How is The Sandbox parcel valued? What drives land prices?

This article comes fromDappradar, the original author: Pedro Herrera, compiled by Odaily translator Katie Koo.

This article comes from

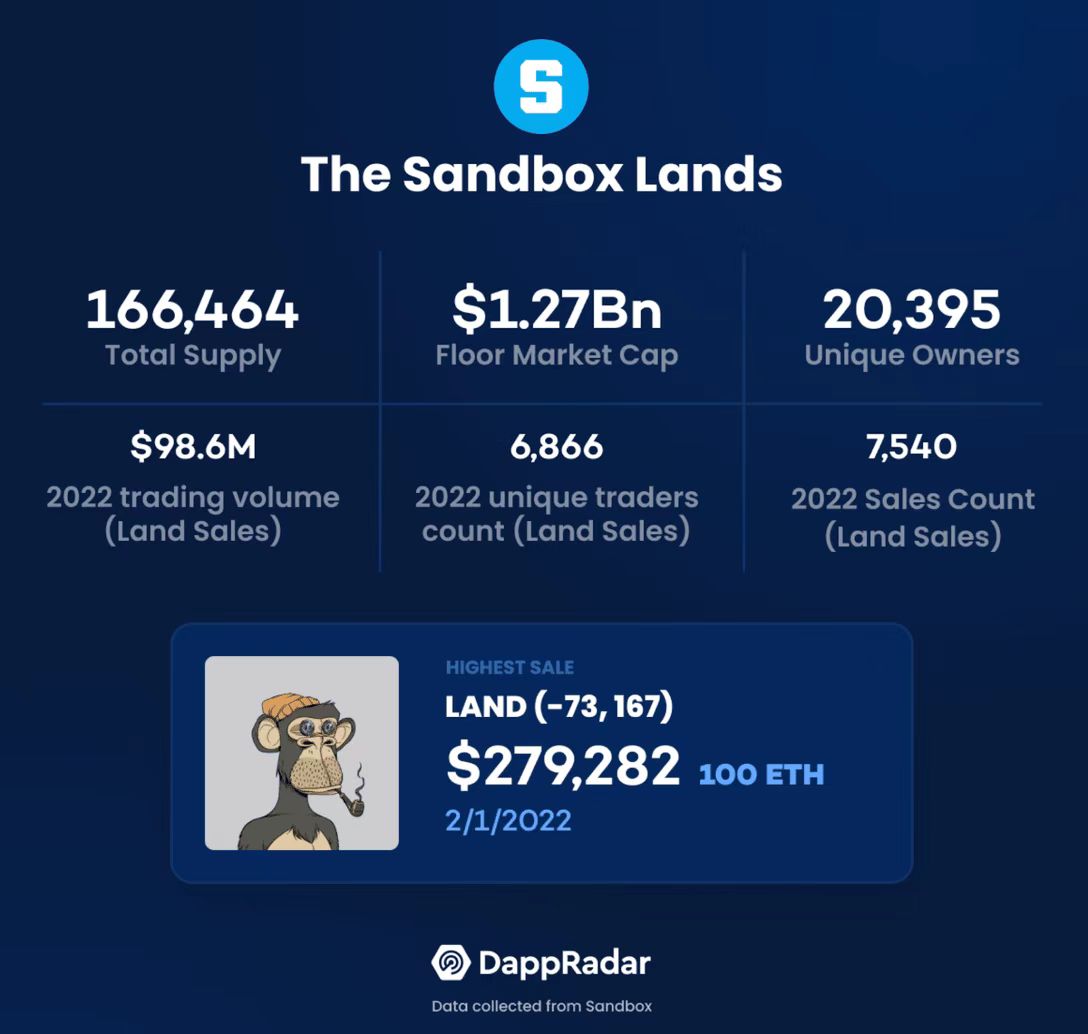

Since Meta announced its foray into the metaverse last October, demand for virtual land NFTs has surged, driving prices up. The Sandbox has established itself among the leading Metaverse blockchain projects. It consists of 166,464 ERC-721 tokens, and creators can create profitable experiences for players, such as games, events or parties.

This article will lead you to analyze the valuation process of The Sandbox plot. In this virtual world, what factors determine the final price? Are there parcels that are overpriced or undervalued? How does The Sandbox compare to other Metaverse projects in terms of funding, scarcity, and partnerships?

secondary title

Learn about plots in The Sandbox

When Facebook announced the name change to Meta, there was a surge of interest in Metaverse-related projects. Since then, demand for virtual world projects, including The Sandbox, has skyrocketed. The lowest price of The Sandbox has risen from less than 1 ETH in Q3 2021 to a historical high of 5 ETH in January, and has reached an average of 3 ETH as of this article. The current floor price gives The Sandbox a minimum market capitalization of $1.27 billion.

What exactly are parcels in The Sandbox?

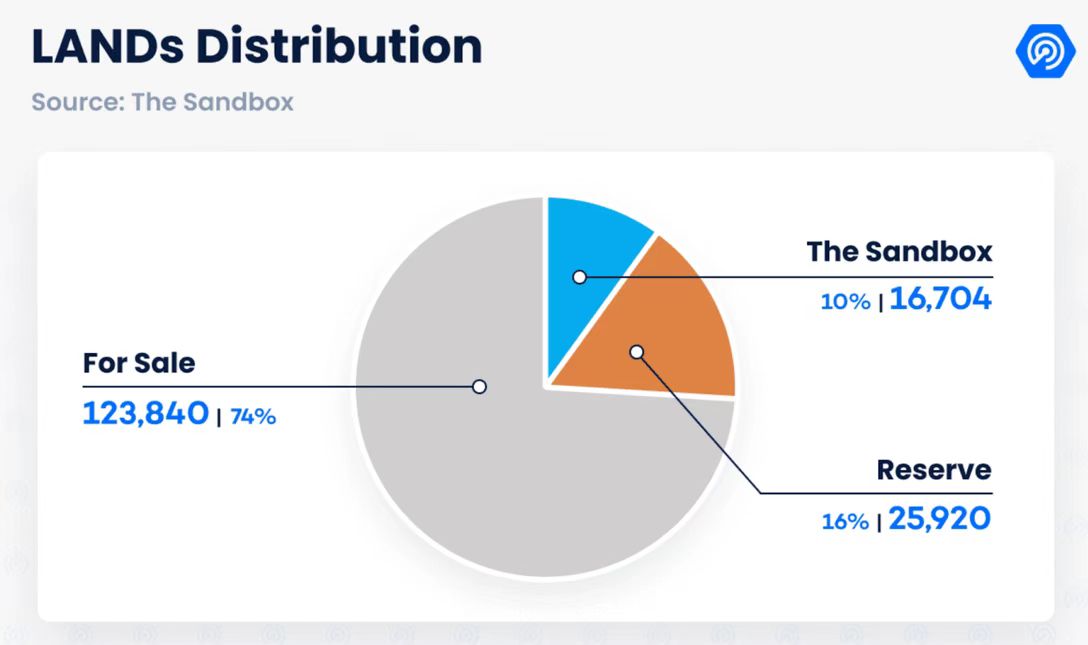

In terms of token distribution, 10% of the total lot supply (16,704 lots) will be held by The Sandbox to host special events and feature exclusive games. Another 16% will be used as a reserve to be distributed to partners, creators and players as rewards. The remaining 74% (123,000 blocks) are up for sale, of which 81% (100,054 blocks) have been sold at the time of writing.

Now that we've introduced the land parcels in The Sandbox, let's take a look at the factors that affect land prices when evaluating land parcels in the Metaverse.

secondary title

How to value The Sandbox lotLot valuations in The Sandbox follow the same principles as real-world real estate. Price is determined by two main variables: location and size. Other factors such as structural design or plot function are the first factors that attract users to a plot, but the location and size of the plot determine their price. The Sandbox metaverse is still in its early stages and experiences are only just beginning to be created.

We analyzed more than 25,000 The Sandbox lot sales between August 2021 and March 16, 2022. This analysis only considered 1×1 lots.

Because larger plots are mostly sold by auction, and the secondary market is not representative due to high price constraints.

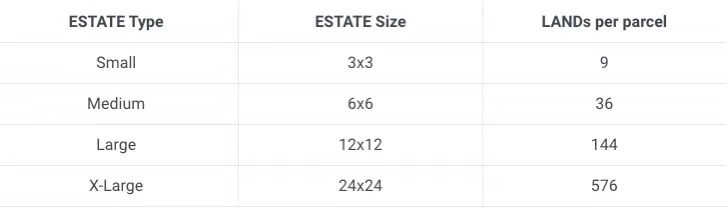

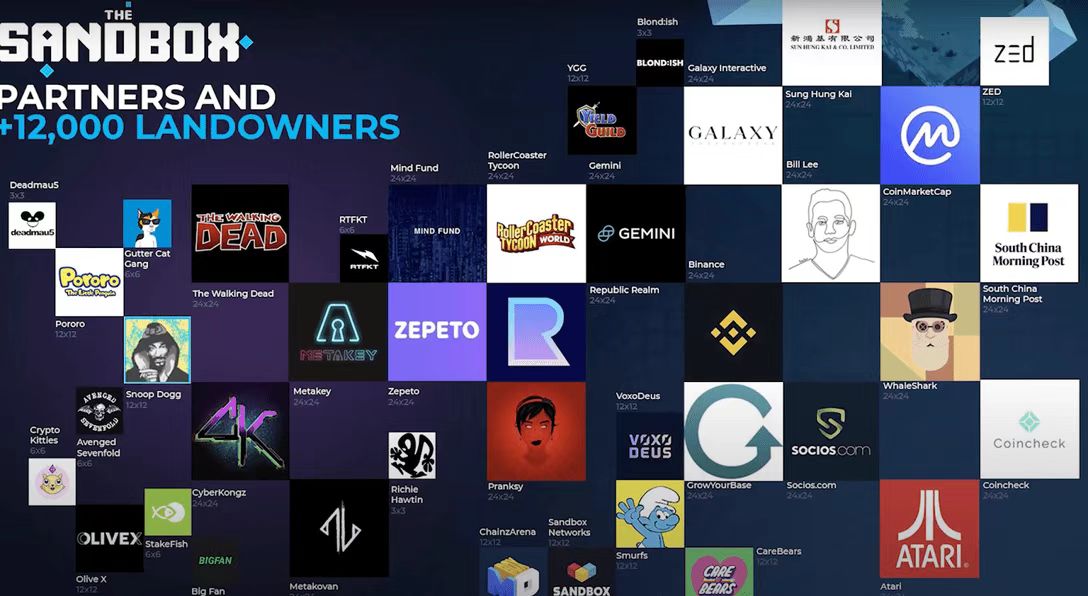

Adjacent 1×1 parcels can be divided into parcels of different sizes in The Sandbox. The maximum area (XL) of adjacent plots is 24×24, with a total of 576 plots. There are 35 XL parcels in total, 13 of which belong to The Sandbox. Land plots of this size occupy more than 12% of The Sandbox’s territory. The “celebrities” who own land include game developer Atari, famous NFT collector Pranksy, NFT project Cyber Kongz, Binance, Ubisoft, and fan token companies Well-known companies such as Socios, Gemini, Coinmarketcap, Meta Key, Republic Realm, Warner Music Group, and South China Morning Post.

The geographic model of The Sandbox adds importance to adjacent parcels. While lot size is intrinsically linked to price, its location plays a crucial role in the valuation process.

This is illustrated by the highest transacted prices for 1×1 sized plots. Lot #151499 owned by The Yacht's King Domain, adjacent to a medium sized BAYC lot and a large lot called LooksRare for 100 ETH. The lot’s price exceeds that of smaller sub-lots like The Crypto Lifestyle, which sells for 71 ETH.

secondary title

In The Sandbox metaverse, location is king

Well-known brands and celebrities purchase properties in this metaverse, and the purpose of acquiring these virtual lots is to create experiences such as games or social hubs to attract crowds. High foot traffic around these key partners increases the likelihood that adjacent parcels will direct visitors into their own experiences, potentially increasing their revenue streams.

Snoopverse, a large virtual plot owned by music legend Snoop Dogg, and its plot around NFT is very attractive, because this large plot will be a garden of exclusive experiences, including games, concerts, and neighbors Steve Aoki Partner with SupDucks. The five small parcels sold for an average of 78,200 SAND, or about $230,000, as part of Snoopverse’s second round of public auctions.

The Sandbox map can help identify popular areas, such as the Snoopverse. Following the same logic of targeting areas with high traffic potential, The Sandbox marks some parcels as "premium," owned by major brand partners or The Sandbox itself.

Land parcel values vary in different regions. As the platform develops into a more mature money-making metaverse, increased demand in these areas could drive up the prices of nearby plots.

To sum up, while the size of the plot is directly related to the price, at this early stage, the location plays a crucial role. As the game matures, the design, or type of experience, such as the specific use of the plot will undoubtedly become more important. For now, however, location is king in The Sandbox.

secondary title

Comparison with other metaverses

While the parcels have been analyzed in terms of size and location, as a platform, The Sandbox's price is also influenced by other factors and can be used as a benchmark for comparison with other virtual worlds.

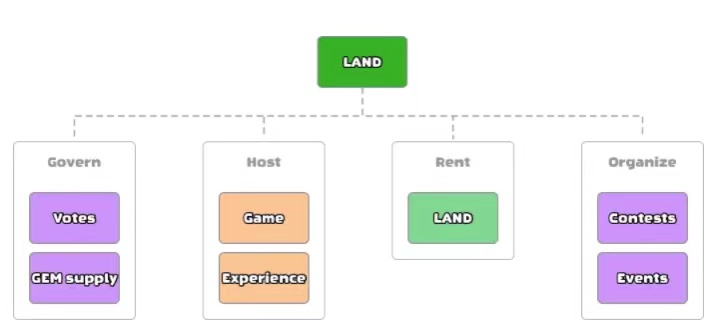

Utility is one of the most important value propositions in The Sandbox. In addition to the entire game earning and social experience, The Sandbox also has a full micro-economy by allowing owners to rent out their property and hold SAND in it, also granting access to governance voting. Projects like Decentraland compete with these experiences, but lack the financial gain. Other projects like NFT Worlds may have solid passive income mechanisms but lack a great immersive experience.

Economically, this play-and-earn Dapp also has a competitive advantage. The historical transaction volume of The Sandbox parcel exceeds 530 million US dollars, which is only behind the decentralized area. So far in 2022, The Sandbox has become the leading virtual world platform with over $98 million in transactions and attracted over 6,800 unique traders.

The floor price of a plot has stabilized at around 3 ETH, which is lower than smaller virtual worlds such as Decentraland or NFT worlds, but almost double that of peer metaverse projects such as CryptoVoxels, Webbland or Treeverse. This floor price makes the market value of the floor price of The Sandbox plot 1.27 billion US dollars, which is 36% higher than that of the downtown area.

With nearly 900,000 followers on Twitter and over 280,000 members on Discord, The Sandbox has one of the largest communities in Web3. Decentraland has 560,000 Twitter followers and 160,000 Discord members. The future is promising for both projects, but The Sandbox's community size is a very positive indicator.

Summarize

secondary title

Summarize

The geospatial model adds importance to neighboring parcels. Celebrity neighbors like Snoop Dogg or The Sandbox can create an economic impact in terms of traffic, gameplay and exposure of the game on those lots and become a "premium" asset.