What drove the OP skyrocketing?

On August 4, according to Binance data, the token OP of the Ethereum L2 project Optimism once rose to 2.243 USDT this morning, and is now reported at 2.075 USDT, with a 24-hour increase of 38.3%.

In the case of the overall narrow range fluctuation of the encryption market today, the OP has skyrocketed for a short time. What is the reason? After comprehensive information from all parties and in-depth investigation by Odaily, we believe that:The skyrocketing price of OP is due to the impact on the token economy caused by its official announcement of “Bedrock” major technical progress on August 3.

On August 3, Optimism officially announced that it will release a Rollup called "Bedrock" in the fourth quarter of this year, which includes a model that will change the current Optimism protocol foundation and Rollup architecture.

Unlike the technical progress of other Rollup projects,Bedrock is not an upgrade of the Optimism client, but a brand new Rollup that combines ZK and OP's existing technologies.After the development of Bedrock is completed, the ecology on Optimism will be migrated to Bedrock.

The immediate benefits of Bedrock to the networkIncluding: 4x reduction in L1 to L2 deposit time, ~20% reduction in the cost of committing data to L1, reduced divergence from Geth to ~500 lines of code, support for any number of alternative proof systems (including ZK).

In terms of technical architecture design, Bedrock is similar to the merged Ethereum, with a separate consensus layer and execution layer.

This major technological development really stimulates the price of OP tokens, essentially because Bedrock promotes the decentralization of the Optimism sequencer, which in turn brings staking income to OP tokens.Next, let us step by step derivation.

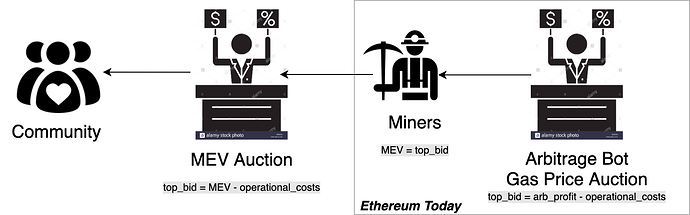

First briefly introduce the sorter mechanism on Optimism and its source of income - MEVA.

Optimism's sorter is similar to miners/nodes on L1, and has the power to sort transactions. The sorter can choose to execute transactions with higher gas prices first to obtain additional profits. This additional profit is called MEV (Maximal/Miner Extractable Value Maximum Extractable value), the behavior of ranking right auction is called MEVA (Maximal/Minter Extractable Value Auction). Optimism has the sole ordering right due to the centralized operation of the orderer, thus earning all MEVA revenue.

And Optimism'stechnical documentationDecentralized sorters are mentioned in . This means that if the decentralization of the sorter is promoted and a new consensus mechanism (such as PoS) is introduced, the MEVA income will be given to the sorter and token pledgers. Under this expectation, OP can not only be used to participate in governance voting, but also can be used by holders to pledge to nodes to obtain MEV/MEVA income generated by the agreement.

Currently, Optimism earns gas (MEVA) income through a centralized sorter.After the sorter is decentralized,$7 million monthly gas revenueIt will no longer flow to the Optimism team, but will be distributed to sequencers and token stakers. For token pledgers, if they pledge OP to obtain agreement income, the price-earnings ratio of OP will reach 5.12. At present, the circulating supply of OP is about 215 million, the token price is 2.02 USDT, and the market value is 434 million US dollars. The annual income of Optimism gas is about 84 million US dollars, and the annual rate of return is 19.3%, which is very impressive.

Regarding the plan for the decentralization of the sorter, the officialtechnical documentationTwo stages are proposed.

The first step is that there is still only one sorter, the precise mechanism has not been finalized, but will involve economic mechanism and governance mechanism. The second step is to support multiple concurrent sorters, which is achieved through standard BFT consensus. The consensus mechanism can refer to the PoS mechanism, but it cannot be realized on the Optimism of the centralized operation sequencer at present, and has to rely on a new consensus network-this is Bedrock, based on Bedrock's new consensus and basic protocol, the sequencer Only in this way can decentralization be realized, and the protocol income will be given to nodes and token pledgers.

Bedrock is in the transition between these two steps, laying the technical foundation for the second step.

Optimism's future plans in March this year《Our Pragmatic Path to Decentralization》also talked about its decentralization route.

The future roadmap consists of five steps: form a governance body, release Bedrock, enable multi-client architecture, incentivize/support the creation of alternative clients, send multi-client proof contracts, and eliminate Optimism's centralized upgrade keys.

Summarize

Summarize

Airdrop Guide: How to get Optimism’s follow-up airdrop?