LD Capital: The increasingly fierce Pendle War

Author: Jaden, LD Capital Research

1. Pendle Status

Pendle Finance is a yield strategy protocol deployed on Ethereum and Arbitrum. It launched its v2 version at the end of 2022, along with changes to its economic model. It subsequently added support for LST assets and launched on Arbitrum. For more fundamental information, please refer to LD Pendle's historical report.

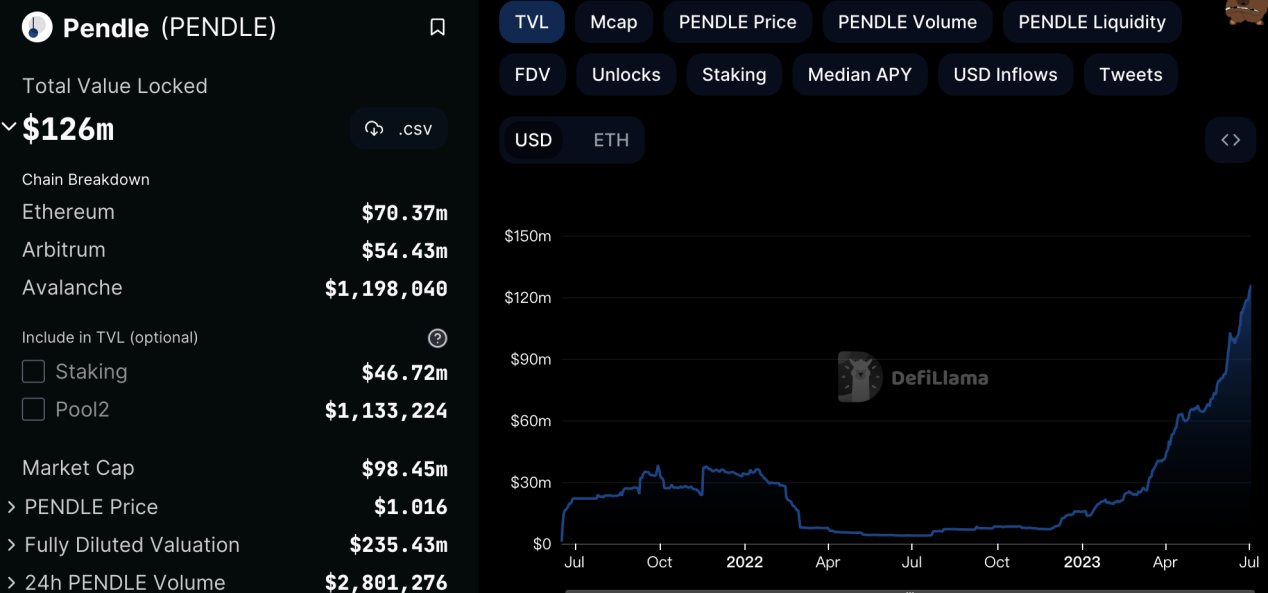

Figure: Pendle TVL

Source: Defillama, LD Research

Its TVL has been continuously increasing since the end of 2022, and the current TVL has exceeded $126 million.

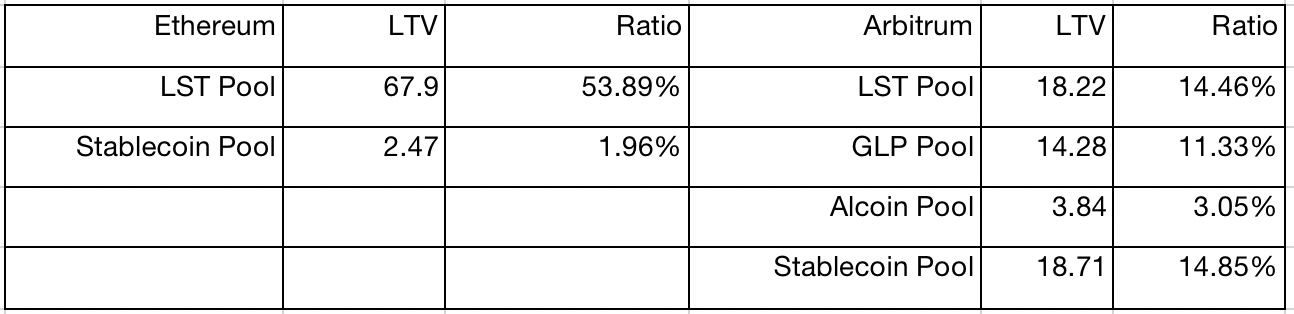

Figure: Liquidity Distribution (Million)

Source: LD Research

The liquidity within the Pendle protocol mainly comes from LST assets, with GLP, stablecoins, and other tokens accounting for only about 30% of its TVL. The income of GLP primarily comes from trader profits and protocol fees, which vary daily. The profitability has more room for speculation and tradability.

The initial income of LST assets comes from ETH PoS. Due to differences in the amount of staking, LSD protocol operation mechanism, and platform fees, there are variations in the profitability of different LSD platforms, but the differences are not significant. The profitability is usually maintained at around 4%, and the low elasticity of profitability determines the relatively poor tradability of LST assets. The Pendle protocol adopts the veToken and Gauge voting mechanism for liquidity mining, so the Pendle LST pool can achieve a yield of 10%-30%.

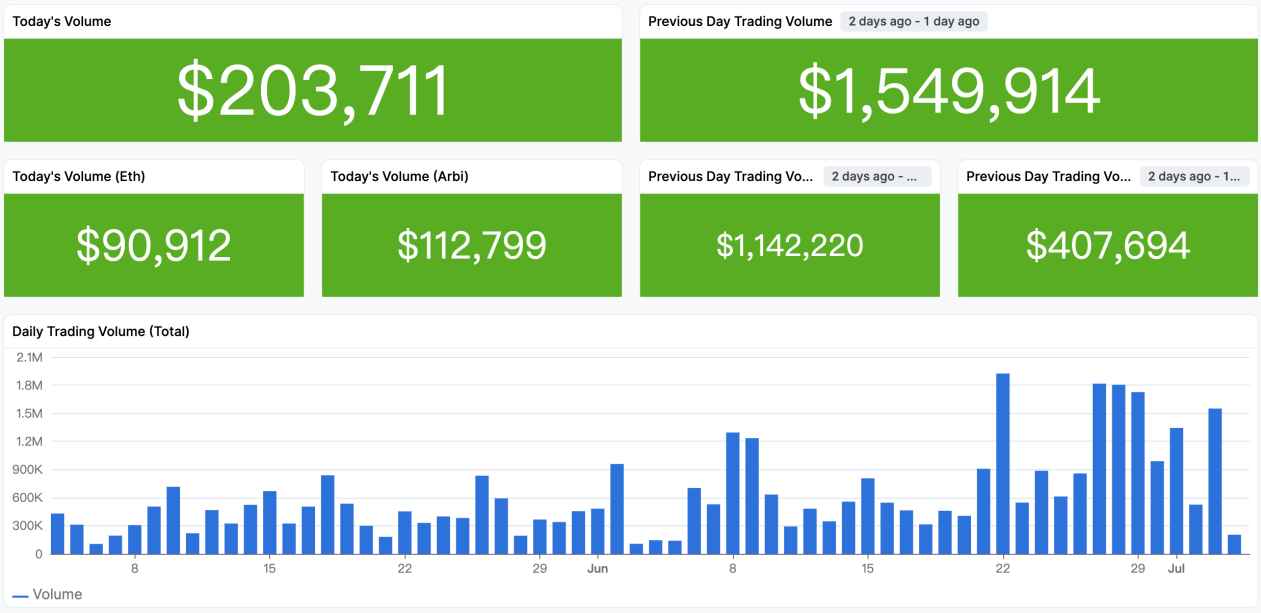

Image: Pendle protocol trading volume

Source: app.sentio.xyz, LD Research

According to historical trading volume data, the daily trading volume of the Pendle protocol is generally below $1 million. LSD asset trading volume accounts for 54.82% of the total trading volume, while GLP's historical trading volume accounts for 24.09% of the total trading volume. GLP trades usually occur when the market is more active, so in the past 1 day of trading, GLP accounted for 51.29%. Considering the LTV ratio of various assets in the protocol, GLP has a greater potential for yield optimization.

2. Pendle Economic Model

Token Allocation

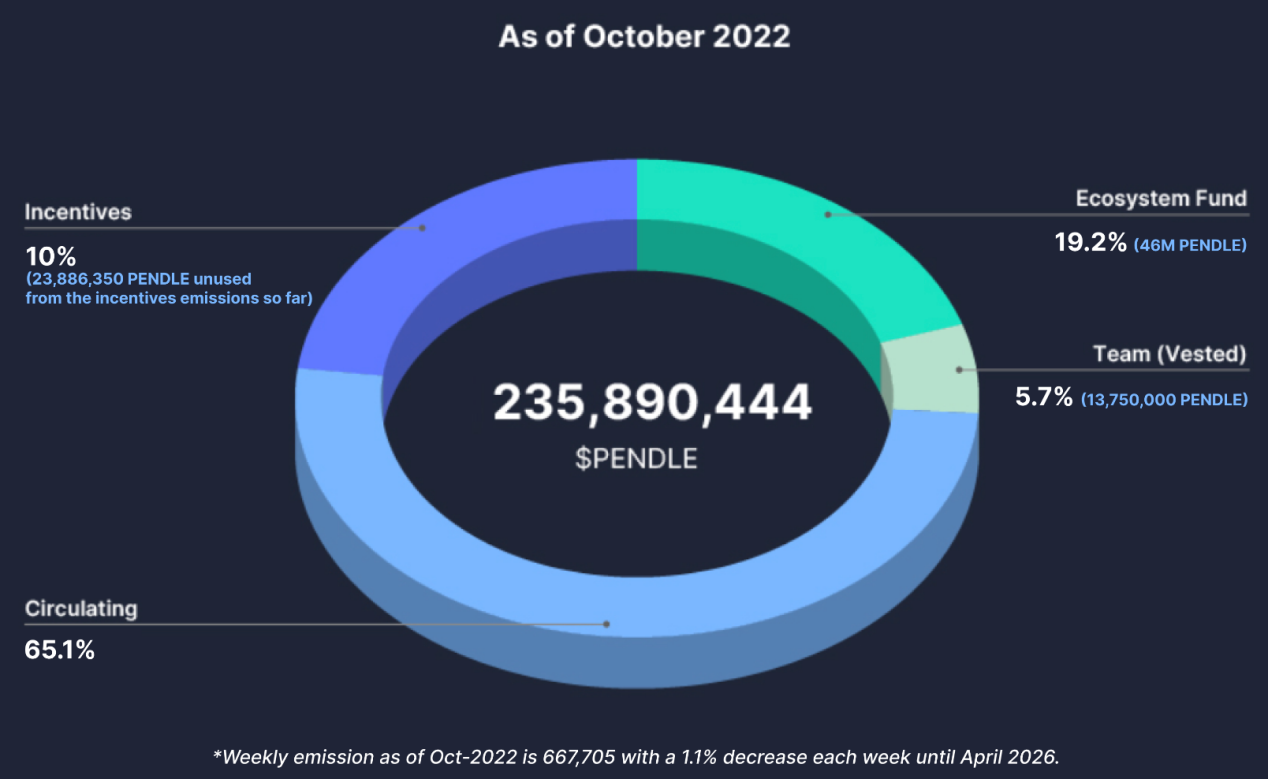

Image: Token Allocation

Source: Pendle Docs, LD Research

Currently, the team, advisors, and investors have unlocked part of the tokens.

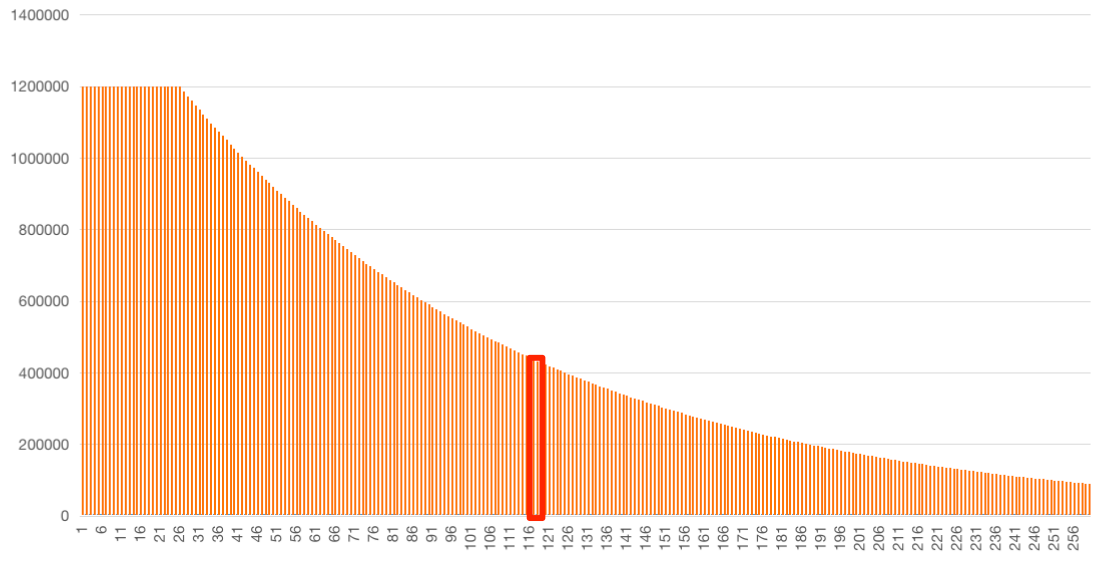

In the liquidity incentives section, 1.2 million tokens are distributed per week for the first 26 weeks, and then decreased by 1.1% each week until the 260th week. After the 260th week, the annual inflation rate is 2% based on the circulating token supply, and the weekly liquidity release remains at a relatively stable level. According to the team's description, the weekly release amount in October 2022 is approximately 667,705 (the 79th week release amount), and it is currently around the 113th to 117th week, with a weekly release amount of about 450,000 tokens. PENDLE will continue to be released in the long term.

Chart: PENDLE Weekly Release Amount

Source: LD Research

Pendle introduced the veToken model in November 2022 primarily to improve the protocol's liquidity. Pendle's lock-up period ranges from 1 week to 2 years. vePENDLE holders direct rewards to different pools through voting, incentivizing liquidity in the voting pool. Snapshots of all votes will be taken at the start of each cycle on Thursday 00:00 UTC, and the incentive rate for each pool will be adjusted accordingly.

Key features of vePENDLE:

1) The incentive for token issuers to bribe vePendle holders is low. As a leading DEX, token issuers typically provide their own token mining rewards and bribe veCRV votes to increase CRV liquidity mining incentives in Curve. The demand for vePENDLE mainly comes from LPs participating in mining, lacking strong demand from token issuers.

2) vePENDLE lockers can only participate in the fee distribution of the voting pool transactions.

3) vePENDLE holders can share 3% of the earnings generated by Yield Token (YT).

4) vePENDLE holders can receive 80% of the transaction fees from the voted AMM pool.

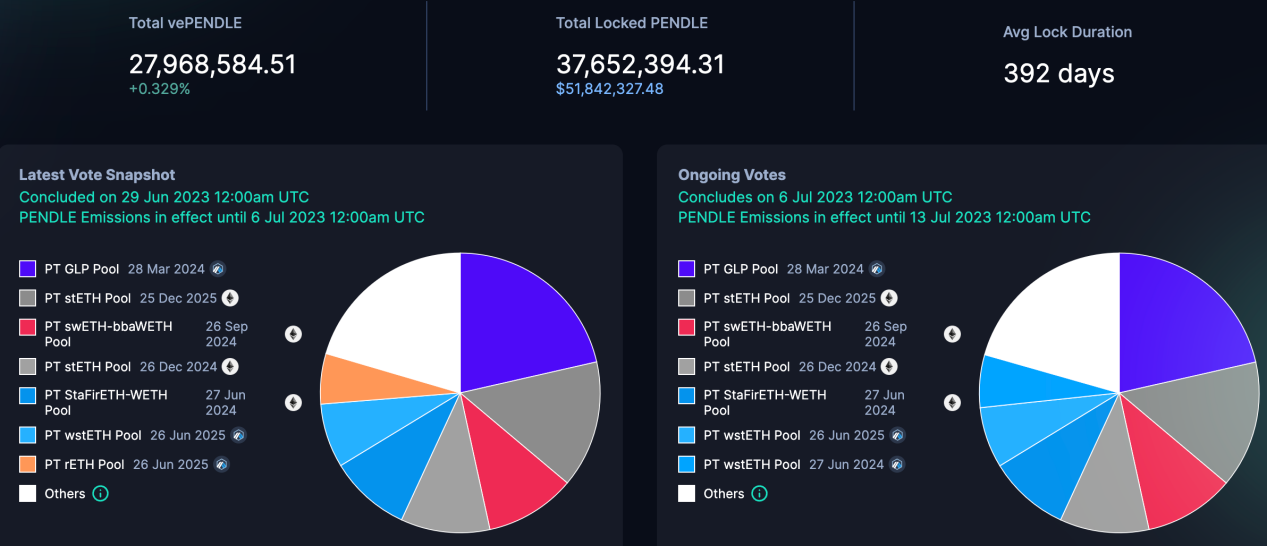

Figure: PENDLE staking status

Source: Pendle Finance, LD Research

As of July 3rd, the PENDLE lock-up amount is 37 million tokens, with an average lock-up time of 392 days.

3. Penpie/Equilibria

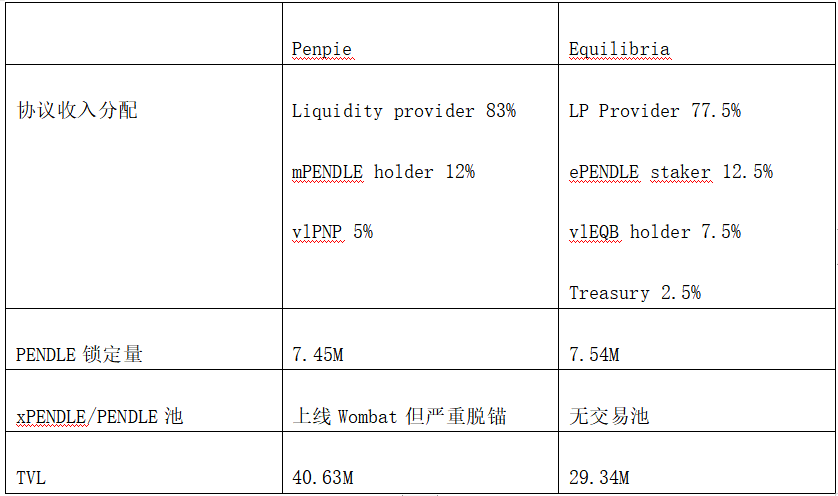

Penpie and Equilibria are auxiliary protocols that enhance LP earnings based on the Pendle veToken economic model. LP can earn Pendle mining boost without staking Pendle. The two have similar business models.

Penpie

The protocol currently supports the Ethereum mainnet and sp;Arbitrum.

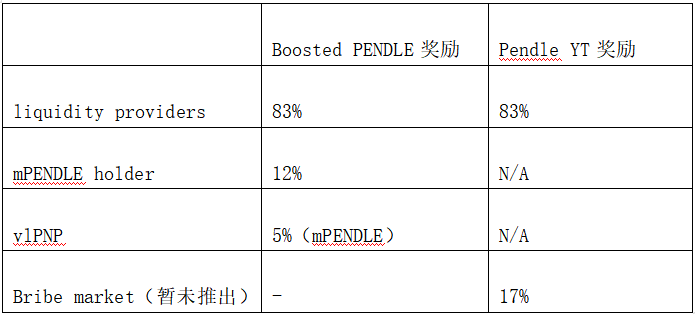

Users can convert PENDLE to mPENDLE through Penpie, and the protocol collects the staked PENDLE to generate vePENDLE for LP to achieve mining boost. 83% of the boost income is allocated to LP, 12% to mPENDLE holders, and 5% to vlPNP. The team plans to allocate 17% of the YT rewards in the vePENDLE equity to the Bribe market, but it is not yet live.

Table: Income Distribution

PNP is the governance token of Penpie. Users can obtain vlPNP at a ratio of 1:1 by locking PNP tokens. Holding vlPNP allows users to earn protocol distribution income and participate in governance. Once users lock their PNP tokens as vlPNP, they will enter the default lock state with no time limit. Users must "start unlocking" to enter a 60-day cooldown period. During the cooldown period, vlPNP holders can continue to earn passive income but cannot participate in voting. After the 60-day deadline, users can unlock their vlPNP tokens back to PNP. The penalty cost on the first day of the cooldown period is 80% of the total locked PNP token amount, which gradually decreases over time.

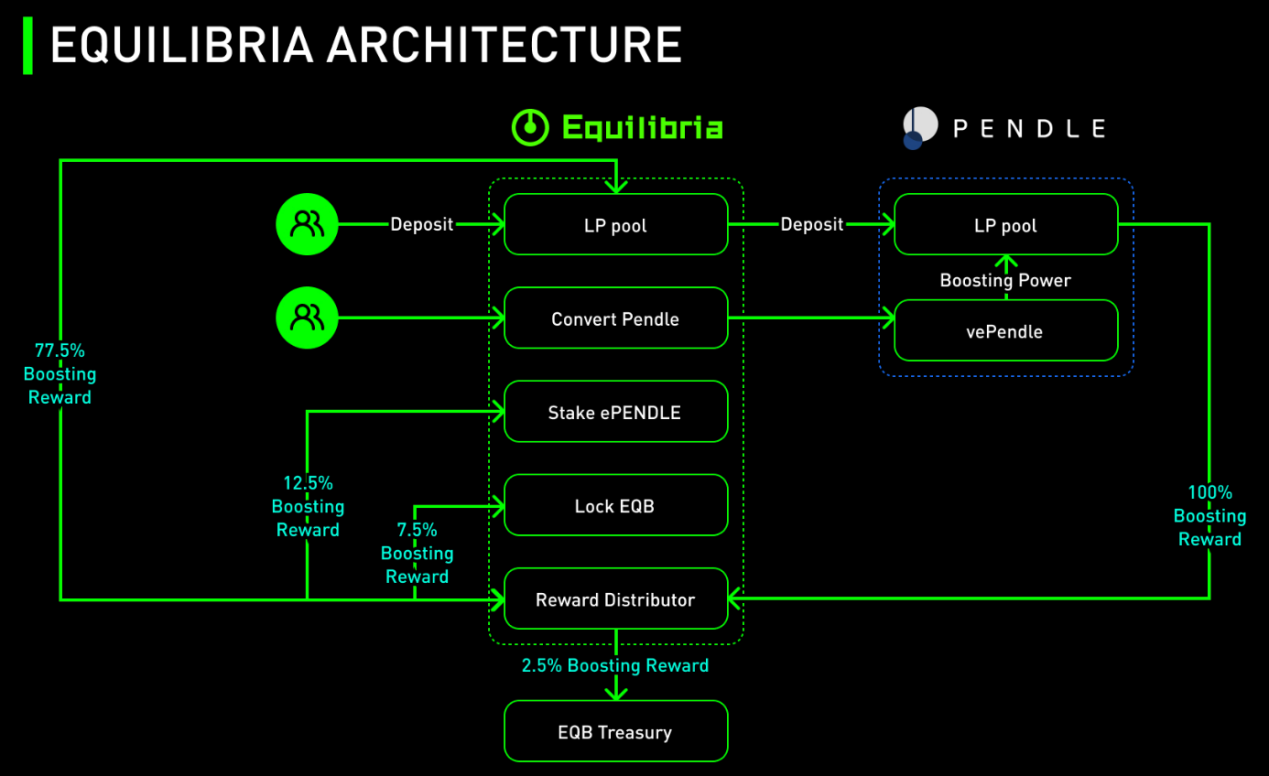

Equilibria

Equilibria's business model is similar to Penpie, helping Pendle LP achieve mining boost without the need to stake PENDLE. Once Pendle is staked as ePendle, it cannot be reversed. Users need to lock EQB/xEQB as vlEQB to receive protocol fees and voting rights. xEQB can be converted to vlEQB, and the team plans to integrate xEQB into other protocols, although currently there are not many use cases.

Figure: Equilibria Architecture

Source: Equilibria docs, LD Research

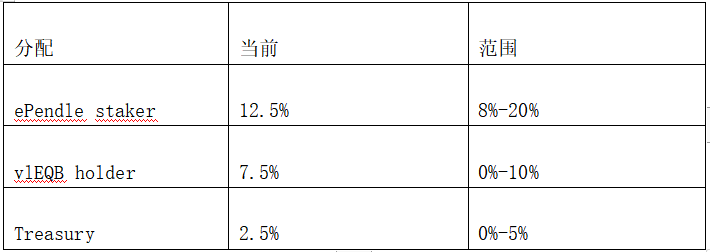

After mining boost is implemented through Equilibria, 77.5% is allocated to LP, 12.5% is allocated to ePendle holders, 7.5% is allocated to vlEQB holders, and Treasury receives 2.5%. The income distribution proportion for each role is set within a certain range.

Table: Income Distribution

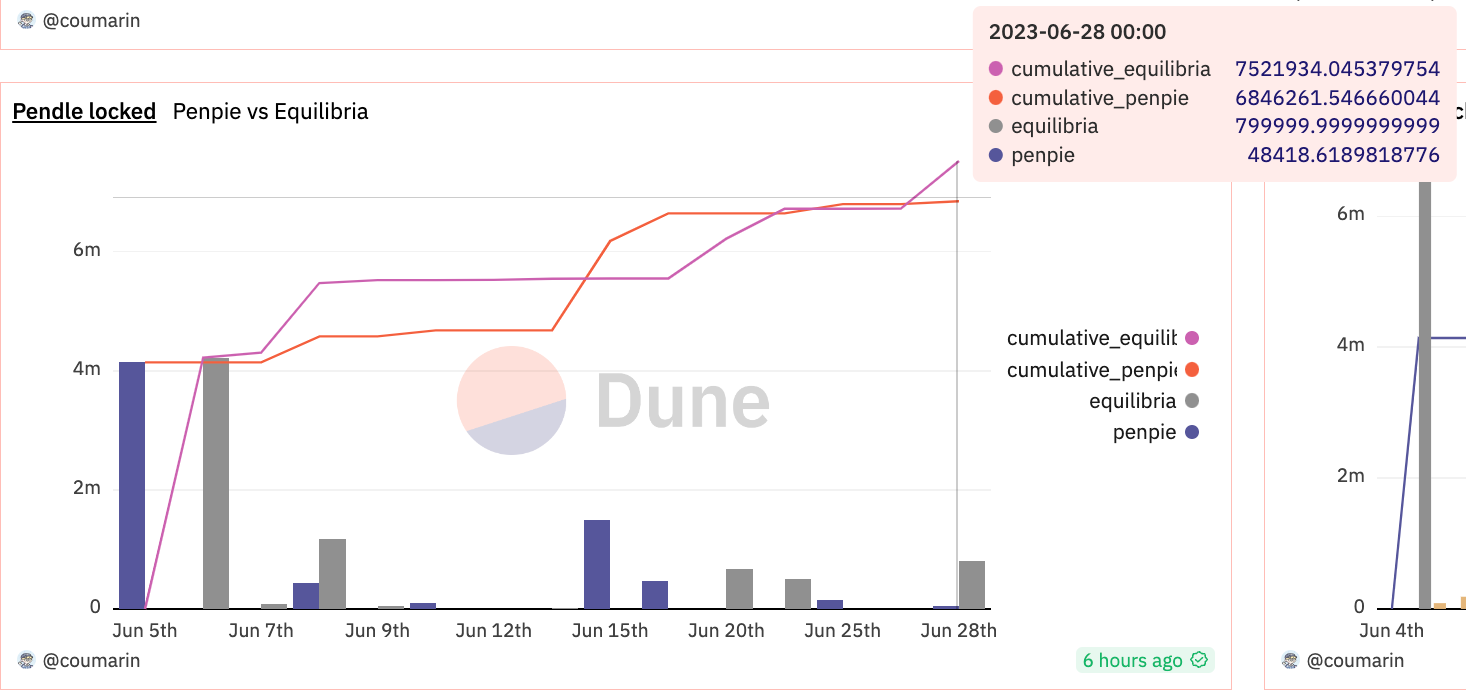

Protocol Data

Figure: PENDLE Lock Data

Translation:

Source: dune.com, LD Research

*dune data as a reference (stagnant as of June 28), there are discrepancies with the current data on the official website.

According to the official website data, as of July 4, the locked amount of Penpie PENDLE is 7.45 M, and the locked amount of Equilibria is 7.54 M. Although ePENDLE, mPENDLE, and PENDLE are all exchanged at a 1:1 ratio, Equilibria announced the suspension of ePENDLE/PENDLE liquidity pool after June 19. The original plan stated a delay of 2 weeks or longer. Currently, the team has not provided a definite time. As for mPendle, it launched Wombat, but the exchange ratio is approximately 1:0.72, indicating significant wear and tear.

">Table: Penpie vs Equilibria

Source: LD Research

Compared to Equilibria, Penpie allocates a larger portion of the boost rewards to LP, making it more friendly to LP and retaining more profits for LP. Under the same conditions, LP would be more willing to choose Penpie.

From a data perspective, the Pendle protocol's TVL is steadily increasing, and the fundamentals are gradually solidifying. However, the risk lies in the continuous emission of PENDLE tokens. Neither the PENDLE protocol nor Penpie and Equilibria can maintain high APR in the long term, making it difficult to sustain user staking of PENDLE. Additionally, there is a large amount of ePENDLE and mPENDLE that cannot be sold due to no liquidity pool or detachment from the anchor, creating hidden selling pressure.