There are also gold mines in the small pool of Uniswap V3, and LPs on the gold rush road show their skills

Official website:Blockin.ai

Official website:Turnaround of UniswapV3 LP from loss to profitTurnaround of UniswapV3 LP from loss to profit

》We mentioned that most of the LPs in the Uniswap V3 protocol have long-term losses under the U standard, but we still found that some currency pools are making good profits. We speculate that this type of currency pool is usually not a dual-stable currency pool or a currency with a large amount of lock-up This is because the dual-currency currency prices of these two types of currency pools are more stable and the risk of currency holding is lower. At the same time, the higher liquidity of the pools leads to lower average fees.

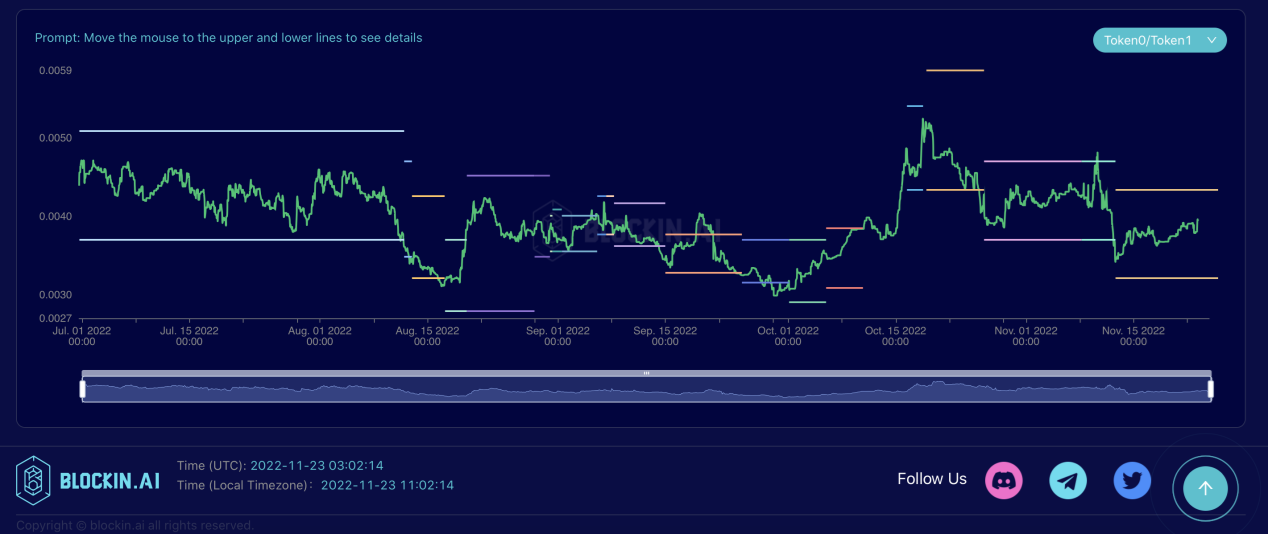

We believe that LP mining in small and medium-sized currency pools is because these currency pools bring higher handling fees due to the scarcity of liquidity on the one hand, and on the other hand, they are optimistic about the small currencies in this currency pair and use high fees to reduce Risks brought about by currency price fluctuations, or using the "grid" mode of the AMM curve to automatically sell high and buy low, this can be regarded as a disguised form of currency speculation. In addition, institutions will also provide a large amount of liquidity for mining pools of native utility coins and stable coins issued by them to improve market liquidity.

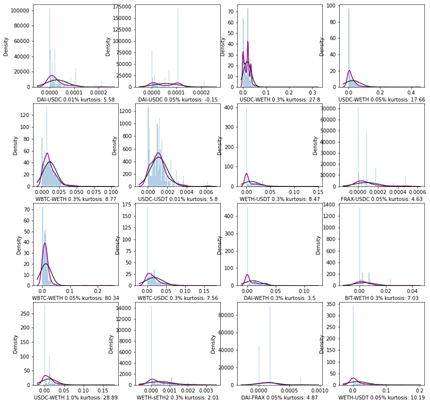

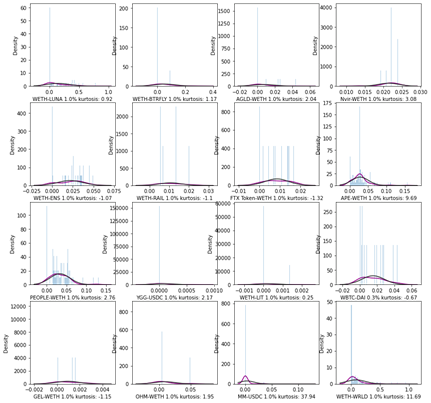

In order to confirm this point of view, we first analyze from the perspective of pure mining revenue. Taking July 2022 as an example, we found that the pool’s LP mining yield distribution does not simply obey the normal distribution, and the kurtosis values of different pool distributions vary greatly, and the kurtosis reflects the sharpness of the peak of a distribution , when the kurtosis is greater than 3, the distribution presents a steeper tail than the normal distribution. When the mining yield of LPs in the pool does not show a normal distribution, it shows that the income of LPs is often greatly affected by their strategies, and only a small number of LPs can obtain high mining yields. In short, it is the fees in the pool. The competition is tougher and more "volume". It can be seen that from the perspective of the largest mining pools in tvl, WBTC-WETH0.05% is the most "volume" mining pool, followed by USDC-WETH1.0%, USDC-WETH0.3%, and USDC-WETH0. 05%.

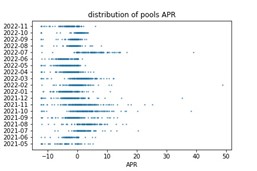

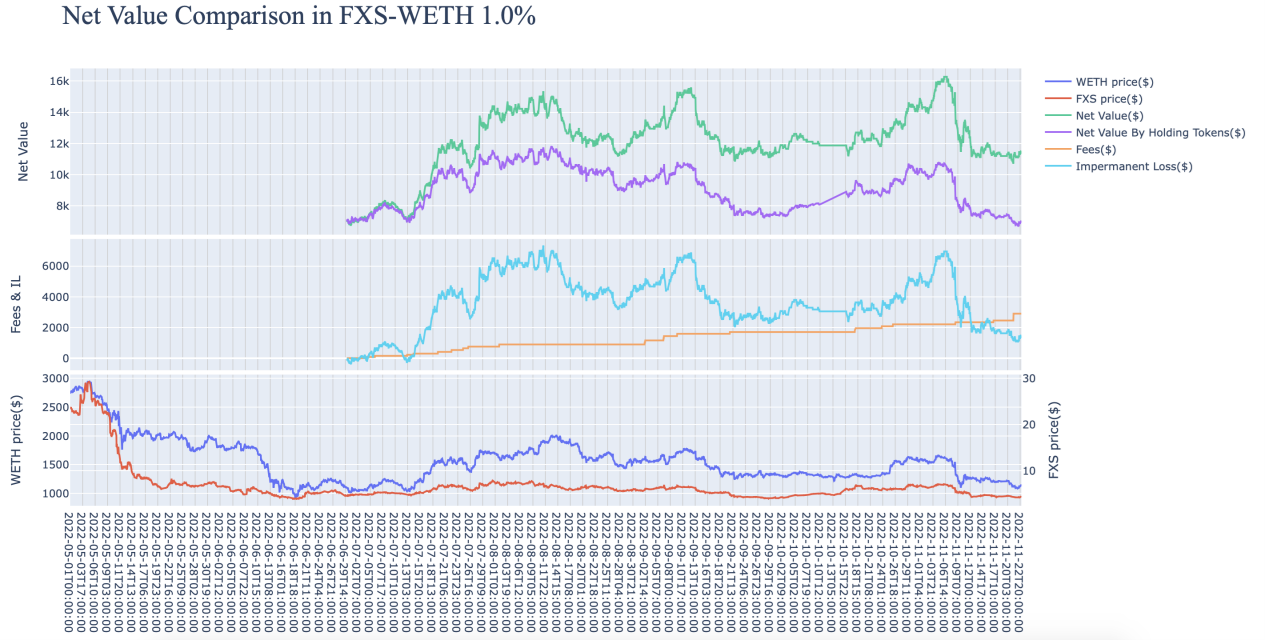

Based on the hourly profit and loss of all positions in Uniswap V3, we calculated the monthly profit and loss of each currency pool from May 2021 to November 2022, and found from the distribution of annualized return rates of the monthly pools that the income of currency pools in different months Rates are clustered, such as August 2021, October 2021, and July 2022. The overall distribution is relatively high.

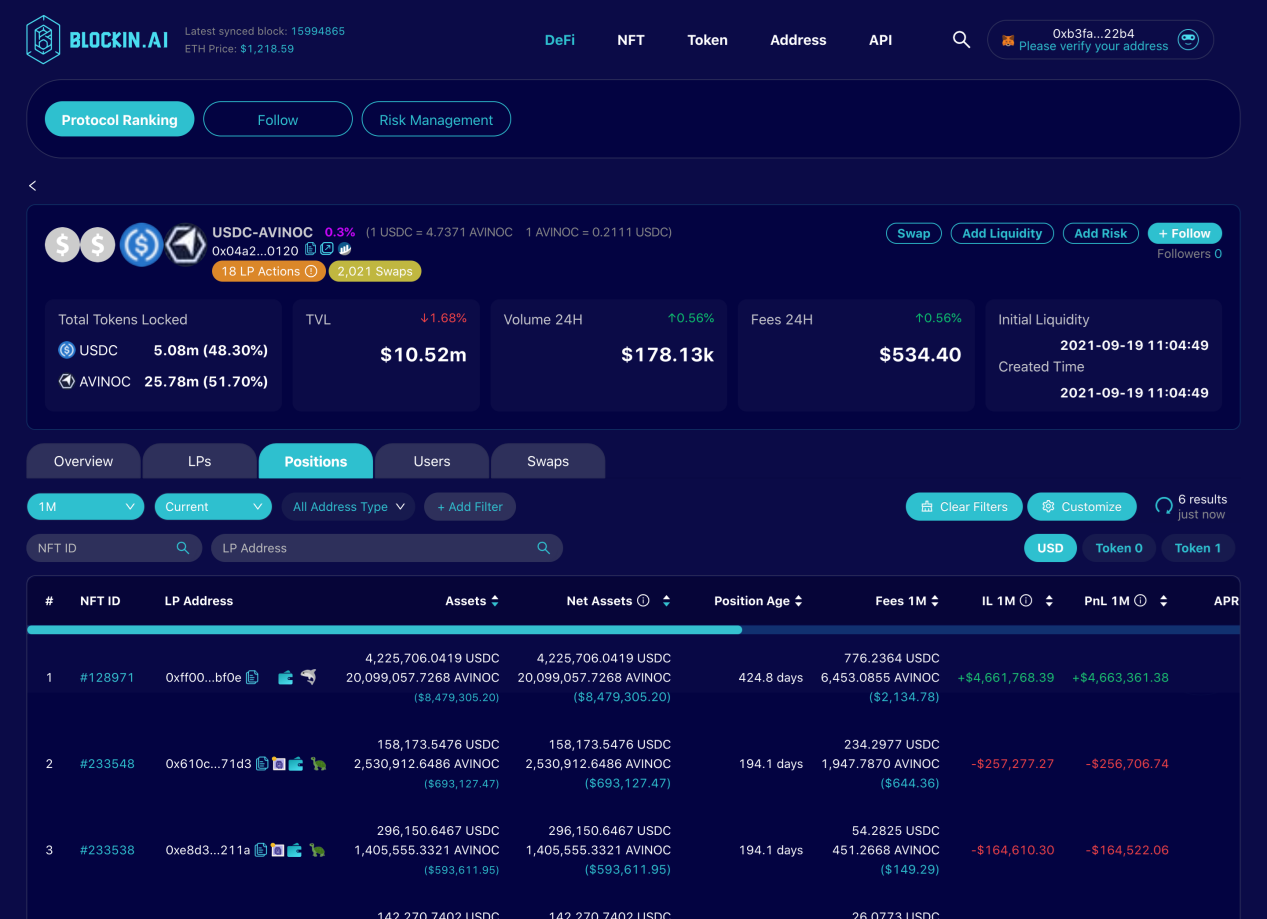

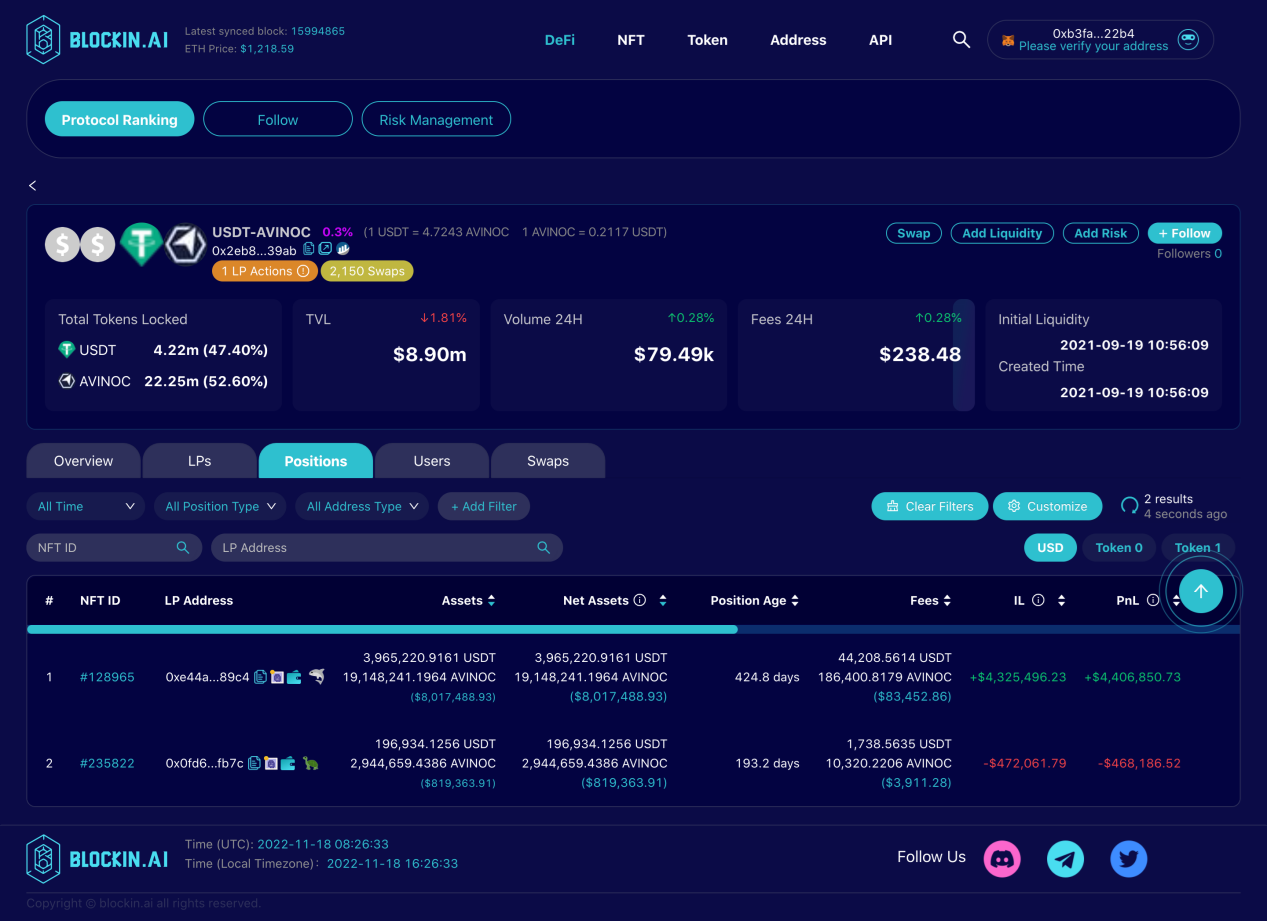

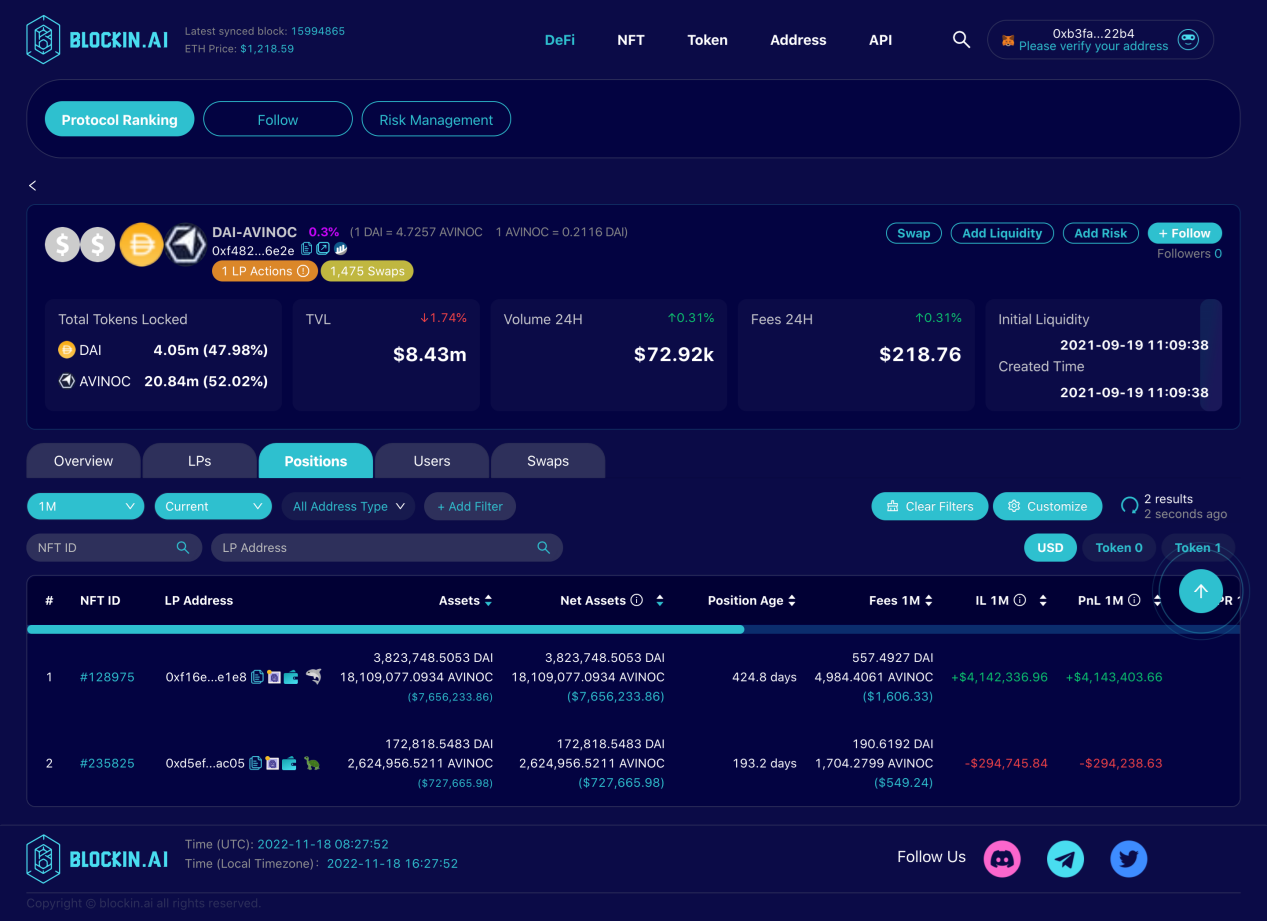

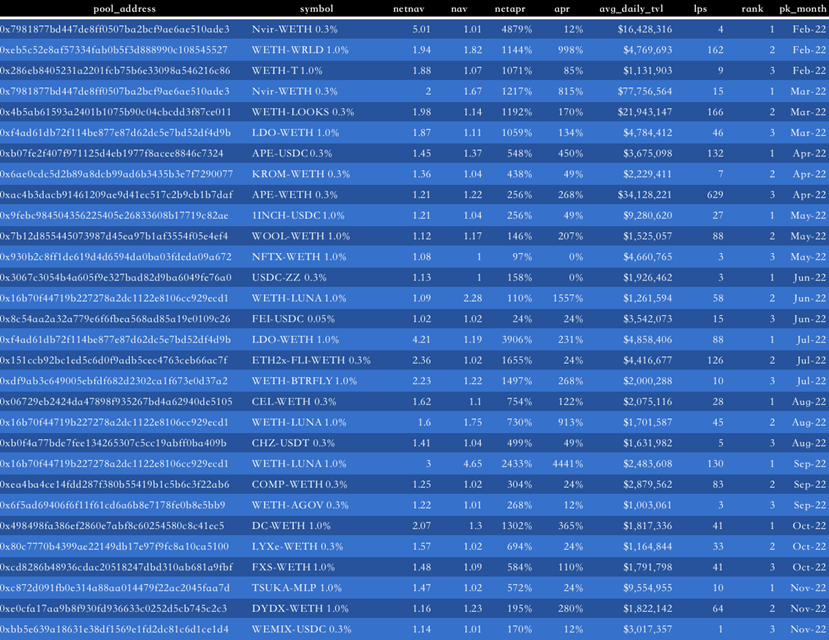

Pools with too little liquidity may have falsely high currency prices due to the influence of the initial liquidity provider, and are actually not liquid. Therefore, we select currency pools with an average daily lock-up volume of more than 1 million US dollars for analysis (see Appendix 1). Among the 61 records of the top three coin pools in terms of monthly yield, we found that only 5 pools have an average daily lock-up volume of more than 10 million US dollars, of which 0.3% of Nvir-WETH will be locked-up on a daily average in March 2022 The volume of 77.76 million US dollars is the highest, which confirms the conjecture that the coin pools with the highest returns are often small and medium-sized pools.

From the point of view of the fee income, there are 35 records whose annualized rate of return of fees has reached more than 100%, and 22 records of which the annualized rate of return of fees has reached more than 300%. However, the rate of return of fees accounted for more than 50% of the net rate of return There are only 21 records, and there are 27 records in which the rate of return of fees accounts for less than 20% of the net rate of return. This shows that although the overall rate of return of fees for this type of currency pool is relatively high, the positive free loss caused by the increase in the actual currency price is the Factors that most affect net income.

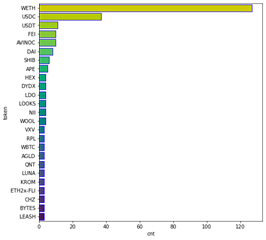

In addition, it is not difficult to find that 95% of the pools in the list contain WETH or stablecoins USDC, USDT, DAI, and FEI, while WETH-LUNA1.0% and KROM-WETH0.3% are the two pools with the highest frequency of occurrence, appearing three times in total . The mining yield distribution of the mining pools with the highest net yield in July 2022 is also drawn, showing that except for MM-USDC1.0%, the kurtosis values of other mining pools are generally not high compared with large mining pools, which also reflects It is easier for LPs to obtain high returns from some small and medium-sized mining pools with potential.

Everyone in the currency circle has witnessed the sudden skyrocketing and rapid return to zero of many coins, including the decoupling of the largest algorithmic stablecoin UST from the U.S. dollar and the LUNA thunderstorm incident. LPs have a wait-and-see attitude towards the future of some coins. For them, they directly hold They are not sure about the risks of long-term bullish currencies. At this time, the "grid" mode of AMM has become a disguised currency speculation method. This mechanism helps them actively sell small currencies and exchange them for Ethereum when their prices rise. Or stable currency, and the high fees of small mining pools partially offset the free loss caused by the decline in currency prices, making the risk of market making much lower than the risk of simple currency holding.

first level title

appendix:

appendix:

Appendix 1