Bankless: Inventory of 5 on-chain options agreements worthy of attention

Author: Jack Inabinet

Original source: Bankless

Compilation of the original text: The Way of DeFi

Compilation of the original text: The Way of DeFi

It's a risky world, and when crypto investors have a strong view of where the wind is headed, they often turn to options.

Know your options

image description

Photo: Logan Craig

As cryptocurrency investors face a minefield of potential volatility — with inflation data and regulators trumpeting their own concerns — it’s important to remember…you have options.

The introduction to options trading is divided into:

101 Basics of DeFi Options

Our Five Favorite On-Chain Options Protocols

If you're dabbling in options, you're probably a Degen trying to get highly leveraged returns without being a market maker, or you're worried about volatility and looking to hedge the downside. Options trading may be the best solution for you.*This guide (not financial advice!) only scratches the surface of options. learnBlack-Scholes Pricing Model

The key inputs to and their impact on option pricing are a must for any options trader!

image description

source:TDAmeritrade

source:

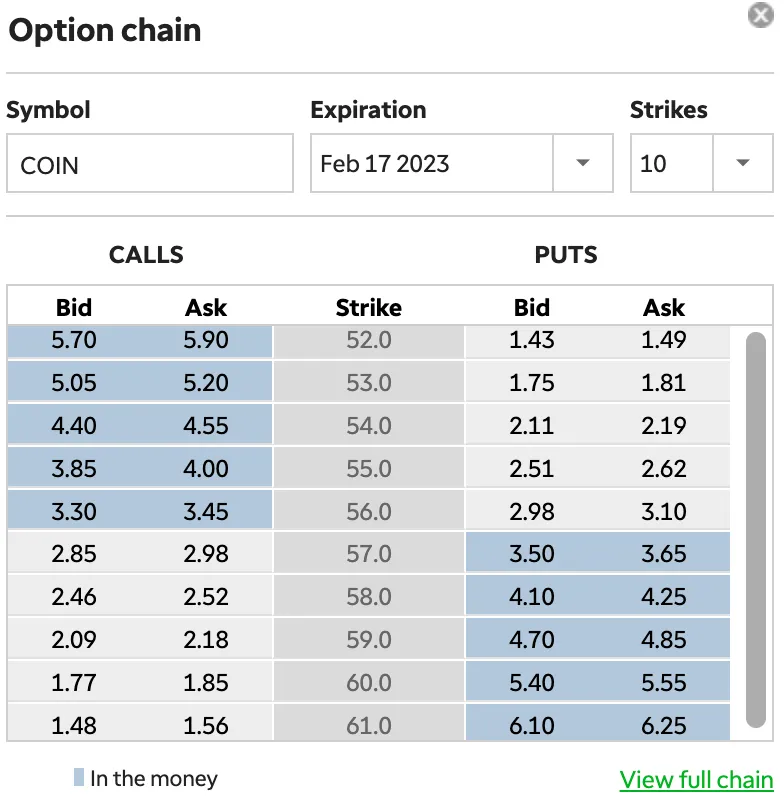

The above is the option chain of Coinbase (COIN).

The option chain lists various strike prices (middle) for various calls (left) and puts (right) for a given expiration date (February 17, 2023).

The buyer of an option has the right to buy or sell the underlying asset at a predetermined strike price.

1. 🐂 Call options (Calls): the ability to purchase COIN at the strike price

2. 🧸 Put options (Puts): the ability to sell COIN at the strike price.

Scenario: Your friend thinks the regulatory drama at Coinbase is total FUD, exclaiming: "$COIN is going to go supernormal by Friday! I have to ape now and use options to increase my gains, but I have no idea what to buy Know."

Your response (not financial advice!!!): "Really? Well, if you insist...Given your strong bullish conviction, I recommend buying Feb at $60 strike Call options expiring on Friday the 17th."

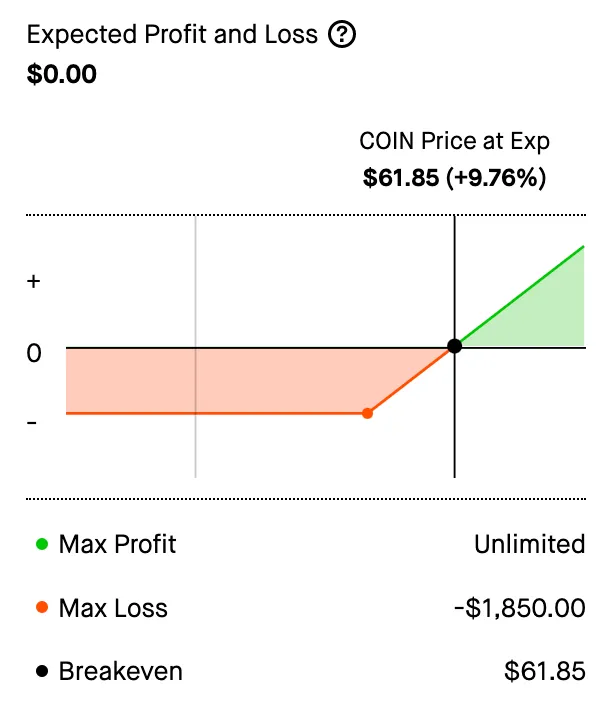

Your friend then trades $1850 for the right, but not the obligation, to buy 1000 COIN shares at $60 each on or before February 17th.

Options can be thought of as insurance-like contracts: a premium ($1,850) is paid upfront to get coverage. When "disaster strikes" (ie COIN is trading above $60 in this example), investors start to profit.

Your friend is not considered profitable until COIN is trading above $61.85 ($60 strike + $1.85 premium), but has no exposure beyond the initial $1850 investment, for every cent COIN exceeds $61.85 Money is all about real profit.

Capped losses and unlimited upside make options extremely attractive to many market participants across a variety of use cases.

Our Favorite 5 On-Chain Options Protocols

Whether it's Degen or risk-averse, the same on-chain options protocol is used.

When it comes to cryptocurrency options, forget about exchanges because the best markets are built natively on-chain.

丨

Options: ETH, BTC

image description

source:Lyra Finance

Lyra is recommended for: Seasoned traders looking to replicate the experience of traditional brokerages.

2.Hegic

Options: ETH, BTC

If you feel constrained by Lyra's preset expiration dates, maybe you're interested in implementing complex multi-leg option strategies.

image description

source:Hegic

Recommend Hegic for: Degens looking for flexible expiration and one-click complex options strategies.

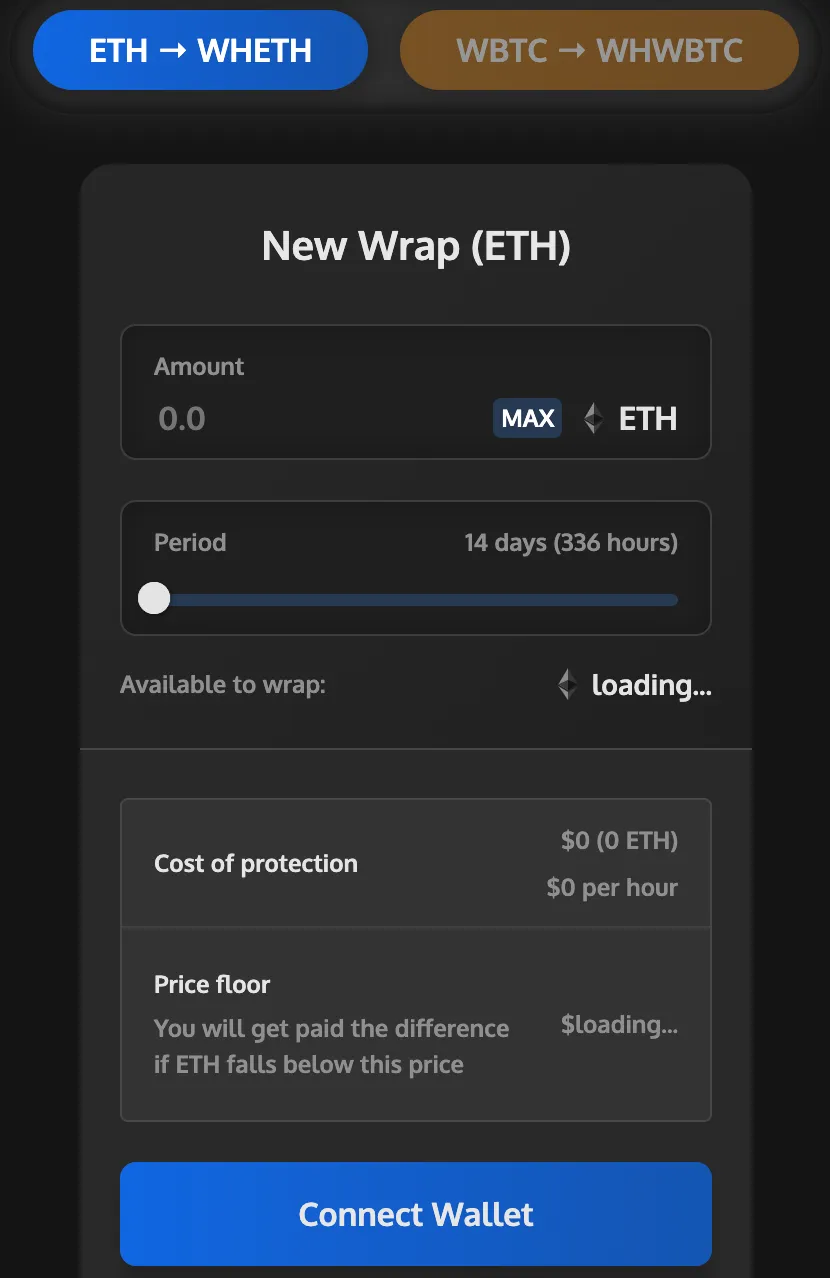

3.Whiteheart

Options: ETH, BTC

Do you have financial problems? Have you been looking for an easy way to lock in today's ETH or BTC price and collect fees?

Whiteheart offers an extremely simple user interface with two decisions:

ethereum or bitcoin

image description

source:Whiteheart

Recommend Whiteheart for: Novice options traders looking for an easy-to-understand way to lock in to the current ETH or BTC price and eliminate downside risk for a fixed time period.

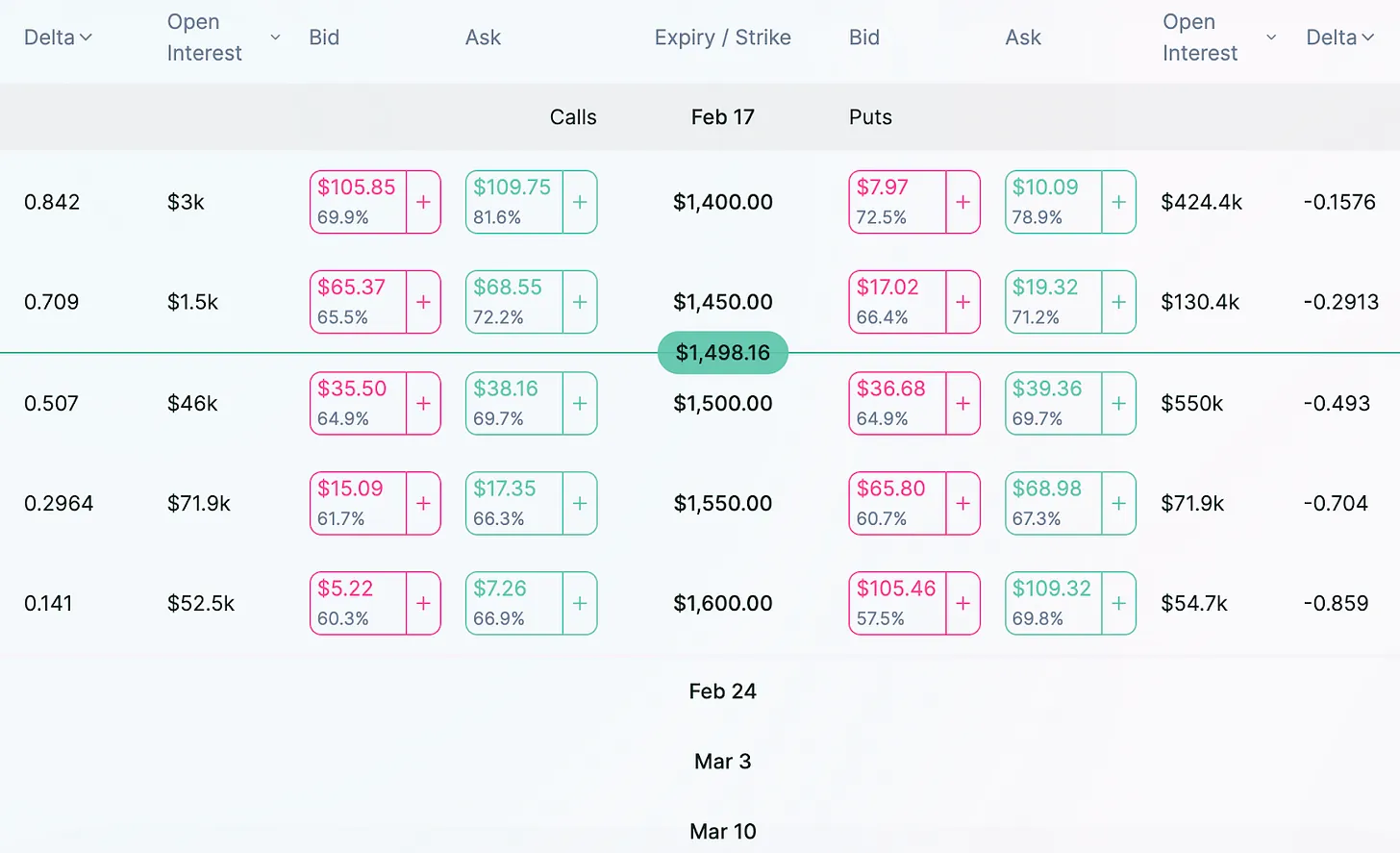

4.Premia

Options: ETH, BTC, YFI, LINK, ALCX, alETH, OP, FTM

Who said options can only be used for ETH and BTC?

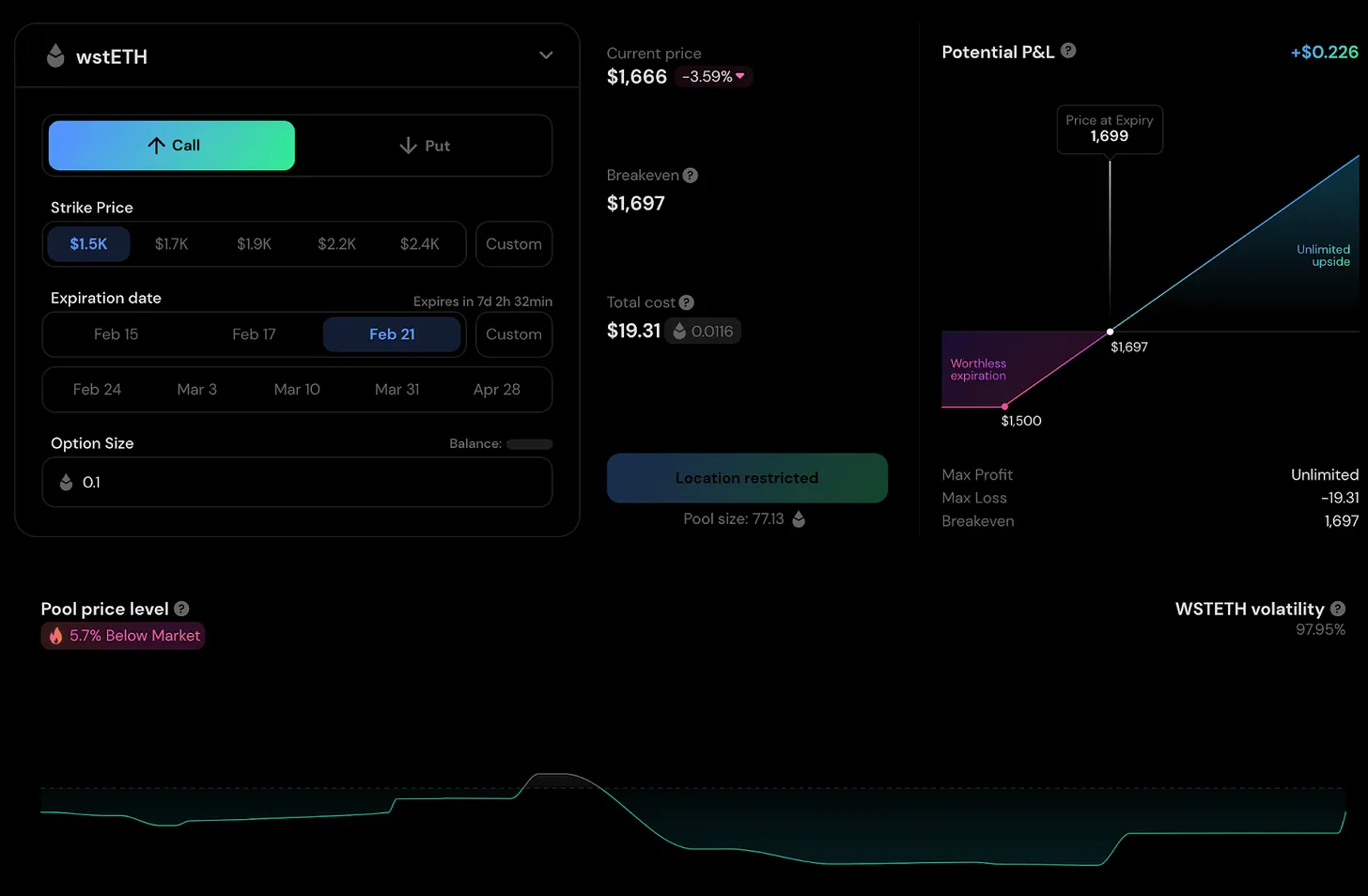

image description

source:Premia

Premia is recommended for: Traders looking for flexible expiration dates and who want in-depth insight into option pricing on a variety of underlying assets.

5.Siren

image description

source:Siren

source: