Talking about the three modes of NFT mortgage lending: peer-to-peer, fund pool and centralized mode

Original author: Jiawei (Twitter:Elegy4TheArctic)

foreword

foreword

(In a daze, more than ten months have passed since the DeFi summer of 2020. As a DeFi lending "white horse stock" Aave's market value ranking has quietly dropped to 61st, and Compound has fallen outside the 100th place. I can't help but feel a little unexpected .)

Speaking of mortgage lending, for FT, mortgages obviously need to bear a certain liquidity cost: in the face of rising tokens, they cannot sell and make a profit; in the face of token decline, they can only passively hold them.

For institutions or core players who hold long-term top NFT projects (such as CryptoPunks and BAYC, etc.), they may not have the intention of selling. Therefore, when assets need to be realized, mortgage lending is an option worth considering. The price of the head NFT is also relatively stable.

Furthermore, for speculative purposes, there may be frequent buying and selling of NFTs in the hands of retail investors, and the total value of NFTs is generally not high, which is relatively unsuitable for mortgages.

first level title

Three types of projects

peer-to-peer mode

In DeFi lending, Aave's predecessor, Ethlend, uses a peer-to-peer model.

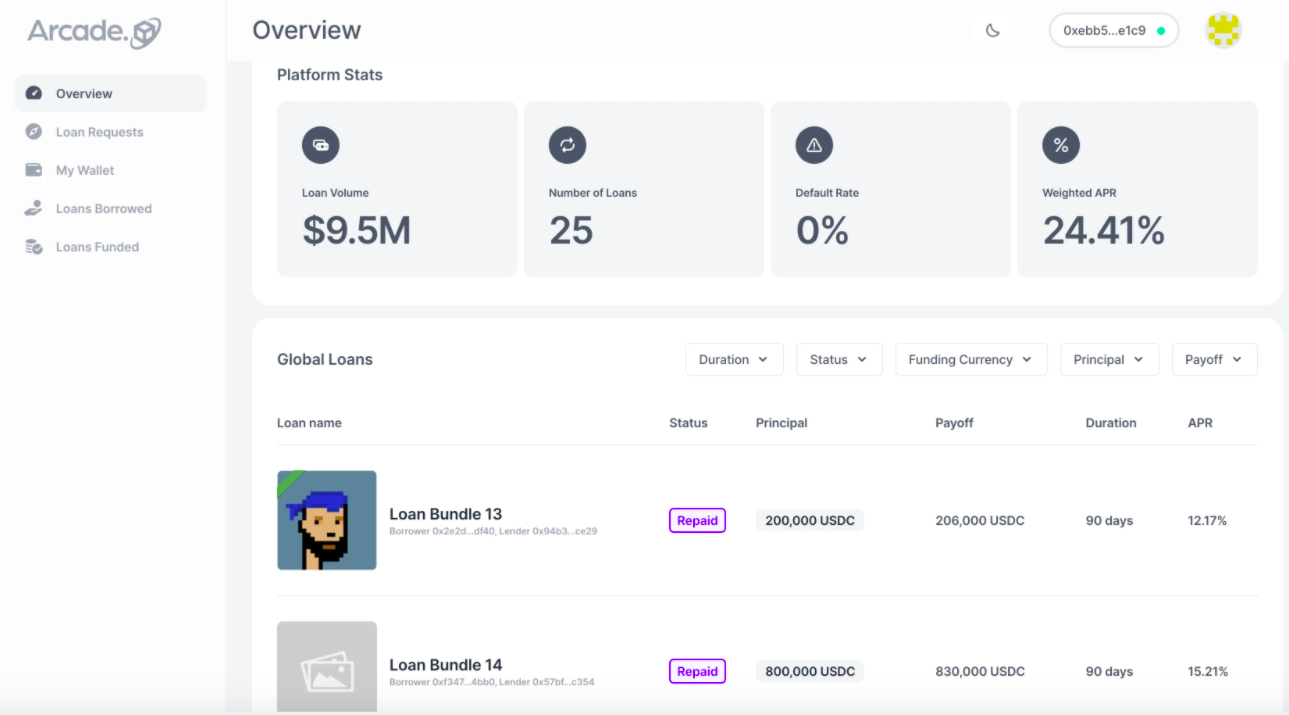

ArcadeSimilarly, its AssetWrapper contract supports packaging and mortgage ERC721, ERC1155, ERC20 assets, and then wNFT will be generated. After setting the loan amount, repayment amount, currency and time, the borrower will mortgage the wNFT, and then wait for the lender to match the order. Arcade will add amortization mode in future versions.

It should be noted that Arcade does not set up automatic liquidation. In the event of default, the borrower can still repay the loan before the lender claims the collateral.

For peer-to-peer platforms, whether lending needs can be responded to in a timely manner is directly related to the user experience of the platform. The average wait time for a match is not yet available in Arcade's platform data. According to team members, loan requests for BAYC and CryptoPunks floor prices can basically achieve instant response.

In addition, the difference between NFT and FT is that NFTs of the same series are different, and it is difficult for lenders to evaluate NFTs with high rarity, or the valuation of collateral between borrowers and lenders has differences, which increases the uncertainty of lending sex.

Fund pool model

Fund pool model

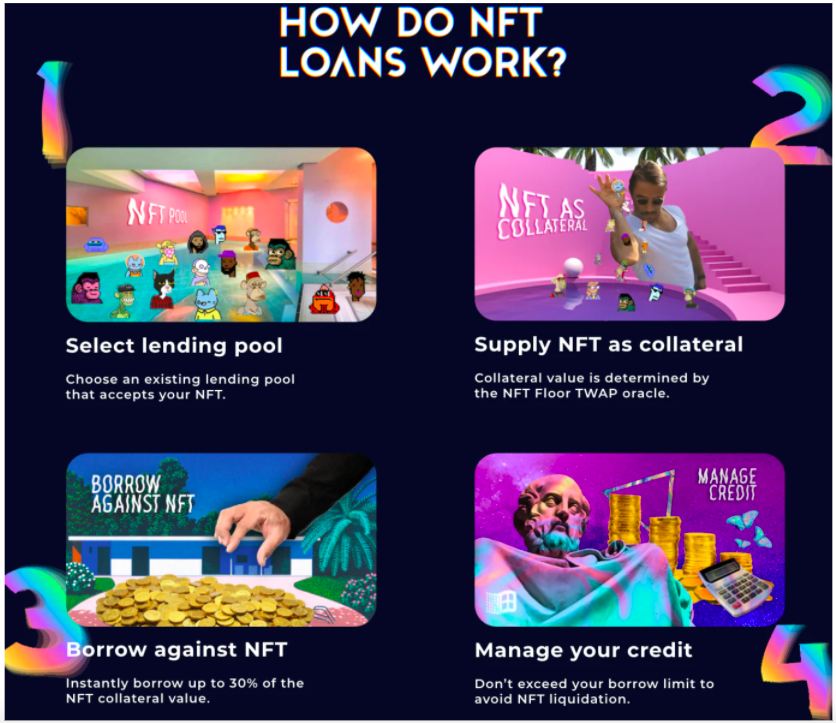

The second type is a fund pool model similar to Aave and Compound, for exampleDrops DAO。

In this model, the loan has no maturity date and the interest rate is calculated based on the utilization of the asset. The real-time price of NFT is quoted by the oracle machine.

This articleThis articleis explained in more detail.

For NFTs with high rarity, the value in the fund pool is actually diluted, making the loan-to-value ratio of this part of NFTs uneconomical.

Overall, the fund pool model is relatively complex, and there is a possibility of malicious price manipulation and serial liquidation. In the case of general liquidity in the NFT market, there are high systemic risks. In the early stages of the development of decentralized NFT lending, the peer-to-peer model is relatively more stable and reliable.

centralized model

At the end of last year, digital asset financial service institutionsNexoCooperated with Three Arrows to launch a centralized NFT lending business. The exchange Kraken also plans to launch the same business.

Nexo provides the equivalent of an OTC service that requires filling in a simple KYC application form. At present, only BAYC and CryptoPunks are supported as collateral. The value of mortgaged NFT must exceed US$500,000. The annualized lending rate is about 15%, and the loan-to-value ratio is between 10% and 20%. That is, NFT worth US$500,000 can Loans of $50,000-$100,000.

Summarize

Summarize

For an analogy, look at the real art market. Affected by the epidemic, the global art transaction volume in 2020 fell by 22% compared with the previous year, still exceeding US$50 billion. From the figures alone, there seems to be a good market for art mortgages .

However, the identification of works of art (including antiques here) has different opinions, lack of authoritative guarantee, and valuation is difficult; and because of the lack of liquidity, it is unknown whether the collateral can be realized and sold even after liquidation. In order to make up for this part of the risk exposure, traditional pawnshops have severely suppressed prices and often only provide very small loan-to-value ratios.

Speaking of NFT, compared with traditional works of art, the authenticity of NFT only needs to check the contract address; the valuation has the floor price of the same series of NFT as a reference; the form of online transactions makes it relatively easy to realize. In terms of technology and operability, NFT loans face relatively fewer problems.

Original link