Panoramic Interpretation of the Web3 Payment Track Layout and Development Trend

secondary title

guide

Payment seems to have always been an easy-to-understand but vague vocabulary. As one of the native applications of blockchain technology, encrypted payment contains more semantics and contains huge opportunities. It is an extension of the current network payment. This article will start from traditional mobile payment. Begin to explain the basic concept of payment, then explain the similarities and differences between Web 3 encrypted payment and traditional payment, and finally combine the mature ecology of traditional payment and the current development of encrypted payment to make a track map of Web 3 payment, analyze its development trend, and comprehensively Analyze the specific direction, application scenarios, overall picture of the track and the venture capital opportunities discussed in the Web 3 field.

1.1 Talking about traditional payment

Payment is the act of handing over money and delivering goods, in other words, the transfer of funds. Where are the funds of the modern people stored? In the final analysis, there are two places, one is the cash in hand, and the other is the deposit in the bank.

There are four basic methods of payment:

cash payment

bank account transfer

debit card transfer

pay by credit card

The method of cash payment will not be discussed here, and the latter three methods complete the transfer of funds through the financial system of the bank.

And when the payment cannot be completed directly through these three methods, the participation of a third-party non-financial institution is required. According to the "Non-financial Institutions Payment Service Management Measures" promulgated by the People's Bank of China: Non-financial institutions that provide payment services are all third-party payment institutions, which means that non-financial institutions provide the following fund transfer services as intermediaries:

online payment

Issuance and acceptance of prepaid cards

Bank card acquisition

Other payment services determined by the People's Bank of China

Due to the development of network technology, most of the scenarios we encounter are third-party online payment with mobile devices such as mobile phones as the carrier, and agents such as POS machines for payment when purchasing offline goods. Therefore, third-party payment is also what we often call mobile network payment.

1.2 Workflow of participants in each link of payment

Image credit: Zonff Partners

The user side is the starting point of fund transfer. The third-party payment institution connects with the user's bank account and the credit/debit card issued by the card issuing bank, transfers the user's funds to the payment channel, and then connects with the card organization for clearing and settlement. The card organization is an international regional payment information processing network, and all third-party payment institutions must access the card organization to perform clearing and settlement operations for payment orders. At present, there are six major bank card organizations in the world, VISA, Mastercard, China UnionPay, American Express, JCB, and Discover. After clearing and settlement, the third-party payment institution transfers the funds to the merchant. When there is an offline shopping scenario, an acquiring agent is required to connect the merchant and the third-party payment institution.

1.3 Fundamentals of a payment institution

policy regulation

business model

business model

Judging the profitability of a payment institution company mainly depends on whether it can maximize the profit of handling fees by reducing and choosing the most suitable payment channels as much as possible, and whether it can expand more income methods.

Common profit methods are:

handling fee. The main revenue source of third-party payment institutions generally charges 0.6% of the transaction amount, and the service fee is finally paid by the merchant and distributed to the participants in the payment link, that is, third-party payment institutions, card issuers and card organizations. The ratio is generally 1 : 7 : 2 .

foreign exchange. Only cross-border payment products are involved. As a payment channel for fund transfer in different currencies, a fund pool will be generated. At this time, when there is a cross-currency transaction, it can avoid the bank and directly perform currency exchange for users, thereby obtaining the exchange rate difference.

Access service fee. This scenario involves the concept of aggregated payment, which is to integrate existing third-party payment products into its own product system as one of the underlying payment channels to broaden the ability to transfer funds. For example, if a Chinese payment company wants to open up cross-border payments In the Indonesian market, it will be much easier to access the existing local third-party payment products such as Gopay than to open up the financial system such as local banks. Similarly, any payment product can open an interface to another payment company as the underlying channel and charge access service fees.

Data asset income. The value of the data generated by the accumulated user payment information is realized.

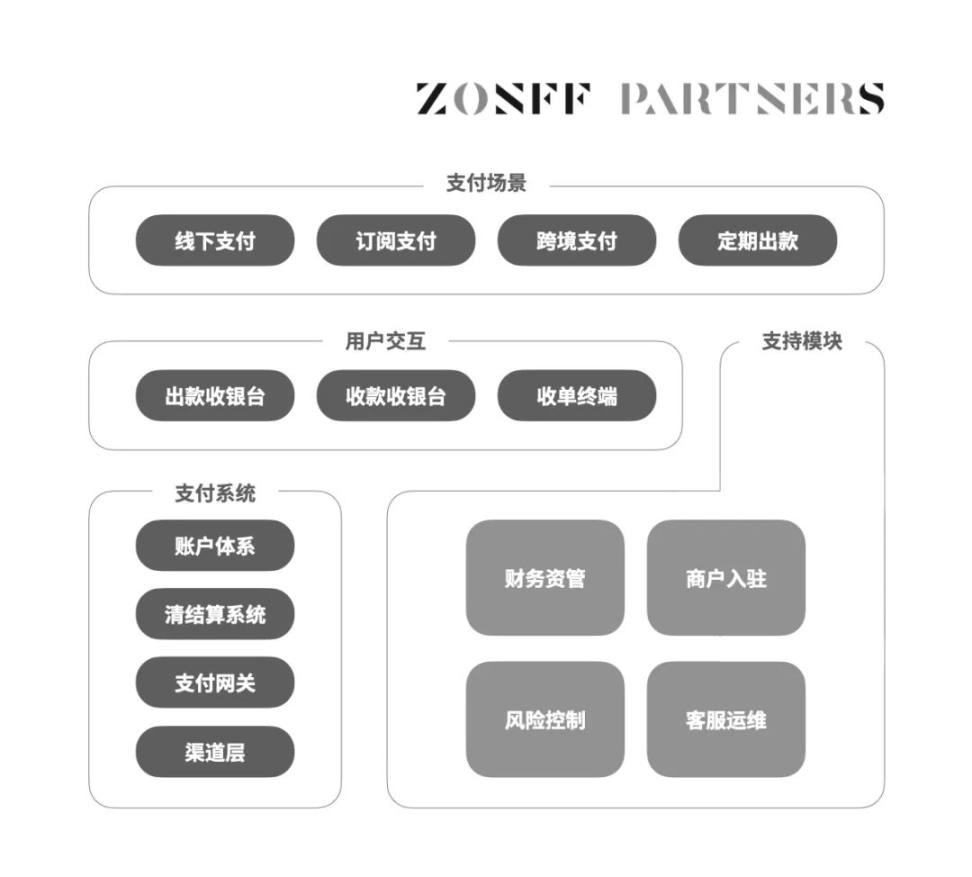

image description

Image credit: Zonff Partners

The payment product system is quite complicated and requires high technical capabilities. The measurement indicators include system stability, transaction processing success rate, security, etc. Any technical accident may cause serious financial losses, mainly including the core system modules shown in the above figure :

Channel layer, the core system of payment, the ability to realize fund transfer

Payment gateway, receiving judgment and processing order transaction flow information

The clearing and settlement system is connected with clearing networks such as UnionPay to process information flow and capital flow

The account system links merchants and users as a notification of transaction completion

The cash register, as the front-end page interacts with users and determines the user experience

At the same time, it also needs to cooperate closely with the operation and maintenance modules such as risk control system, fund management, clearing and settlement.

The object and carrier of the payment discussed above are legal tenders. When we introduce encryption technology and cryptocurrencies, there are two situations, one is the payment used for deposits and withdrawals of cryptocurrencies, and the other is that the cryptocurrencies themselves are used as currency to purchase other Commodities, in either case, most of the payment scenarios and corresponding projects discussed in the Web 3 industry involve the conversion between fiat currency and cryptocurrency.

2.1 Cryptocurrency deposit and withdrawal payments

2.1.1 Workflow of participants in each link of deposit and withdrawal payment

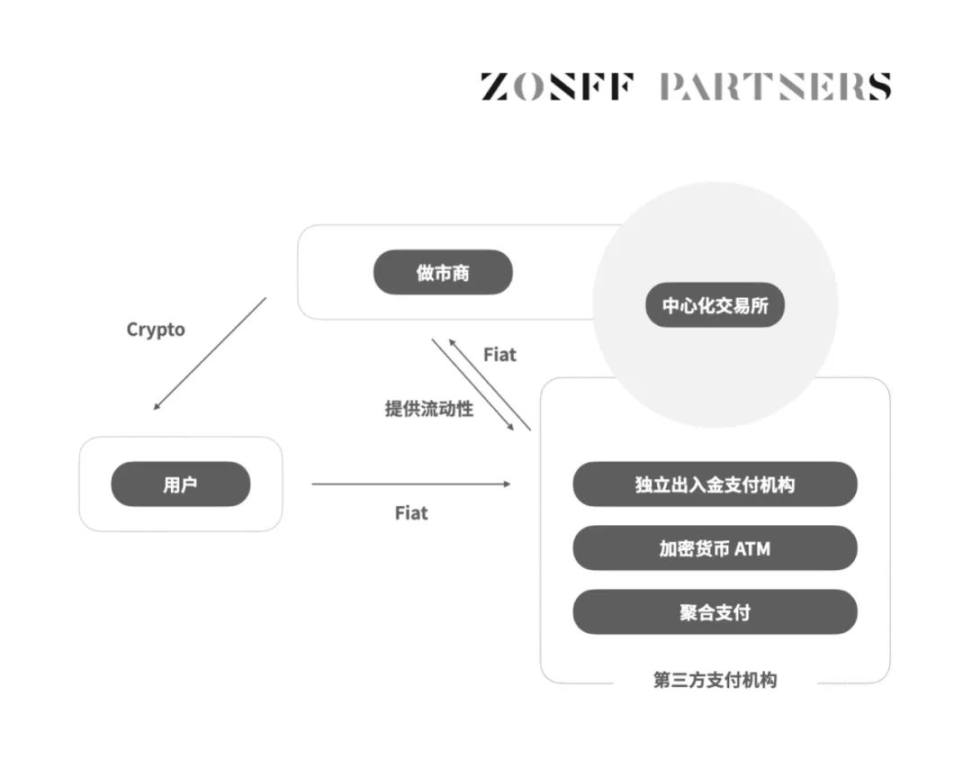

image description

Image credit: Zonff Partners

Centralized exchange

Centralized exchange

Centralized exchanges that have obtained licenses in some countries and regions will make their own deposit payments, and users can directly purchase cryptocurrencies through debit/credit cards or bank transfers. In most cases, centralized exchanges will build a P2P matching platform to allow users to deposit funds to the centralized exchange address through P2P. Therefore, centralized exchanges often have the lowest deposit rates. However, in some regions that do not have P2P trading habits or are explicitly prohibited by legal regulations, such as Europe and the United States, centralized exchanges need to access independent deposit and withdrawal payment institutions as the underlying channel to complete the purpose of user deposits and withdrawals.

Independent deposit and withdrawal payment institution

Moonpay is a leading independent deposit and withdrawal project, positioned as PayPal for Web 3. The main methods for users to deposit funds are credit cards, debit cards, ACH transfers and wire transfers. After entering the address and currency amount on the chain, the payment can be completed. Moonpay cooperates with 250+ ecological partners and holds MSB licenses to support local operations in 160+ countries. It integrates AML, KYC and other anti-fraud capabilities to meet regulatory requirements. Coinbase provides liquidity supply for it, relying on complete deposit and withdrawal The Matthew effect brought by functions and first-mover advantages quickly occupied most of the European and American markets dominated by credit card usage, propping up a valuation of 3.5 billion US dollars.

In addition, there are some more direct deposit and withdrawal payment products, relying on a simpler and more directly adapted functional interface or a single module with more sophisticated technology to win a place. For example, Rampay only serves as a deposit gateway for other larger independent deposits and withdrawals. The project provides interfaces as one of the components, and provides liquidity through them, and supports retail investors to connect credit or debit cards through Rampay for deposits.

Deposit and withdrawal aggregation payment

Like the above-mentioned traditional aggregation payment, it connects multiple independent deposit and withdrawal payment institution interfaces to form an aggregation platform, and provides users with quotations from different payment institutions through channel routing to guide users to purchase cryptocurrencies and earn commissions. Most aggregated payment platforms only serve as intermediaries for quotes, and do not transfer funds themselves, so they do not require a remittance license.

Cryptocurrency Retail Terminal

Supporting users to purchase cryptocurrency directly with cash offline, there are currently two solutions, one is cryptocurrency ATM machines, and the other is encrypted retail terminals located in convenience stores. This method has the following characteristics:

anonymity. KYC is not required when the deposit is less than a certain amount

Most retail terminals only support a few mainstream currencies such as BTC and ETH

The handling fee rate is high (5% ~ 20%). Offline terminal operation and maintenance costs are high, making it difficult to reduce costs

Bitcoin Depot is a cryptocurrency ATM project in North America. There are more than 7,000 ATMs in North America and some Canadian regions. It is connected to the Bitcoin Depot App on the mobile phone to complete the cash deposit operation, and also supports credit card debit card payment.

OTC deposit and withdrawal

Strictly speaking, this method is not the third-party payment we are talking about in this article, because the process does not involve the participation of third-party payment institutions. Generally, there are two modes: OTC (over the counter) mode and P 2 P (peer to peer) mode. In the OTC model, the two parties to the transaction are users who need to buy cryptocurrencies and a counter that has market makers to provide liquidity for them. This counter is generally affiliated to a large centralized exchange. The counter provides quotations for users and earns the part that is better than the quotations as profit. This method is generally applicable to large transaction users to eliminate transaction slippage and avoid losses caused by insufficient liquidity. In the P2P mode, the two parties to the transaction are users who need to deposit and withdraw from each other. The two parties can reach an agreement on the quotation to carry out the fiat currency transfer under the chain and the encrypted currency transfer on the chain. Some platforms such as centralized exchanges will provide custody to match P 2 P buy and sell and charge a very low service fee rate.

In addition, there are also debit cards and credit cards issued by some centralized exchanges and payment institutions in cooperation with financial card issuers, which also have the function of deposit and withdrawal, but in most scenarios, they are not used for deposit and withdrawal but for cryptocurrency payment. We will be discussed in the next section. As for how to choose the above-mentioned multiple deposit and withdrawal payment methods, the principle is that the less middlemen earn the difference, the cheaper it will be. Therefore, for ordinary retail investors, P2P should be preferred, but at the same time, pay attention to the price of the other party and the risk of fraud by the other party. .

2.1.3 Compared with traditional third-party payment

In terms of system technology and product form, deposit and withdrawal payment is not much different from traditional third-party payment institutions, but in addition to the technical standards required by the above-mentioned traditional third-party payment, there are also related technologies for on-chain operations. Compared with traditional third-party payment products, the simpler the deposit and withdrawal interface and process, the better, and more attention should be paid to localization. policy regulation. Like the above-mentioned traditional third-party payment institutions, they need to hold a payment license, and in some countries and regions with more sound and strict regulations on encrypted assets, such as Europe and other places, they also need to hold a virtual asset service provider license VASP. business model. Different from the current traditional third-party payment process where the merchant pays for the service fee, the current service fee generated by the deposit and withdrawal is all paid by the user itself, and the service fee includes not only the service fee generated by the above-mentioned third-party payment process, but also the blockchain transaction fee. The transfer fee, that is, the gas fee, these parts are added together to share the profit between the third-party payment institution and the supplier that provides liquidity for it. At present, it is not known that there is a relatively uniform standard of handling fee rate and profit sharing ratio in the industry. In addition to handling fees, there are also access service fees and data asset values that are the same as traditional third-party payment institutions.

2.2 Cryptocurrencies themselves as money payments

2.2.1 Cryptocurrency payment solution

At present, there are two main types. One is that third-party payment institutions first exchange encrypted currency into legal currency through deposits and withdrawals, and then make payment. At present, the most common solution is the issuance of encrypted credit cards. Encrypted platforms such as centralized exchanges cooperate with financial card issuers such as Visa and Mastercard to issue encrypted credit cards. Users can use credit cards to swipe their cards offline as long as they hold encrypted currency in their platform accounts. In the actual payment, the encrypted platform will first convert the encrypted currency into local legal currency to pay the merchant through the withdrawal payment channel. The well-known ones are Binance Pay and Weld Pay. This solution is very popular in countries and regions that are accustomed to using credit cards. However, due to regulatory and banking obstacles, it is difficult for giants like Binance to penetrate into all major countries. For example, Ukraine does not Allowing the use of Binance Pay credit cards gives Weld Pay, a product that focuses on crypto payments, the opportunity to develop.

The other is direct transactions with cryptocurrencies, where users pay cryptocurrencies and merchants also receive cryptocurrencies. Like traditional third-party payments, this type of cryptocurrency payment also needs to integrate multiple system modules to form a complete solution to solve the problems encountered in real-world payment scenarios, not just peer-to-peer transfers based on blockchain technology. To give an example of online shopping, in the case of complete trust between both parties, you can communicate directly with the merchant, get the address on the merchant chain, and notify the merchant to deliver the goods after you transfer ETH, but in real scenarios, only relying on point-to-point direct payment is obviously No way. First of all, you will not fully trust online merchants, what should you do if you do not deliver the goods after receiving the transfer, then you need a third-party payment agency as a guarantee; secondly, the entire process is too inefficient, imagine that merchants sell thousands of items a day At this time, it is impossible to communicate and confirm with the seller one by one. At this time, a clearing and settlement system and an account system are needed to let the merchant know which users have paid; moreover, point-to-point communication with the merchant and the operation of address transfer on the chain, plus waiting for the block Confirm the time to reach a consensus, the whole transaction process will be quite painful.

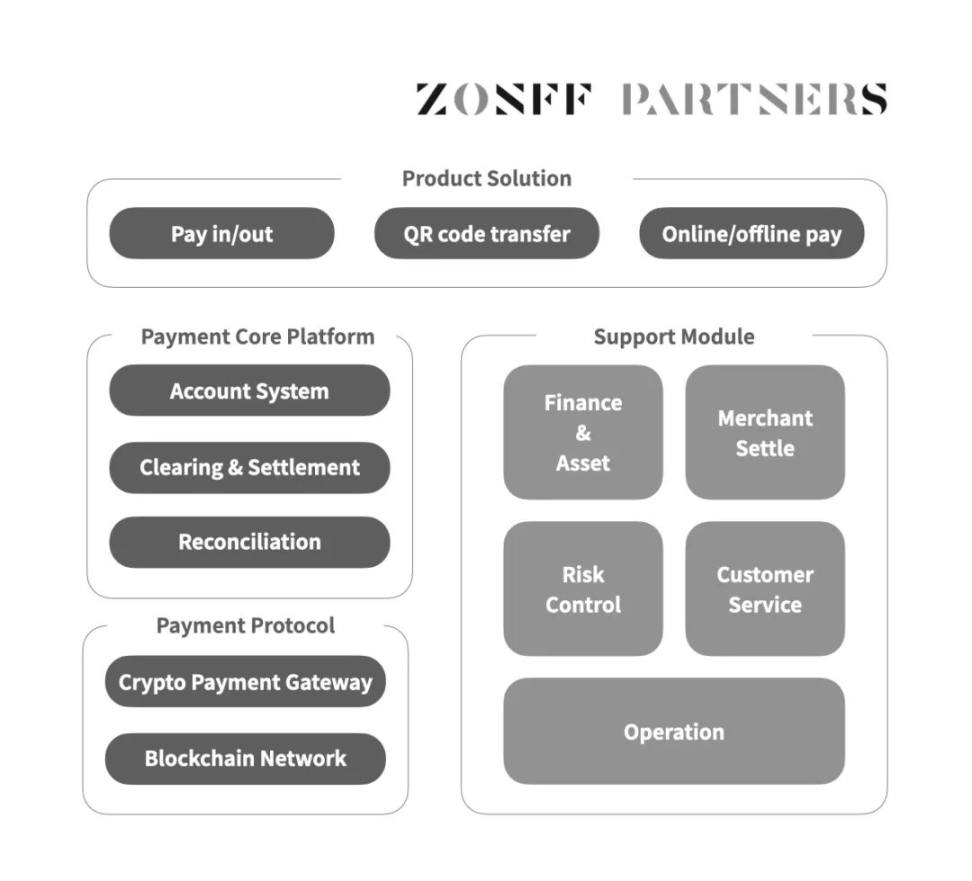

Image credit: Zonff Partners

As a third-party payment institution, cryptocurrency payment products solve the above problems. It includes the encrypted payment protocol, payment core system, front-end product interaction and corresponding support modules shown in the figure above. The core and bottom layer is the encrypted payment protocol, which is based on the Storage Consensus Paradigm (SCP), which separates computing and storage. The blockchain does not perform any calculations but only stores data. All calculations are performed by the client/server under the chain. The generated state is also saved by the off-chain client/server. The calculation layer is an encrypted payment gateway, which is at Layer 2, and the storage layer is a blockchain network. That is to say, the encrypted payment gateway is responsible for the confirmation of transaction information. When the system receives a transaction from the front-end interaction, the payment gateway is responsible for recording and sending it to the payment core system for reconciliation and settlement, and at the same time packs the transaction information on the chain. Stored in the blockchain network to prepare for the subsequent transfer of funds on the chain. After receiving the transaction information in the payment core system, it will process all the transactions related to the merchant together for settlement, and notify the merchant to complete the collection through the account system. So far, what the user and the merchant perceive is that the transaction has been completed. Complete, this process is the processing of information flow, since the whole process takes place off-chain, the efficiency and TPS are no different from traditional Internet server processing, and transactions can be confirmed instantly. After the transaction information is stored in the blockchain network, the payment system first receives the user's cryptocurrency, aggregates it as a short-term fund pool, and performs the liquidation process according to the settlement information confirmed in the information flow, and unifies the cryptocurrency due to the merchant in the Call merchants on the chain. At the same time, because the information on the chain is publicly available, each payment transaction is open, transparent and traceable. This process is the processing of capital flow, which is a delayed process compared to information flow. In this way, by separating information flow and capital flow, instant payment of cryptocurrency is achieved. As for the front-end product interaction and support modules, they are similar to the implementation functions of traditional payment products, so I won’t repeat them here.

At present, some mainstream encrypted payment protocols on the market, such as Everpay, Raiden Network, and Alchemy Pay's innovative integration protocols, although they have different similarities and differences, are based on the principle of separation of computing and storage similar to the above, to separately process information flow and capital flow to achieve real-time transactions The purpose of settlement is to support the upper encrypted payment solution.

text

The incident of buying pizza with Bitcoin is the earliest cryptocurrency payment, but this simple peer-to-peer transfer on the chain is not really a viable encrypted payment product, because it fails to solve the above-mentioned settlement waiting time, online payment trust and other issues. Encrypted payment currency payment products have experienced the development of the underlying payment protocol, to the emergence of payment gateway products, and then to the emergence of complete payment solutions, hybrid payments and more subdivided scene products.

Encrypted payment protocol is the infrastructure of payment products. The blockchain consensus mechanism makes the transfer on the chain take a long time, and it is difficult to achieve real-time settlement. When encountering network congestion, it takes longer and even the transfer fails. As the earliest encrypted payment protocol, Lightning Network has shortened the transaction time, but still cannot achieve real-time settlement; Everpay protocol has achieved real-time settlement based on the above-mentioned SCP principle, and expanded the supported cryptocurrencies from BTC to ETH, USDT and other mainstream currencies ; Later, more payment protocol networks such as Raiden Network appeared to solve the details of encrypted payment, as well as innovative payment protocols such as the streaming payment protocol Zebec Protocol.

Cryptocurrency payment gateway product. Based on the payment protocol, such products make payment gateways and core systems for the B-side, provide technical interfaces and charge technical service fees. This model is suitable for companies with small resources and specialization in technology, and can concentrate on perfecting technical problems. Ramp Pay, OpenNode, etc. are typical payment gateway products. Like traditional payment gateways, such gateway products are in great demand and the market is growing rapidly. In the past two years, dozens of encrypted payment gateway products have emerged.

A complete and convenient payment solution. As mentioned above, the payment process requires a complete solution assisted by multiple modules. For example, the payment gateway product cannot be oriented to the C-end due to the lack of front-end interaction of the cash register, and the lack of a risk control system will also face security issues such as fraud. At this time, it is necessary to purchase External risk control products such as Sardine can be used in combination. Some payment products, such as Xpay, cover auxiliary modules such as risk control, and have complete solutions. Compared with Ramp Pay, they have expanded usage scenarios and can occupy the C-end market.

Mixed payment with cryptocurrency and legal currency. Compared with XPay, Alchemy Pay not only has a complete cryptocurrency payment solution, but also integrates the legal currency payment system in order to pull in the cryptocurrency system and the legal currency financial system, so that cryptocurrency payment and legal currency payment can be seamlessly switched, and users can also Make deposits and withdrawals through Alchemy Pay, freely convert cryptocurrencies and fiat currencies. This model can also allow Alchemy Pay to expand its profit channels, and its cryptocurrency payments and legal currency deposits and withdrawals both charge a handling fee of about 1%.

With the maturity of payment product solutions, more payment segmentation scenarios have been discovered and met. In the past year, some cryptocurrency payment products targeting segmentation scenarios have emerged. For example, Loop Crypto realizes the automation of cryptocurrency transactions for the regular payment scenarios of enterprises; Maplerad provides cryptocurrency payment, storage and loan solutions for the lack of banks and other financial systems in Africa; and DolarApp specifically solves cross-border payment problems in Latin America. Such products make differentiated solutions for specific payment scenarios and occupy their own ecological niche in the Web 3 encryption track.

2.2.3 Compared with traditional third-party payment

Compared with traditional payment, what stage of development is cryptocurrency payment in?

If traditional payment has matured after several years of development, cryptocurrency payment is still in a very early stage. Looking at the future potential space from the number of users, Paypal will have 430 million active users in 2022, while Alchemy Pay, a well-known cryptocurrency payment project, only has 2 million verified users. There is no real giant company in the entire cryptocurrency payment field. If Assuming that cryptocurrency payment can only develop to one-tenth of the scale of traditional Fintech in the future, there is room for growth of more than ten times. Comparing the completeness of the upstream and downstream industries and product technology solutions, traditional payments already have mature industrial chains and technical solutions such as acquiring agents and risk control agencies, while cryptocurrency payments are still emerging with new underlying payment protocols to iteratively solve the payment process However, there are not many projects emerging in the necessary links such as acquiring agents and risk control in the payment chain, and they are still in a relatively blank state.

What is the relationship between cryptocurrency payment and traditional fiat currency payment, replacing or supplementing?

At present, it is generally believed that cryptocurrency payment will not completely replace fiat currency payment. In most countries, regions and application scenarios, fiat currency mobile payment is convenient enough, and the current rate of cryptocurrency payment is not superior to traditional payment. However, with the increasing popularity of cryptocurrencies, there will be more scenarios where cryptocurrency payments will be used as a supplement to the fiat currency financial system. For example, in some regions where the fiat currency financial system is underdeveloped, such as Latin America, the deflation and depreciation of local fiat currency requires a decentralized financial system such as cryptocurrency for payment. There are also some scenarios that have appeared in recent years that must be paid in cryptocurrencies, such as regular salary payments in cryptocurrencies. Nowadays, more and more Web 3 project parties pay salaries to addresses on the chain through encrypted currency, and it is expected to be an inevitable trend in the future. Salary payment has become one of the application scenarios of encrypted payment. Reap, a project party in Hong Kong, is committed to building the Payroll System for Web 3, helping Web 3 project parties and more traditional companies that will transform to Web 3 in the future to regularly issue cryptocurrency as salaries to employees.

What irreplaceable advantages does cryptocurrency payment have over traditional payment?

At present, the most worthwhile advantage is to avoid the participation of the centralized financial system, which greatly improves the efficiency of cross-border payment and speeds up the speed of clearing and settlement. Let's study the DolarApp project to get a good idea of this. First of all, let’s recall the cross-border remittance transfer process. After the Bank of China initiates the remittance, it is reported to the UnionPay network clearing system. However, there is no unified network clearing system in the world, so UnionPay needs to deploy domestic banks to transfer positions to Bank of America, and then the United States Clearing systems similar to UnionPay, such as ACH, VISA, etc., remit funds to designated accounts, which may involve manual accounting. Even in China, where online payment is already quite developed, it still takes 1 to 3 months to exchange US dollars from a Chinese bank account to a US bank account. 3 working days, it takes longer to exchange US dollars in Mexico, and it takes 5-7 working days to use ACH wire transfer, and you need to pay high handling fees, which is a very painful process for Mexicans who frequently need to enter and leave the United States , so it is often seen that some Mexicans take out a large amount of peso cash at the airport and bring it to the United States and then convert it into US dollars. DolarAPP provides deposit and withdrawal services from peso to the stable currency USDC, provides liquidity for users to purchase cryptocurrency USDC through the market maker behind it, and cooperates with Mastercard to provide users with an American account and issue a credit card. Holding USDC in China can use credit cards to spend globally. In this way, through the connection of stable coins, the peso account and the US dollar account are unified, avoiding the cross-border remittance that the centralized financial system needs to participate in, and meeting the needs of Mexican users to switch At the same time, it also enables users to store assets as USDC to avoid losses caused by peso inflation.

2.3 Competitive Landscape of Web 3 Payment Players

2.3.1 Encrypted exchanges carry out payment business

Exchanges generally carry out payment services in the form of issuing credit cards in cooperation with the centralized financial system. Leading exchanges such as Coinbase, Binance, and Crypto.com all launched payment services around 2020, and cooperated with Mastercard or Visa to issue cryptocurrency credit cards to support users with cryptocurrency assets to use credit cards globally. However, due to legal regulation and license restrictions in various countries and regions, these exchanges can only issue credit cards in some regions, giving independent deposit and withdrawal projects in many countries and regions the opportunity to carry out the same business.

2.3.2 Traditional payment giants cut into encrypted payment

With the rise and development of the encryption industry, traditional payment giants have begun to cut into the encryption payment business in recent years, focusing on cryptocurrency deposit and withdrawal services, and most of them provide technical services. For example, Stripe takes advantage of its original payment network to increase the business of purchasing cryptocurrency, and provides deposit and withdrawal payment API interfaces for exchanges and the like. Traditional payment giants can easily use their own mature payment systems to quickly provide deposit and withdrawal technical services. For cryptocurrency payments, due to the lack of blockchain-related technology accumulation and understanding of the Crypto industry, they have limited advantages compared with Web 3 native payment products. With the advantage of its basic user volume, it can quickly enter the field of cryptocurrency payment by cooperating with Crypto Native institutions such as centralized exchanges. For example, Circle has recently cooperated with Applepay to provide merchants with cryptocurrency payment API interfaces, allowing Applepay to quickly enter the cryptocurrency payment market.

2.3.3 Native Web 3 Payment Players

Unlike encrypted exchanges and traditional payment giants who have cut into payment from their main business in recent years, some native encrypted payment players have entered the game early, and are committed to solving the problems of cryptocurrency deposits and withdrawals and real-world payment scenarios. BitPay is one of the encryption payment giants that started in 2011. It provides a complete deposit and withdrawal solution, and provides merchants with bitcoin payment solutions. However, due to the low popularity of cryptocurrencies in the early years, as of 2018, Bitpay only settled in 6w merchants, and with the rapid growth of cryptocurrency users in recent years, as of the latest data last year, Bitpay has entered 12w merchants to double the growth. At the same time, a large number of Web 3 payment native players have also emerged in recent years. The independent deposit and withdrawal project MoonPay was established in 2019, and has become an independent deposit and withdrawal payment giant with a valuation of 3.5 billion US dollars in three years.

Compared with traditional payment giants, native payment projects often have more Web 3 gameplay. Most payment companies have issued Tokens. For example, Alchemy Pay issued the token ACH, and WeldPay issued the token Weld as a reward for its payment users. Users can get token cashback when paying with their encrypted credit cards, but this model is prone to fraudulent users The token model of encrypted payment projects is worth studying in depth. But it is worth mentioning that encrypted payment products are supported by hard application scenarios, and users often have a stronger consensus to support the value of tokens. Some Web 3 payment institutions such as MoonPay and Nuvei support the direct purchase of NFT by credit/debit card to simplify the NFT purchase process, which is essentially the same as the legal currency deposit to purchase cryptocurrency. Some other payment institutions have different ways of playing, such as Weld issuing NFT and using it as the skin cover of encrypted credit cards.

image description

Image credit: Zonff Partners

3.1 Trend: Cryptocurrency will be more closely integrated into the legal currency financial system

3.1.1 Gradually infiltrate traditional payment application scenarios for "chain reform"

Offline retail. As mentioned above, the current common solution is the issuance of encrypted credit cards, but the use of credit cards obviously cannot meet the offline payment scenarios in all countries and regions. Encrypted payment products should at least have code scanners at retail counters and self-service settlement terminals in unmanned supermarkets to help merchants receive orders like current traditional payment products. Such products require third-party encrypted payment institutions to cooperate with offline agents to make Produce terminal products that support on-chain cryptocurrency acquisition.

Subscription payment. Loop Crypto is a platform that allows organizations to automatically make recurring cryptocurrency payments. Its core product is similar to the subscription function of traditional payments; after a one-time signing and approval, Loop users can automatically make subscription-style transaction payments without having to pay each time Re-sign and re-submit the same transaction during payment. Loop automates invoking payments by delegating the execution of recurring transactions to automated smart contracts. The flow payment protocol technology described below may completely revolutionize the application of subscription payment scenarios.

Make regular payments. The most common scenario is salary payment. As mentioned above, the project party Reap is building Payroll System for Web 3, and there is no finalized plan yet. Compared with the traditional salary management and distribution system, which includes multiple modules such as financial management and information notification, the product complexity is not low. In addition, different countries and regions have different application scenarios and usage habits. It is expected that there will be more projects in this segment Fang came out to create a more innovative and perfect on-chain salary management and distribution Dapp. For example, Zebec, a streaming payment protocol, has developed Zebec Payroll, a system with tax-compliant on-chain processing functions, which provides the basis for the legality of Zebec Pay streaming salary payments.

3.1.2 Encrypted Payment Auxiliary Module Products Will Emerge

According to the above discussion, the third-party payment institution needs to hold a license issued by the bank and meet the regulatory measures required by the bank, including having a qualified AML and risk control mechanism. Not only that, a complete payment link also needs to include financial management , account reconciliation, merchant settlement and other modules are assisted to complete together. Project products such as AML anti-money laundering, risk control, on-chain compliance auditing and on-chain financial management related to on-chain data analysis will be useful. For example, the Sardine project, known as the anti-fraud fighter of Web 3, aims at the characteristics of Crypto/NFT fraudulent behavior and provides risk control services for deposit and withdrawal payment companies. At present, there are very few products of these modules. With the increase in demand brought about by the development of cryptocurrency payment products, more auxiliary projects will fill this gap.

3.1.3 Realize freer exchange between cryptocurrency and legal currency, compatible with mixed payment of the two

In the long run, the application of cryptocurrency will become more and more widespread, but it is unlikely to completely replace legal currency. The ultimate form of payment in the future is likely to be a seamless hybrid payment of legal currency and cryptocurrency. The most likely way to go in this direction It is Alchemy Pay, which has developed its own payment system integration protocol by integrating underlying payment protocols such as the Lightning Network, State Channel, and Raiden Network, and completed the initial form of online and offline payment integration. transfer. Similar competitors include Pyypl and Xpay, which have recently completed their B round of financing.

3.2 Opportunities: Encrypted Payment Opportunities under Regional Differences

3.2.1 The cash deposit problem caused by the underdeveloped financial system

The cash usage rate in some regions such as Southeast Asia, Africa, and Latin America remains high. For example, as many as 65% of the people in Latin America have never participated in centralized financial systems such as banks and have always used cash. In the future, the full deployment of cryptocurrency retail terminals will be a trend. You can refer to Indonesia, where e-commerce is already very developed. The local offline convenience store payment products Alfamart and Indomaret still account for 30% of the third-party mobile payment market share. This is related to the local urbanization rate as low as 50% and local users’ cash usage habits. It is difficult to change in a short period of time. In the near future, if the number of cryptocurrency users continues to grow, it will inevitably be accompanied by the rollout of retail terminals that support cash purchases of cryptocurrency. Startups with lower fees will come out soon. In addition, in addition to the cash issue, due to regional differences in payment habits, more localized independent deposit and withdrawal products will be required.

3.2.2 The problem of high inflation rate of legal currency in Latin America

Many regions in Latin America suffer from high local fiat currency inflation, and their currency prices fluctuate even higher than most cryptocurrencies. Combining stablecoin with payment can better solve this problem. Users can purchase fiat currency into stablecoin through stablecoin deposit payment products, and realize payment in the real world through credit cards issued by payment products, which can avoid inflation problems .

3.2.3 Difficulties in cross-border payment in Africa, Latin America and other places

As mentioned above, the DolarApp project has better solved the difficulty of cross-border payment in Mexico to exchange US dollars. In Latin America, there is a need to exchange US dollars and other neighboring countries for legal currencies in more regions. The cross-border payment network Arf project focuses on solving cross-border payments with encrypted stable coins, avoiding the participation of the centralized financial system. The African project Maplerad, which has just completed a $6 million seed round of financing, uses the same logic of the DolarApp product to solve cross-border payment problems in Africa through cryptocurrency as a bridge, and to solve the problem of lack of centralized financial systems in most African regions. The function of deposit cross-border payment products is gradually improved, and the financial products integrating account, payment and foreign exchange act as a local banking service platform. Similar projects include Flexa, Airswift, etc. In general, due to the backwardness of economic and cultural development in these areas, problems such as cross-border payments brought about by the traditional financial system are overworked, while cryptocurrency payments have the advantage of being decentralized and avoiding the traditional centralized financial system, which can improve this. It is expected that more Startups will go to Africa, Latin America and other places to solve local financial problems.

3.3 Innovation: Encrypted Payment Technology Mining and Application New Scenarios

3.3.1 Flow payment

Zebec Protocol, a streaming payment protocol based on the Solana chain, has introduced a new application scenario in the payment field. In the streaming payment service provided by Zebec, funds are usually locked in smart contracts, and the protocol is automatically executed according to the settings of streaming payment, which can realize real-time , frictionless and continuous payment flow, allowing users to make payments continuously. This payment method can be applied to a variety of scenarios, such as subscriptions. Users no longer need to pay monthly, but pay when they use the service, and stop payment when they are no longer in use, avoiding the loss of excess funds and giving more payment flexibility. Another example is the process of unlocking the tokens of the project party, the application flow payment, the payment procedure is set at the beginning, the investor can obtain the tokens continuously, and once the payment contract is set, it cannot be changed, and the investor does not have to worry about the Rug risk of the project party . In addition to Zebec, the streaming payment protocol also includes other projects such as Superfluid, Sablier, and Drips.

3.3.2 Apply zk's private payment

Original link