One week after the mainnet was launched, what is the progress of the Sui ecosystem?

Today, one week after the Sui Network mainnet went live, encryption researcher 2 Lambroz experienced all the DeFi projects that went live on the mainnet, and organized and summarized the relevant information of these dApps in onesheet, and draw the following conclusions:

I am currently not very optimistic about Sui, because most of the current projects are still in the stage of raising funds and issuing tokens.

As a user, I have nothing to do and nothing worth mining.

- Stablecoin mining yields are not high due to low transaction volume

- SUI/USDT is not attractive

first level title

secondary title

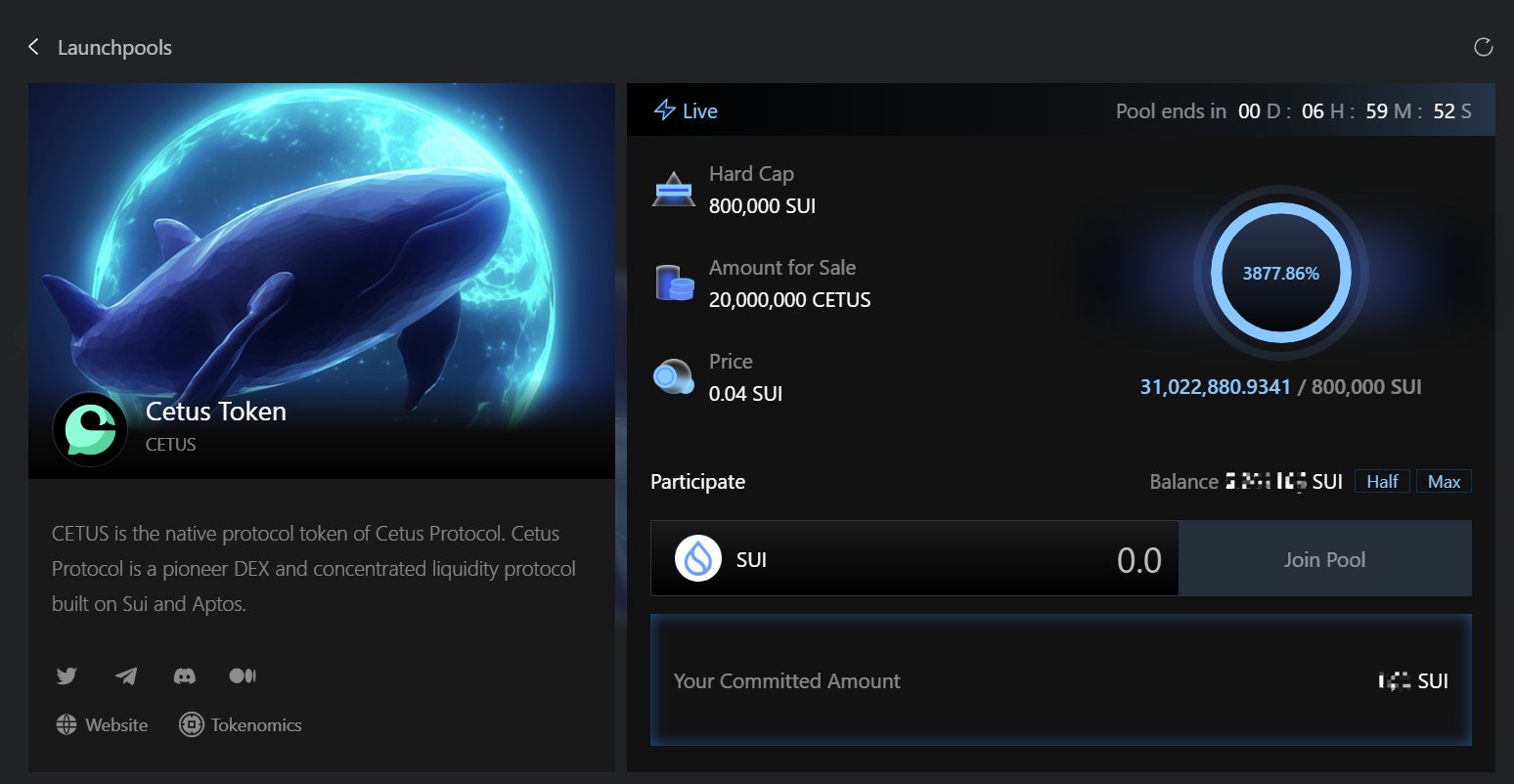

Cetus Protocol

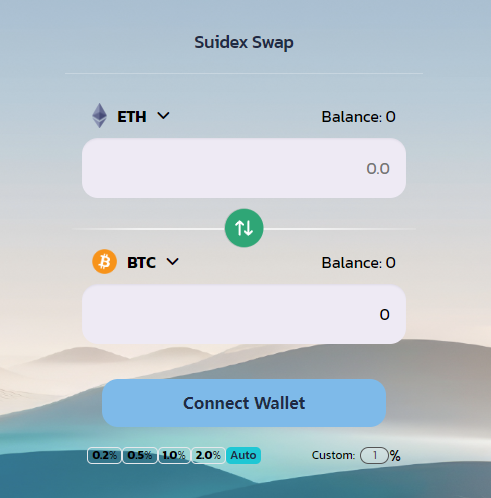

Category: Swap

Status: Mainnet launched, seed round financing completed, IDO in progress

Cetus is currently the DEX with the highest TVL on the Sui mainnet ($15 million), with single-currency staking and LP mining functions. He was selected for the second round of Sui's developer funding project, and the seed round was invested by OKX Ventures, KuCoin Ventures, NGC Ventures, Animoca Ventures, etc.

secondary title

Turbos Finance

Category: Swap

Status: Mainnet launched, seed round financing completed

secondary title

Typus Finance

Category: Options

Status: Mainnet launched

secondary title

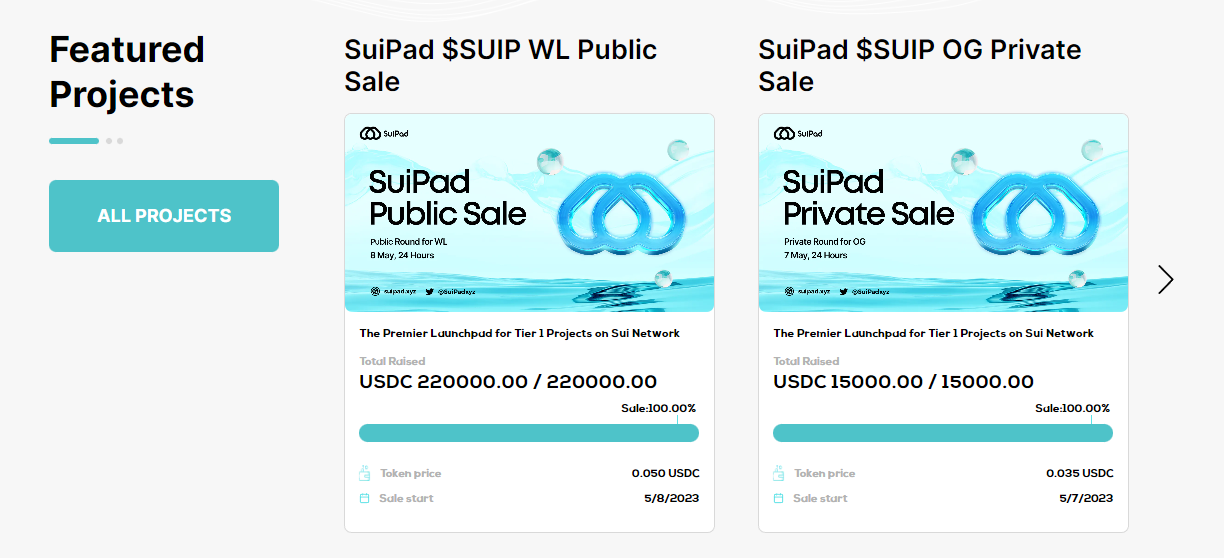

SuiPad

Category: Launchpad

Status: Mainnet launched, IDO completed

SuiPad is a Launchpad platform on Sui that claims to be an official partner of Sui developer Mysten Labs (I didn't verify). The project announced at the end of April that it had completed $1.15 million in financing from NGC Ventures, GBV Capital, Cogitent Ventures, PANONY, and others.

secondary title

Mole DeFi

Category: Liquidity Mining

Status: Mainnet launched

secondary title

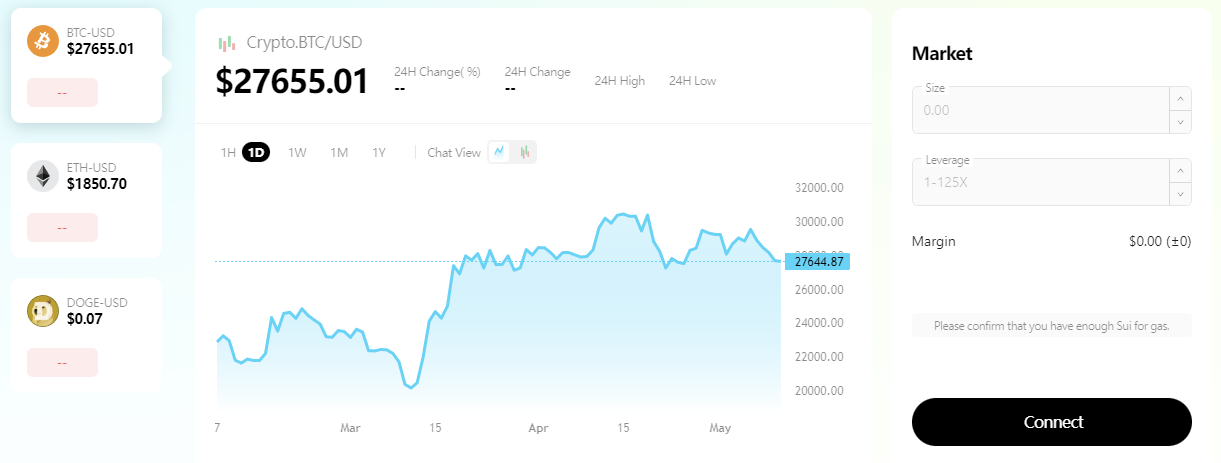

Kriya DEX

Category: Swap, Perpetual Contract

Status: Mainnet launched

secondary title

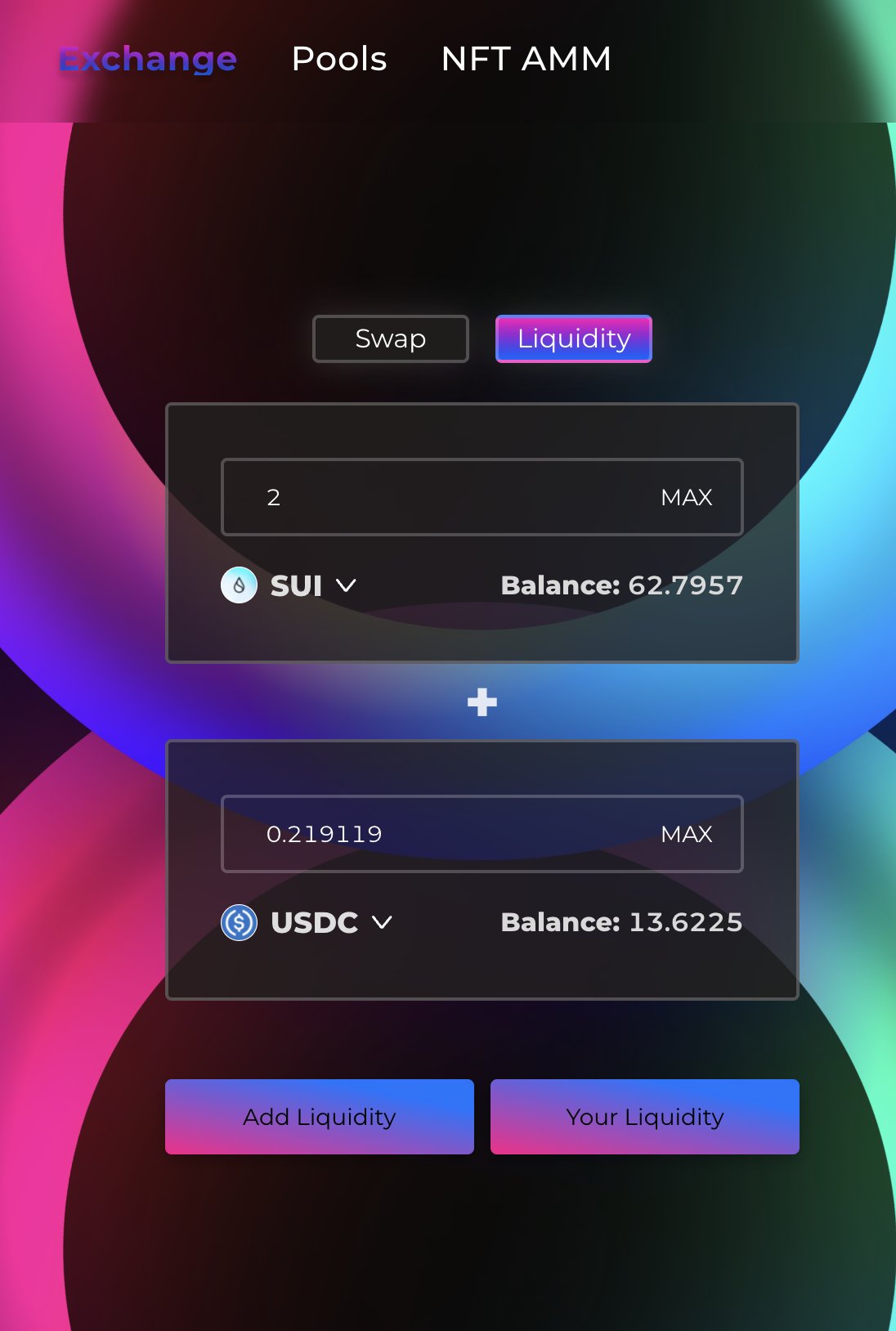

GiroSwap

Category: Swap, NFT-Fi

Status: half online?

secondary title

MovEX

Category: DEX

Status: Testnet

secondary title

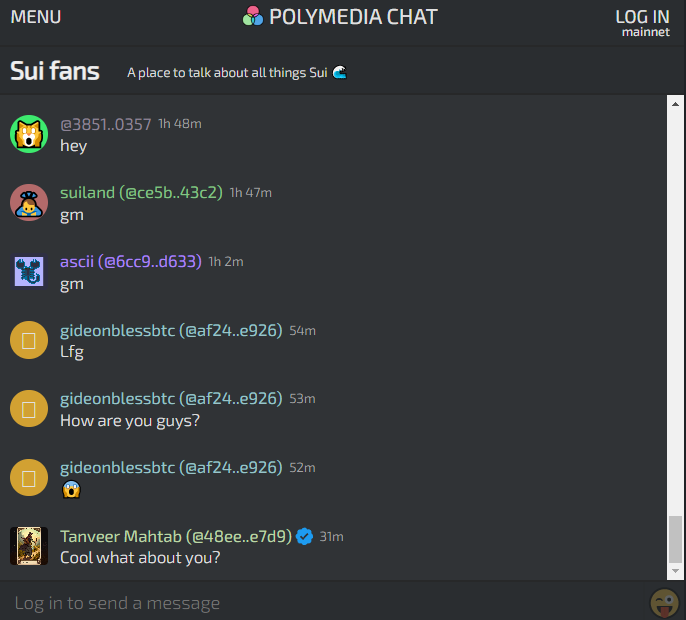

PolyMedia

Category: Social

Status: Mainnet launched

secondary title

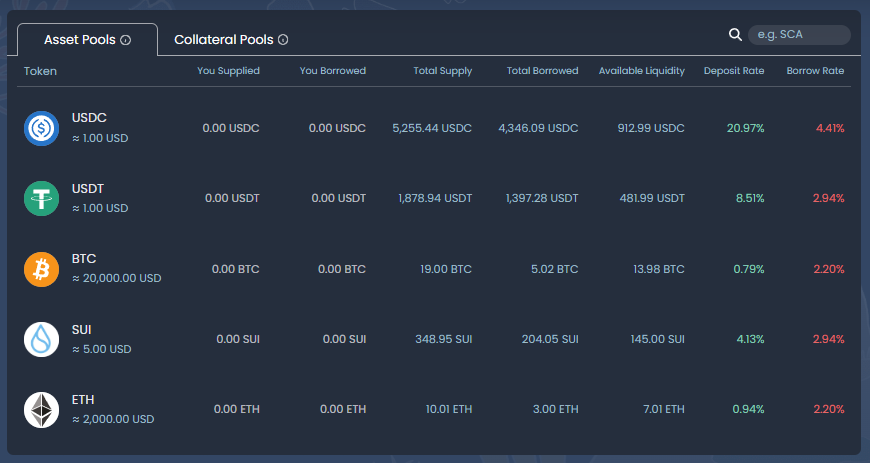

Bucket Protocol

Category: Stablecoins, Lending

Status: Testnet

secondary title

FlowX

Category: Swap

Status: Testnet

This is a DEX with single-currency staking and LP mining, and the token economics has not been released in its official website documents.

secondary title

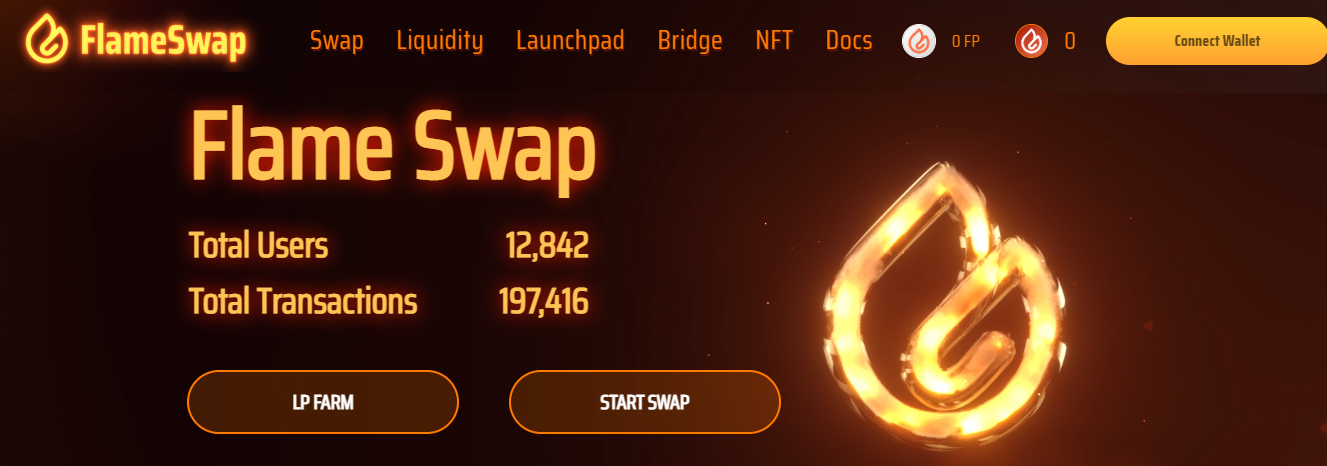

Flame Finance

Category: Swap, Launchpad

Status: Testnet

Flame Finance is a DEX built on Sui. Three points worth noting in token economics:

5% : private or public sale

6.5% : Airdrop to community builders and users

secondary title

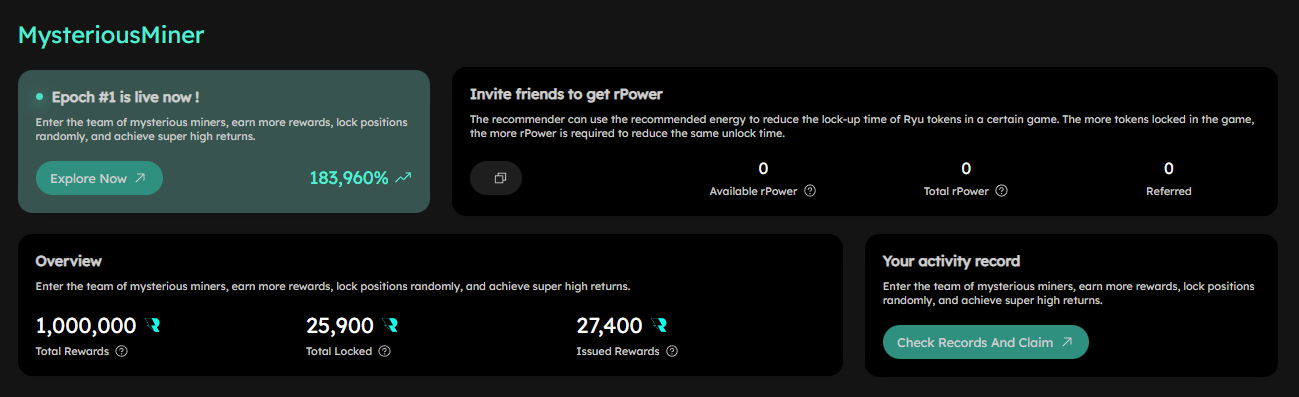

Ryu Finance

Category: Swap, Launchpad, GameFi

Status: Testnet

secondary title

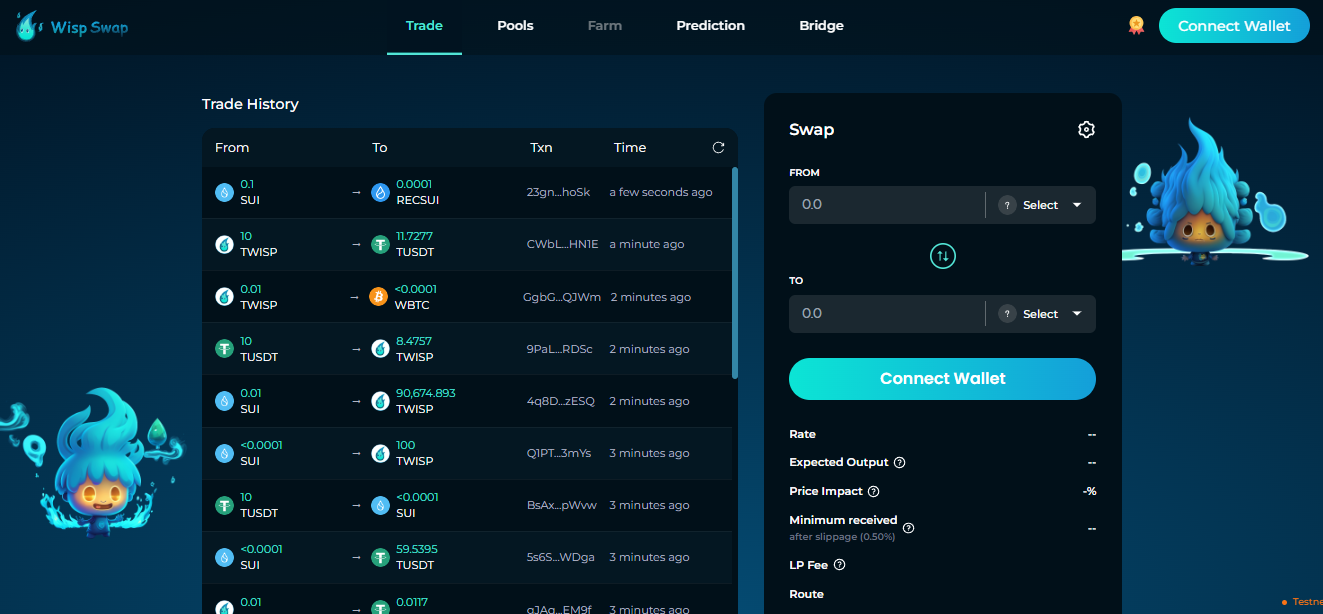

Wisp Swap

Category: Swap, prediction market

Status: Testnet

Wisp Swap has not yet launched the main network, and has launched two functions: spot trading and prediction market. According to the white paper, functions such as lending, Launchpad, and pledge mining will be launched in the future.

secondary title

Sui DEX

Category: Swap, NFT-Fi, Launchpad

Status: Testnet

secondary title

Interest Protocol

Category: Swap

Status: Testnet

Interest Protocol is a DEX with single currency pledge and LP mining, token economics highlights:

2.5% : Airdrop

secondary title

AftermathFi

Category: Swap

Status: Testnet

secondary title

Jujube Finance

Category: Swap

Status: Testnet

secondary title

Sui Swap

Category: Swap

Status: Testnet

secondary title

Belaunch

Category: launchpad

Status: Testnet

secondary title

Scale Protocol

Category: Perpetual contract

Status: Testnet

secondary title

ABEx Finance

Category: Perpetual contract

Status: Testnet

secondary title

Patronus Fi

Category: Borrowing

Status: dApp coming soon

secondary title

Navi Protocol

Category: Borrowing

Status: dApp coming soon

secondary title

TrustLend

Category: Borrowing

Status: dApp coming soon

secondary title

Scallop

Category: Swap, Lending

Status: Testnet

secondary title

SweeFi

Category: Income Aggregator (Single/Dual Currency Compound Interest)

Status: dApp coming soon

secondary title

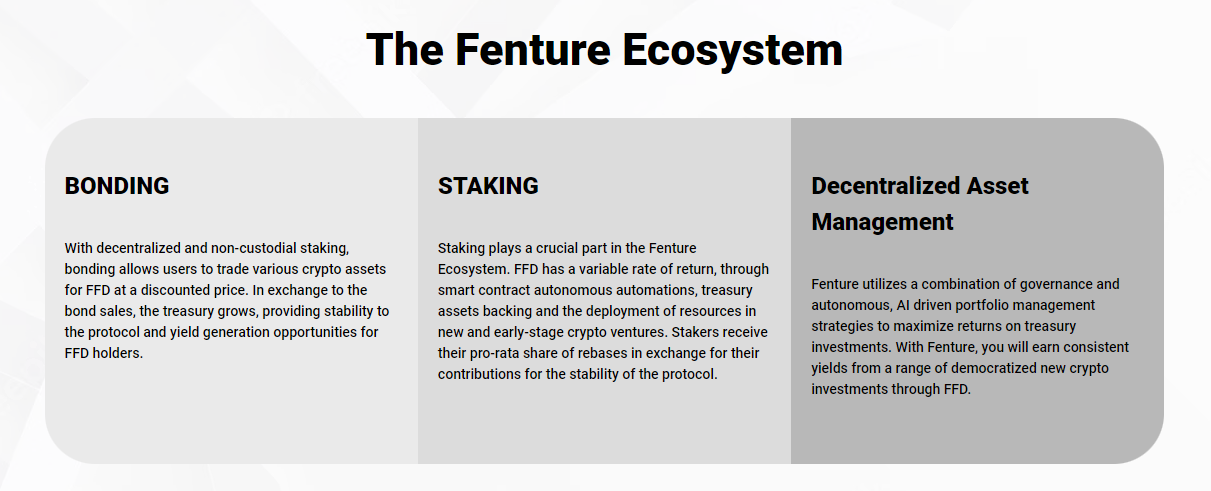

Fenture Finance

Category: Yield Aggregators

Status: dApp coming soon

secondary title

Smoove Finance

Categories: LSD, Vaults

Status: dApp coming soon

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.