How much selling pressure will ETH face after the upgrade in Shanghai?

Ethereum core developers finalized part of the network's next hard fork, an upgrade dubbed "Shanghai," at the All Core Developers conference this Thursday.

secondary title

What has been upgraded in "Shanghai"?

This upgrade is scheduled to take place in March 2023, and will open the withdrawal of ETH pledged by the beacon chain, that is, EIP 4895.

The developers also agreed to a second hard fork sometime in the fall of 2023, which would address another important scaling upgrade — proto-danksharding, also known as EIP 4844. EIP 4844 will make ethereum more scalable through sharding, a method of dividing the network into "shards" to increase its capacity and reduce gas fees.

The developers also agreed to a second hard fork sometime in the fall of 2023, which would address another important scaling upgrade — proto-danksharding, also known as EIP 4844. EIP 4844 will make ethereum more scalable through sharding, a method of dividing the network into "shards" to increase its capacity and reduce gas fees.

secondary title

Exit restricted

At present, the total ETH pledge amount exceeds 15.55 million, and 13% of the total ETH supply has been pledged. Calculated at current prices, the total value of these ETHs facing release exceeds $19.8 billion.

But fortunately, these ETHs will not all be thrown into the market-even if the holders want to, they can't do it.

As early as the beginning of ETH to PoS, the designer took into account the impact of a large number of ETH withdrawals on the market. Therefore, some restrictions have been made on the withdrawal and exit of validator nodes.

When the verification node initiates the exit request, it cannot exit immediately, but enters the exit queue. According to the design of the exit mechanism, there is a concept called "Churn Limit Quotient" in ETH withdrawal, which is the total number of verifiers / 65536. This number represents the maximum number of exits per epoch on the Ethereum chain.

As of the publication of this article, there are 485,573 Ethereum validators on the Beacon Chain. That is, currently 485, 573 / 65, 536 ≈ 7 validators can be withdrawn per epoch.

All verifiers will queue up to exit in sequence. Based on this exit speed, 1,575 verifiers can withdraw every day, and each verifier pledges 32 ETH, so a maximum of 50,400 ETH can be unlocked every day.

secondary title

Where is the ETH staked?

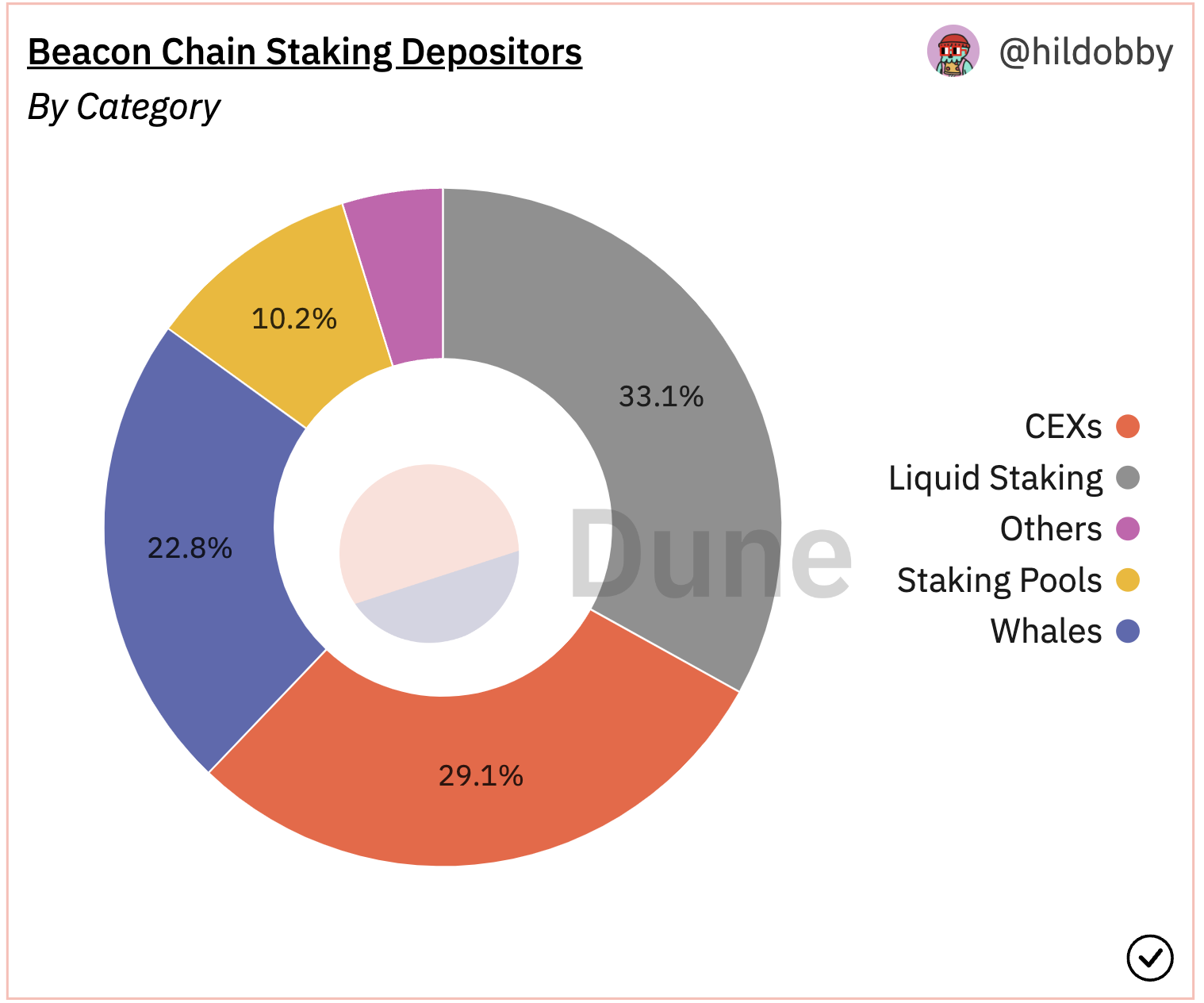

Currently, staking service providers are still the largest source of staking. Dune data shows that about one-third of ETH pledges come from pledge service providers, while centralized exchanges account for almost the same share, ranking second. In addition, the amount of ETH independently pledged by giant whales should not be underestimated, with more than one-fifth of the share.

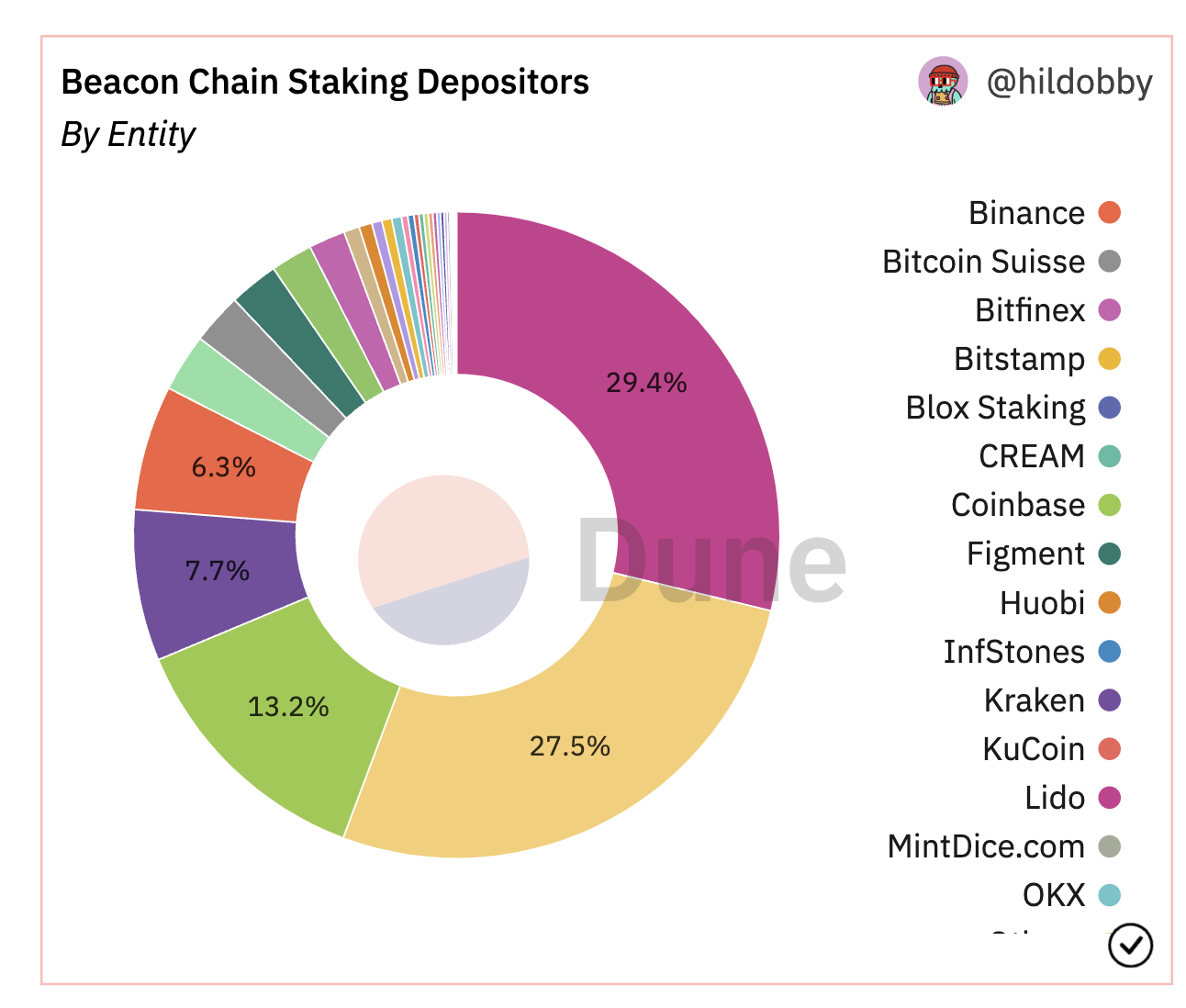

As the most popular staking service provider, Lido has a 29% market share and pledged about 4.6 million ETH, followed by Coinbase with more than 2 million pledged.

secondary title

Staking risk, or more from regulation

At present, the selling pressure of pledge unlocking on ETH does not seem to be as huge as people imagined.

Now that the encryption market has picked up slightly, the impact of staking unlocking may not be worthy of too much attention. What is more worthy of concern is the old-fashioned regulatory issue.

Etherscan’s node tracking statistics show that about half of the staking nodes are from the United States, and regulatory risk may still be the biggest risk of staking.

As early as September this year, SEC Chairman Gary Gensler said that cryptocurrencies and intermediaries that allow holders to "stake" their tokens may need to pass the Howey test to determine whether their assets are securities, which means that PoS cryptocurrencies may subject to federal securities regulations.

The question of whether PoS-consensus cryptocurrencies are securities has long been open. After the Shanghai upgrade is completed, ETH will be unlocked and generate income. Whether supervision will continue to attack, or it will become the sword of Damocles for PoS ETH.