OP Research: The game of human nature in the Crypto dark forest system

first level title

1. What kind of animals are we?

Suppose there is an orangutan, whether it is an intelligent bonobo or a muscular and brainy silverback gorilla, how can it quickly become the overlord of the population?

image description

Picture: Beastmaster Rolling Barrel Shocks All Directions

When a nightingale on the tree sings, it will trigger a chorus; the first monkey to jump into the water curtain cave will be the king, because other monkeys will follow him into the cave. There is also a similar phenomenon of imitating the same kind in human behavior, which is called the meme (MEME) effect. Bitcoin (BTC) was originally circulated among programmers and geek enthusiasts because of the MEME effect. Dogecoin (DOGE) and Shiba Inucoin (SHIB), as rising stars, are widely known by relying on developed social media communication.

The narrative logic of these MEME tokens is simple and straightforward, the slogans are extremely provocative, and they are blessed by celebrities such as Elon Musk, and followers have bought them one after another. The popularity of non-homogeneous tokens (NFTs) whose main content is pictures was originally due to the need for identity recognition in social scenes, such as Crypto Punk (Crypto Punk) avatars and boring ape (BAYC) avatars. Therefore, encryption is not the main feature of MEME coins, but more similar to the herd effect of fans in star concerts.

image description

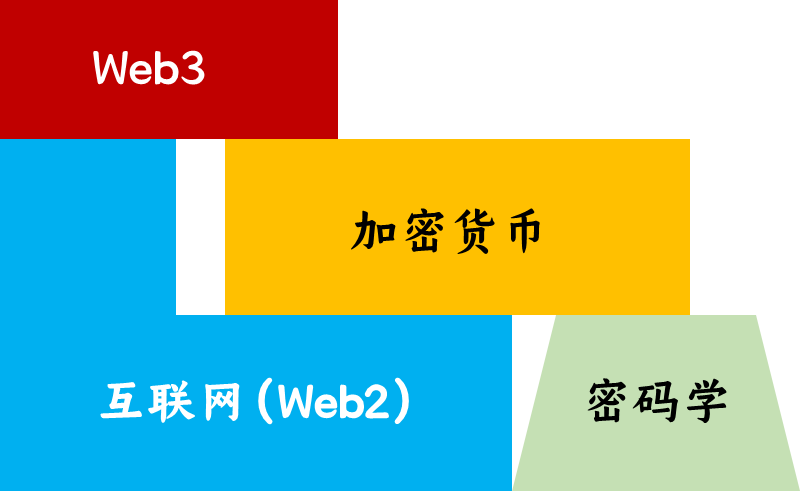

Figure: Crypto and Web 3, drawn by the author

After the wilderness of Web 3 has gradually flourished, the MEME phenomenon has gradually become an old narrative, like carrion in many cases, and it is not easy to be looted by beasts. However, once there is an excellent narrative logic, it will still be swarmed by hyenas and vultures. At this point, whether it is institutional capital, large investors or retail investors, they all have the same "fear of missing out" (FOMO) mentality.

On October 28, 2022, after Elon Musk personally led a group of funds to complete the acquisition of Twitter, the price of DOGE tokens rose sharply, and the transaction volume surged. Since Elon Musk is the main promoter of the popularity of DOGE coins, investors expect that DOGE coins will be introduced into some payment scenarios on Twitter. This expectation made the trading volume of DOGE coins exceed that of Ethereum (ETH) once again . This shows that the MEME effect is still a casino with fierce betting, and the technical application prospect is only a supporting role like a beautiful dealer (of course, this green leaf supporting role is also indispensable).

first level title

2. Irrational behavior of advanced animals

Adventure in the irrational and wild Web 3 jungle is a very high test of the humanity of digital nomads. It is necessary to gradually eliminate greed, hatred, ignorance, suspicion, and slowness in human nature before they can see their nature and become a Buddha.

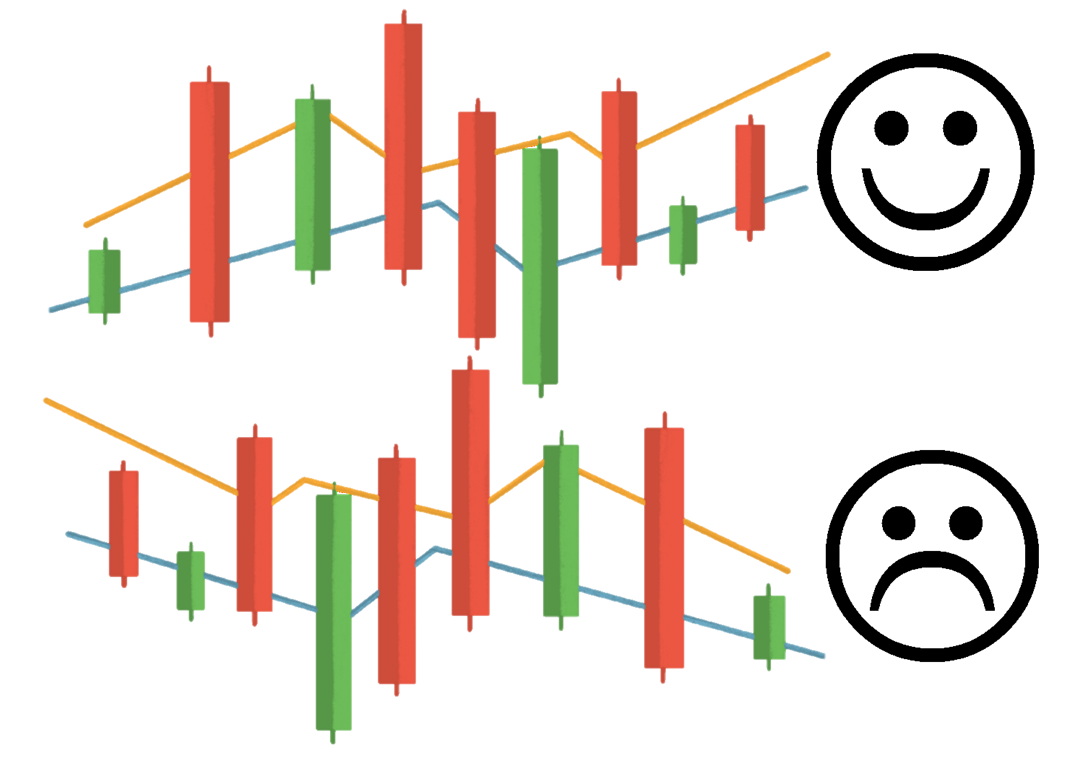

greedy. Greed is the chief evil, mainly manifested in delusion to eat the last copper coin, trying to grab the fish head and tail from the dealer, and failing to stop profit and ship in time. This is the mentality of a profiteer and a profiteer.

angry. The trend reverses, the price of the currency in the position falls and refuses to admit defeat, and continues to increase the position; the price of the currency rises and then continues to rise after selling, you can’t just walk around empty positions, but regret selling, and buy again at a high point and get trapped. This is the mentality of a violent reckless man.

Crazy. Fantasy holding a coin for a few years, value investment, forever, but this coin is not BTC and ETH. This is the mentality of a girl in love.

suspect. After researching the market or the basic information of a certain project, you are not confident enough to participate in ecological interaction or transactions decisively. This is Yuan Shao's mentality of hesitation.

slow. It is impossible to maintain the state of being a student every day, and constantly learn new projects and new knowledge. The arrogance of a veteran can ignore a lot of valuable information. This is the Eight Banners dandy mentality.

image description

Picture: Don’t be happy with K, don’t be sad with U, the author’s drawing

first level title

3. From zero-sum game to positive externalities

The historian Machiavelli said: "A thing can be successful and long-lasting if it benefits all." This behavior is called principled altruism. By this standard, currently in the Web 3 industry, the model that benefits everyone (including other industries outside the circle) is relatively rare.

image description

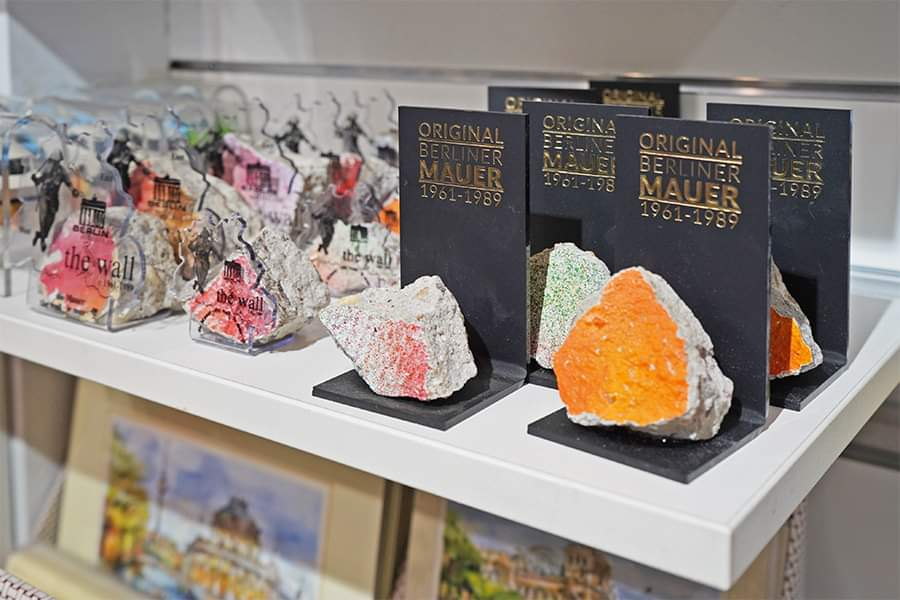

Photo: Stone memorial of the collapsed Berlin Wall, source: https://www.facebook.com/rainieis

BTC, which has many staunch believers in hoarding coins, high mining costs, output deflation, and easy wallet loss, has gradually become something that many coin holders will not sell for a long time, thereby reducing transaction frequency and energy consumption. For non-high-frequency traders, the most important function of BTC now becomes value storage. Therefore, the value of BTC is that people want to own it and keep it, not sell it and give it up. In the long game of buying and selling over the past ten years, BTC has gradually concentrated in the top few wallets. In this way, the deflationary and centralized BTC is not suitable for the universal popular currency of Web 3.

The deflation of currencies in the pre-epidemic period is fatal. In the early Ming Dynasty, copper coins were legal currency and silver was illegal currency, but everyone (including the emperor) kept silver privately and generally recognized the value of silver. The common people cast silver into pieces and hid it underground, which indirectly caused the Ming Dynasty government to be unable to obtain enough silver and could only collect various agricultural and sideline products instead of collecting taxes, lacking financial capacity. During the Wanli period of the Ming Dynasty, Zhang Juzheng reformed and officially adopted silver as the official currency. After Emperor Wanli, who was keen to collect money and store silver, legalized illegal mining activities among the people, the silver mines were quickly exhausted. In the late 16th century, Spanish colonists invaded Mexico and Peru and imported a large amount of silver from the Americas to China. In the 16th and 17th centuries, half of the silver produced in the Americas was imported into China. This directly led to the depreciation of silver in the Ming court treasury, and large-scale inflation of commodity prices denominated in silver occurred. However, due to the fact that the kings and dignitaries in the capital are greedy and hide a lot of silver (similar to the behavior of the centralized exchange), Confucian defenders (both true and false) give the kings no taxation and moral shackles, landlords and plutocrats (usually also Confucian scholars) The national treasury is still in short supply of silver. The drought and natural disasters caused by the superimposed small ice river climate, and the Jurchen tribe's southward migration eventually led to the bankruptcy and collapse of the Ming Empire.

image description

image description

image description

Right image source: https://zhuanlan.zhihu.com/p/ 435556626

image description

Figure: Some tokens after ICO were smashed shortly after going online

We’ve seen ICO fundraisers for various projects that promote the crypto narrative, but projects that have nothing to do with the principles of cryptocurrency, like colonists arriving in America with a Bible in one hand and a bullet in the other. These fundraising practices are similar to traditional financial institutions, but not as regulated as they are.

image description

Picture: Issuing new coins in ancient and modern times is a sharp weapon for harvesting wealth, source: https://kknews.cc/zh-sg/collect/98 boroq.html

Cross-chain project tokens between public chains are often hacked due to technical loopholes. For example: On August 10, 2021, Poly Network was hacked simultaneously on multiple public chains of ETH, BSC and Polygon, resulting in a loss of more than $600 million; On October 7, 2022, the Token Hub of the BNB Chain cross-chain bridge was attacked In the incident, hackers stole 2 million BNB; on November 4, 2022, GALA coins were attacked on the BSC chain, and hackers issued a large number of the coins and sold them. In these incidents, whether it is institutions, centralized exchanges or retail investors, they all suffered huge property losses.

As long as a token has a project party, there will be pre-sale or pre-mining, which will create unequal opportunities for participation, and eventually lead to the concentration of tokens and the power expansion of a few people. In October 2022, crypto-fundamentalist programmer Jack Levin designed the XEN coin, which is a token issued by no project party and everyone is equally mined for the first time. XEN quickly attracted a large number of wallets to participate in mining on public chains such as Ethereum Chain (ETH) and Binance Smart Chain (BSC), and once accounted for 50% of the sent blocks on the ETH chain. XEN currency creatively solves the problem of "scientists" or "witches" who use script batch mining, and uses its profit-seeking motive to drive it to make profits for ordinary people who participate. The more wallets mined by the "Mao Mao Party" in batches, the more tokens will be obtained after waiting for a period of time for ordinary wallet mining, so that everyone will benefit. In the beginning, XEN was mined continuously and was highly inflationary. Over time, the inflation rate gradually decreased, and finally became a token with negligible inflation rate.

Inflation is one of the reasons why shells can be used as currency in the early stages of human civilization, that is, seashells are produced continuously for a long time without depreciation. Seashells are rare and difficult to obtain in the inland areas, and when coastal merchants sell sea salt and fishery products in the inland areas, the journey is long and difficult, so naturally they spare no effort to bid high prices. One possible scenario is: as a psychological compensation for consumers, the businessman presents seashells with unique and magnificent patterns, beautiful and durable, hard shell and durable for storage, and easy to carry around to the buyers (generally wealthy) family). Therefore, seashells are naturally valuable as premium protection.

Similar inflationary but value-preserving currencies also include spices such as pepper. Until the early Ming Dynasty, the pepper sold by the Arabs from the ocean was very precious and durable, and it could still be paid as part of the wages of civil servants. First-class officials also use pepper to buy some daily necessities. Pepper and seashells both consume the transportation costs of vehicles, boats and horses, and have a certain value in themselves. Just like XEN’s mining activities consumed more than 6,000 ETH within one month of its launch. Therefore, only after ETH is converted to POS in September 2022, the mechanism of XEN inflation and value preservation issued on the ETH chain one month later has a weak possibility of success.

Due to the official monopoly of salt and iron, in fact, the early private merchants mainly dealt in luxury goods. Non-homogeneous tokens (NFT) are like luxury goods such as pearls, rhino horns, tortoise shells (rare sea turtle shells), ivory, whale teeth, and woodpecker scalps. Treasures of good quality are hard to come by, and artistic aesthetics vary from person to person, and the circulation is not as good as that of seashells. Each NFT has its own characteristics, but aesthetic differences cause large price differences. In the eyes of some people, these luxuries may not be worth a penny, and they are not as useful as cloth, silk, firewood and charcoal. The transfer of blue-chip NFT is more like the transfer of interests and friendship between the upper class, and it is difficult to be used as a payment currency for ordinary people. As for NFT pictures that have no aesthetic value, bad street, low price, and almost no transaction volume, they are more like soft crab shells that can only be fed to chickens. The characteristics of low liquidity will also prevent most NFTs from being sold in a bear market.

first level title

4. Define value in a large and diverse ecosystem

Neither the "Utopia" imagined by the Western sages nor the "Great Harmony" society imagined by the Eastern sages does not exist. The homogenization of the universe means the restart of creation, and the lack of differences in biological traits means extinction. The Web 3 world should be big but different, the core is not "big", but "different", an ecosystem that can accommodate a variety of participating gameplay and experience types.

Web 3 redefines two questions: what is the value? What is the trade-off for value? Around these two issues, all the current application scenarios are just prologues. There are many kinds of wealth that people possess, but only one kind of wealth is forever diminishing, that is time. All applications that serve people are their time. Money is only a medium of exchange, and the ultimate exchange is the exchange of time. For example, what the house seller replaces is only the future working time of the house buyer, which can be used to experience the current leisure life. The products that Web 3 currently provides to users are more projects that consume the time of the participants rather than save the time of the participants, such as "airdrops" and so on.

Whether it is the traditional Internet industry entering Web 3, or the Web 3 industry copying the App model and transforming it into a so-called DApp (decentralized application), rules and gameplay are more important than scenarios and products. The overall user experience of Web 2 is still smoother and easier to use than Web 3. After all, half of the world’s population owns a smartphone, and most of the billions of people are below the level of a bachelor’s degree. Therefore, the graphical interface and marketing of Web 2 products The receiving model needs to be as simple as possible. Calculating mortgage lending rates, buying land in the Metaverse with a lot of money, spending a lot of time every day grabbing airdrops, and weighing game props and output-to-income ratios are not done by ordinary people who have to work hard every day. In the real world, most people who are running around are still more inclined to open TikTok than to continue to care about each other in the virtual world. Players who really love games don't think about making money while playing games, but spend hundreds of dollars to buy genuine game hard drives.

For a series of applications such as GameFi, SocialFi, and Metaverse, what should be solved most now is not the problem of gameplay, but the problem of user growth and the introduction of capital flow. The number of users and capital flow are the cornerstones of all financial ecology. With the foundation, you can build any house structure on the foundation; with the ingredients, you can make a variety of dishes, and it is difficult for a clever woman to cook without rice. Whether the user end is an on-chain hot wallet or hardware wallet with a private key, or an exchange custody account without a private key, or a multi-party computing wallet (MPC) wallet, whether the application end is App or DApp, DEX or CEX, the essence is two-way trust Choice, people-oriented, there is no distinction between good and bad.

first level title

5. How to escape the fate of being reduced to the garbage dump of history

The world's total wealth output (referring to the mining and manufacturing of physical entities) is growing every year, and the money printing machine has no way to turn back. The broad money supply (M 2 ) is increasing at a rate exceeding the output of entities every year ( 10 - 20 % ). More Web 2 and other legacy funding is being considered or entering the Web 3 industry.

As mentioned earlier, traditional financial markets are a relic of thousands of years of violent history. Currency, credit, and borrowing come from the monarch's external looting wars and internal plundering of people's wealth. What is desperate is that today's financiers are also blood-soaked alliances of violent machines. If traditional financial markets are to fully shed their violent origins and their fate of being reduced to the dustbin of history, they must do the opposite, collaborating with the cryptocurrency industry and transforming into innovation, honor, trust and interconnected digital Network Web 3. Decentralized finance (DeFi) and traditional finance (TradFi) can prosper together, and each needs the other.

The cryptocurrency industry is going through the throes of a bear market, and some well-known crypto industry companies have gone bankrupt. But traditional finance is even more messed up, and now it has become a laughing stock. For example, Chinese fund managers generally face their clients with a loss of 20% to 40% of their performance.

image description

Figure: FTX exchange token FTT plummeted 90% in just 3 days

image description

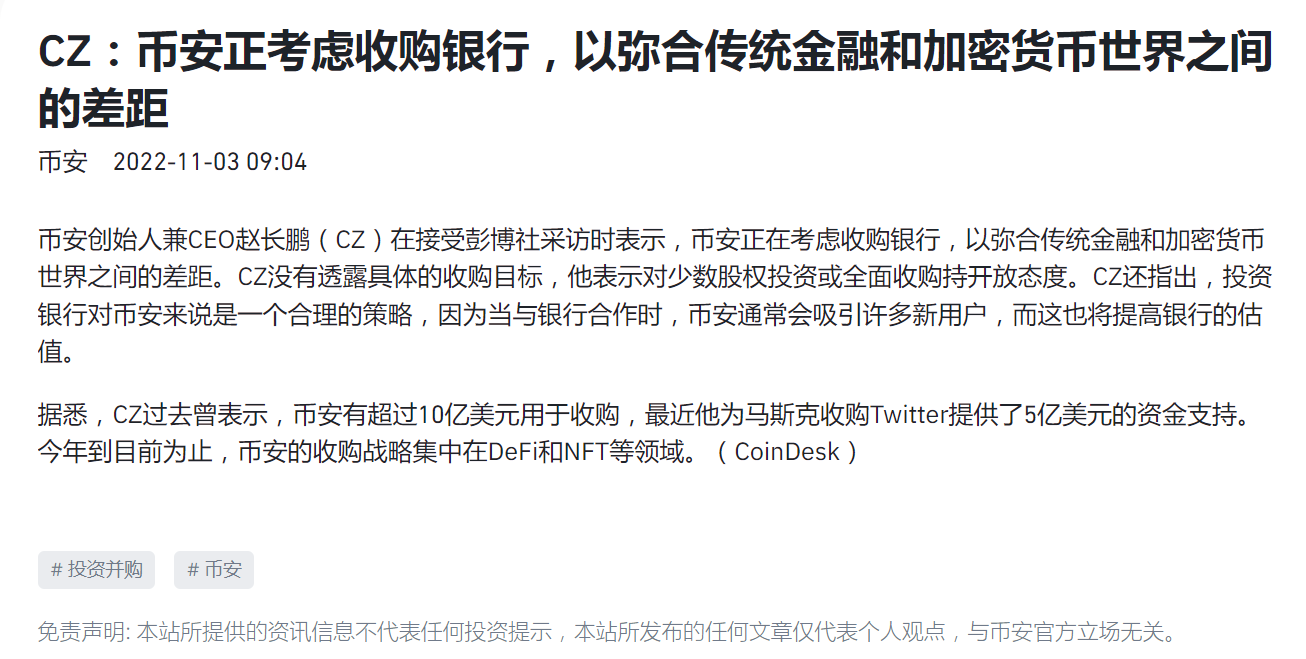

Figure: https://www.binance.com/zh-CN/news/flash/7260189

In fact, if the encryption industry, which is used to eating meat with its mouth, is so "disgraceful", the Yamen's sharp knife is already on the way to help decent. On November 14, 2022, U.S. Treasury Secretary Janet Yellen stated that the FTX thunderstorm incident exposed the weaknesses of the encryption industry, and the U.S. government has considered regulating the encryption industry. Fortunately, the current encryption industry is not closely connected with the traditional financial system, and the interests are not deeply tied together. Otherwise, the impact of FTX’s bankruptcy and reorganization will be like the bankruptcy of Lehman Brothers on the eve of the 2008 financial crisis, which will affect global financial stability. threatening.

The development of productivity is the instinctive demand of human society. Any form of economic operation mechanism, as long as it is conducive to the development of social productivity, will inevitably absorb relevant application scenarios, and then provide multiple traffic entrances and user participation channels. As for the choice of entry channel, it is not important. As long as all possible conditions are met, factual results will be produced. If the flow or chips of tokens in DeFi are concentrated in a few institutions, and the management of encrypted assets is controlled by a few people or even one person (such as SBF), it is centralized finance CeFi or TradFi; if TradFi adopts decentralized The operating mechanism, then TradFi, which operates simultaneously with the regulatory rules of the financial industry and the transparent rules of the blockchain, is more trustworthy and efficient than DeFi. This point, whether it is the struggle between capitalism and socialism, between dictatorship and democracy, or between decentralization and centralization, is the same: when all the causes are satisfied, there will be results that deserve it.

Perhaps, the initial starting point of cryptocurrency is not to plant the "red flag of decentralization" all over the world (Satoshi Nakamoto and Marx may be the two most misunderstood people), but to become a short-selling opponent in the traditional financial world. The more decayed the opposite side, the more prosperous this place will be. However, sooner or later, the clown will end up in jail, just like the fund manager in "The Wolf of Wall Street" will be ruined sooner or later. Batman would also take a back seat. A double-faced sheriff is bound to show up.