The stablecoin market has seen a decline in dominance and the emergence of new players, offering a glimpse into the changing landscape of decentralized stablecoins.

Author: Frank, Foresight News

The world of cryptocurrencies is noisy, but stablecoins have always been a perennial topic. However, in the past year, the stablecoin race has experienced a series of major crises, such as the UST collapse and the anchoring crisis of Silicon Valley Bank's USDC. There have been some interesting changes in both market size and internal structure.

Especially this year, old players represented by DAI, FRAX, and LUSD, and new players represented by crvUSD, GHO, and HOPE, are exploring new business directions. They are likely to bring new variables to the decentralized stablecoin market and the entire stablecoin race.

A year of "each rise and fall" for stablecoins

In the past year, it has been a year of "each rise and fall" for decentralized stablecoins and centralized stablecoins.

The stablecoin race first celebrated the rapid rise of algorithmic stablecoins—UST brought the possibility of breaking the circle of algorithmic stability to the center of the crypto stage. However, the seemingly invincible Terra ecosystem and UST algorithmic stability empire collapsed rapidly within a week, and algorithmic stability has since been struggling.

The centralized stablecoin representative USDC, which has always been known for "compliance," has also been deeply affected by the successive thunderstorms of CeFi institutions last year. The heavy blow of the Silicon Valley Bank incident at the beginning of this year further interrupted its aggressive expansion.

The rise and fall of algorithmic stablecoins

Before May 2022, stablecoins entered the era of algorithmic stability, especially UST, which expanded its use cases while ensuring the stability of its value. Its market value exceeded $18 billion, surpassing both DAI and BUSD and ranking second only to USDT and USDC.

At the same time, FRAX, which was also based on algorithmic stability, made great strides forward, continuously integrating with most mainstream public chains outside of Ethereum. At its peak, its market value reached nearly $3 billion.

Even Terraform Labs released a new proposal to launch UST, FRAX, USDC, and USDT 4 pool on Curve, aiming to replace the 3 pool (USDT, USDC, DAI) that sits at the core of the stablecoin market with decentralized algorithmic stablecoins, gaining significant attention.

However, the sudden collapse of UST/Terra in May 2022 caused a huge shake-up in the algorithmic stablecoin race. The plan came to an abrupt end, with UST going to zero overnight. The volume of FRAX also quickly shrank, halving to $1.5 billion in just one month, and gradually falling to around $1 billion, remaining stable throughout the year.

Algorithmic stability has since been in a state of decline, and decentralized stablecoins have entered a new stage of development.

The contrasting fortunes of centralized stablecoins

Regarding centralized stablecoins, the aftermath of the Silicon Valley Bank incident has yet to calm down for USDC. According to CoinGecko data, since the US regulatory authorities closed Silicon Valley Bank on March 10th, the net outflow of USDC tokens has exceeded 17 billion USD, with a total circulation of around 27 billion USD, a decrease of about 40%.

This has also affected "partially decentralized stablecoins" such as DAI, which have USDC as one of their reserves, resulting in a significant decline in market share.

In addition, BUSD has also been affected by regulatory pressure and continues to be destroyed, with a continuous decrease in circulation of more than 3 billion USD in the past 30 days.

Meanwhile, USDT market value continues to increase, currently exceeding 83.6 billion USD, accounting for more than 65% of the total market value of stablecoins, regaining the majority market share. Its market advantage has been steadily expanding after the market turmoil in the first quarter of this year, making it even more secure as the top stablecoin.

Overall, in the context of decentralized stablecoins facing the dual crisis of "reserves + regulations," decentralized stablecoins are seeking new directions in the midst of turbulence, which is the industry's biggest expectation for stablecoins.

Against this backdrop, some new variables regarding decentralized stablecoins are beginning to emerge.

The war of decentralized stablecoins has just begun

Overview of decentralized stablecoins

As of the time of writing (July 17, 2023), the top two decentralized stablecoins are still familiar faces, namely DAI with a market value of 4.3 billion USD (ranked third) and FRAX with a market value of 1 billion USD (ranked sixth). DAI has gone from over 7 billion USD at the beginning of the year to the current 4.3 billion USD, while FRAX has maintained relative stability with no increase or decrease in circulation over the past year.

New players in the decentralized stablecoin market, such as crvUSD, GHO, and HOPE, have also begun to appear and advance their strategies, bringing some highly anticipated new variables.

DAI

DAI is a decentralized stablecoin pegged to the US dollar developed by MakerDAO. DAI is over-collateralized, and users can deposit different forms of collateral (such as ETH) into the vault to mint stablecoins. Users must maintain their positions above the collateral amount, as the protocol can liquidate their collateral assets when it falls below the set collateral ratio (which varies depending on the assets).

Although DAI has surpassed BUSD in terms of market value, it is actually shrinking overall, which is related to the impact of the USDC unpegging during the Silicon Valley Bank crisis in March.

FRAX

FRAX was originally based on the mechanism of "hybrid algorithm stablecoin" with the aim of algorithmically maintaining a 1:1 anchor to the US dollar, combining both algorithm and collateral characteristics:

Compared to over-collateralized stablecoins like DAI and LUSD, FRAX adopts a partial collateral mechanism, where the collateral assets behind it are mostly less than 100%.

Compared to purely algorithmic stablecoins like AMPL and UST, FRAX also has a significant backing of hard assets primarily in USDC, which helps preserve its intrinsic value even in extreme situations.

However, after the collapse of UST in 2022 led to the demise of the entire algorithmic stablecoin sector, FRAX was also affected, rapidly shrinking in size from $1.5 billion to around $1 billion within a month and maintaining stability since then.

FRAX has now begun gradually increasing its Collateralization Ratio (CR) to 100%, which means FRAX is completely abandoning its algorithmic stability properties and moving closer to the fully and even over-collateralized model of DAI.

crvUSD

Since its launch on May 18th, crvUSD has forged over 80 million tokens within just two months, showing strong momentum.

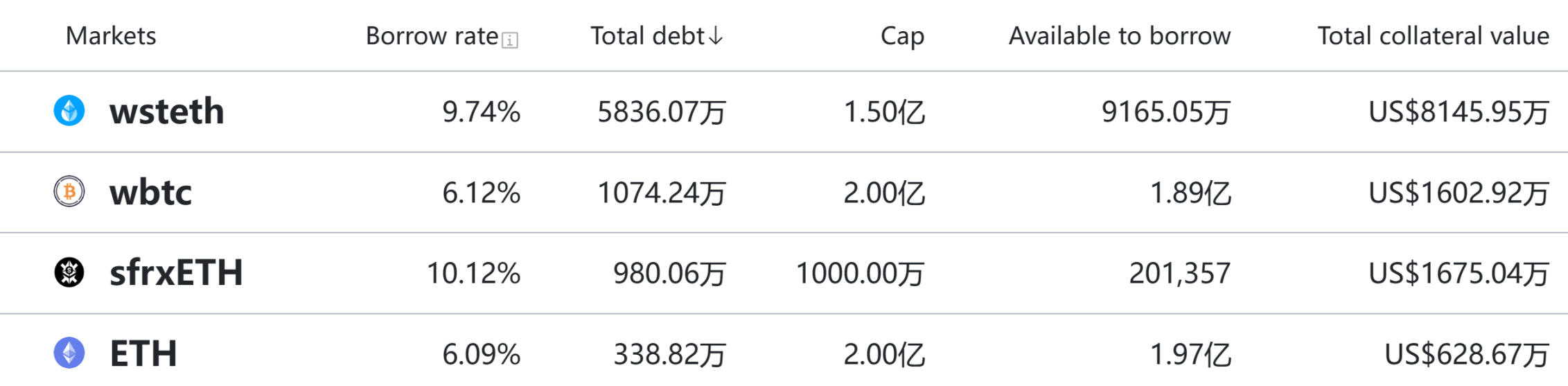

Furthermore, crvUSD has already supported collateral minting for sfrxETH, wstETH, WBTC, WETH, and ETH, covering virtually all mainstream cryptocurrencies and LSD assets.

GHO

On July 15th, Aave launched the decentralized stablecoin GHO on the Ethereum mainnet, allowing users to use assets in Aave V3 as collateral for over-collateralized minting.

Currently, Curve has launched the GHO/crvUSD liquidity pool, with a total liquidity of approximately $400,000 at the time of writing.

HOPE

HOPE is not a conventional "fixed face value stablecoin" but a stablecoin that dynamically fluctuates between "under-collateralization" and "full-collateralization".

It would reserve Bitcoin and Ethereum as reserves, assuming an initial price of $0.5 (i.e., assuming an initial reserve value of $500 million). The subsequent real-time price would dynamically change with the actual value of the reserves (Bitcoin and Ethereum) (without increasing the issue) :

If the value of the reserve increases to $600 million, the price of HOPE will instantly become $0.6;

If the value of the reserve increases to $1 billion, the price of HOPE will be $1;

If the value of the reserve exceeds $1 billion, HOPE will remain anchored at $1;

In the third case, as the reserve value of HOPE increases, HOPE will change from under-collateralized stablecoins to over-collateralized stablecoins. The excess portion of the reserve can be used to continue issuing HOPE, that is, to increase the supply of HOPE.

In addition, the vision of HOPE is to evolve from DeFi (on-chain) to CeFi and TradFi (off-chain) and become the core routing asset of the Web3 world.

First, from the on-chain perspective, DEX has always been the core of DeFi, and the "Curve War" has already proven that DEX is the key battlefield for stablecoins - deep liquidity helps strengthen the exchange rate peg of stablecoins and makes stablecoins popular trading pairs for other assets.

Currently, Hope has launched HopeSwap, which provides deep trading liquidity between HOPE and other stablecoins and mainstream cryptocurrencies, thus establishing an exchange rate market for pricing HOPE.

Next, HopeLend will be launched soon, which further supports the pledging of other mainstream assets and exchanging them for HOPE. For example, users can obtain HOPE by pledging Ethereum and other cryptocurrencies and use it as a universal asset for stablecoins in other DeFi scenarios.

This allows HOPE to be more broadly anchored to major asset classes and distributed to usage scenarios outside its own DeFi ecosystem. In short, the combination of "HopeSwap+HopeLend" means that the exchange rate and interest rate market of HOPE have been constructed.

After the on-chain DeFi scene is complete, it lays a foundation for the launch of the next phase of Hope Connect: With HOPE becoming an important on-chain collateral asset, it can be used as a springboard in the form of RWA and other forms to expand from on-chain DeFi to CeFi and TradFi usage scenarios.

The blossoming exploration directions

Stablecoins are a trillion-dollar incremental market, and for decentralized stablecoins, decentralization level, stability, application scenarios, and future expansion space are all key dimensions to see the true chapter.

Decentralization level

In terms of decentralization, the performance of DAI and FRAX, which rank high in decentralized stablecoins, is not satisfactory.

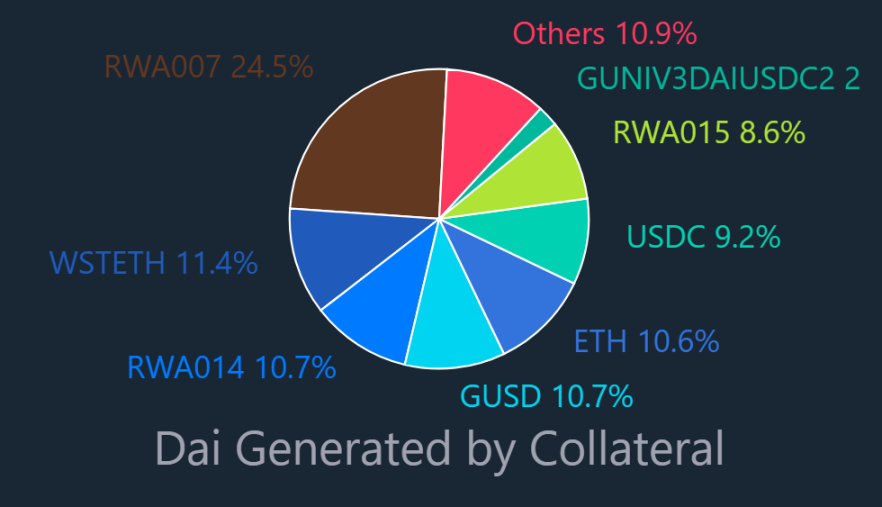

Dai Stats data shows that as of July 17th, 10.7% of DAI's collateral is still GUSD, and 9.2% is USDC, which means that nearly 20% of the reserves supporting DAI issuance come from centralized stablecoins.

The Silicon Valley bank incident sounded an alarm for DAI: even centralized stablecoins with full reserves can still face redemption crises due to the single point of risk in traditional financial custody.

On the other hand, FRAX has been trying to transition from algorithmic stability to fully-collateralized stablecoin. As of the time of writing (July 17, 2023), the CR has gradually recovered and stabilized at around 95%, but its level of decentralization is only about 22.55%, which is still relatively low and more susceptible to shocks.

The decentralized design of HOPE adheres to a practical concept, using a "distributed" mechanism to balance the merits of decentralization and centralization. It not only avoids the impact of single point failures on the operation of stablecoins but also ensures the custody security of stablecoins and eliminates potential regulatory risks:

Distributed reserves. The reserves related to HOPE will be held in custody by the most trusted institutions globally, including Coinbase. Cooperation with local custodians in major regions around the world ensures compliance with local regulatory conditions while avoiding excessive concentration of assets and centralized risks;

Distributed distribution system. HOPE has many distributors, similar to how Bank of China, HSBC, and Standard Chartered can issue Hong Kong dollars. In the future, any eligible institution can mint stablecoins by being whitelisted in the HOPE system;

Distributed system (multi-chain system). HOPE will initially be built on Ethereum but plans to expand to other blockchains in order to avoid single point failures;

Stability

In addition, one of the most critical and deadly questions is how to ensure the stability of the currency value as a stablecoin, especially during extreme market conditions so that it remains safe and reliable without being arbitrarily unanchored.

Both DAI and FRAX have undergone the test of being unanchored, and although they have currently recovered stability, DAI still has millions of dollars in bad debt, which is the cost of maintaining the stability mechanism.

crvUSD, GHO, and HOPE have not yet experienced the test of being unanchored, and the actual performance of their stability still needs continuous observation.

Application Scenarios

Although DAI, crvUSD, and GHO are emerging players in the stablecoin field, they are all products based on mature leading projects. The only difference is that one enters the lending market based on the right to mint its own stablecoin, while the other is based on building stablecoin usage in DEX and lending scenarios.

Based on this, they are also exploring two completely different paths for decentralized stablecoins:

As leading DeFi projects with DEX and lending markets respectively, Curve and Aave's native stablecoins crvUSD and GHO, will at least not lack usage scenarios in their subsequent development;

On the other hand, DAI, with a total supply of around $4 billion and widely present in various DeFi applications, is expanding its own lending protocol by leveraging the advantages of its native stablecoin;

This can also be seen as a difference in strategy: whether it is easier to penetrate fields such as lending based on native stablecoins, or whether it is more advantageous to expand the usage scenarios for stablecoins based on lending and DEX protocols.

HOPE's vision is to move from DeFi (on-chain) to CeFi and TradFi (off-chain), becoming the core routing asset of the Web3 world. It has also chosen a middle path, combining "native stablecoin + self-built usage scenarios", which is somewhat similar to the path of Frax Finance - the stablecoin (FRAX) and lending (Fraxlend) and DEX trading (Fraxswap) businesses mutually supporting and promoting their own horizontal expansion.

Hope has already launched HopeSwap, which provides deep trading liquidity for HOPE with other stablecoins and mainstream crypto assets, thus building a rate market for pricing HOPE. HopeLend will be launched next, which will further support the collateralization of other mainstream assets in exchange for HOPE.

This anchors HOPE more widely to different asset classes and distributes it to usage scenarios outside its own DeFi ecosystem. The product combination of "HopeSwap + HopeLend" also means the construction of HOPE's rate and interest rate markets.

After the completion of the on-chain DeFi scene, it has laid the foundation for the launch of the next phase, Hope Connect: With HOPE becoming an important collateral asset on the chain, it can serve as a springboard in the form of RWA to expand from the on-chain DeFi scene to the CeFi and TradFi usage scenarios.

Token Model

crvUSD and GHO are still managed by Curve DAO and Aave DAO because they are stablecoin products introduced by Curve and Aave.

DAI and MKR adopt a dual token model of stablecoin and governance token. MKR holders can vote on protocol parameters such as different collateral types and different liquidation penalty settings.

In addition, if the value of all collateral in the system is insufficient to repay all debt, bad debt will be created and Maker will conduct a debt auction - issuing and auctioning new MKR to restructure capital in order to repay the debt.

The surplus auction, on the other hand, involves bidders using MKR to bid for a fixed amount of DAI, with the highest bidder winning. Once the surplus auction ends, the Maker protocol will automatically destroy the MKR obtained from the auction, reducing the total supply of MKR.

Although FXS and FRAX also have a dual token mechanism design, FXS is a utility token. For example, as mentioned earlier, if the CR is 95%, users need to collateralize 95 USDC by pledging 100 FRAX, and destroy FXS worth $5, in order to obtain the corresponding FRAX. In addition to the mentioned expenses, users also need to pay a minting fee of 0.2%.

Redemption is the reverse operation of the above process. Users provide 100 FRAX and can retrieve 95 USDC according to the current CR value of 95%, as well as the system's newly minted FXS worth $5. Similarly, in addition to providing 100 FRAX, users also need to pay a redemption fee of 0.45%.

HOPE also adopts a dual token model design. In addition to the stablecoin HOPE, there is also a governance token LT (Light Token). Interestingly, in addition to veLT holders being able to receive bonus rewards and protocol revenue sharing, LT has an implicit value as a perpetual call option on Bitcoin/Ethereum.

1. HOPE: Limited-profit "Stablecoin Option"

HOPE is essentially similar to a "Stablecoin Option" with an exercise price of $1 and limited profits under the insufficient reserve background.

For example, when the HOPE is less than $1, buying HOPE directly is equivalent to indirectly anchoring the future value fluctuation of mainstream crypto assets such as Bitcoin and Ethereum through the "securities" certificate mapped with the equivalent reserve.

However, since HOPE can only rise to a maximum of 1 USD, even if the reserve increases significantly, the excess income cannot directly reflect on the value of HOPE.

Therefore, HOPE can be understood as a "stablecoin option" that users purchase with the current price as the premium. The upper limit of the maximum possible return is: exercise price (1 USD) - premium.

2. LT: "Bitcoin / Ethereum perpetual call options" linked to excess reserve value

LT is essentially similar to a "Bitcoin / Ethereum perpetual call option" that locks in future excess reserve income, benefiting from the linkage to excess reserve value.

Especially during bear markets, when the value of reserves is low, holding LT is equivalent to locking in the excess value brought by the continuous rise in reserves in advance: as Bitcoin and Ethereum's value increases, the price of HOPE will achieve a 1:1 anchor to the US dollar, and the excess value brought by the continuous rise in reserves will be reflected in the value of LT.

Overall, we are still in the early stage of the stablecoin long-term competition. The arrival of new challengers like crvUSD, GHO, and HOPE is likely to change the competitive landscape and bring new variables to the decentralized stablecoin market and even the DeFi track.