Messari: USD 2023 Liquidity Forecast and Future Market Outlook

Original compilation: BlockTurbo

Original compilation: BlockTurbo

While the U.S. dollar may not be the best currency, in 2022 it is without question still the most important currency. As the global reserve currency, the U.S. dollar helps understand asset prices. The global price of an asset is driven by the availability of cash (money and credit) and the supply of the asset. All else being equal, fewer dollars means lower prices.

first level title

secondary title

Federal Reserve Balance Sheet

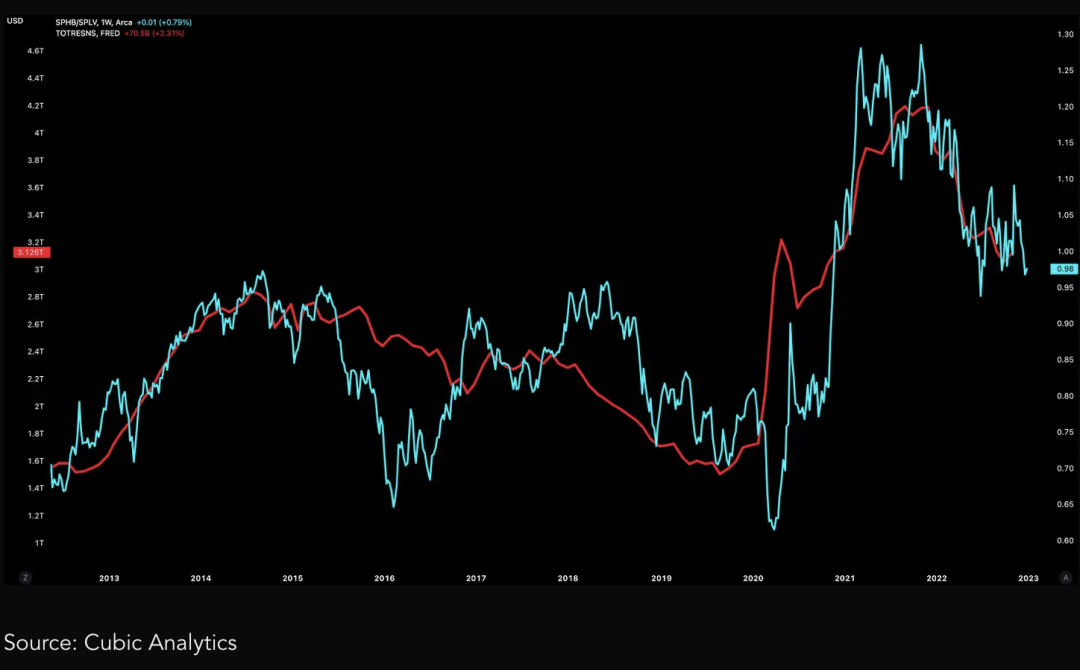

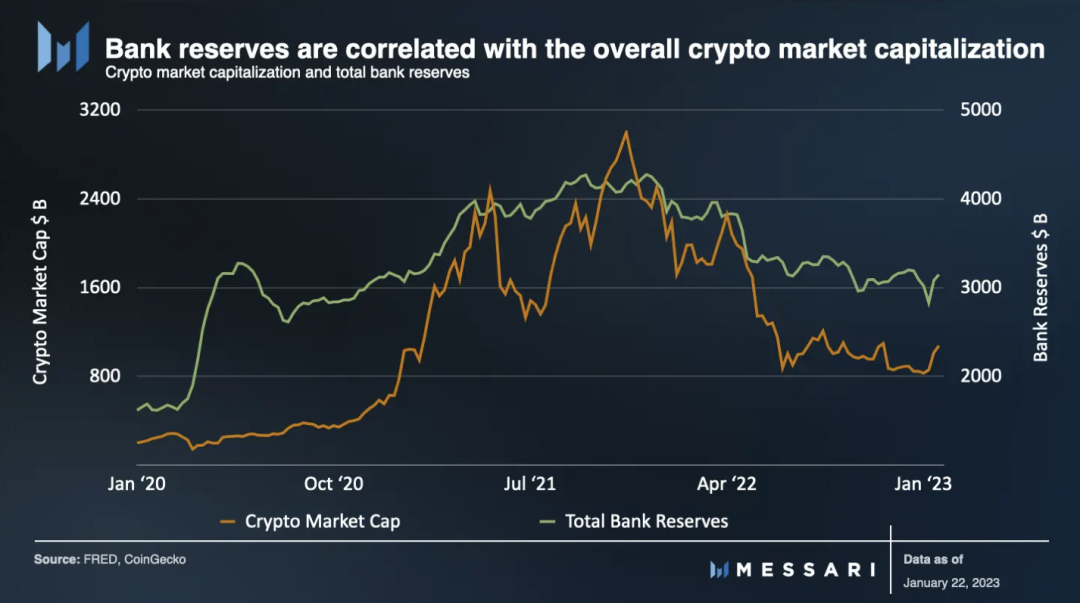

Since the global financial crisis, Fed balance sheet flows have become the most important component of dollar liquidity. When the Fed injects large amounts of liquidity into the market by buying assets (Treasuries and mortgage-backed securities), this is called quantitative easing (QE); on the other hand, quantitative tightening (QT) is when the Fed sells some of its Treasury bonds and mortgage-backed securities).

QE and QT affect risky assets (i.e. cryptocurrencies) through the “portfolio rebalancing effect”. During quantitative easing, that meant money flowed into risky assets.

Example: Fed buys Treasuries from investors -> Treasury prices go up, so yields go down -> Investors don't want to hold cash, they want to buy similar, safe long-term assets with attractive yields. Investor buys corporate bond -> issuing company uses bond proceeds to buy back stock from investor -> stock price rises and becomes more expensive (higher P/E ratio) -> investor doesn't want to hold cash but wants to buy still higher Potential assets -> Investors buy cryptocurrencies.

QT is just a step backwards in this process. To absorb the additional supply of these "safe" assets and keep their allocations intact, investors need to sell other assets. This usually starts at the riskiest end of the curve (i.e. cryptocurrencies).

Thus, as expected, Fed balance sheet flows are positively correlated not only with the performance of financial assets, but also with the relative performance of riskier (high-beta) assets.

The chart above shows that the riskier S&P 500 stocks index (SPHB) outperforms the less risky S&P 500 stocks (SPLV) as reserves increase, and vice versa. Of course, this correlation also applies to the preeminent risk-on asset class, namely cryptocurrencies.

secondary title

U.S. Treasury account

When the Fed launched massive monetary stimulus in response to the deflation caused by the COVID-19 lockdown, the US Treasury did not let the opportunity (cheap money) go to waste. It has increased its "bank account" (Treasury General Account - TGA) by approximately fivefold, thereby increasing its role in overall liquidity.

Usually, the extracted TGA is good for the asset. That means more dollars flowing into the economy and less debt being issued (in the form of U.S. savings bonds, U.S. Treasury bills, and U.S. Treasury bills). However, how TGA funds are spent is also an important factor to consider. For example, direct payments to households, such as those in 2020 and 2021, are a stronger stimulus for risk assets than infrastructure spending, for example.

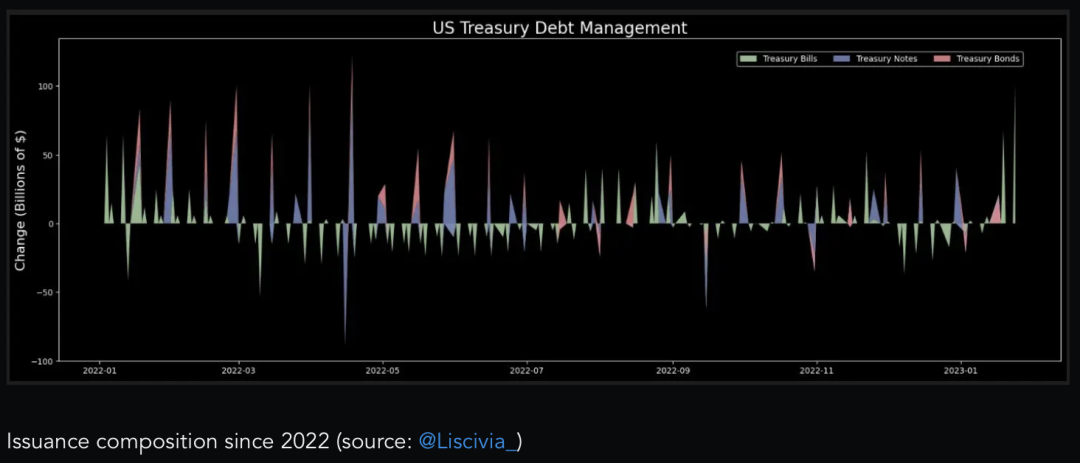

On the other hand, when TGA increases, this is usually bad for the asset. Increased debt issuance sucks dollars out of the system, effectively crowding out opportunities below the risk curve (e.g., corporate bonds). However, just as important as whether the TGA increases or decreases is the composition of the offering—in other words, how the TGA is funded.

secondary title

reverse repurchase agreement

Treasury transfers in 2020 and 2021 have led to high personal savings rates. Much of that savings spills over into more attractive money market funds (rather than regular savings accounts). Money market funds (MMFs) invest in low-risk, short-term debt securities -- primarily U.S. Treasury bills.

The New York Fed's reverse repurchase facility (RRP) absorbs these savings to establish a "soft floor" on short-term interest rates. Therefore, money market funds will not interfere with the Fed's interest rate target by pushing down yields on the short end of the yield curve. RRPs offer rates similar to US T-bills, but they have no maturity risk and funds are "locked in" overnight only.

Funds deposited into RRP are effectively illiquid because it is not loaned out or deployed in any other way. This means that increased RRP is a net liquidity drain. Funds leaving RRP, on the other hand, are net liquidity injections. That money could be reallocated through money market funds—into Treasury bills, AAA-rated US corporate commercial paper, repo loans, etc. Alternatively, it can be withdrawn from money market funds and used to buy other assets or spend in the real economy.

first level title

Debt ceiling and TGA

When understanding TGA's financial flows, the US fiscal situation is of primary importance. In the short term, the most important dynamic is around the debt ceiling. The debt ceiling is a limit set by Congress on how much debt the U.S. Treasury can hold. The debt ceiling was hit on Thursday, January 19, and the Treasury has been using "extraordinary measures" to fund the government since then.

This has many implications for TGA and upcoming bond issues. The first is to spend the TGA, leaving investors with more cash.

However, the Treasury could also continue to issue bonds (about $500 billion) by selling securities held in other government accounts and suspending investments in certain federal employee retirement funds. Also, as the auction schedule shows us, the upcoming (through April) coupons (for a longer duration) are very heavy. If the Treasury sticks to their plan and TGA spending replaces Treasuries, long-term supply will weigh on risky assets. Having said that, Treasury's plans are subject to change, so for the actual, exact size and composition of past and upcoming issues, please follow Treasury's announcements and results pages.

However, if the Treasury does sell bills, especially above the RRP rate, the RRP should fall and risky assets should rise, as has been seen over the past few weeks.

The recent turmoil suggests that negotiations to raise the debt ceiling could be fraught with risks. If the TGA runs out after the debt ceiling is reached, the government will have to shut down. The turbulent negotiation process and ensuing uncertainty could have a slightly negative impact on risk assets, especially if long-dated bond issuances remain on schedule.

For the most part, the drama surrounding the debt ceiling isn't a big deal to markets. The politics and implications surrounding this negotiation are beyond the scope of this report, but if history is any guide, the debt ceiling will rise.

The debt ceiling extension is not bad for long-term assets. In fact, the reduced uncertainty is an advantage. However, in the current environment, a new wave of bond issuance may intensify the Fed's quantitative tightening, resulting in a net withdrawal of liquidity.

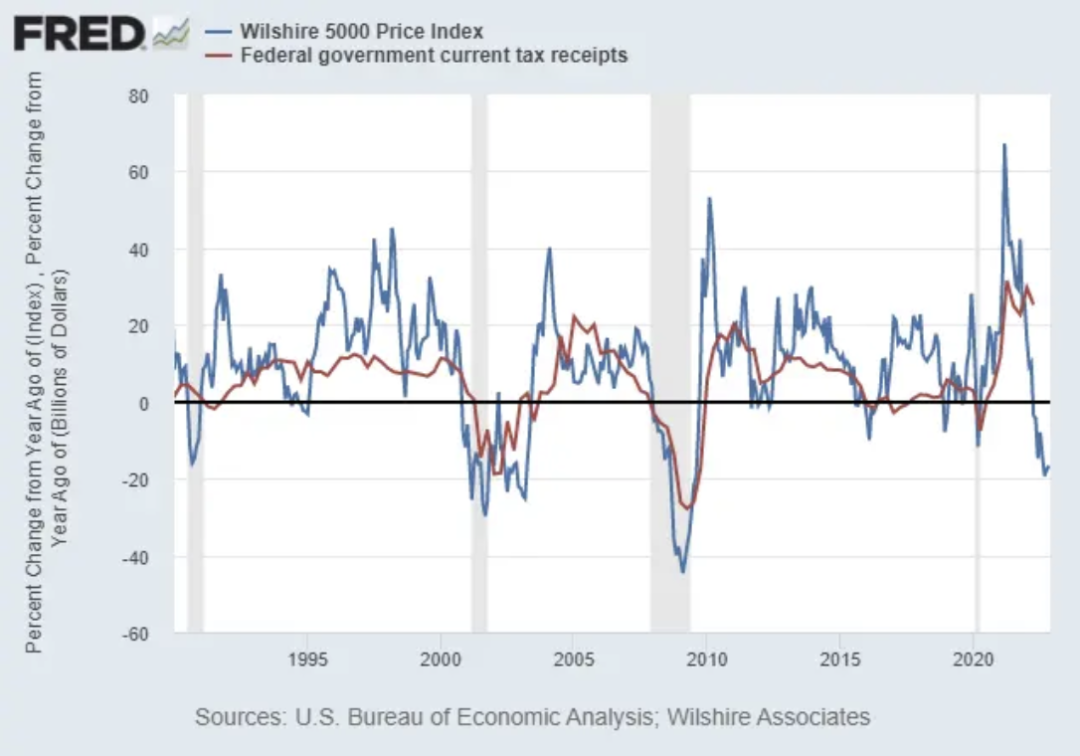

For now, investors should continue to focus on the debt ceiling negotiations, while keeping an eye on the daily Treasury statement. Given the volatility of capital markets, and the growing correlation between capital gains and tax revenues, trends and shifts in momentum should be closely monitored.

Based on experience, TGA liquidity dynamics were flat to slightly positive in January due to the estimated tax situation in 4Q. However, there was more change in February and March as the TGA began funding seasonal rebates.

Adequate reserve system?

In a speech to the Brookings Institution in late November, Fed Chairman Jerome Powell defended QT's aggressive pace, saying banks were in a "rich reserve regime". This means that, at least in theory, banks should be able to buy US Treasuries without depleting their reserves below the Fed's comfort level of about $2.5 trillion.

However, as Jerome Powell later mentioned, the reserves are very volatile. That's especially true for the ever-changing Treasury bond market.

With high MMF fees and close to 0% interest rates on savings accounts and CDs, "American households" are marginal investors in Treasury bills. As households drive down T-bill yields, MMFs have become unreliable buyers, typically dumping their T-bill holdings in favor of more attractive RRP instruments and their higher yields. This presents a double whammy. Rather than drawing funds from the RRP, households are the main buyers of bills, which means that bill issuance will continue to drain bank reserves as households spend their bank deposits (currently $10 trillion) on bills.

While this is a major dilemma for the Fed and Treasury, it doesn't necessarily spell disaster due to the many tools at their disposal.

Adjusted Supplemental Leverage Ratio (SLR): SLR is the amount of liquid collateral a bank needs to back its assets (assets include treasuries and reserves). By lowering the SLR or creating a waiver, the Fed can make it easier and cheaper for banks to build reserves and buy Treasuries.

RRP Adjustment: The safest way for the Fed to adjust RRP is to set a participation cap, pushing MMF into the note. Another riskier approach is to adjust the RRP ratio. However, both approaches would ripple through (depress) all short-term interest rates and would very clearly run counter to the Fed's interest rate goals.

Treasury buybacks: US Treasury hints at buybacks. The key to the plan is the issuance of shorter-dated Treasury bills to buy longer-dated Treasuries. Shorter market duration is very beneficial for risky assets (i.e. cryptocurrencies), but needs to be used in conjunction with one of the above strategies in order to maintain bank reserves while attracting RRP liquidity.

first level title

secondary title

economic recession

Factors usually associated with recessions, such as employment and credit spreads, have been buzzing. On the other hand, the bond market, especially the yield curve, is undergoing an unprecedented recession. Of particular note is the 10-year to 3-month U.S. Treasury yield spread, which is the most inverted on record. Since World War II, there have been 8 times when 3-month rates were higher than 10-year yields. In each case, the recession occurred over a period of 12 to 18 months.

One way to understand what's going on is to use 42 Macro founder Darius Dale's business cycle framework. In short, there are two phases: the first, when liquidity falls, leading to the second, when earnings (and thus employment and credit) fall.

secondary title

Interest rate differentials and dollar strength

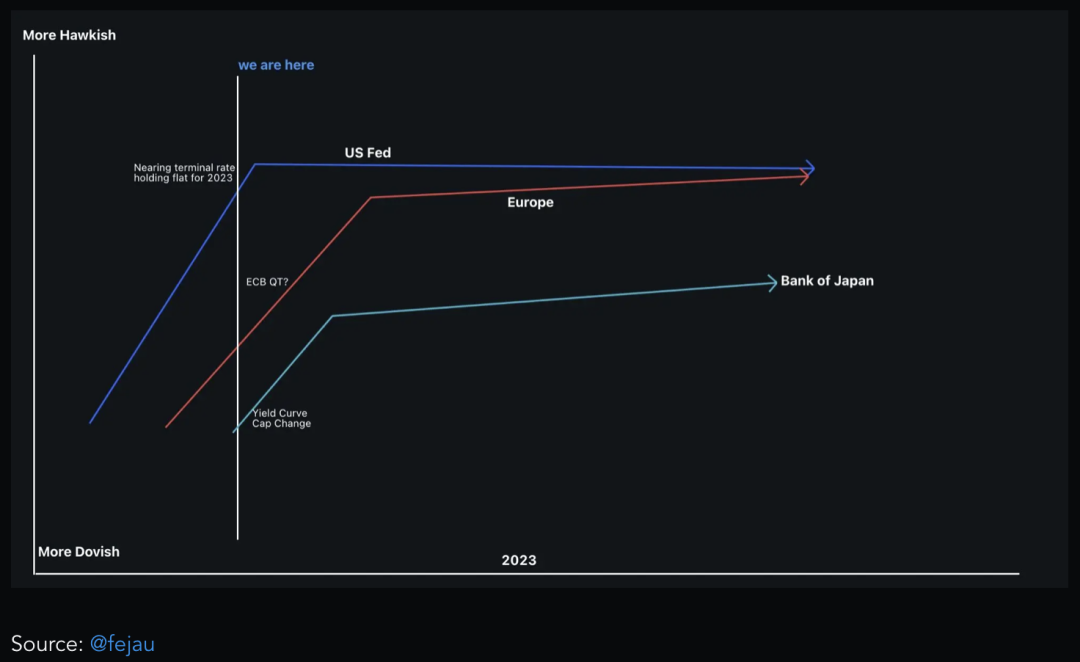

The U.S. dollar index (DXY) fell sharply as other central banks caught up with the Fed (interest rate differential narrowed).

secondary title

other central banks

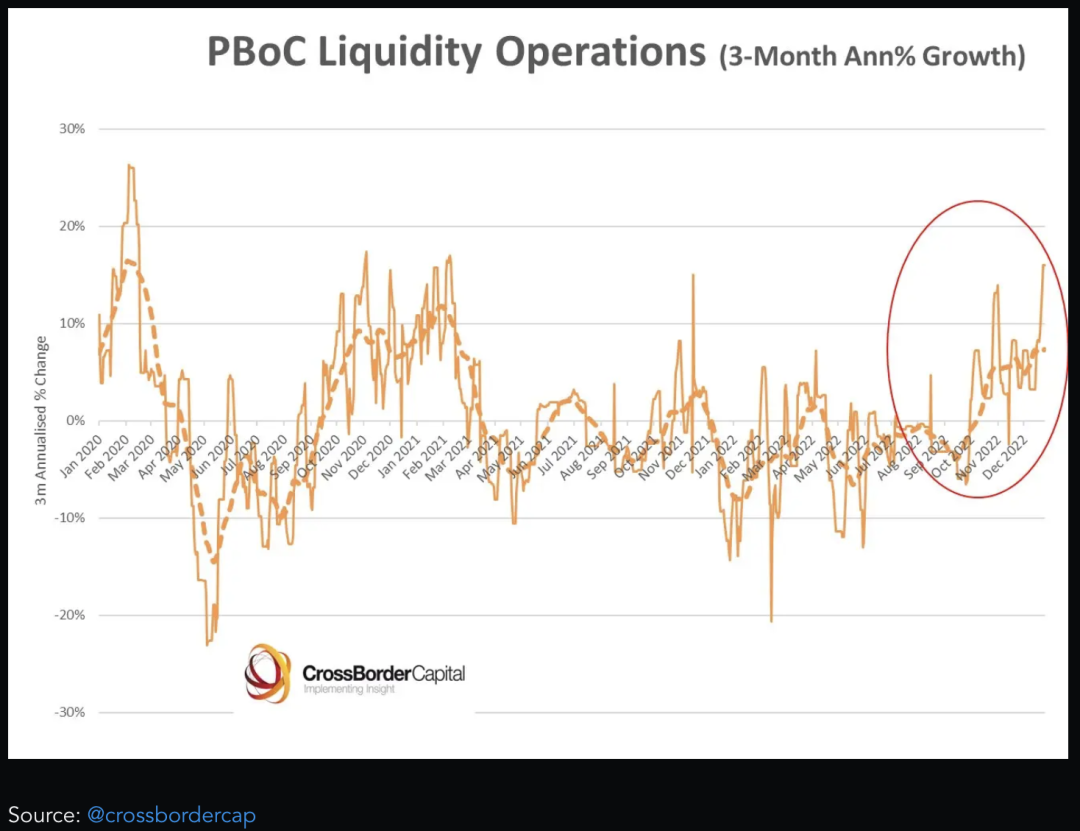

The other three important central banks for global liquidity and markets are the People's Bank of China (PBoC), the European Central Bank (ECB) and the Bank of Japan (BoJ).

The People's Bank of China is second only to the Federal Reserve in terms of global liquidity. While it's less important to those pricing assets in dollars, it's still worth understanding because of its economic footprint.

The combination of PBOC easing and China’s reopening (restarting consumption) has increased global liquidity. However, (demand-side) inflationary effects, especially on commodity prices, deserve close attention.

On the flip side of the liquidity equation is Japan, the largest holder of U.S. government bonds. In December, Japanese inflation hit a 41-year high, forcing the Bank of Japan to reconsider its ultra-loose monetary policy. The first impact of this was a sell-off of US bonds by large Japanese institutions in favor of more attractive domestic yields and a stronger yen. The bigger impact, however, is the threat to the yen's role as a "funding currency".

Summarize

Summarize

With few exceptions, high-debt, low-growth regimes (like the one we are in today) have higher volatility. On the one hand, there needs to be sufficient liquidity to maintain solvency. On the other hand, currency devaluation and inflation also need to be managed.

As we have seen, the Fed is playing an increasingly volatile game. From a market function standpoint, both T-bills and longer-dated coupons, which are liquid, are incredibly problematic to draw from reserves. This would be exacerbated by the sudden hawkishness of the Bank of Japan once the debt ceiling is lifted, which could force the Fed to intervene. However, this is very different from the COVID-19 response. Instead of a massive wave of indiscriminate asset purchases, keep an eye out for more impactful stealth QE (treasury buybacks, tweaking SLR or RRP, etc.). While this may not have much of an impact on the real economy, it could still drive new money flows into cryptocurrencies, especially BTC.