binance reached approximately US$20 billion, of which futures trading accounted for about 90%. It ranks fourth among many countries in terms of volume-to-volume ratio.

Top 5 countries by Binance spot and futures trading volume in May 2023

In a short period of time, this news quickly became the focus of the leading local encryption media in Vietnam such as Coin 68 and Coin 98 Insight, and also hinted that the Vietnamese market has become a key area that cannot be ignored in the encryption industry.

Compared with the top three countries China, South Korea, and Turkey, it is really curious that Vietnam has been promoted to the fourth largest trading volume country on Binance.

We are probably no strangers to the fact that China, South Korea, and Turkey are hot spots for cryptocurrency trading. Among them, it is not surprising that China ranks first in the number of trading users and trading volume due to its relatively large base of crypto users; in South Korea, due to high unemployment and housing prices, serious class consolidation, young people regard cryptocurrency investment as a hope for counterattack, and are often dismissed. It is regarded as the country with the largest number of people involved in currency speculation; Turkey has always had a high inflation rate and its national currency, the lira, has depreciated seriously, causing people to have to look for anti-inflation assets. Stablecoins and Bitcoin are a good choice for Turks .

Although Vietnam is still an emerging market in the field of encryption in comparison, various data show that the number of Vietnamese encryption users has not lagged behind. Instead, it ranked first in terms of cryptocurrency adoption in 2021 and 2022.

However, with the exception of Axie Infinity, there are not many relevant reports on the Vietnamese market. As a result, users know very little about the Vietnamese market and have always regarded it as a mysterious existence.

Now that Vietnam has grown into an important region that cannot be ignored in the encryption industry, it has become a top priority to quickly understand the layout of Web3 projects and related companies in this market. As the exchange is the first entry point for users to come into contact with the crypto world, the trading activity of its users is often used to measure the popularity of crypto activities in the local market. So, how is the development of Vietnams crypto trading track?

There are leading exchanges in China such as Binance and OKX, and in South Korea there are Upbit, Bithumb, etc. What trading platforms are there in the Vietnamese market? What are the criteria for local users to choose exchanges? This article will systematically review the development status of Vietnam’s crypto market and the pattern of crypto exchanges.

Demographic dividend unleashes the growth potential of Vietnam’s encryption market, with encryption adoption rate ranking first for two consecutive years

In 2021, the popular phenomenon-level product Axie Infinity not only created jobs and opportunities for people in Southeast Asia such as Vietnam and the Philippines to earn living expenses, but also set off a new wave of Web3 entrepreneurship locally, giving birth to games such as the Yield Guild. Games (YGG), Ancient 8 and other Web3 projects that have influenced the world.

The commonality between these projects is that the founding teams are all in Vietnam. Their success has attracted the attention of the encryption industry to Vietnam, a fertile land, and has become a gold nugget for the Web3 industry. A large number of international capital and encryption people have begun to enter Vietnam, and some venture capital The organization even set up a special investment fund for the Web3 project created by the Vietnamese team, hoping to find the next popular Web3 product like Axie Infinity in Vietnam.

According to the Vietnam Cryptocurrency Market Report 2022 released by Coin 98 Insights in March this year,Seven of the world’s top 200 blockchain companies were founded by Vietnamese,These include Axie Infinity, Ancient 8, Yield Guild Games, Coin 98, Kyber Network, and more.

As of December 2022, Vietnam has more than 200 blockchain projects in operation, and Vietnam has more than 200 active blockchain projects, covering multiple fields, including GameFi, DeFi, and NFT. Among them, games and metaverse projects accounted for 28.8%, DeFi accounted for 26.0%, NFT accounted for 12.4%, infrastructure accounted for 11.3%, and Web3 accounted for 5.1%.

Additionally, the report stated thatVietnam’s digital asset trading volume reached $112.6 billion between July 2021 and June 2022, higher than Singapore’s $101 billion.

In the Global Cryptocurrency Adoption Index report released by the blockchain data company Chainalysis, Vietnam ranked first in the cryptocurrency adoption rate for two consecutive years in 2021 and 2022.Among them, the Vietnamese market shows extremely high purchasing power and population adoption rate in centralized services, DeFi and P2P transactions.Hunter, a partner of BitouchNew, a Vietnamese crypto media, has a deep understanding of this. He said that you can see people carrying black plastic bags on the streets of Vietnam to exchange Vietnamese dong (VNT) for USDT. They can also use USDT to pay rent and pay some living bills.

All the above data fully show that the potential and prospects of the encryption market in Vietnam are promising. At present, the development of the encryption market in Vietnam cannot be ignored. According to a report by MarketsandMarkets, Vietnam’s blockchain-related market value is expected to reach nearly US$2.5 billion by 2026, a five-fold increase from 2021.

But for encryption companies, whether it is profitable in a market (such as lower costs), whether it can bring potential user growth, and whether policies are supportive will all become important considerations in deciding whether to explore the market. .In todays Vietnamese market, cost and user growth seem to be in line with expectations in these two aspects.

First of all, in terms of cost, Vietnam can provide relatively low labor costs.According to data from the Coin 98 Insights report, the average salary of blockchain personnel in Vietnam is relatively low compared with the world. Taking HR positions as an example, the average salary of blockchain HR in Vietnam is 30,000 US dollars per year, and 42,000 in North America. USD/year. For the most important developer position for Web3 companies, the monthly management salary is 2526 US dollars.

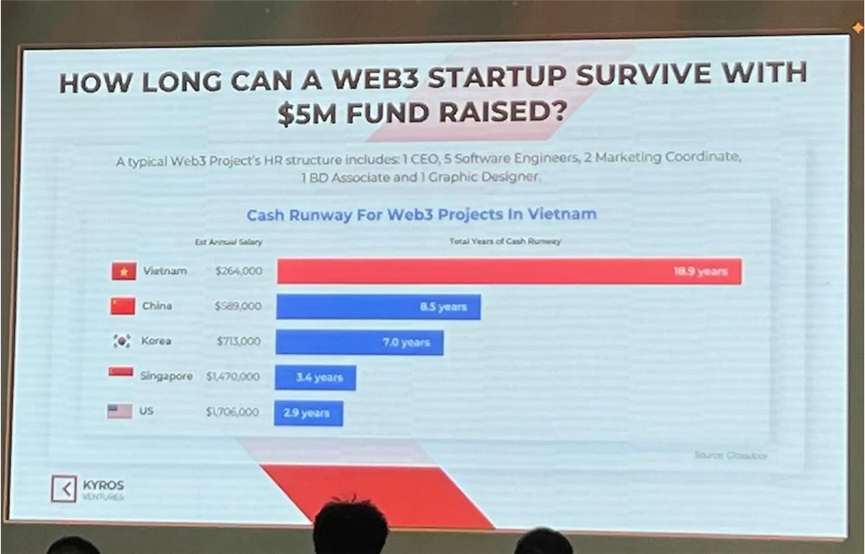

Among them, at the GM Vietnam Vietnam Blockchain Week event held in Ho Chi Minh City in July this year, a set of data from the organizer Kyros Ventures:

Suppose a 10-person Web3 start-up company (1 CEO, 5 engineers, 2 marketers, 1 BD and 1 designer) has an initial start-up capital of 5 million US dollars. If the headquarters is located in Vietnam, then such The configuration can make the company survive and operate for 18 years. The same configuration can last for 8.5 years in China, only 3.4 years in Singapore, and only 2.9 years in the United States.

Second, Vietnams population growth dividend can bring potential user growth to crypto companies.In April this year, Vietnams population officially exceeded the 100 million mark, becoming the third country in Southeast Asia with a population of over 100 million after Indonesia and the Philippines, and the population structure is dominated by young people, of which the population aged 18-34 accounts for the vast majority. A perfect match with the target audience of cryptocurrencies, providing the ideal soil for cryptocurrency adoption.

In addition, Vietnam has a high penetration rate of mobile Internet,The cost for users to learn Web3 is relatively low. As long as enterprises adopt appropriate incentives, they can attract these groups of people and gain more users. According to data, at present, there are more than 16.6 million cryptocurrency holders in Vietnam, accounting for one-fifth of the total population, of which 31% hold Bitcoin.

In terms of policy, currently,The Vietnamese government does not yet have a clear regulatory legal framework for cryptocurrencies, so trading in such assets remains in a gray middle ground.

Although as early as 2018, the State Bank of Vietnam (SBV) had explicitly banned all cryptocurrency-related transactions through the banking system, it did not prevent Vietnamese users from using cryptocurrencies. The Prime Minister of Vietnam also announced an initiative in July 2021, instructing the State Bank of Vietnam to study and carry out digital currency pilots. At the same time, he stated that cryptocurrency and blockchain are technologies that Vietnam hopes to develop and master, which will help build a digital government.

In addition, with the increasing application and demand of cryptocurrencies in Vietnam, the Vietnamese government has also begun to realize the potential and importance of cryptocurrencies, and is exploring how to regulate and manage the cryptocurrency market. In July last year, Vietnamese Prime Minister Pham Minh Chinh called on the Vietnamese government to study cryptocurrency regulation and add virtual currency amendments to the Anti-Money Laundering Act, but the regulation-related bill has not yet been implemented.

As for the implementation of Vietnams cryptocurrency regulatory policies, Hunter mentioned that the complexity of the Vietnamese governments structure determines that it is not an easy task to formulate relevant encryption policies. It requires consultation and agreement from multiple government departments before reaching conclusions. There should be no specific encryption policy introduced.

It can be seen that Vietnam currently has a young, relatively low-cost labor force, and is open to new technologies such as blockchain, while vague regulatory policies also provide opportunities for the development of encryption-related projects.

What crypto trading platforms are available in the Vietnamese market?

The exchange is the first entrance for users to access the encrypted world. Most of the users and liquidity funds in the encrypted market are concentrated in the centralized exchange. The trading volume and user activity of the platform are often used to measure whether a market is prosperous. Important indicators. Vietnam, which is considered to have the most market potential, is naturally also a gold nugget in the eyes of encrypted trading platforms, and they have gone to take root one after another.

As early as 2019, Binance has opened up the market in Vietnam. Its CEO Changpeng Zhao also spoke at the Binance Vietnam Blockchain Week in 2020 and said, “Since 2018, Vietnam has been the market with the most active users. One, Vietnamese users have shown great enthusiasm for blockchain-based financing and transactions, and Vietnam is likely to become the next global blockchain innovation center. In 2022, Changpeng Zhao will appear in Vietnam again and attend the Hanoi Vietnam NFT Summit, and signed a strategic event relationship with the Vietnam Blockchain Association (VBA).

At the same time, well-known exchanges such as OKX, Huobi, and Bithumb also announced the opening of Vietnam stations and entered the Vietnamese market. In the near future, there are still exchanges in the market. In June this year, the encrypted trading platform Blofin announced that it will launch a trading platform service for the Vietnamese market and add a Vietnamese page.

So, what trading platforms are there for users to choose from in Vietnam? What are the differences in the products of these platforms for Vietnamese users, and what special benefits do they provide for users?

1. Early deployment of mainstream international exchanges in Vietnam

Binance’s C2C supports buying and selling crypto assets with Vietnamese Dong (VND) credit cards

Binance’s C2C business has launched the Vietnamese Dong (VND) trading function as early as 2020, and supports users to use Visa and other credit cards to directly use VND to buy and sell BTC, USDT, ETH, BNB, BUSD and other currencies.

According to its official Vietnamese page, Binance has listed more than 350 cryptocurrencies with transaction fees as low as 0.1%.

In 2022, Binance announced a strategic partnership with the Vietnam Blockchain Association (VBA). The two will jointly discuss the research and application of blockchain technology and train relevant talents for Vietnam.

OKX supports Vietnamese users to trade with VND

Compared with Binance, OKX has an earlier layout in the Vietnamese market. In 2018, its fiat currency trading area opened Vietnamese Dong (VND) trading services, supported Vietnamese users to issue VND trading orders, and launched a Vietnamese version of contract trading products .

MEXC is famous for its wide variety of assets in Vietnam

For MEXC users, the main reason why they choose to use MEXC among many exchanges is that MEXC is rich in assets, and almost all kinds of innovative projects can find trading pairs on MEXC. It is reported that MEXC currently supports more than 1,500 encrypted assets for trading. MEXC supports the Vietnamese language version in August 2019,

Bybit Vietnam market trading volume to triple by 2022

According to Bybits Bybit Next Level 2022 performance report released in September 2022, its total trading volume has tripled (109%) in the Vietnamese market.

According to an interview with its founder Ben, Bybit has started to focus on the Southeast Asian market in 2020.

What sets Bybit apart is that it has no KYC requirements for cryptocurrency trading, allowing investors to start trading with just an email and password. This aspect makes Bybit an extremely attractive option for Vietnamese investors. In addition, the platform provides users with a channel to enter and exit Vietnamese Dong legal currency, and the spot market transaction fee is zero in the short term, and has a dedicated customer service team to handle inquiries from Vietnamese customers.

Huobi has quietly cultivated in the Vietnamese market

At the same time as OKX, Huobis OTC trading area began to support Vietnamese Dong currency trading, and in 2019, the contract terminal was launched in Vietnamese. According to industry sources, Vietnam used to be the overseas market that Huobi will focus on developing in 2022, and provided a series of preferential policy support for Vietnamese partners, such as generous rebate ratios, etc., which attracted many professional transactions in Vietnam with financial strength Members join the platform. However, since October 2022, after Huobi was acquired by the fund of Hong Kong Baiyu Capital, the business of the Vietnam station has been temporarily put on hold.

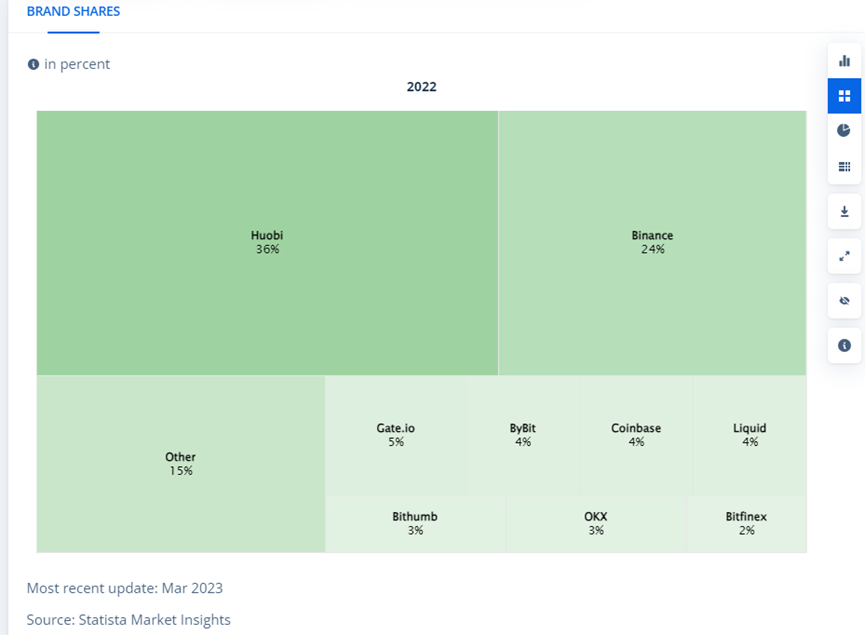

According to statistics from the Statista analysis platform, Huobi’s market share surpassed that of Binance for a short period of time in 2022.

BingX gained a firm foothold locally by cooperating with Vietnamese community KOLs

The derivatives trading platform BingX was originally named BingBon Popsicle and changed its name in November 2021. By cooperating with KOLs in the local Vietnamese community, it quickly gained a foothold in the Vietnamese market and set up an office in Vietnam. According to its 2022 year-end report, its global offices in Germany, Turkey, South Korea, Vietnam and other regions have added more than 200 positions.

2. Most of Vietnam’s local trading platforms are OTC

Peer-to-peer trading platform Remitano

Remitano is a local encrypted asset point-to-point trading platform in Vietnam. It was established in 2014 and supports users to purchase BTC, USDT, ETH, BNB and other assets in a point-to-point manner. Since the entry of other exchanges such as Binance, the platform has been an important land acquisition for Vietnam to participate in encrypted asset transactions, and it is also the main birthplace of Vietnamese OG players. It’s just that because of the P2P trading model, each transaction needs to be confirmed by both parties to complete, and the efficiency is low, and the market has been competed by overseas exchanges.

Vietnam OTC Trading Platform BitcoinVN

BitcoinVN is the largest cryptocurrency OTC trading platform in Vietnam. The platform supports currency transactions and fiat currency transactions, including a variety of fiat currency channels including Vietnamese Dong.

To sum up, there are only a handful of localized exchanges in Vietnam, most of which are OTC platforms.

Vietnam’s crypto trading landscape: Overseas platforms dominate, and users prefer large exchanges with high security

“The Vietnamese crypto market lacks mature local trading platforms and is mainly dominated by foreign overseas brands, and local investment users mostly choose the latter.” This is basically a consensus among industry insiders who are familiar with the Vietnamese market. Nowadays, several encrypted trading platforms have opened Vietnam station services. What is the current track pattern of Vietnam exchanges? What are the criteria for screening exchanges by Vietnamese local investment users?

In fact, the Vietnamese encryption market also follows the 28th rule.The leading trading platform occupies about 80% of the market share, and the rest of the platforms share the remaining 20% of the market.

The criteria for Vietnamese users to screen exchanges are not much different from those in China. In this regard, Mumu (pseudonym), a Vietnamese native engaged in the encryption industry, said,Asset security and platform reliability are the first principles for Vietnamese users to choose trading platforms. Secondly, whether the website page is friendly to Vietnamese users (such as supporting Vietnamese language, using Vietnamese dong or local bank deposits and withdrawals), and the depth of asset flow on the platform. In addition, whether the platforms customer service is timely or professional, transaction costs, and whether the asset types supported are rich, etc. will also be considered.

In addition, she added that in fact, the thinking of many Vietnamese people is very similar to that of Chinese people. How Chinese users choose a trading platform is the same for Vietnamese users. Therefore, when choosing an exchange, Vietnamese users also give priority to supporting Vietnamese stations. The leading platform of the industry.

At present, most of the encryption platforms popular in the Vietnamese market are platforms previously used by domestic users, such as Binance, Bybit, MEXC, etc.

According to statistics from SimilarWeb, the website traffic share of the five trading platforms shows that in the past year, among the website search traffic in the entire Vietnamese market, Binance official website search traffic accounted for about 70%, followed by Remitano, which accounted for about 10%, and then MEXC, OKX, Bybit, etc.

Regarding this statistical data, Vietnamese encrypted OG user Tam is not surprised. He explained that from his personal experience and the data he has, this market share is basically consistent with his prediction.In Vietnam, Binance has the largest market share, followed by platforms such as Bybit, OKX, MEXC and local Remitano.

The reason for such a prediction, he said, is that first of all, Binance is the current leading trading platform with relatively reliable security. It supports many types of crypto assets and is a comprehensive exchange (supporting spot and contracts). It is also very friendly to Vietnamese users ( With a Vietnamese page and support for using Vietnamese credit and bank cards), most Vietnamese users will choose Binance. Remitano is used by many Vietnamese OG users. Bybits futures and other derivatives are very good and have relatively low transaction fees. OKX has an early deployment in Vietnam, and MEXC supports many types of assets. Of course, there are also some players who use other less famous platforms or try new platforms. However, this is not mainstream in Vietnam. Currently, most of the platforms that are well-known and recognized in Vietnam are the leading platforms in the global crypto trading circuit, and some have already A platform that has been in the Vietnamese market for some time and offers its own advantages.

It can be seen that the competitive landscape of Vietnams crypto trading market has entered a fierce stage. At present, it is mainly dominated by overseas leading platforms. If new trading platforms do not have some strategies or unique advantages, it will be difficult to break through in a short period of time.

It is still a good opportunity to enter Vietnam, and the operation strategy needs to be adapted to local conditions

Although the current competition in Vietnams encryption trading market seems to be quite sufficient, for a market with population growth dividends, it is still a good opportunity for exchanges and other Web3 projects to enter the Vietnam market now.

Tina, who has researched the Vietnamese market, agrees with this view. He said that many Web3 companies are already focusing on the Vietnamese market, especially this year. At the GM Vietnam Vietnam Blockchain Week event conference held by Coin 98 and Kyros Ventures in July, you can see the booths of many well-known projects around the world, such as Polygon, Aptos, Coinbase, Chainlink, Avalanche, etc., and meet people from various countries. Crypto people, the conference is very international.

This is very different from the Korean blockchain I participated in before. In the several Korean events I participated in this year, most of the attendees were people in Korea, and few people from abroad were seen. At the several conferences held in Vietnam this year, the participants were all very international, and the content of the conversations followed the forefront of the industry, such as BRC 20 in the past few months. There were even Vietnamese initiators or Vietnamese communities behind some projects. Earlier in the same month, the Vietnam Blockchain Association and Spores Network announced a partnership to launch the Web3 accelerator program SwitchUp, with more than 50 funds and international organizations investing to support Web3 start-up projects in Vietnam.

He also said that the developers he contacted in Vietnam generally spoke very good English. For projects that want to have a global layout, deploying in Vietnam can be said to be a very labor-saving place. There are also many Vietnamese universities that have projects and training courses that cooperate with blockchain companies, which can provide them with high-quality Web3 talents. In addition, Vietnamese users are very willing to spend money and time to learn about the encryption industry. Many Vietnamese friends they have contacted are willing to spend tens of thousands of yuan to participate in blockchain-related training courses to learn how to speculate in coins and related development after work. knowledge etc.

However, if the Web3 project wants to make achievements in the Vietnamese market, it still needs to formulate some operating strategies that are in line with the habits of local users.

Tina explained that taking social channels as an example, users in Vietnam prefer to use FaceBook instead of Twitter and Youtube, so Web3 companies entering Vietnam must prioritize FaceBook. In addition, some crypto communities in Vietnam have very strong appeal. For example, BingX has quickly established a foothold in the Vietnamese market through cooperation with the community.

He also added,The investment amount of Vietnamese encryption users is not much, with an average of 100 U per capita.It can also be seen from the disclosed Binance data that Vietnamese users prefer high-risk futures and are relatively speculative. Companies cannot ignore users services just because their investment amount is small. This is mainly because most of the crypto users who participate in investment are young people who have just entered the workforce. Their current income is not high, so the investment amount is low, but this is also the case. This means that as their salary increases, the amount invested in the future will also increase.

Of course, this does not mean that entering the Vietnamese market is without risks. The biggest uncertainty at the moment comes from government supervision. Since there is currently no clear and specific regulatory framework, the Web3 project is in a stage of wild development. Once regulatory policies are truly introduced, This will inevitably have an impact on some companies.

However, there are also views that when regulation is actually introduced, it may have an adverse impact on the Web3 industry in the short term, but in the long term, clear regulation may encourage wider adoption, make policies more complete, and may provide benefits to retail investors. and institutional participation to provide greater protection for investors.