Continuous innovation on the old track: borrowing from cutting-edge Scallop to inject vitality into the Sui ecosystem

Original - Odaily

Author - Loopy Lu

In this market upturn, we have seen a significant increase in activity on the Sui network.

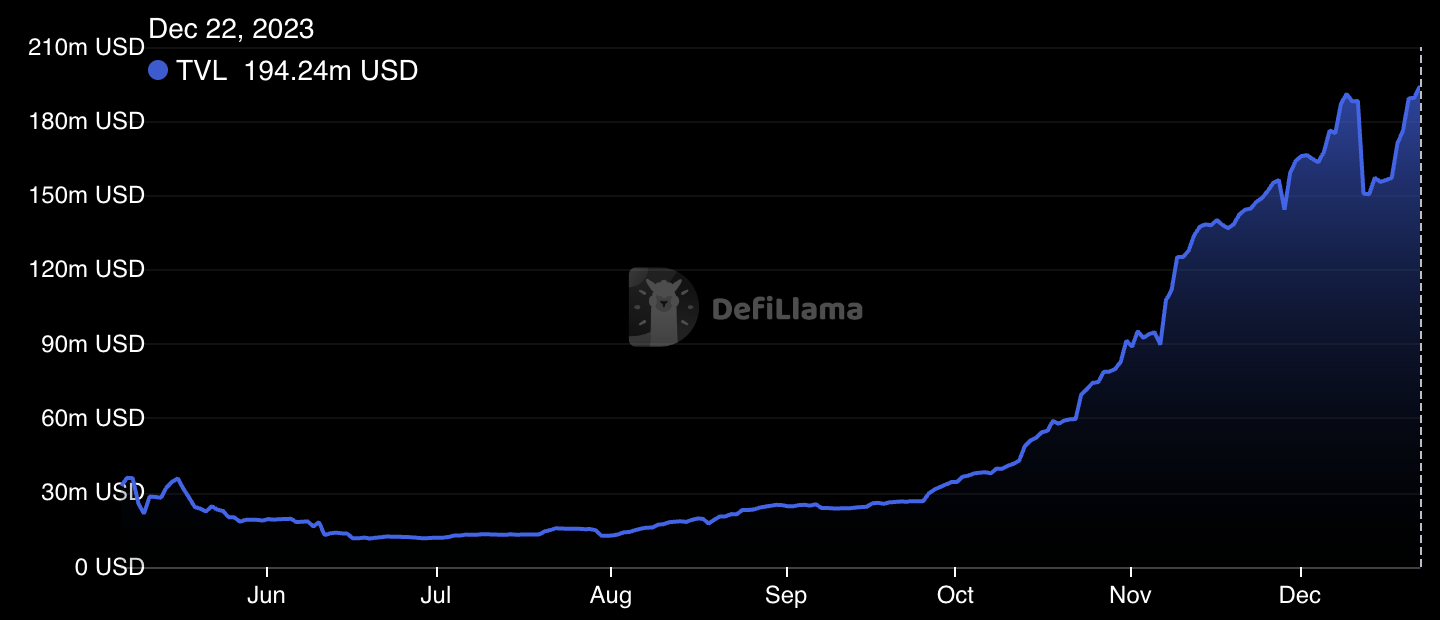

DeFiLlama data shows that Sui’s TVL has risen rapidly and is now close to $200 million, which is several times the average level of the previous months.

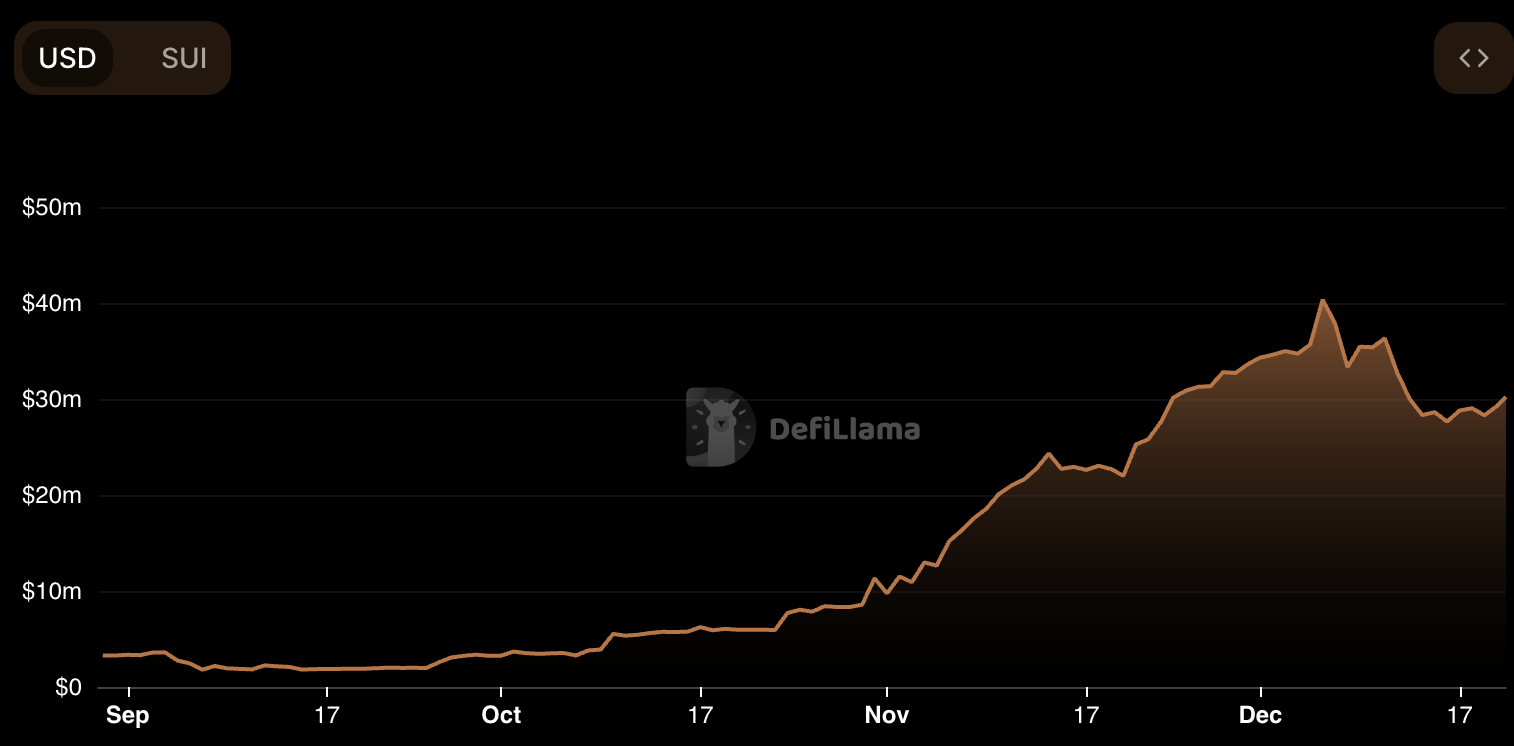

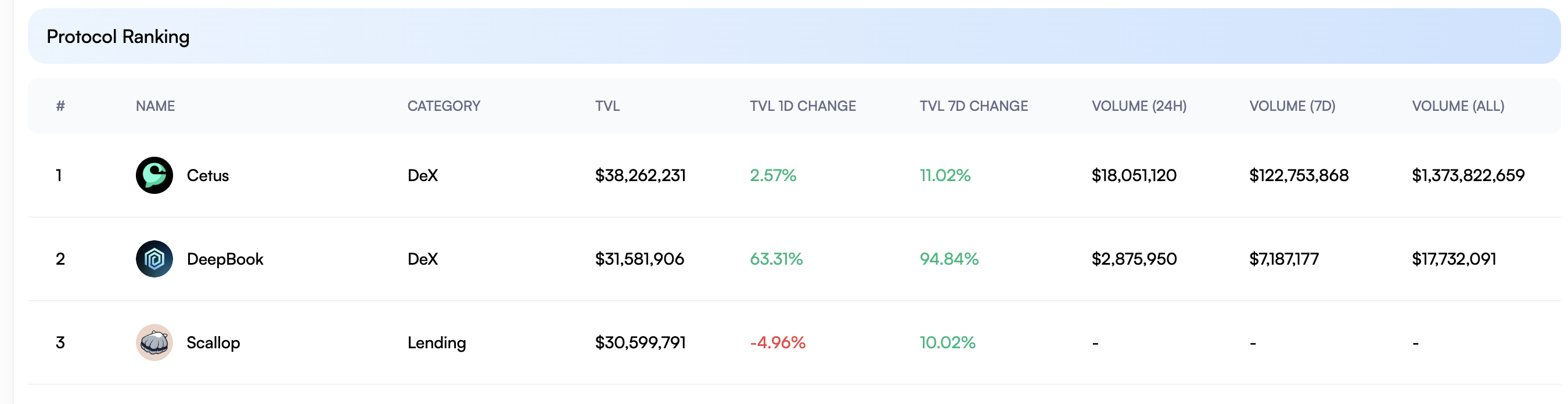

In the current growth of the Sui DeFi ecosystem, the lending market called Scallop is particularly noteworthy. SuiVision data shows that Scallop’s rapid growth has made it a key player in the Sui ecosystem. Scallop TVL currently exceeds US$32 million, and at its peak it once exceeded US$40 million.

In terms of ecological niche, the lending platform is slightly old, but Scallop has relied on its technical capabilities and deep cultivation in this field to make differentiated innovative breakthroughs in the field of DeFi lending.

Scallop not only represents an innovative breakthrough in the DeFi field, but also shows the industry how to better utilize the technical characteristics of non-EVM emerging public chains and continue to produce innovations for the old track.

The lending market is vast, how to gain official recognition in the new non-EVM ecosystem

Currently, there are more than 300 DeFi lending protocols included in the data platform DeFiLlama alone. Data from Stelareum shows that the entire DeFi lending market is extremely large. Its data shows that the total TVL of lending protocols currently exceeds US$10 billion.

Although the current market focus is still occupied by endless new hot spots, as an important liquidity infrastructure in the on-chain market, lending platforms are still an extremely important track and have a profound impact on the market.

Although it has gone through a long period of development, the current DeFi lending platform still faces various limitations, such as high gas, low transaction efficiency, security risks, and lack of scalability. The emergence of Scallop is expected to bring better solutions to the market.

Scallop is deployed on the Sui network and is an innovative on-chain lending market in the lending field. It is also the first DeFi protocol to receive official funding from the Sui Foundation.

According to DeFiLlama, Scallop’s peak TVL has exceeded $40 million.

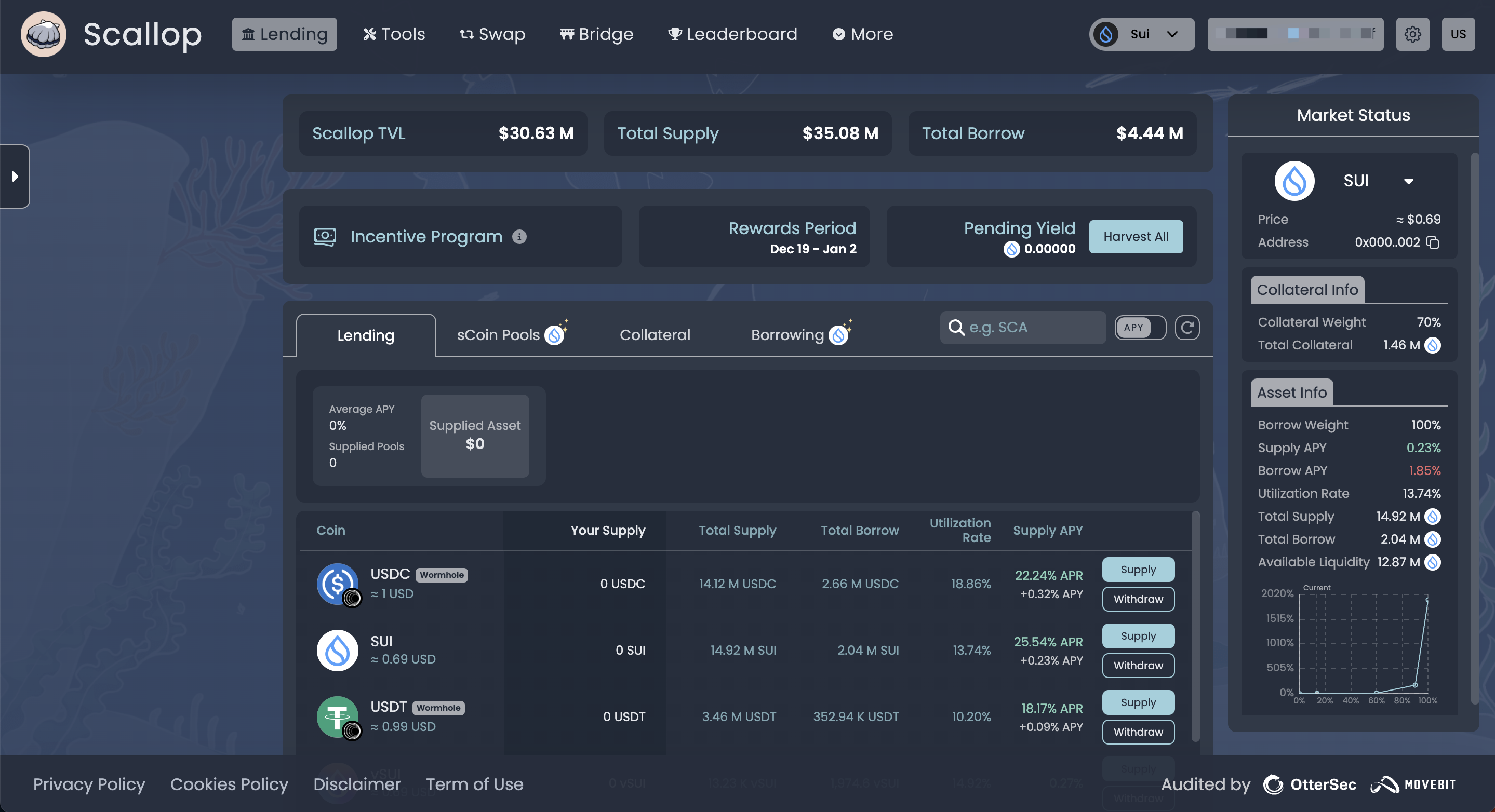

By emphasizing institutional-grade quality, enhanced composability, and strong security, it strives to build a dynamic money market and provide diversified services, including common on-chain lending, flash loans, and more. In addition, Scallop has developed a 2-layer SDK specifically for professional traders and provides an arbitrage trading UI that requires no programming knowledge.

For the lending market, which lending model to adopt is an unavoidable question. Since its launch at the end of 2022, the Compound V3 model has long been the first choice for development considerations in many EVM lending markets due to its stable security.

However, due to language and environment differences and late launch time, the Compound V3 model has always been limited to the EVM ecosystem.Scallop pioneered a lending market that improved the Compound V3 model on non-EVM chains. Its model is based on Compound V3, Solend V2 and Euler, making Scallop the only unique lending protocol.

With this, Scallop provides a safe, efficient, and transparent lending environment, which not only effectively improves transaction efficiency and security, but also successfully solves scalability issues and makes technological innovations by leveraging the characteristics of the Sui network. .

Scallop attaches great importance to the concept of user experience, making the platform more attractive to a wide range of user groups, including traditional financial users, by providing a 2-layer SDK for professional traders and an easy-to-use arbitrage trading UI.

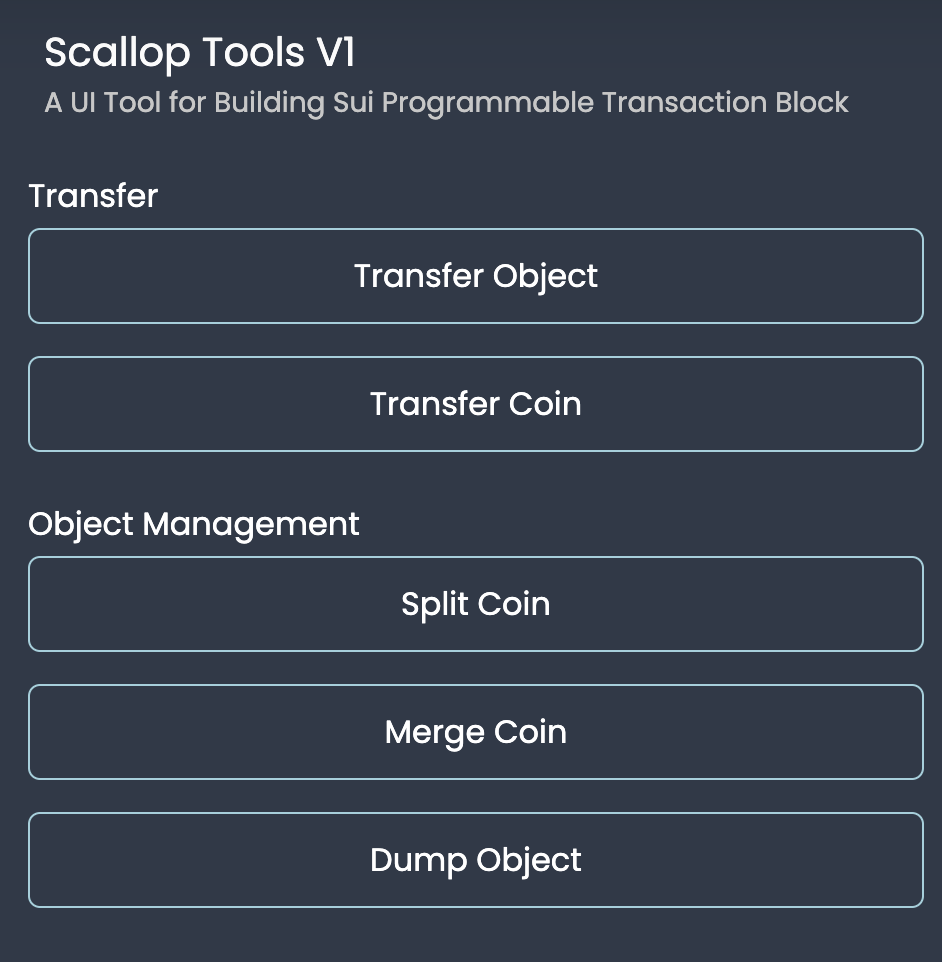

Another interesting design that optimizes ease of use is that Scallop also integrates transfer tools and Sui object management tools. This provides users with a better experience.

Leveraging Sui’s technical expertise to improve the Compound V3 model

To better understand Scallop, we have to start with Compound V3. Why is Compound V3 so important?

For the DeFi market, the ability of a protocol to operate for a long time is one of the reference indicators for higher security.

One of the most typical improvements of Compound V3, launched in late 2022, is that lenders have full ownership of their funds because the collateral is no longer lent to others, thus eliminating the risk of illiquidity and improving the risk management security of the overall protocol. sex. While Scallop inherits Compound V3, it also inherits the excellent risk management of the V3 model and makes some improvements on it.

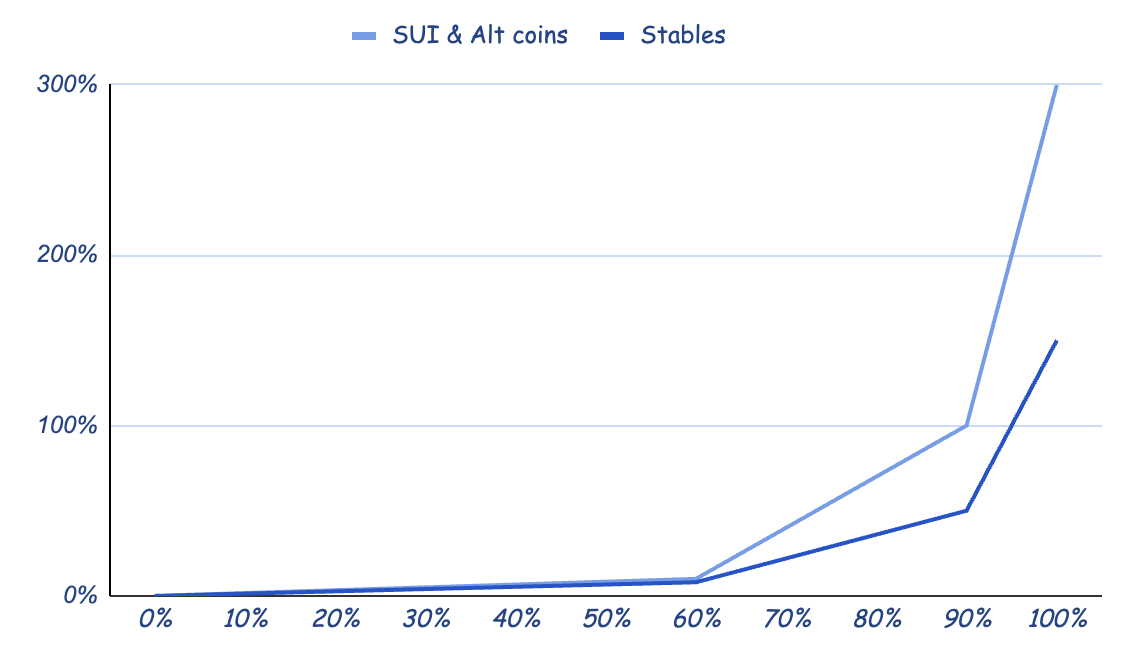

Unlike the two-line interest rate model used by most lending protocols, Scallops three-linear model is its most outstanding design.The trilinear interest rate model is specifically designed to meet the dynamic needs of the decentralized finance sector, optimizing the stability of interest rates and responsiveness to market conditions.

Specifically, the model is divided into three distinct phases, each triggered by a different level of capital utilization. When capital utilization approaches the cap, the system ensures that liquidity providers are fully compensated for increased risk, while borrowers are signaled to reduce their positions due to increased borrowing costs.

As we all know, oracle price manipulation has always been the main means of attack in the lending market. To guard against this risk, Scallop also adds an extra layer of security to the oracle -Use a multi-oracle consensus strategy to maximize the cost of price manipulation attacks and avoid oracle price manipulation attacks.The components of the Scallop price module include Pyth, Switchboard and Supra Oracles, and can be expanded to allow multiple oracles to obtain data together.

When lending on Scallop, users can get market tokens (Scallop Market Coins) representing lending assets, such as sSUI, sUSDC, etc. sCoin is a lending derivative that aims to tokenize debt and maximize In order to ensure the composability of the protocol, sCoins can be mortgaged to other protocols to release idle liquidity. Currently, sCoins are also the most liquid derivatives on the Sui District fast chain.

And Scallop implements dynamic constraints on the total amount of loans and withdrawals allowed, which can be adjusted for each asset and pool. This helps prevent unusual token minting events and reduce unusual withdrawal behavior.

For Scallop, the characteristics of the Sui network are fully exploited. Suis programmable transaction blocks, high scalability and low transaction costs enable Scallop to effectively provide fast and efficient financial services. In addition, the emergence of Scallop also promotes the ecological diversity and overall development of the Sui network, bringing more users and activities to Sui.

For the Sui ecosystem, Scallop undoubtedly brings higher liquidity support to the entire network. SuiVision data shows that Scallop is currently the No. 1 lending platform in the Sui ecosystem TVL, which means that a large number of mainstream assets can release liquidity, bringing higher capital efficiency to the ecosystem.

Based on Scallop, there are also multiple income aggregators that have accessed Scallop’s liquidity, including Typus, Kai Finance, SUI Pearl, etc.

Among them, Kai Finance is a more interesting project. Kai Finance places more emphasis on the use of stable coins and only provides users with a way to deposit USDC. This product puts more emphasis on the expansion of Web2 users to provide Scallop with ample liquidity.

Through this powerful composability, Scallop can capture assets from more sources, including crypto-native users and users new to Web3.

Another extremely innovative feature of Scallop makes full use of the characteristics of the Sui network. Suis account system is different from common EVM addresses, providing users with main accounts and sub-accounts. Scallop also makes full use of this feature, allowing users toEfficiently self-manage multiple accounts. Transfers of assets and liabilities between subaccounts do not require approval, and users can easily segregate collateral and debt according to their preferences.

Even more interestingly, Scallop provides users withTransferable sub-account functionality. Users can encapsulate assets and debts in a sub-account, and the sub-account is transferable. For users, in addition to the consideration of risk isolation, it is also convenient to package their own asset portfolios so that the asset packages can be circulated.

The team has rich background and experience, and the future path is worth looking forward to.

Scallops team is composed of senior experts in the fields of blockchain and financial technology. Team members have rich technical backgrounds and the ability to deeply understand financial markets. Scallop’s outstanding performance in the industry also reflects the team’s professional capabilities. Scallop has already won multiple awards.

Scallop is a recipient of the Sui FoundationThe first officially funded DeFi project, and also achieved results in multiple hackathon competitions, including:

First Place, Circle Award, Move Hackathon;

Third place in Sui x Kucoin Labs Summer Hackathon;

Sui x Jump_ Builder House 3rd place in Ho Chi Minh City CTF Challenge;

Sui Builder House 5th Place Denver CTF Challenge;

At Sui Builder House’s Seoul Hackathon, the Scallop team won thetwo awards——Scallop Tools won first place at Seoul Hackathon. Sui Kit, a web interaction package, won fifth place.

In addition to receiving official funding from the Sui Foundation, Scallop has other investors including Mysten Labs, Comma 3, Assembly Partners, Skynet Trading, Supra Oracles, Vitality Ventures, Credit Scend, PHD Capital, LOL Capital, OtterSec, Movebit, and others.

Scallop is about to issue the protocol’s native token SCA, with a maximum total supply of 250 million.

SCA plays multiple functions in Scallop. It can participate in voting as a governance token and also has various practical functions. Holding a certain amount of SCA can enjoy discounts on lending interest fees, and users can also use SCP to participate in liquidity mining.

The specific token distribution is as follows:

45% is used for liquidity mining;

18.5% allocated to Scallop contributors;

4.00% for development and operations;

2.00% allocated to advisor;

10.00% allocated to strategic partners;

8.50% for ecosystem, community, marketing;

5.00% for liquidity;

7.00% vests in the project treasury.

In the future, Scallop plans to continue to expand its influence in the DeFi field. It will explore new cooperation opportunities and launch more innovative products.

The official roadmap shows that the Scallop Tools V2 version will be launched in the upcoming first quarter of 2024. There are also Telegram and Discord bots. In terms of assets, Scallop will also support synthetic asset pools, which can bring more asset types to the Sui chain ecosystem. The introduction of isolation pools this quarter will also bring additional security to Scallop.

In the second quarter of 2024, the introduction of RWA, cross-chain deployment, support for cross-chain lending and leveraged lending will also open up more room for imagination for Scallop.

According to the team, Scallop plans to launch the first phase of airdrop before the end of this month to reward early users. The second phase of airdrop will be launched in the form of points + blind box in the future. Users who love the interactive experience in the new ecology and capture early opportunities can Keep an eye on official channels for developments.