让以太坊再次伟大:L2板块领涨,ETH汇率反弹

Original - Odaily

Author - Loopy

Today, the OKX market shows that ETH hit a high of $2,445. After the continued carnival in the BTC ecosystem, the sector finally rotated to ETH. This also brings the dawn of recovery to ETH, which has been dormant for a long time.

The OKX market shows that ETH’s 24-hour amplitude exceeds 11% (of course, most of the amplitude is rising). Amid the strong gains, the ETH/BTC exchange rate has also begun to rebound.

Market data shows that the ETH/BTC exchange rate reached a new high this month. Judging from the short-term trend, the decline in the ETH exchange rate has finally stopped falling and rebounded.

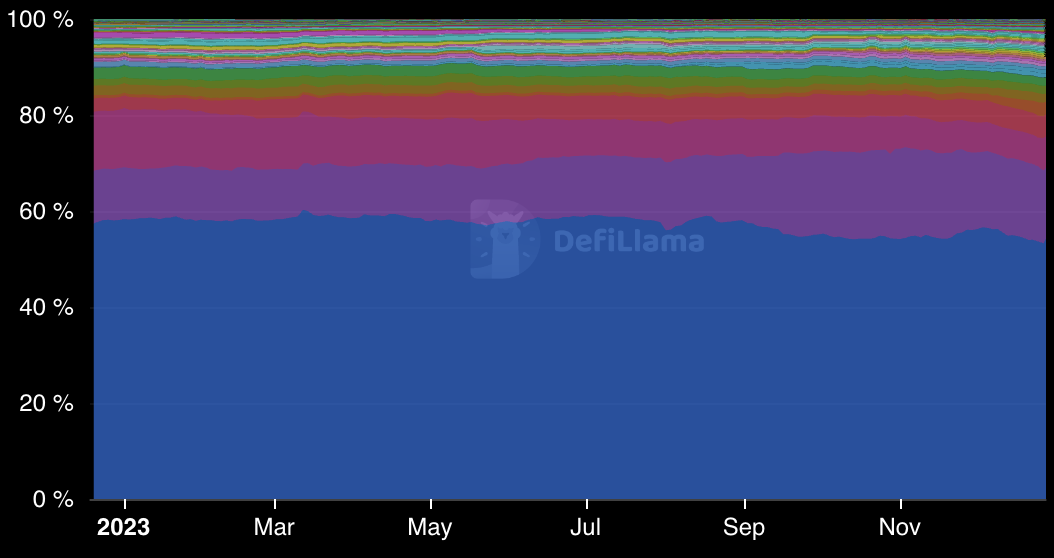

In this round of market conditions dominated by the BTC ecosystem, the weak performance of Ethereum has also made the EVM ecosystem as a whole lose its luster. On-chain data also shows the long-term weakness of the Ethereum ecosystem since this year. DeFiLlama data shows that the proportion of ETH mainnet TVL in the entire DeFi world has dropped from 58.3% in early 2023 to 54.1% today.

(The blue graph is the market share of Ethereum TVL)

At present, the BTC ecology has receded from its most enthusiastic period, and the inscription market has gradually become chaotic. Is the Ethereum ecosystem finally about to see a long-awaited recovery?

Why does the Layer 2 sector lead the recovery of Ethereum?

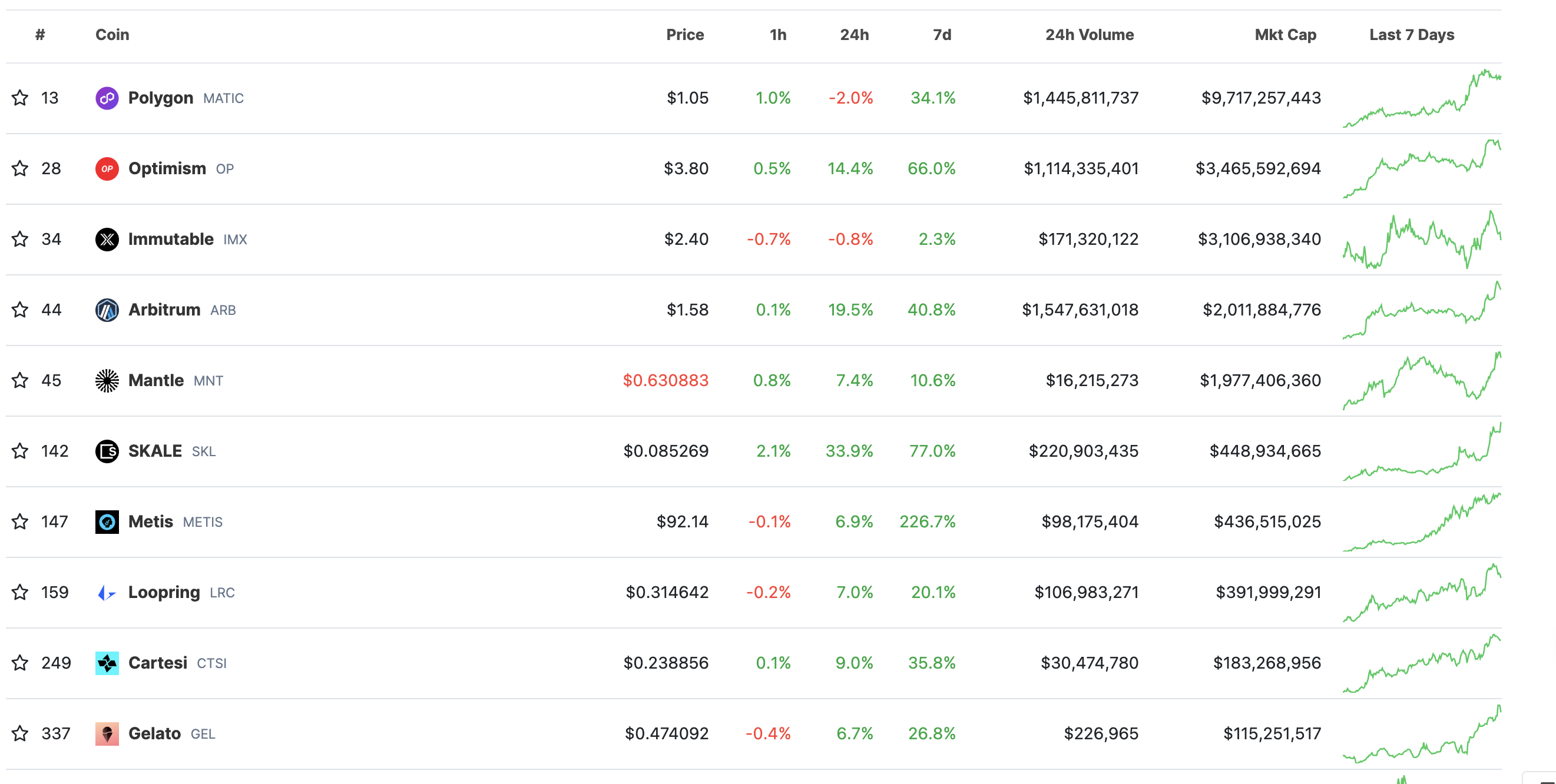

In this round of rise, OP is the most dazzling one. Although OP has slightly pulled back today, judging from recent days, OP still maintains an upward trend.

Currently, OP has a market capitalization of approximately $3.5 billion. ARB followed closely behind and also ushered in a long-awaited rise today. Ouyi OKX market shows that ARB hit a maximum of $1.668 today, with a 20-hour increase of up to 20%.

The Layer 2 sector is leading the recovery of the Ethereum ecosystem. Coingecko data shows that the entire Layer 2 sector has created considerable gains in recent days.

Of course, the most amazing performance is the “V God Mom” concept Layer 2 Metis. Back when the project was created in 2021, there was a lot of controversy surrounding its celebrity concept.

Metis uses Optimistic Rollup technology and was created by a Canadian team. Metis co-founder Elena Sinelnikova is also the founder of the blockchain non-profit organization Crypto Chicks, a womens organization dedicated to blockchain education, mainly providing opportunities for women to learn and enter the blockchain field.

Since Natalia Ameline, another founder of Crypto Chicks, is the mother of Vitalik Buterin, the founder of Ethereum, the project has always been regarded as Layer 2 of the theme concept of V God Mom, and there are also meme in Layer 2, meme in meme Layer 2” is an interesting statement.

Cancun upgrade is imminent, what are the other benefits of Ethereum?

Judging from the current time point, the approval of the BTC spot ETF is imminent, and the approval of the ETF may start the next round of rising prices for the BTC ecosystem.

The strong rise in Layer 2 has also brought more benefits to ETH. But how long can this increase last?

Today, Buterin once again proposed new technological progress, which is still announcing the progress of Ethereum to the market. Vitalik proposed three ways to address what he described as the underlying system complexity at the heart of Ethereum’s proof-of-stake consensus mechanism:

A PoS simplification proposal: Design a scheme that requires only 8192 signatures per slot (even under SSF), making the consensus implementation simpler and lighter. The main problem is that the validators who keep the network running must produce a large number of signatures - digital signatures using cryptography - as part of the process of keeping the network running. This is already a considerable amount of work for the network, but as more validators join the network, this will increase the number of signatures and place a greater burden on the system. According to current plans, subsequent upgrades will significantly increase signature requirements.

But can technological evolution drive the recovery of currency prices?

Grayscale issued a document stating that ETH generated strong returns (more than 80%) in 2023, but its performance lagged behind BTC and certain other smart contract blockchain tokens. Grayscale writes that in fact, most smart contract platform tokens have gained less than Bitcoin this year, with ETH largely in line with this peer group. The FTSE Grayscale smart contract platform CryptoSector Index is up about 94% in 2023, only slightly outpacing ETH’s gains. While ETH lags behind Bitcoin and certain other cryptoassets in 2023, it still outpaces traditional asset classes. As such, we believe ETH’s rebound should be viewed as evidence of a broadening crypto recovery.

Ethereum, which has been slightly absent in this round of market conditions, may gradually usher in greater room for recovery as expectations for the Cancun upgrade come true.

According to the core developer consensus call report, at the end of November, the activation of the Cancun upgrade on the testnet further announced to us that the Cancun upgrade is coming. The Cancun/Deneb upgrade was activated on Devnet #12 on November 30, and Teku, Lodestar, and Lighthouse client software, as well as all execution layer (EL) client software, are currently being tested on Devnet #12. Additionally, developers discovered a validator exit issue on Devnet #11, which is being addressed by the Nimbus client team. Devnet #11 will remain operational until the issue is resolved.

Recently, Vitalik Buterin’snew articleDescribed for us the various possibilities of Layer 2 after ZK is built into Ethereum. This article explores how Ethereum will have its own ZK-EVM built into future network upgrades.

As we all know, in the context of the slow development of Ethereum, almost all mainstream Layer 2 currently have ZK-EVM. When the Ethereum mainnet encapsulates its own ZK-EVM, will the mainnet and Layer 2 have role positioning? What about conflict? How to effectively divide and cooperate between Layer 1 and Layer 2 is a major potential issue.

With the Dencun upgrade set to be deployed in March or April 2024, through EIP-4844, Ethereum L2’s gas costs will be significantly reduced and Ethereum’s scalability will be improved. Ethereum L2 activity is continuing to grow and is currently at an all-time high. L 2B eat data shows that the TVL of the entire Layer 2 ecosystem has exceeded the $20 billion mark.

With the rapid advancement of Layer 2 systems, perhaps Ethereum in the future will continue to sail towards a greater recovery under the leadership of these former little brothers.