Synthetix V3 Application Prospects and Data Interpretation

Original author: BitAns, Krypital Group

This article is for communication and learning purposes only and does not constitute any investment advice.

After the bankruptcy of FTX, the trading volume and attention of decentralized derivative exchanges have significantly increased. In recent years, with the improvement of L2 and various Appchain open source architectures, the reliability and concurrency of Dex have greatly increased. Dex PERP has become the most profitable type of product in the bear market. With the continuous exploration of decentralization by the industry, such products will undoubtedly become an important part of the industry in the future.

Currently, the mainstream decentralized derivative designs mainly include the Orderbook mode represented by Dydx and the Spot Pool and Vault mode represented by Snx. Today's Snx has evolved from an asset synthetic platform in 2017 to a modular liquidity protocol, aiming to become a universal liquidity layer for on-chain financial products. New features and improvements are expected to bring new business increments and valuations. In this article, we will interpret Snx V3 through data and use cases.

TOC:

I. Snx V2 Existing Mechanisms and Issues

II. Snx V3 New Feature Modules

A. Liquidity as a service

B. New debt pool and collateral mechanisms

C. Perps V2 and Perps V3 engines

D. Oracle improvement scheme and anti-oracle delay arbitrage

E. Cross-chain liquidity solution

III. Economic model + revenue data

Snx V2 Operating Mechanism

To better understand V3, we need to briefly review the current design of Snx and the various problems that exist.

There are two types of core users in the Snx ecosystem

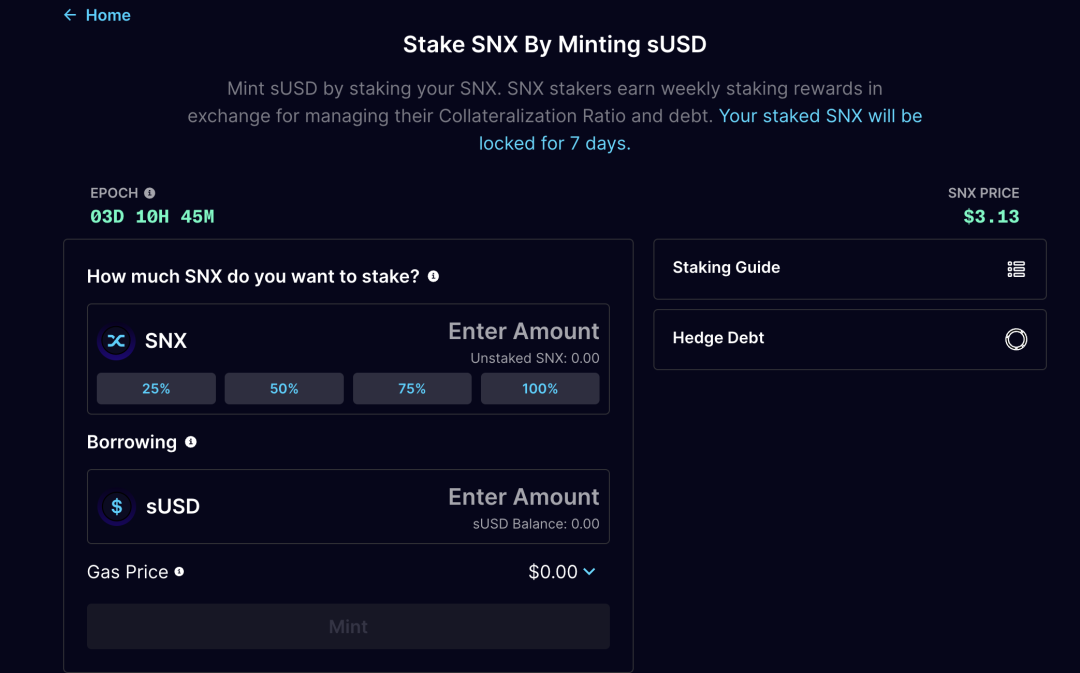

1. Staker, the pledging user

Pledge Snx to receive system inflation rewards and Trader's transaction fees.

2. Is the trading user Trader

Users who use atomic swaps or Perps transactions in the Snx protocol

Principle of synthetic assets

The principle of pledging stablecoins is to generate tokens equivalent to USD by collateralizing assets. Similarly, users can also collateralize assets and use price data from oracles to generate tokens anchored to the price trends of stocks, gold, and other assets.

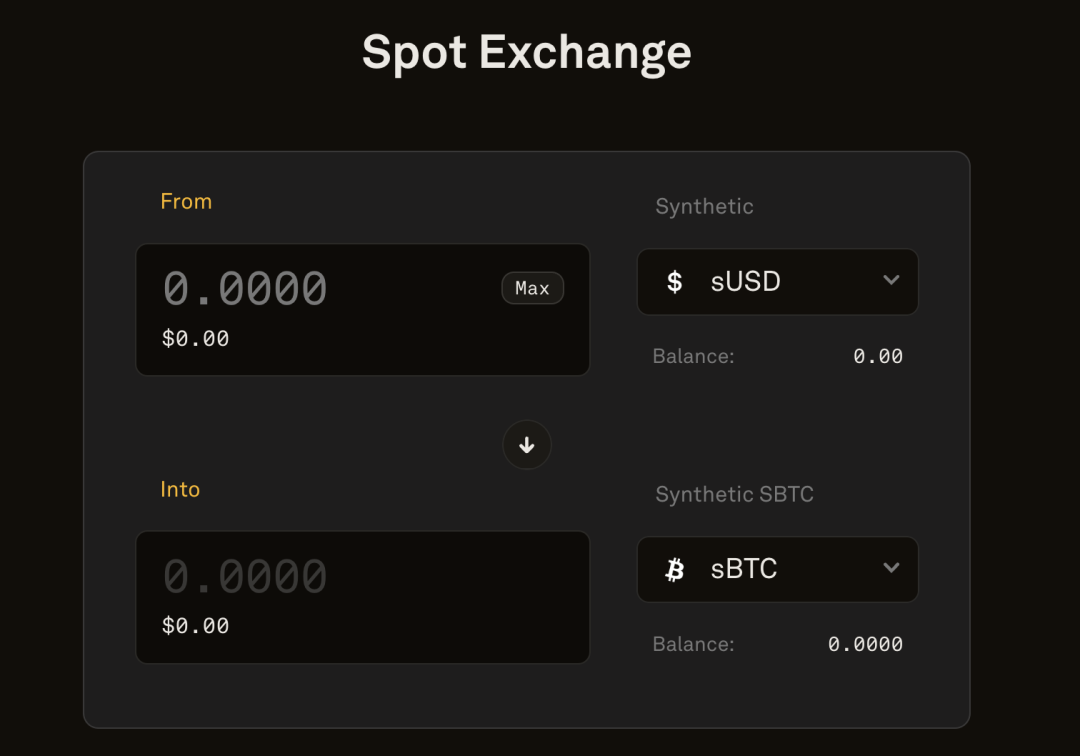

The Snx ecosystem currently has sUSD anchored to the USD price, sBTC anchored to the Bitcoin price, sETH anchored to the Ethereum trend, etc. They are collectively called Synths synthetic assets.

The entire system's debt is denominated in sUSD. In Snx V 2, only Stakers can generate sUSD by pledging Snx. Essentially, Snx is collateralized to borrow sUSD. Therefore, the minted sUSD becomes the user's and the entire system's debt.

When the staking ratio reaches above 400% (this ratio will be determined by DAO vote based on market conditions), Snx inflation rewards and transaction fee rewards can be obtained. If the staking ratio falls below 160%, and there is no replenishment of pledged Snx or repayment of sUSD debt to maintain the staking ratio above 400% within a 12-hour buffer period, Stakers may face the risk of liquidation. To unlock the pledge, Stakers need to repay all sUSD debts.

Process of atomic swaps

Transactions between Snx synthetic assets are completed by smart contracts that destroy one token and mint another token. Therefore, except for price fluctuations caused by delay, there will be no slippage if tvl is satisfied.

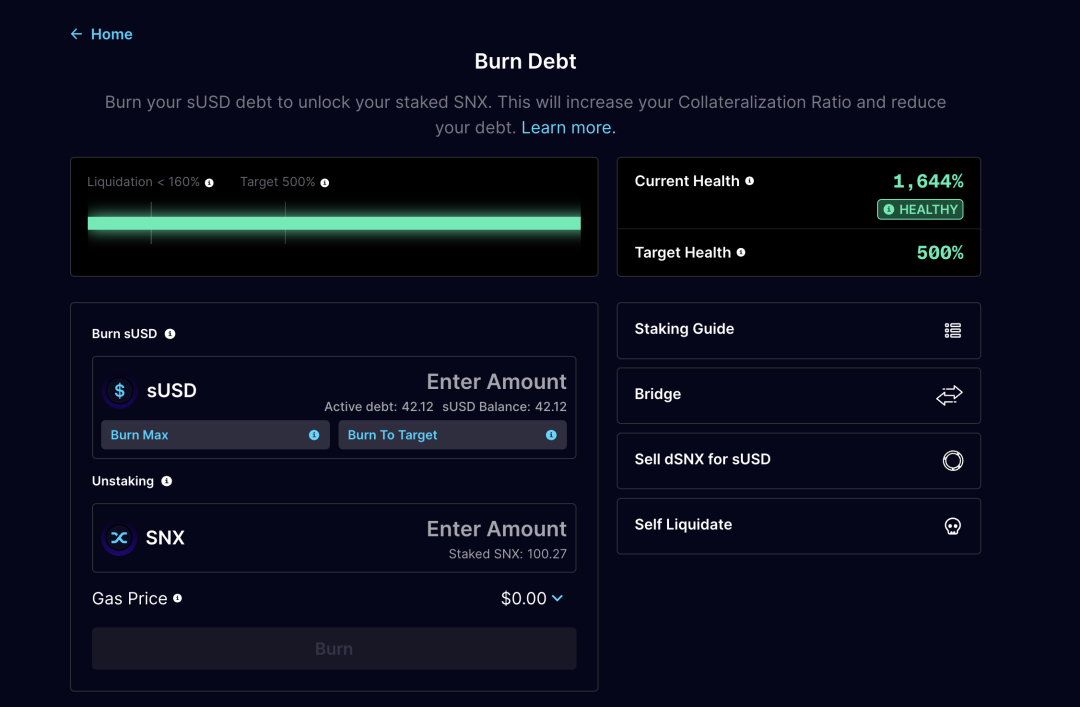

Principle of dynamic debt pool

The total value of all Synths assets in the entire system = total issued debt of the system

If a trading user Trader exchanges sUSD for other Synths assets, such as sBTC, the overall debt quantity will increase or decrease with the rise or fall of the corresponding Synths price. So the total debt of the system is not fixed, that's why it's called a dynamic debt pool. And the total debt of the system is shared proportionally by all SNX stakers. So even a Staker who only participates in minting sUSD without taking any other actions will have a dynamically changing debt.

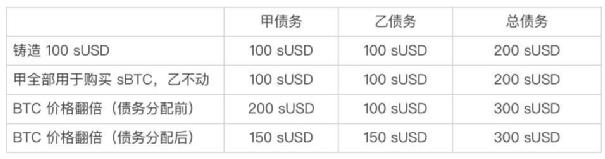

Case:

Assume there are only two individuals in the system, A and B. They respectively pledge SNX and mint 100 sUSD. Assuming the current price of BTC is 100 u, when A buys sBTC with sUSD, the SNX protocol will destroy 100 sUSD in the debt pool and generate 1 sBTC in the debt pool.

If B does not take any action. As shown in the figure above. When the price of Bitcoin doubles, the debts of both A and B become 150 sUSD, but the asset value of A is 200 sUSD, and the asset value of B is still 100 sUSD. At this time, A sells sBTC for 200 sUSD and only needs 150 sUSD to redeem SNX, while B needs to purchase an additional 50 sUSD to redeem the pledged SNX.

So when a trader suffers losses, his losses will decrease the total value of the global debt pool, thereby reducing the average debt level of all pledgers and allowing each pledger to share the benefits in proportion, that is, reducing debt. Conversely, when a trader makes a profit, it will increase the debt of the pool. Each Staker will share the loss and need to purchase additional sUSD to redeem their SNX.

Snx supports spot atomic swapping and perpetual trading. In the case of a large enough pool size, the impact of a single transaction on the pool will tend to stabilize, and Stakers can receive transaction fees for each transaction. According to the Kelly formula, Stakers will be in a profitable mode in the long run.

However, if the system is imbalanced between long and short positions, Stakers may face situations where others profit while they incur losses, especially in extreme or one-sided market conditions. In order to further reduce the risks for Stakers, V3 provides more mechanisms to maintain system Delta neutrality.

What does Snx V3 bring?

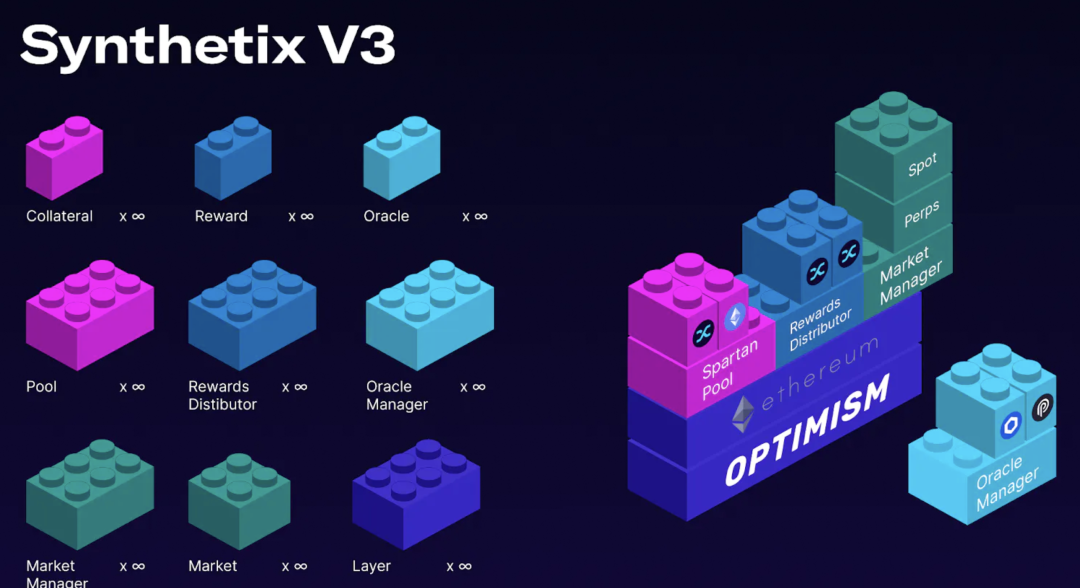

Liquidity-as-a-Service

After two years of rebuilding and development, Synthetix v3 positions itself as the liquidity layer for decentralized finance. Synthetix V3 will be rolled out in phases over the next few months, with v2's existing functionality becoming a subset of v3. After the final version is launched, developers can directly integrate the Snx debt pool to gain liquidity for developing new derivative markets, including perpetual futures, spot trading, options, insurance, exotic options, and other derivative markets, without starting from scratch.

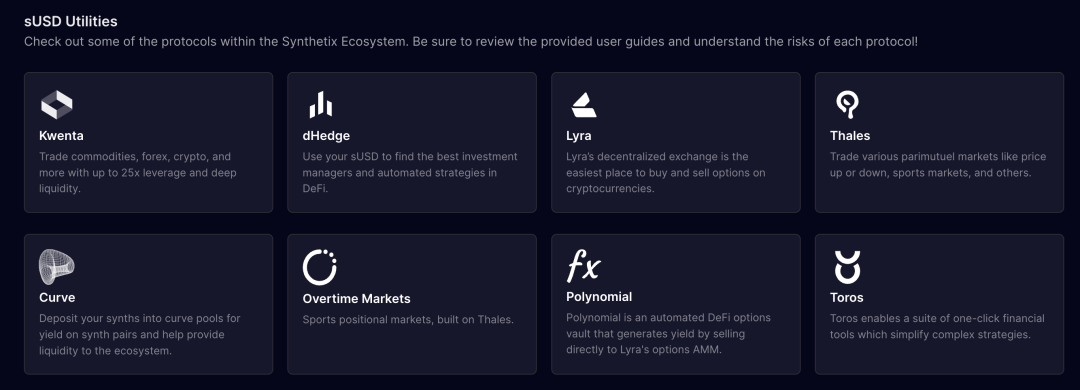

Current products in the Snx ecosystem

Some application examples proposed by Snx are as follows:

Perpetual futures/options/structured products: Supports perpetual futures, leveraged trading, basis trading, and funding rate arbitrage.

Case: Kwenta and Polynomial exchanges have been launched, and GMX can also be built on Synthetix v3.

NFT-Fi lending/perpetual contracts: Users can borrow synthetic assets anchored to the trend of NFTs or create perpetual contracts speculating on the future price of NFTs. For example, nftperp.xyz can be built on Synthetix v3.

Insurance market: Users can purchase insurance contracts for various risks, collateralize them in the pool, and be managed by smart contracts. For example, Nexus Mutual can be built on Synthetix v3.

Prediction markets/binary options/sports betting: Users can bet on the outcome of events. For example, election results or sports matches. Lyra and dhedge have been launched in the Snx ecosystem.

RWA market: With reliable oracles and trusted entity verification, trading markets for synthetic assets such as artworks, carbon credits, or other off-chain assets can be developed on-chain.

New debt pools and collateral

As mentioned above, in the Snx Pool and Vault model, Stakers need to temporarily act as counterparties to Traders. The volume of Staker debt pools determines the liquidity limit.

Currently, having a single collateral may lead to the following issues:

It may limit the maximum open interest of the system due to Snx's market cap limitations, thus limiting the liquidity for traders.

Different synthetic assets have different price volatilities. Staker's returns and risk rewards may not align.

In extreme scenarios, potential dangers of spiral liquidation may arise.

From Kwenta, we can see the total position currently held by Synthetix across the network. In cooperation with OP, the short and long positions of BTC and ETH have approached the system's capacity limit multiple times.

To address the above issues, V3 introduces the following features:

Isolated debt pool

In the existing Synthetix V2, all transactions go through a single Snx debt pool, and different synthetic assets have different volatility, as well as varying risks and returns. To address this issue. (This article will list relevant cases in the section on anti-oracle delay attacks below)

Synthetix V3 introduced the SIP-302: Pools (V3) proposal, allowing Stakers to decide for themselves which markets to support liquidity for based on their risk preferences. Through voting governance, they can determine the collateral types and limits for each pool, even limit risks within a small range. It also provides SNX stakers with an opportunity to take on higher risks for higher returns. This gives stakers more control over their exposures. For example, they can decide to only provide exposure to mainstream assets like ETH and BTC, without participating in market debt pools for long-tail assets like NFTs.

Multi-Collateral Mechanism

V3 introduces a universal collateral treasury system that is compatible with multiple collateral types. This means that in addition to $SNX, Synthetix will also support other assets as collateral for Synths, expanding the market size of Synths.

Voting governance will determine which assets, in addition to the current SNX, will be supported as collateral. For example, voting can decide to include ETH as collateral. Eight proposals related to this, SIP-302 to SIP-310, have already been passed through.

So the new pool and treasury system have three main advantages:

Better risk management: The pool is connected to specific markets, therefore having specific exposures

Better hedging capabilities: The pool is connected to specific markets, enabling precise hedging

Greater collateral range: Stakers can pledge any assets accepted by the pool, resolving the risk of a single asset

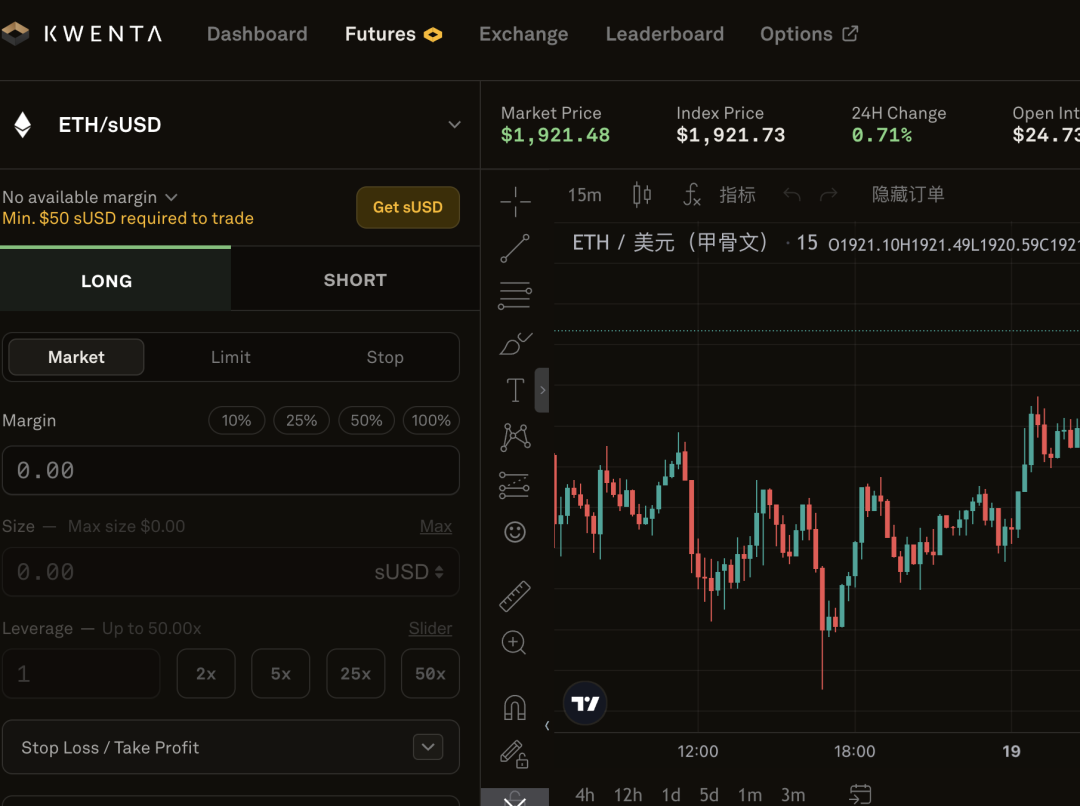

Perps V2 and V3 Engine

Perps is a decentralized perpetual engine launched by Synthetix based on debt pool liquidity.

The beta version of Synthetix Perps V1 was released in March 2022 and generated over $5.2 billion in trading volume and provided $18.1 million in transaction fees for Stakers without any trading incentives.

Synthetix Perps V 2 scheme was launched in December 2022 and is the current version in use. It reduces costs, improves scalability, and enhances capital efficiency. It includes isolated margin.

Synthetix Perps V 3 is planned to be released in the fourth quarter of this year. Synthetix Perps V 3 supports all V 2.x features and introduces new functionalities such as cross margin and new risk management tools aimed at eliminating market deviation. This includes price impact measures and dynamic funding rates.

Founder Kain Warwick stated that Synthetix aims to launch the Perps V 3 version and its new decentralized perpetual contract trading platform front-end, Infinex, in the fourth quarter of this year.

The team states that Infinex will focus on making decentralized perpetual contract trading easy for users. It aims to provide a better user experience and eliminate the cumbersome processes currently required by DEX for each transaction.

Maintaining Delta Neutrality

Perps V 2 effectively matches buyers and sellers, with SNX stakers acting as temporary counterparties to temporarily assume asset risk. Incentives are in place to encourage traders to keep the market neutral.

Synthetix incentivizes long and short open contracts in the market to remain balanced through funding rates and premium/discount pricing. The crowded side of the trade pays the funding rate, while the other side receives it.

In centralized trading platforms, funding rates are typically charged every 8 hours, whereas in Synthetix, they are charged in real-time as positions are held. Similarly, trades that cause an imbalance between long and short positions are charged a premium, while trades that restore balance are discounted. This mechanism encourages arbitrage traders to take action when deviations occur and reduces LP risk in one-sided markets.

Oracle Improvement Plan

Oracle Latency Arbitrage Resistance

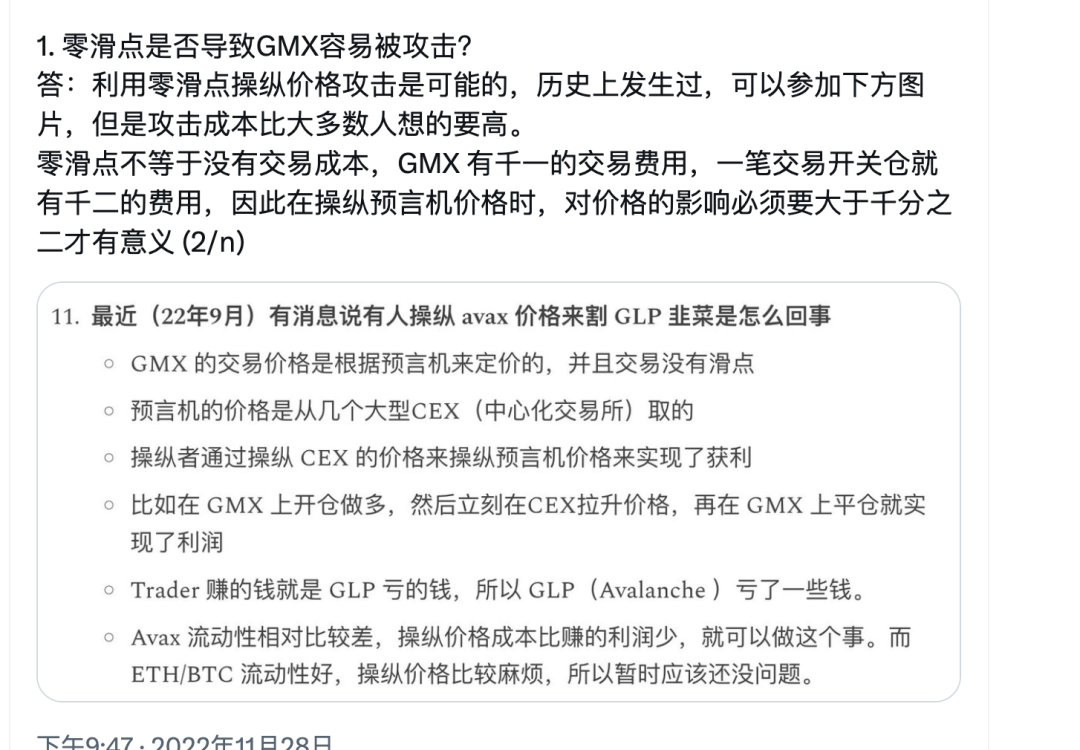

Oracle Latency Arbitrage has been a major challenge for DEX platforms in competing with centralized exchanges.

In previous versions of Synthetix, Synth relied on the Chainlink oracle to provide prices. However, the oracle's price updates on the chain lagged behind the price changes in the spot market, creating the possibility of front-running trades. In the context of Synthetix's slip-less trading, SNX stakers could suffer significant losses as a result. For example, if a user observes that the price of ETH rises from $1000 to $1010 within a short period of time, while the price quoted by Chainlink remains at $1000, the user can exchange sUSD for sETH in Synthetix at the price of $1000. After the oracle price update, disregarding transaction fees, each sETH can generate a profit of $10. The user's profit comes at the expense of SNX stakers who fall victim to front-running.

Supplemental case: Strategy adopted by GMX, Snx's biggest competitor

Source: CapitalismLab

Snx currently offers an oracle management mechanism where market creators can choose from multiple oracle solutions and set custom aggregation to have more control over the oracles that power the market. The oracle manager presents new opportunities for supporting new markets and assets.

Example: Select the lowest price for spot Bitcoin based on the time-weighted average price (TWAP) from Chainlink, Pyth, and Uniswap.

Synthetix (Snx) is also exploring two solutions to address oracle latency arbitrage:

1. Hindsight oracle solution: A solution proposed by Synthetix in collaboration with the Pyth team. This solution reduces the likelihood of oracle latency arbitrage through asynchronous trading and configurable delay time. It helps lower transaction costs for DeFi platforms and makes them more competitive.

2. Low-latency data source for Chainlink: Another solution provided by the Chainlink team for Synthetix. This solution aims to provide a low-latency data source to reduce the opportunity for oracle latency arbitrage. This solution has certain advantages over the hindsight oracle solution, such as not relying on third-party executors (keepers) to complete transactions, reducing transaction costs, and protecting the data privacy of data providers.

Introduction of Pyth and Snx collaboration:

https://www.youtube.com/watch?v=UAFR4c4-DPk&ab_channel=PythNetwork

Off-chain oracles achieve fast on-chain prices with competitive fees. They play an important role in significantly reducing transaction costs. Due to the resolution of the oracle latency arbitrage problem, the transaction fees for the major currency pairs of Synthetix are currently between 0.2% and 0.6%, which is equivalent to Binance's advanced VIP users.

Cross-chain solution

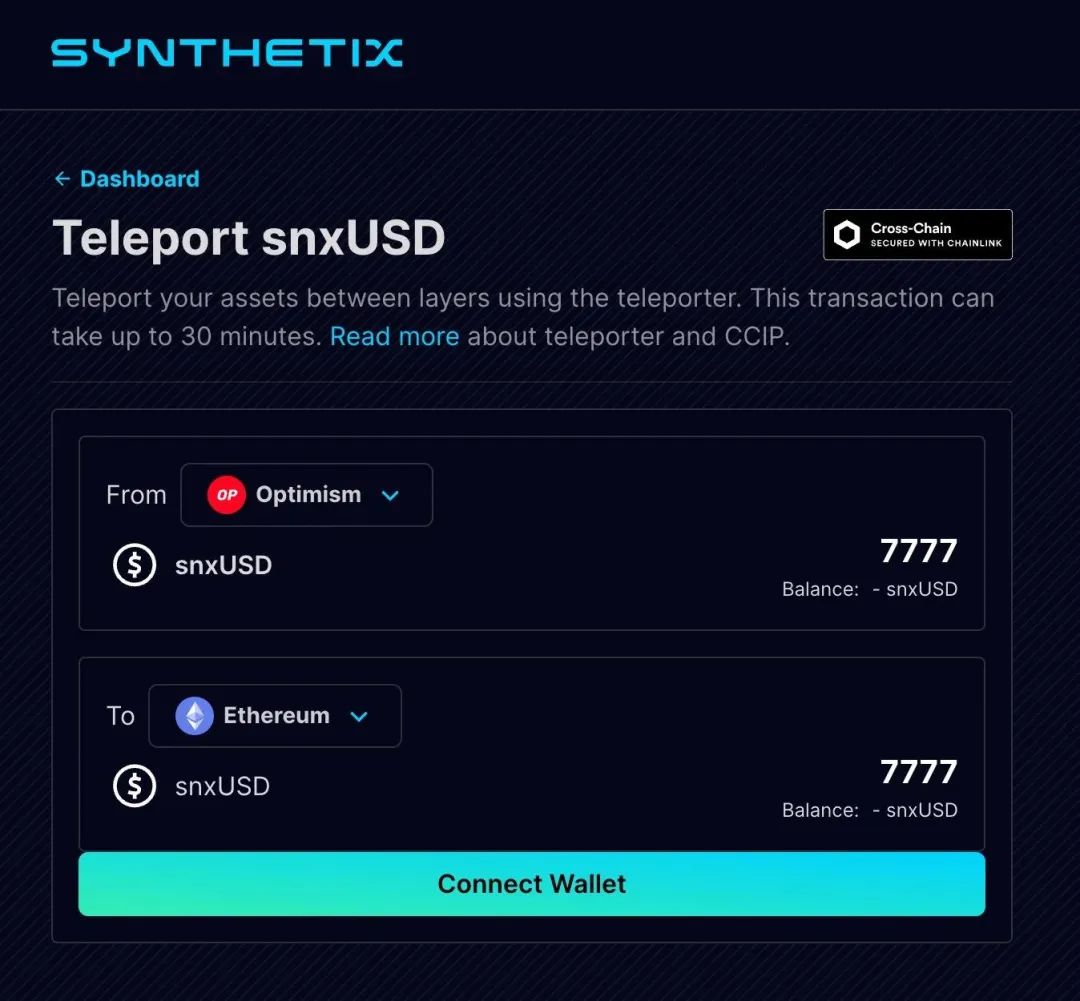

Teleporters - Stablecoin-focused

The SIP-311 proposal introduces the concept of Teleporters, which can burn newUSD on one chain, transfer cross-chain messages, and mint newUSD on another chain.

This means that the newUSD stablecoin can be used on any chain deployed by Synthetix without the need for cross-chain bridges or transfer slippage.

It allows the sharing of collateral between the liquidity layers on all chains.

It enables fast movement between chains and returns from L2 to L1 without challenging the verification time.

Cross-chain liquidity pool

Debt pool-focused

SIP-312 proposal, allowing all on-chain markets and mining pools to access the current status of all on-chain composite collateral.

This means that Perps markets can be quickly deployed to new chains and can leverage the collateral from existing debt pools on Optimism and the Ethereum mainnet.

As stated above through Teleporters and Cross-chain liquidity pools, Synthetix's liquidity layer can be extended to any EVM chain and new chains deployed can directly benefit from liquidity support from other chains.

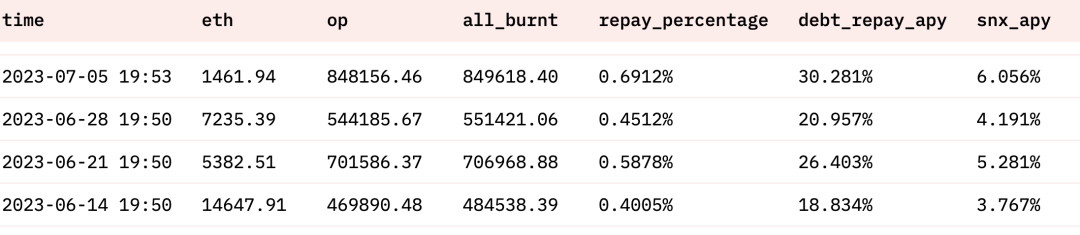

Economic model + revenue data

The revenue of the Synthetix protocol comes from several different channels. Mainly through fees from perpetual contracts and synthetic asset exchanges, fees from perpetual contracts and Snx liquidation fees, and fees from the minting/burning process of synthetic assets. All revenue from the protocol will be distributed to integrators and Snx stakers.

Revenue distribution for integrators

Integrators, such as Kwenta, that develop products accessing the Snx protocol are referred to as integrators. Snx will reward a certain percentage of fees based on trading volume and pay in Snx: 10% of fees for the first $1 million, 7.5% for fees between $1 million and $5 million, and 5% for fees exceeding $5 million. Integrators are free to decide how to use these fees, such as empowering their own platform coins.

The Snx development team no longer runs the front end themselves but instead delegates specific business to integrators, adopting incentive schemes for integrators, allowing for more network effects and the potential for integration into more products, becoming an important DeFi component.

User growth

As of the publication of this article on July 23rd, Synthetix's current TVL, monthly trading volume, and fee revenue are comparable to competitors GMX, but the daily and monthly active user counts are significantly lower than GMX and dydx.

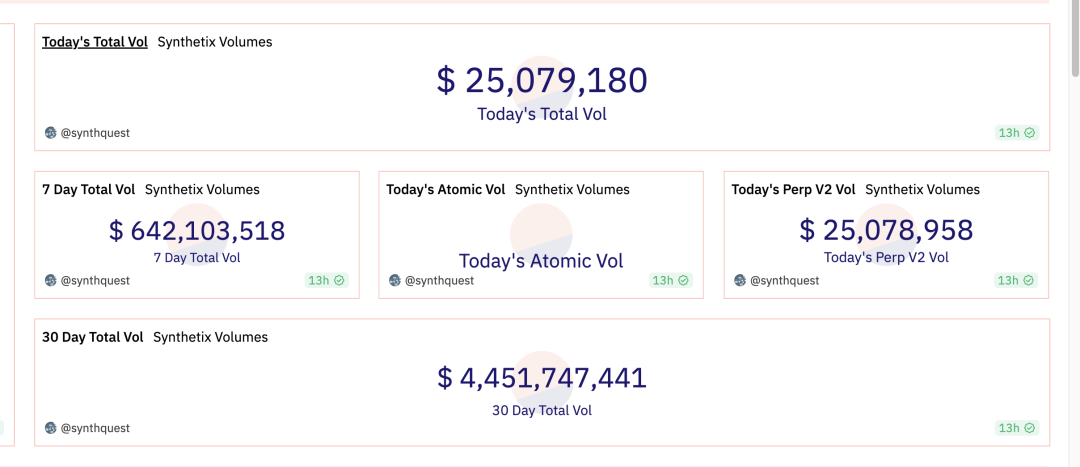

Perp V2 trading volume

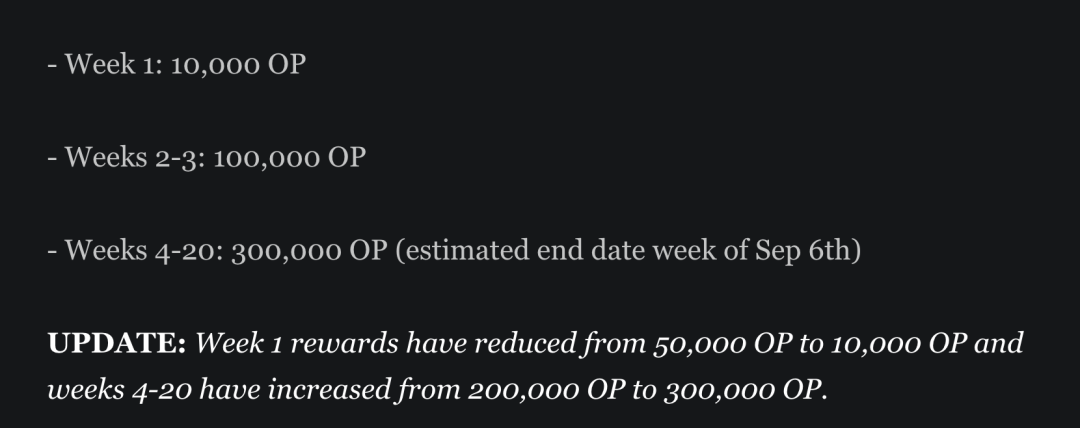

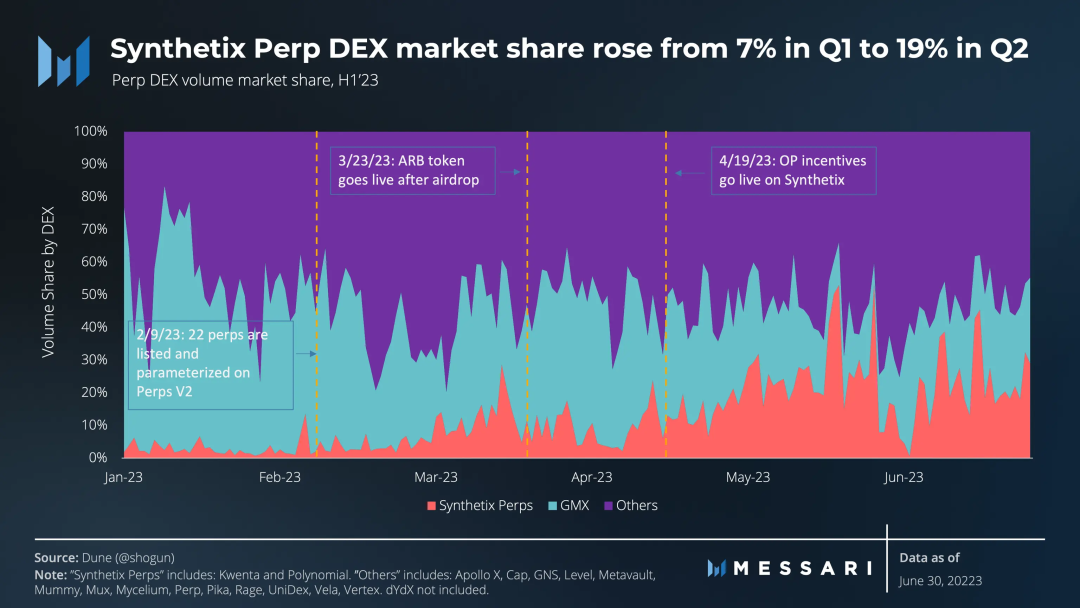

Synthetix Perps received the liquidity incentive program on the Optimism chain this year. Trading users of Synthetix Perps will receive OP airdrop rewards.

The OP incentive started on April 19th and currently covers approximately 80% of the fees.

According to Messari data, Perps has seen strong growth in trading volume due to subsidy incentives. The number and volume of user transactions have grown rapidly.

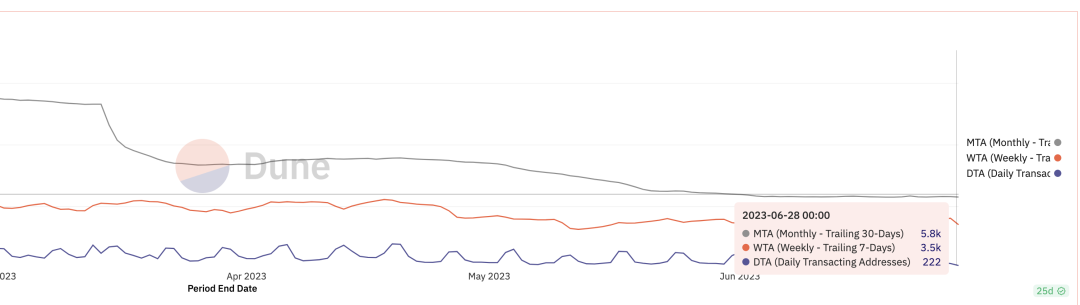

Despite the increasing trading volume, the number of users has not significantly increased according to the trend of on-chain interaction addresses. This means that the largest increase in trading volume comes from the increase in transactions by existing users.

The OP rewards program will continue until September 13th, making it easier to understand retention rates after the third quarter.

Trading user data trend

Data source:

https://dune.com/queries/452148/859385?1+Project+Name_t6c1ea=Synthetix&4+End+Date_d83555=2023-06-28+00%3A00%3A00

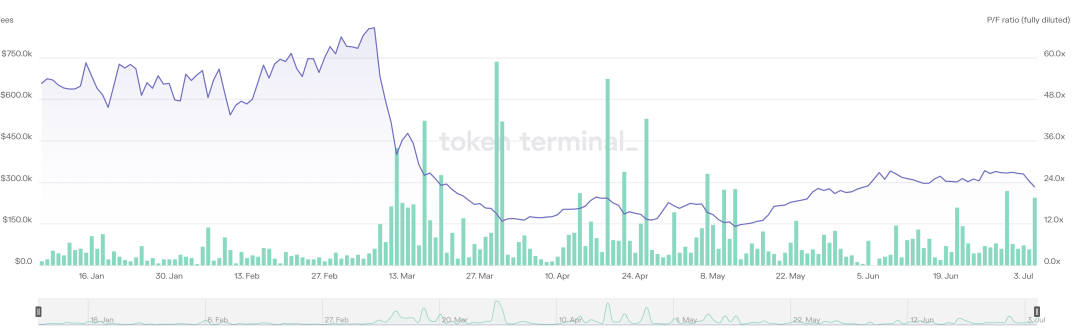

PE level

With the increase in trading volume, it brings an increase in income and an increase in the earnings of the stakers. The PE of Snx has returned to a more reasonable range of 10x-15x from the 50x in the bull market.

Stakers' weekly fee income data

Data source:

https://dune.com/synthetix_community/fee-burn

Exploring the new token model

Snx is currently in circulation, and about 5% of inflation rewards are provided to Snx stakers annually.

In August 2022, Kain Warwick, the founder of Synthetix, proposed SIP-276 to set the circulation of Snx to 300 million and stop minting after reaching that number. However, the proposal has not been adopted yet.

In June of this year, Kain proposed to implement a new Snx staking module in Synthetix V3. This module will simplify the entire staking process, where users only need to deposit Snx without facing market risks or considering hedging needs. Initially, the Treasury Committee will fund this staking pool, but in the future, a portion of the protocol fees of Synthetix may also be allocated to this staking pool. Kain emphasized that this simpler staking method aims to attract more new users to the Synthetix V3 system. The proposal is currently under discussion and is expected to further increase the Snx staking rate.

Summary:

The decentralized derivatives trading space has great potential in the long term. The launch of Snx V 3 is a significant milestone for the Synthetix protocol, introducing many new features and improvements. These enhancements aim to enhance the protocol's efficiency and security, remove liquidity constraints, and enhance user experience. It is expected to attract more users to participate in the Synthetix protocol and bring new business growth and valuation after the full functionality of V 3 is launched. It is also anticipated to be integrated into more products as an important component of DeFi.

However, new user growth is currently slow, and the development timeline for the full functionality of V 3 is uncertain. The profitability of SNX staking under the new token model and the retention rate after the third quarter will be important valuation indicators for SNX holders in the short term.

References:

https://blog.synthetix.io/tokenomics-discussion-review/

https://blog.synthetix.io/what-is-synthetix-v3/

https://twitter.com/jonathanykh/status/1632604358960644098

https://www.techflowpost.com/article/detail_11555.html

https://dune.com/synthetix_community/synthetix-stats

https://www.panewslab.com/en/articledetails/p4tt0ls1.html

https://www.panewslab.com/en/articledetails/jbyg555d.html

https://www.panewslab.com/en/articledetails/tfrnsgg2.html

https://mint-ventures.medium.com/synthetixs-ambitions-a-derivatives-trading-market-with-unlimited-liquidity-a2b79279687b

https://twitter.com/synthetix_io/status/1634285867555758080

https://blog.synthetix.io/what-is-synthetix-v3/

https://medium.com/@doge_bull/binance-killer-summer-b32cce1c22d3

https://mirror.xyz/cavalier.eth/ nOTmVQcole 7 f 0 mnqhF 93 PHO 2 qbCMm 1 Y 0 JAAdiYX 9 tjU

https://twitter.com/NintendoDoomed/status/1597225616340045826

https://messari.io/report/state-of-synthetix-q2-2023?referrer=all-research

https://mirror.xyz/cavalier.eth/ nOTmVQcole 7 f 0 mnqhF 93 PHO 2 qbCMm 1 Y 0 JAAdiYX 9 tjU