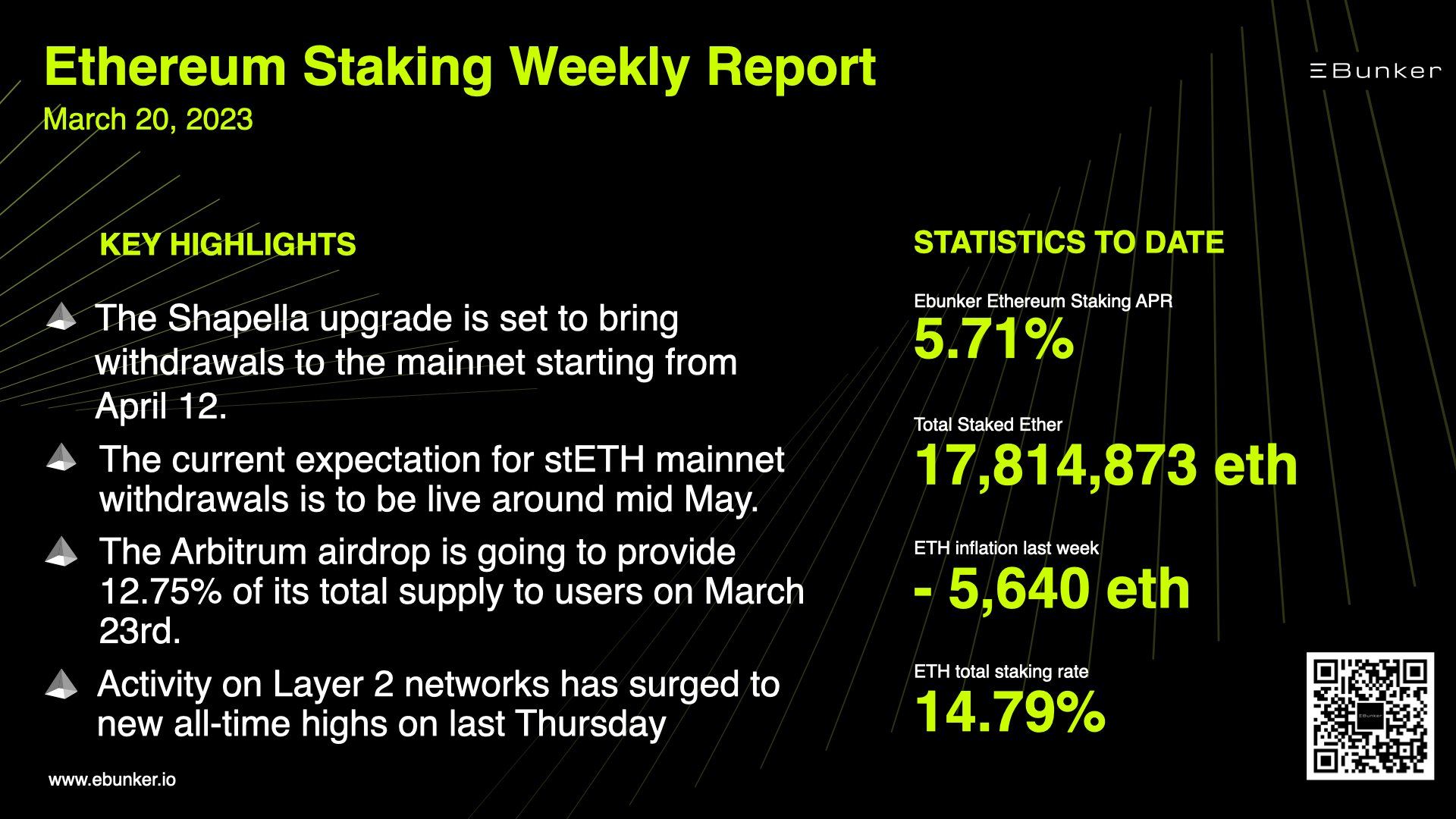

Data analysis: Can Ethereum smoothly meet the "Shanghai upgrade" on April 12?

first level title

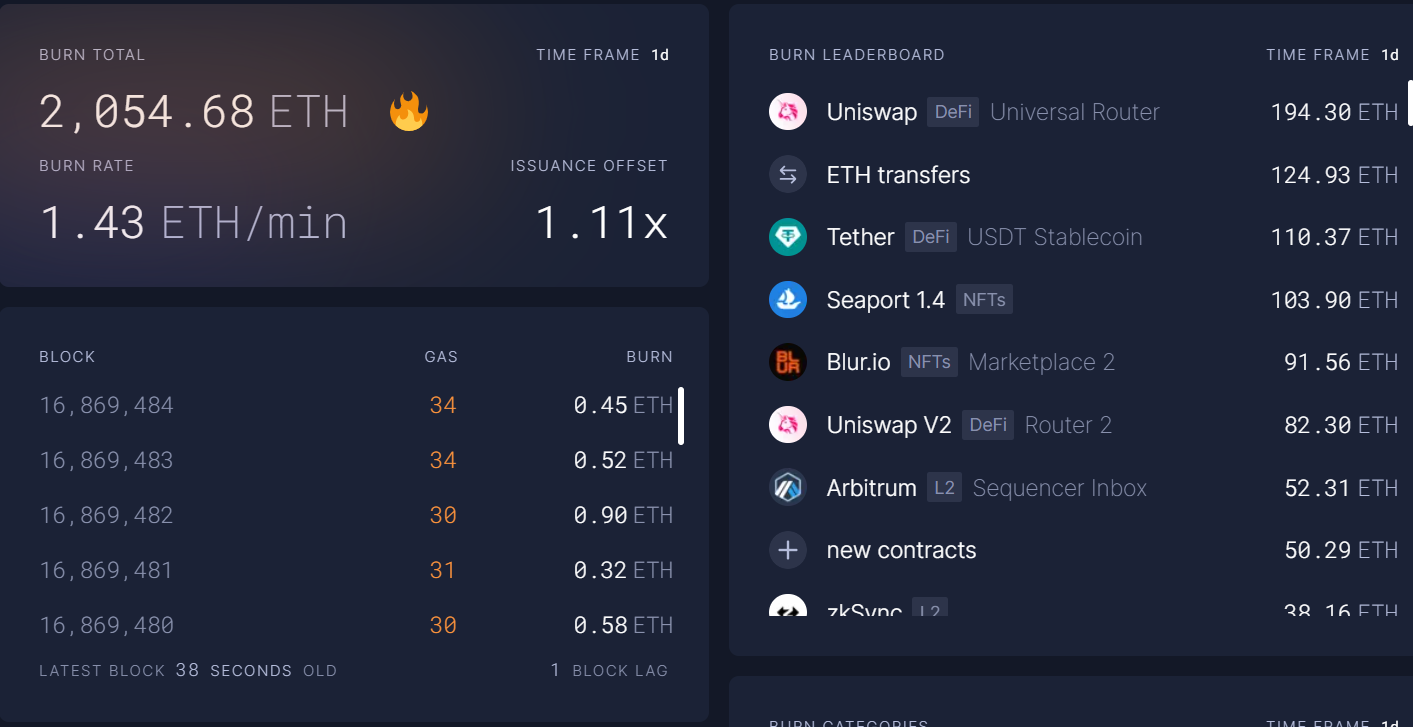

Deflationary models provide price support

Since the merger, the total supply of ETH has decreased by more than 66,000 coins, and the current supply is 120.4 million coins, with an annual inflation rate of -0.109%.

At the current rate, the ETH supply is expected to drop to 118.1 million by 2025. Overall, as long as the Ethereum network maintains its dominant position in the Defi and NFT ecosystems, the deflationary economic model of Ethereum will continue to provide strong support for ETH prices.

first level title

Testnet Preview "Shanghai Upgrade"

At present, about 17.61 million ETHs have participated in Ethereum PoS pledges (accounting for 14.67% of the current total ETH circulation), and there are more than 550,000 active validators.

In order for the "Shanghai upgrade" to go smoothly, the Goerli testnet, which has the most validators and most closely mimics the Ethereum blockchain, recently simulated the "Shanghai upgrade" so that developers can patch potential vulnerabilities before deploying the upgrade . According to multiple ethereum core developers, some validators running older versions of the client were causing brief delays. However, these validators joined quickly, allowing the testnet to successfully perform the upgrade.

According to the latest news disclosed by Ethereum core developers, the Ethereum network will complete the "Shanghai upgrade" on April 12. At that time, the Ethereum network will upgrade the consensus layer of the beacon chain through Capella and introduce functions related to the verification extractor , allowing stakers to withdraw locked ETH.

However, it should be noted that the two-year consensus layer interest of Ethereum does not need to follow the upper limit of 57,600, which brings another layer of implied selling pressure.

first level title

Data on the chain is biased bullish

Glassnode data shows that on March 14, the number of Ethereum non-zero addresses reached a historical peak of 95,474,490, which indicates that the fundamentals of the Ethereum network are good and users continue to expand.

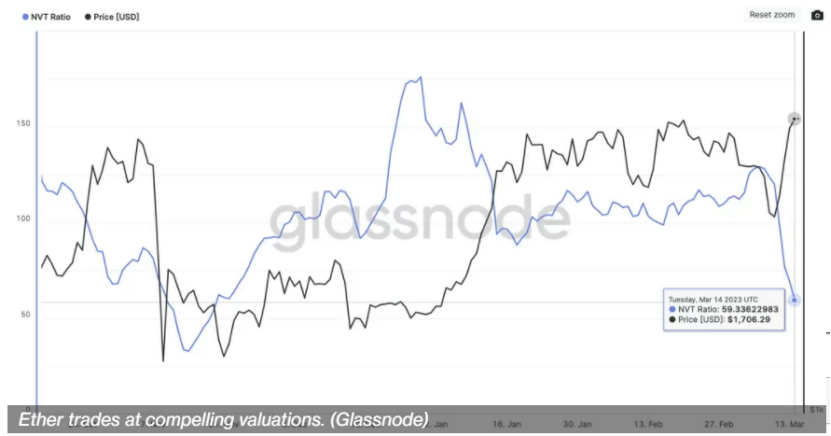

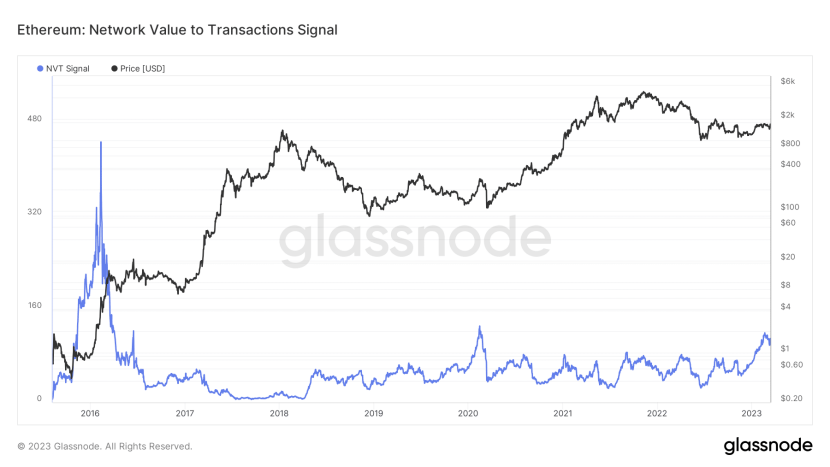

On March 14, the seven-day average of Ethereum’s network-to-value ratio (NVT) fell to 59.3, the lowest reading since November 19 last year. NVT is similar to the price/earnings (P/E) ratio widely used in the stock market.

The decrease in NVT value means that the current market capitalization does not fully reflect the growth of network value. That is, relatively speaking, the value processed through the network is higher compared to the market value. Therefore, a lower NVT ratio usually means better value for money investing in Ethereum.

According to Santiment data, since March 9, whale addresses holding 1,000-10,000 ETH have added a total of 400,000 ETH, or about $600 million.

According to Glassnode data, recently, the outflow of ETH on the trading platform (7-day average) hit the highest value in 3 months (32, 742, 895), which coincides with the time node mentioned above for the increase of holdings by large investors .

An increase in the Ethereum MVRV ratio indicates that most addresses holding Ethereum are starting to be profitable. If the MVRV ratio continues to rise, then the selling pressure on these profitable addresses may continue to increase.

first level title

Recent developments in pledge supervision and pledge service providers

In terms of regulation, there has been a new discussion recently on the topic of whether ETH is a security. Previously, the SEC's main argument for classifying ETH as a security was that ETH raised funds through ICOs in the early days. The SEC believed that investors bought ETH in anticipation of income, which was consistent with the content of the Howey test, and the switch to the PoS mechanism greatly changed With the additional issuance of Ethereum, ETH holders can profit by staking.

Unlike the SEC, which tends to judge ETH as a security, CFTC Chairman Rostin Behnam expressed the opposite attitude. He believes that ETH is a commodity because it has been listed by the CFTC exchange for a long time, and the CTFC has oversight of its derivatives. and underlying market power.

Classifying digital assets such as ETH and stablecoins as securities would mean more restrictions, such as forcing regulated securities to comply with the relevant reporting and registration standards provided by the Securities Act of 1934, which would hinder the industry innovation. On the other hand, if ETH is classified as a commodity, it means fewer restrictions and growth potential.

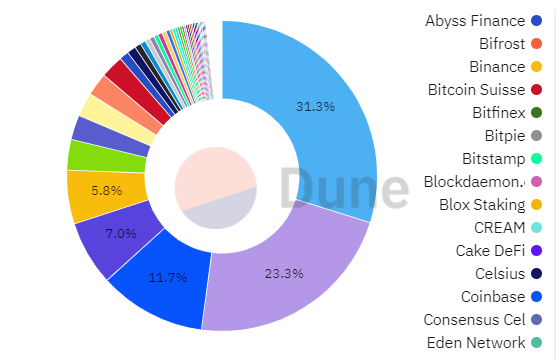

In terms of staking service providers, the Lido Finance protocol, which controls about one-third of the total ETH pledged, is working hard to become more decentralized. Lido expects to complete all audits related to the chain code by the end of April, plus an additional two weeks of security buffer, the current expectation is that ETH mainnet withdrawals can be performed around mid-May.

Rocketpool is also preparing for an upgrade that will lower the minimum validator node deployment threshold of 16 ETH to 8 ETH. Rocketpool is also exploring other upgrades to further lower the staking threshold for institutional users.

Another major ETH staking service provider, Coinbase, said it would begin accepting requests to withdraw ETH within 24 hours of the completion of the “Shanghai upgrade.” However, this does not mean that users will be able to withdraw their ETH immediately, because "the process of withdrawing pledges is controlled by the Ethereum protocol, and as a service provider, Coinbase cannot give an exact withdrawal waiting time." Once the staking withdrawal is processed and released on FangChain, Coinbase will immediately confirm that the user has received their staked ETH (including staking rewards).

Judging from the data on the Ethereum chain, the withdrawal mechanism formulated by the Ethereum Foundation, and the coping strategies of major ETH pledge service providers, the withdrawal of ETH pledge will be a process that lasts for several weeks or even months. The "upgrade" will be completed relatively smoothly, and in the long run, ETH staking will become an important "faucet" for crypto long-termists to pursue stable profits.

Ebunker official website: https://www.ebunker.io