What is the most powerful CEX wealth effect in the head?

CEX has long been a red ocean, with intense competition and significant homogeneity among various platforms. The first-mover advantage and the established structure are apparent. However, with the collapse of derivatives giant FTX in November last year, the CEX landscape has undergone significant changes.

Odaily has researched data indicators from multiple trading platforms, including the wealth effect of IEOs, the market share of platform tokens, spot trading, and derivatives, in order to find new dark horses in the CEX market.

1. Who are the creators of wealth effects?

The most crucial topic that crypto users are concerned about is the increase in profits. Especially this year, with Hong Kong entering the crypto market and traditional funds (such as BlackRock) applying for Bitcoin spot ETFs, it has once again ignited the trading enthusiasm in the market. How have exchanges performed in this new round of wealth creation?

Odaily has researched multiple platforms, including Binance, OKX, Bybit, Bitget, and KuCoin, primarily considering the following two dimensions: the performance of platform tokens, the performance of IEO projects promoted by exchanges, and the situation of new coin listings — reflecting the platform's judgment of market trends.

Data shows that Bitget's platform token BGB has ranked first this year, with a highest increase of 185.5% and a current increase of 156%, both exceeding 100%. It is worth noting that in 2022, BGB's annual increase was 102%, and its token performance this year is related to the platform's strategic adjustment and empowerment of BGB.

OKX's platform token OKB ranks second, with a highest increase of 122.5% and a current increase of 62.4%. OKB's annual decline last year was 10%, but its performance this year has been exceptionally strong, mainly benefiting from its expansion into the Hong Kong market and the development of the OKX ecosystem.

Other exchange platform tokens have generally performed poorly. For example, BNB's highest increase this year is 42%, but it is currently down 1.7%. This is mainly due to a decrease in confidence from some token holders after facing a lawsuit from the SEC. In addition, Bitmart's platform token BMX has performed the worst, with a decline of 68.5% this year.

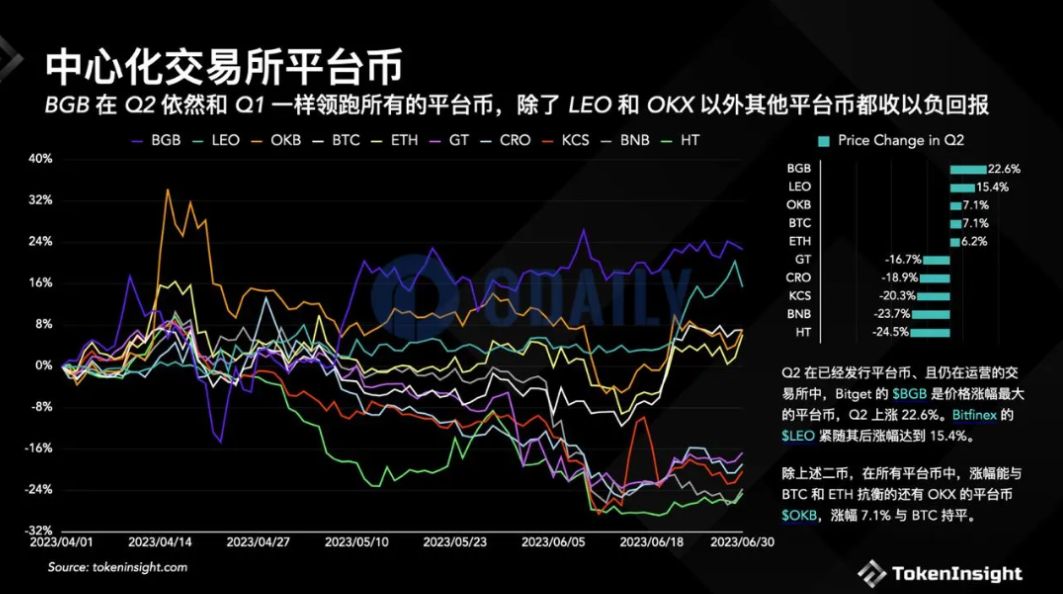

According to Tokeninsight's Q2 Exchange Quarterly Report, Bitget's platform token BGB had the largest price increase in Q2, reaching 22.6%. It was closely followed by Bitfinex's LEO, with an increase of 15.4%. In addition, OKB had an increase of 7.1%, the same as BTC. All other platform tokens had negative returns in Q2. As shown below:

In addition to platform tokens, IEO projects of various exchanges have also been a focus of attention for cryptocurrency investors.

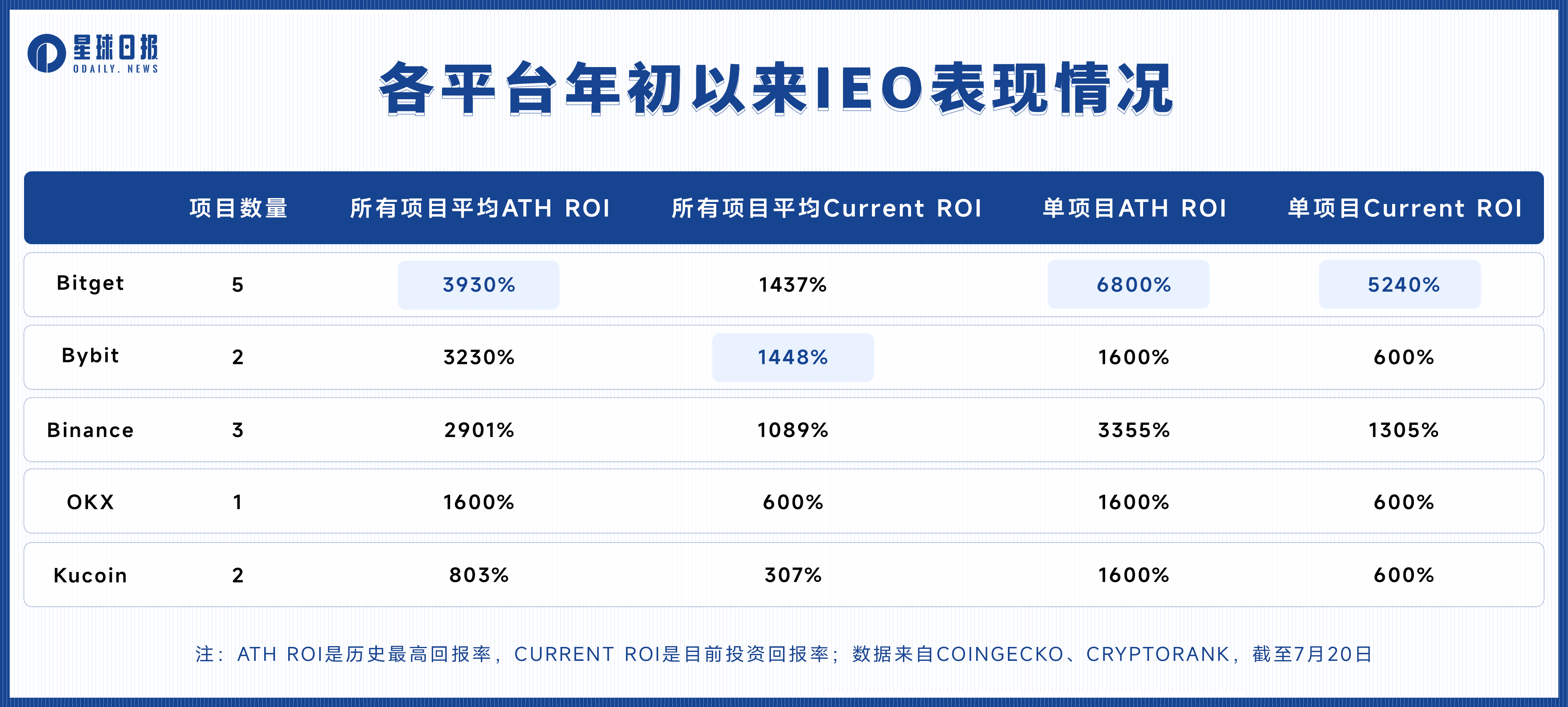

According to Odaily's statistics, among various exchanges, Bitget launched 5 projects after the IEO revision this year, ranking first with an average ATH ROI of 3930% and an average current profit of 1437%. In addition, Bitget is ranked first in terms of ATH ROI and current profit for individual projects, with 6800% and 5240% respectively. The project is called "Typelt", which claims to "earn money while typing".

In addition, Bybit and Binance, although they have fewer IEO projects, have considerable profits: Bybit ranks second with an average ATH ROI of 3230% and currently ranks first with an average profit of 1448%; Binance ranks third with an average ATH ROI of 2901% and currently ranks third with an average profit of 1089%.

Apart from the top players, other platforms such as MEXC and Gate have started flooding the IEO market. This year, Gate.io Startup Launchpad has launched 57 projects, but the profits are not optimistic. Some projects ended up with poor performance, resulting in a decrease in user participation and a negative impact on the platform's reputation.

Finally, let's talk about the situation of new coin listings. This year, exchanges have been trying various methods to attract traffic, and Bitget stands out in this regard.

Bitget is the first to list multiple popular coins like BLUR, and has also launched futures tokens for Arbitrum and SUI; recently, Binance's IEO project Arkham distributed airdrops to users, and Bitget opened trading one hour ahead of Binance, setting the market price in advance. In addition to these, Bitget also has a dedicated section for popular narrative coins such as AI, MeMe, and BRC 20.

Interestingly, listing on Bitget seems to set the trend in the market. Once a popular concept project is listed on Bitget, other platforms will follow suit within a few hours or up to a week. To some extent, Bitget seems to become the litmus test for project recognition in the market.

The market is constantly changing, and so are user demands. Exchanges can only stand strong in the tide of the times by quickly judging the market direction and continuously creating higher wealth returns for users.

2. Top Capital Support Shaping a New CEX Landscape

For traditional industries, the market landscape may not change significantly over the course of ten years; in the fast-paced world of Web 3, however, a year is enough time for earth-shattering transformations to occur. Take CEX for example, in the past few years, there have been several changes in the dominant players, with some platforms fading into obscurity and others even going bankrupt. Of course, there are also newcomers who manage to rise against the tide.

To achieve long-term prosperity, exchanges need to master two key elements: creating stronger wealth effects to attract users to the platform, and continuous innovation through differentiated new products and services to retain users.

For example, Binance established a strong position by creating wealth effects through IEOs in 2019. Bybit and FTX also became contenders in the derivatives market by offering institutional-grade derivative design. Another exchange, Bitget, started with derivatives and pioneered copy-trading products to carve out its own niche.

In 2019, the biggest challenge in the futures market was inexperienced traders suffering frequent liquidations due to poor trading skills. These novice traders were enticed by various KOLs and expert traders to unreliable exchanges, leading to further losses. Bitget was the first to address this pain point by introducing a copy-trading feature, allowing novice users to automatically replicate the opening and closing positions of star traders. This transparent process allows traders to monetize their trading skills without participating in fraudulent activities.

The launch of Bitget's copy-trading product effectively solved industry pain points and brought benefits to both exchanges and traders, achieving a win-win situation for all parties involved. As a result, many other trading platforms followed suit, making copy-trading a standard feature in the derivatives market. Today, Bitget is the world's largest cryptocurrency copy-trading platform. As of June this year, over 100,000 traders share their strategies on Bitget, and more than 490,000 users copy their strategies.

Through the introduction of copy-trading products and continuous improvement of product design, Bitget has firmly established its position in the derivatives market and silently accumulated strength, ultimately seizing its opportunities.

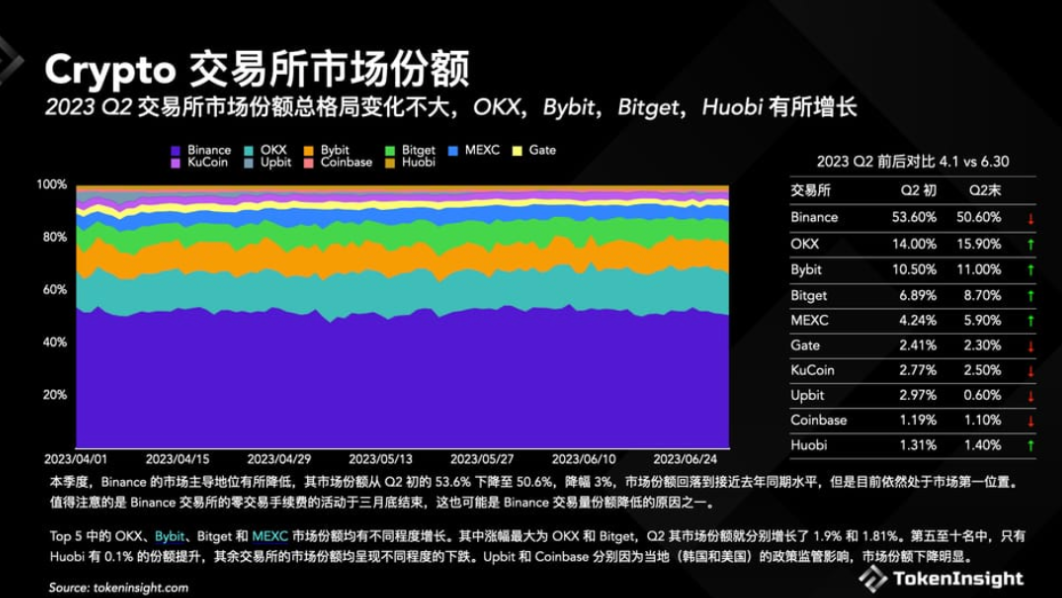

In November last year, as FTX collapsed, Bitget quickly seized the market, emerging as a dark horse with contrarian growth. According to TokenInsight's report, Bitget's market share in the derivatives market rose from 8% to 11% within a month after FTX's closure, ranking fourth. The latest quarterly report shows that the top four players in the derivatives market are still Binance, OKX, Bybit, and Bitget, with little difference between the latter three.

After achieving significant milestones in the derivatives market, Bitget set its sights on the spot market. Earlier this year, Bitget relaunched its Launchpad, attracting a large number of users through token sales and complementing it with the rapid listing of new coins to activate the spot market. In addition, Bitget innovatively uses AI strategies to assist users in trading, which is a first among CEXs (more on AI strategies explained later in the article). These efforts have paid off, as Bitget's spot market share has significantly increased this year, rising from 2% at the beginning of the year to Q

It increased to 6% and ranked among the top five in the market.

From an unknown encrypted startup trading platform, Bitget has grown into one of the top-tier exchanges in five years, and its development potential has been recognized by top-tier VCs.

In April of this year, top-tier VC Dragonfly Capital announced a strategic investment in Bitget, amounting to $10 million. This investment will support Bitget's global expansion and product line extension, as well as carry out more charitable educational activities related to cryptocurrencies.

It is worth noting that this is Dragonfly Capital's first move in the encrypted exchange track since its million-dollar investment in OKCoin in 2014, and it also represents the recognition of Bitget by top-tier capital Dragonfly Capital. With the support of top-tier capital, Bitget will break through its development ceiling and strive for new heights.

"In addition to financial support, we value Dragonfly's professionalism and experience in the field of encryption. At the same time, its vast investment portfolio also helps us build an encryption ecosystem that covers both CeFi and DeFi," said Gracy Chen, General Manager of Bitget.

III. Brand Upgrade, Achieving Smarter Trading

Over the past two years, Bitget has achieved significant growth in trading volume, user base, and product lineup. Currently, it has 1,300 employees in more than 60 countries and regions worldwide, making it the fastest-growing exchange in the bear market. Despite the achievements, Bitget is not resting on its laurels and continues to push forward.

Recently, Bitget underwent a brand upgrade, launching a new corporate brand identity, slogan, corporate vision, and visual image. This brand upgrade focuses on the concept of "Trade smarter," dedicated to shaping a more intelligent digital future and leveraging the power of technology to help users integrate into the crypto world more efficiently.

Furthermore, an important aspect of Trade smarter is the use of AI strategies to address complex investment strategies for ordinary users, which is also one of Bitget's future development directions. Recently, Bitget announced the launch of the Martin Gale AI investment strategy, helping users create more reliable strategy parameters, providing convenient and leading investment strategies, and assisting investors in maximizing their profits.

Bitget's AI strategies offer a variety of intelligent parameters for users to choose from, including conservative AI strategy, aggressive AI strategy, and balanced AI strategy, catering to different investment preferences. It also supports custom strategies, allowing traders to adjust various parameters of the Martin Gale strategy based on their personal trading habits and risk preferences. The parameter settings of the AI strategy integrate historical market trends and price fluctuations, and with the help of Bitget's backend algorithm calculation, provide reliable investment references for traders. Users can also evaluate and select more suitable AI strategies based on a strategy's 30-day backtested return rate and the number of users employing the strategy.

"Bitget's five-year journey has proved our continuous innovation, and I am proud of the progress Bitget has made since 2018. Today, we are launching a new brand identity, vision, and visual effects, which will once again demonstrate our commitment to shaping a smarter digital future. Bitget is committed to collaborating with industry leaders to create a safer, smarter, and more efficient trading environment, reflecting our shared vision," said Gracy Chen regarding the brand upgrade.

On the visual front, Bitget's iconic arrow logo will undergo simplification by removing the tail, resulting in a graphical inclination towards directionality. This symbolizes the ability to quickly find suitable trading directions in the ever-changing market. Additionally, the homepage of the official website will introduce a new visual style and interactive pages. Other pages and the app will be updated over the next 6 months.

The era and industry are undergoing huge changes, but Bitget's original intention remains unchanged, always practicing the values of "customer first, integrity and benevolence, cooperation and mutual benefit".

Last year, the bankruptcy of FTX triggered a crisis of trust in CEX. Bitget also stepped forward to announce the exchange's asset reserve address for the first time and, one month later, released the Merkle Tree reserve proof, developing an open-source tool for "Merkle Tree Proof" to allow users to verify the platform's assets at any time. Since then, Bitget has updated snapshots of the Merkle Tree reserve proof every month, and the latest data shows that its comprehensive reserve ratio is 223%+, remaining consistently above 200% for the past 7 months.

"We will always uphold our commitment to global users and regularly disclose proof of reserve. Bitget is committed to setting higher standards within the global industry and advocating true transparency through the development of cryptocurrencies," said Gracy Chen.

In addition, Bitget has also established a "Trade Protection Fund" to provide a second level of protection for investors. After the FTX incident, Bitget increased the size of the fund from $200 million to $300 million. It is worth noting that Binance and Bitget are the only two centralized exchanges that have publicly disclosed the wallet addresses of their protection funds.

Conclusion: Industry Evangelists Promote Web 3 Development

With the legalization of encryption, Hong Kong is becoming the central hub of the new wave of Web 3, where various parties gather. Bitget has already started its layout in Hong Kong since the end of last year, hiring Hong Kong lawyers and compliance professionals, and planning to apply for a Hong Kong virtual asset trading platform license to provide high standards of security and compliance services for Hong Kong users.

In addition to expanding its own business, Bitget is also committed to promoting the construction and development of Web 3, becoming an industry evangelist.

For example, Bitget launched the Bitget Web 3 Fund during this year's Hong Kong Blockchain Week, with an initial investment of 100 million US dollars. This fund will invest in outstanding Web 3 projects and support investment institutions in related projects, aiming to support the development of the next generation of cryptocurrency projects.

In addition, Bitget also initiated a Corporate Social Responsibility (CSR) program called "Blockchain 4 Youth" this year, aiming to jointly build the future of the crypto world by encouraging the younger generation and providing high-quality talents to the industry. Bitget plans to invest 10 million US dollars in this program over the next 5 years. Bitget will also collaborate with other leading blockchain companies to incubate innovative projects by young entrepreneurs and host the U-30 (under 30) Hackathon to select the most promising projects.

For Bitget today, the momentum of development is just right, as long as they can stick to their original intention, uphold core values, and firmly follow the path of compliant development, the future is promising.