a16z: Neglected connection hosting issue between Web2 and Web3

Author: Mahesh Vellanki

Cryptocurrencies face a major hurdle in terms of mainstream adoption: the user journey is complex, has not yet been established, and it is not easy for someone new to cryptocurrency to do the simplest thing - full control of their digital assets or intuitive things.

Of course, users are not required to have full control over their assets to invest in cryptocurrencies. Centralized exchanges like Coinbase have demonstrated the efficacy of the “custodial” model in cryptocurrency trading, where people deposit their assets with custodians, who secure and track them. The key advantage of this model is convenience. Anyone can buy cryptocurrencies relatively easily using the Coinbase app or other exchanges without having to write down a "seed phrase," the string of words that forms the "private key" that controls access to assets. In this way, users can buy and sell various cryptocurrencies, exchange them for other cryptocurrencies, use assets for purchases and payments, and soon buy NFTs.

However, venturing further into the broader web3 ecosystem of fully decentralized interoperable applications and networks - not just exchanges, but games, tokenized social networks, fan engagement communities and other rich user Experience - largely inaccessible through custodians. This web3 experience requires sending their cryptocurrency to a non-custodial wallet, where no one but the user holds the private keys, and there are no restrictions on the types of transactions that can be done.

In fact, this is the most exciting part of cryptocurrency and where we see so many first-time users give up. Web3 products cannot expect users to immediately step from a familiar centralized experience to deep decentralization. The future of the mass-market cryptocurrency experience lies in apps that provide a familiar custodial experience, with the ability to upgrade to a non-custodial experience.

This article will outline some ways developers can consider introducing users to the cryptocurrency user journey while leveraging some familiar Web2 constructs, and helping those users understand the potential of web3 before handing them the keys to their assets —and ultimately make their products more widely adopted.

A framework to help users complete their journey

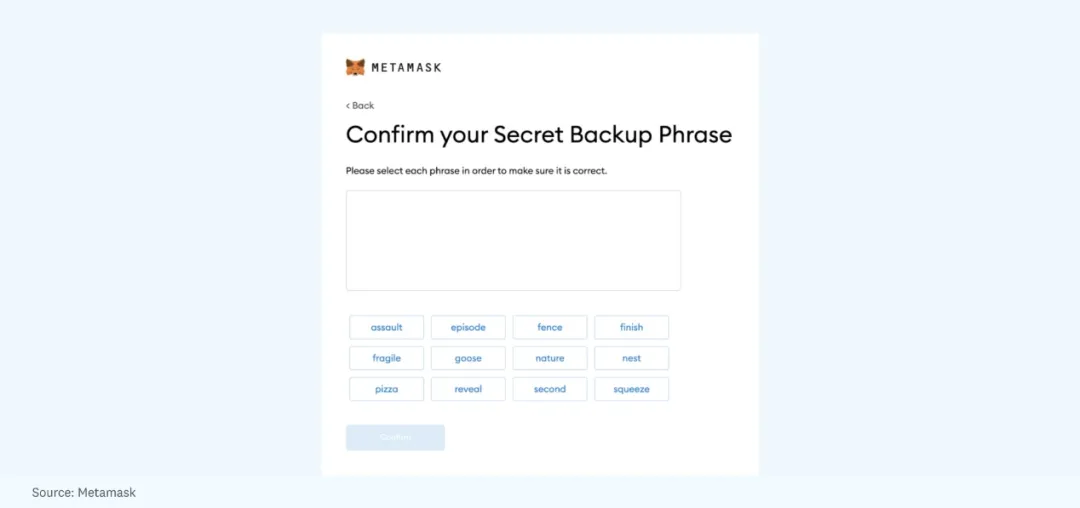

Tokens and NFTs are already foreign to many, and there is a theoretical limit to how far the average person is willing to explore new experiences. In a purely non-custodial environment, most people would glance at a screen that prompts them to write down a 24-word "seed phrase" (the randomly generated phrase that makes up their "private key" or passphrase) and say "this is not worth it" decision.

If the goal is to get first-time cryptocurrency users on board, the experience has to be hosted — at least at first.

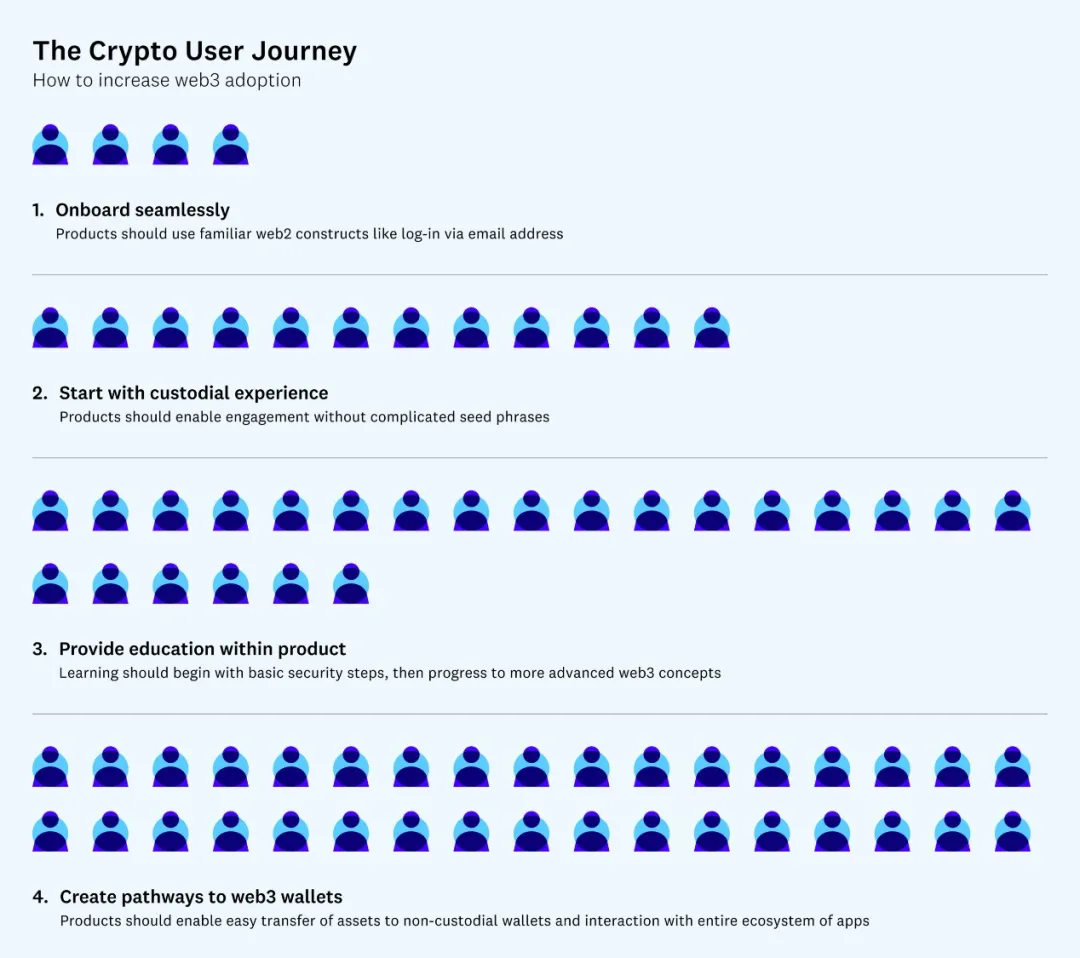

This diagram shows the path to wider adoption of the full web3 experience — and the simplified user journey people need to move comfortably from managed to unmanaged systems.

Below we describe each of these steps in more detail, why they are important, and how they reinforce each other to foster confidence and excitement about emerging web3 activity.

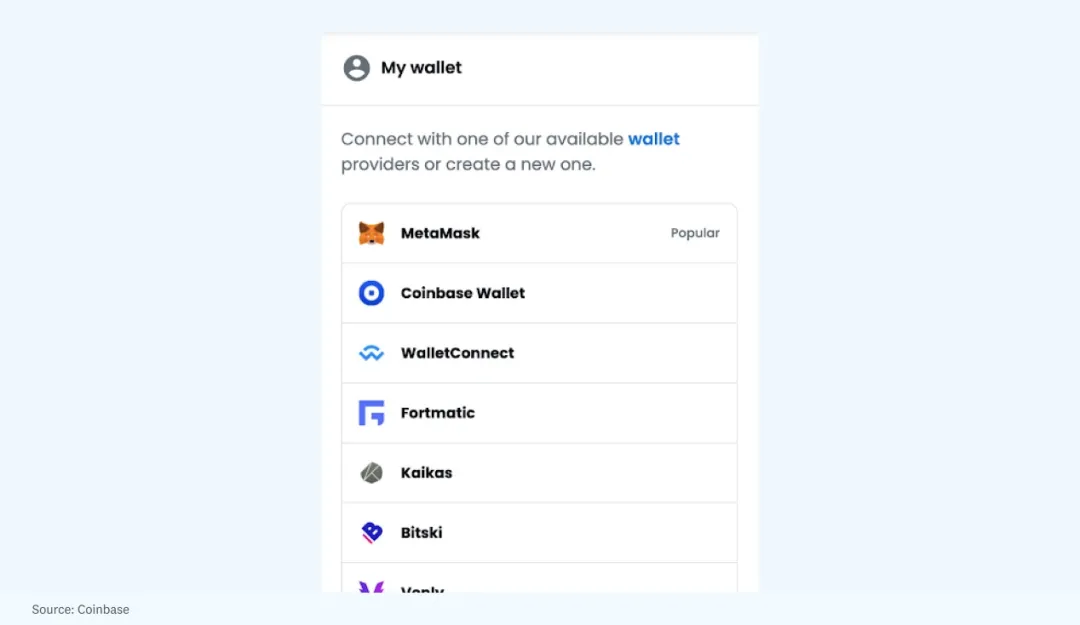

Step 1: Make onboarding seamless for first-time crypto users through familiar Web2 structures (e.g., log in with your email address). Many web3 applications that exist today invite users to log in by connecting their wallets.

This may become the default option for many applications in the future - wallet login is very convenient and secure. However, first-time cryptocurrency users can be confused, overwhelmed, and even skeptical if they don't recognize what they're looking at. For many first-time cryptocurrency users without a wallet, the traditional login method is the only option they are willing to use when trying out a new app.

This is a particularly important step in the user journey for creators who are increasingly looking to use web3 technologies to create new forms of fan engagement. Fans who support an artist early in their career may receive benefits in the form of creator access, recognition, and stipends. (The design space here is virtually limitless, and the wave of innovation and experimentation is just beginning).

However, most fans will not be native to cryptocurrencies, and asking them to acquire a hardware wallet and create a secure system is too much to ask. Fans should be able to sign up, pull out their credit card, buy tokens from creators they like, and see it in their account - it has to be intuitive, it has to mirror the familiar web2 experience to see the user the entire journey. No cryptocurrency wallets, key management, "gas" (transaction) fees, congested transactions, or any other foreign user experience.

In this way, creators can build a shared digital economy with fans that they can use anywhere on the internet, but in a way that doesn't make fans feel intimidated or troubled to join.

Step Two: Provide options to get users started with the product in a simple, fully managed experience. Managing private keys or seed phrases is part of everyday life for experienced cryptocurrency users, but most first-time cryptocurrency users give up immediately when they see such information. "These 12 words are the only way to recover your account. Keep them in a safe and secret place: exhaust turtle silly pretty fog midnight enact throw journey nephew animal reward. Write this down."

Rather than greet users with this experience, set them up with a familiar experience and then offer them unmanaged options further down the user journey. Their initial signup flow should be more like: sign up, create username/password, agree to terms, start buying crypto. Then once they're in the app and transacting, they should have the option to self-host and tap into the wider web3 ecosystem.

Some projects have experimented with other solutions, such as embeddable iFrames that store users' seed phrases via their Google Drive. It's an enticing solution - super easy for users to write down their seed phrase. But the crypto community was quick to point out that this created dangerous user habits, didn't adequately educate users about the risks they faced, and made their Google accounts a target for hackers. Instead of doing things halfway, let your users have a clean experience: start with the hosting experience they're used to, then help them upgrade to full self-hosting when they're ready.

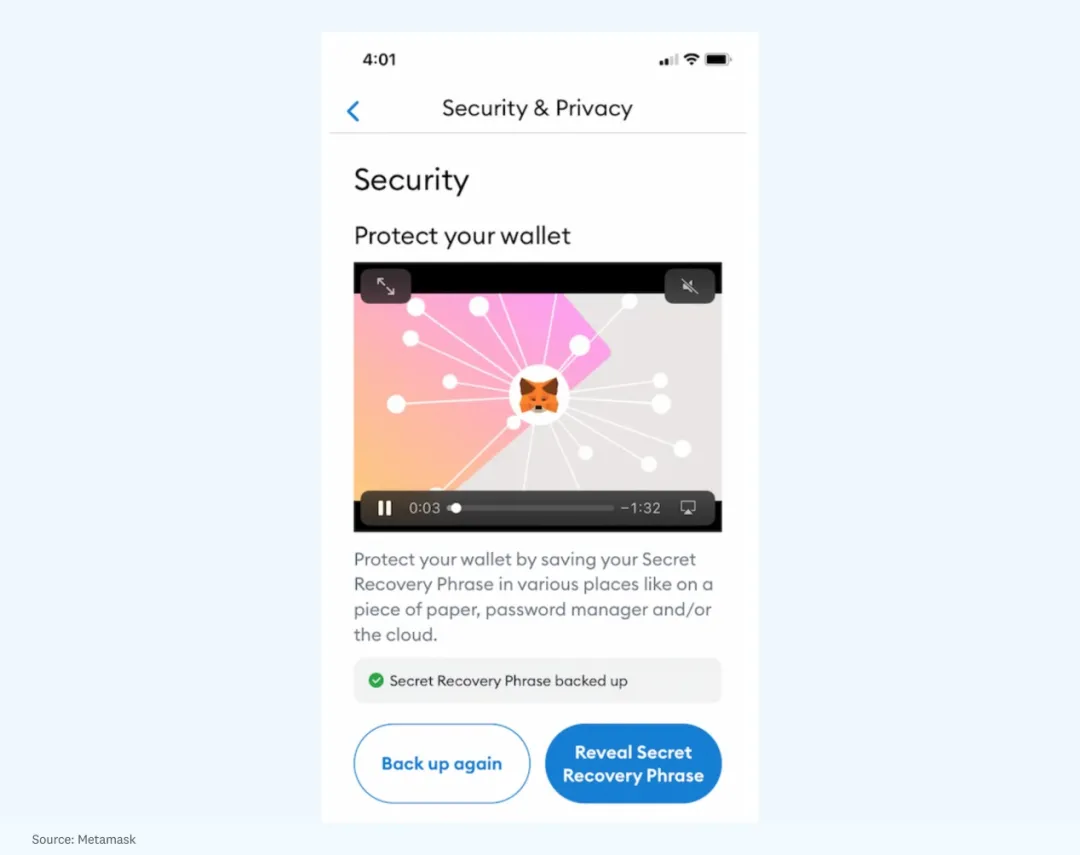

Step 3: Educate users outside of the product and platform. This is especially important when it comes to security - most users aren't even using current best practices (e.g. password managers, 2FA, etc.) in Web2 applications and products. Introducing new experiences requires more education. Metamask does a great job of providing their users with the content they need to stay safe.

As wallets build more "first-time crypto user" features, expect to see wallets incorporate this kind of education and content directly into the product.

Step 4: Create a path to the web3 wallet. Once users who were previously unfamiliar with cryptocurrencies are hired, web3 products can manage to move them down the path of self-hosting. An accessible web3 product must ensure that users are able to exit the system, for example by converting their assets into other forms of currency, or by taking them out of a specific ecosystem and into the wider web3 world.

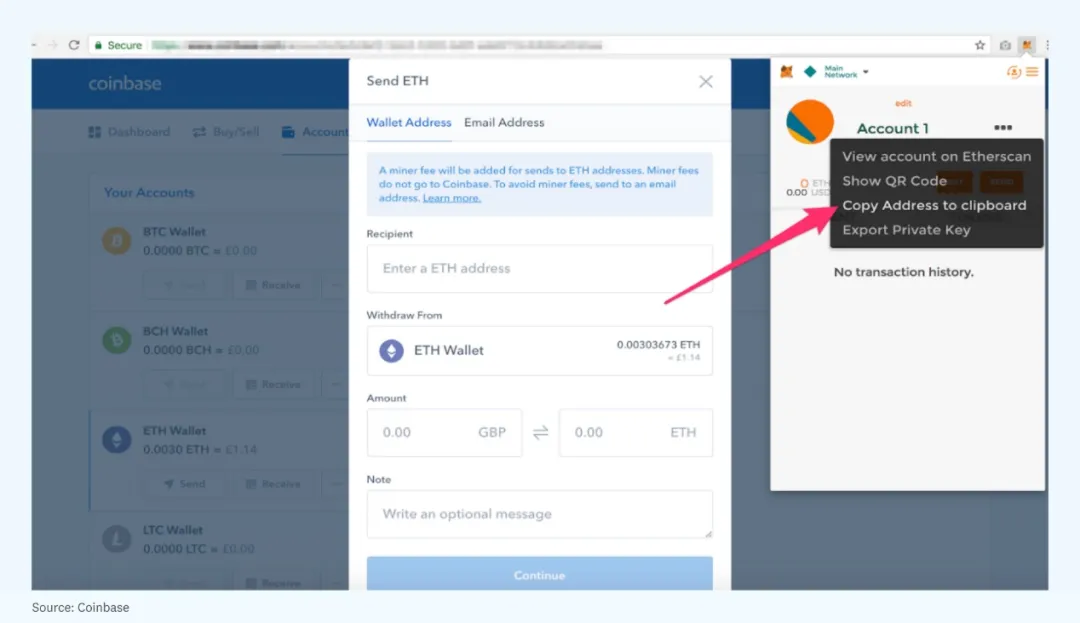

As users become more familiar, it should be easier for them to seamlessly participate in the creator economy, rather than being locked into a particular platform. For example, Coinbase enables users to simply transfer their assets to a non-custodial wallet. This means they can sign up, try to buy cryptocurrencies, then send their assets to a web3 wallet and interact with the entire ecosystem of applications.

At Rally, the social token community I co-founded, users are free to convert creator tokens into the community’s native token, $RLY, which they can then transfer to an ERC-20 (Ethereum compatible) wallet, enabling them to Convert to any cryptocurrency or engage with other communities (while the Creator Social Token itself is now fully custodial, the time to transfer tokens out is coming).

The key to educating non-crypto-native users is to create an experience that makes it easy for fans to onboard and participate in a high-functioning product experience around social tokens, but still retains the flexibility to trade assets, monetize, and extract value as needed.

Of course, different consumer products require different approaches. For Rally, we're already building on sidechains, so it made sense to go custodial from the start. Much like the progressive decentralization we envision for the RLY ecosystem, the best approach for Rally is to start with a familiar experience for end users and build the ability to scale mainnet and self-host over time . But other products will make different decisions; for example, decentralized exchanges, daily fantasy sports, or hardcore games that cater to high-spending users may be better suited to adopting a non-custodial experience from the beginning. The complexity of these user bases and the increased need for distrust justify having a non-custodial user journey right from the start.

Hosting experience means infrastructure requirements

Of course, building applications for custody assets has its own hurdles and challenges. Namely, compliance and security. Allowing users to move from custodial to non-custodial wallets means Know Your Customer (KYC) and Anti-Money Laundering (AML) checks will be inevitable. Also, by hosting assets, you also take on the associated risk of keeping those assets safe on behalf of your users against some very sophisticated attackers.

Right now, cryptocurrency companies are largely doing it on their own. You either build and manage the infrastructure yourself, or find one of the few trusted partners. It's no small task for Rally -- it's doable, but not straightforward or cheap. The simple truth is that there really is no prescriptive advice when it comes to compliance, as many factors determine a cryptocurrency project's compliance strategy: What stage of growth is the company in? In which jurisdictions does it operate? What is the leadership's risk tolerance level?

A good example of how two different approaches work is Coinbase and FTX. Coinbase has always been based in the United States, has adopted a cautious approach to regulation, and has invested heavily in compliance. FTX, on the other hand, mitigates risk by launching outside of the US first and growing the company internationally. Both methods have proven successful among users.

In fact, we are currently seeing a new wave of cryptocurrency adoption coming from emerging markets that were previously overlooked by web2 companies that were unable to monetize advertising models in these regions. The unmanaged experience makes emerging markets really easy to enter because the application is not responsible for compliance. Hosted experiences, on the other hand, involve a thoughtful approach to enabling these users across unique payment providers. For example, credit cards are often declined in these regions, yet there are often "non-traditional" tracks, such as buying cryptocurrencies with cash at 7/11 stores. Even how and where you set up your company can affect what kind of hosting experience you can provide.

But as large web2 social and financial platforms like Facebook, Twitter, Square and PayPal start to push cryptocurrency further and demand more services, the ecosystem will grow rapidly and finding reliable and affordable partners will become easier .

Growing demand for Web3 access

We are closer to this evolution to web3 than many realize. Arguably, within five years, more than half of the large web2 platforms will have initiated initiatives to embrace web3 in some way, likely taking into account many of the UX principles mentioned above.

There is no doubt that there is a pent-up demand, and it will only increase. When Robinhood announced that it would immediately launch its cryptocurrency wallet at Messari’s Mainnet conference in September, everyone expected a big reaction. After all, a standalone cryptocurrency wallet is one of the company's most requested features. This will allow Robinhood users to send their tokens from the company's platform to any address they wish.

But even the most cryptocurrency bulls may not have anticipated just how enthusiastic users are about Robinhood's wallet. The company's co-founder, Vlad Tenev, told a CNBC conference that there are well over a million names on the waiting list, and that's for an upcoming release sometime next quarter. item function.

The huge interest in Robinhood Wallet hints at other things in the cryptocurrency portfolio. After all, users already have a smooth, fun and secure environment for trading coins in the Robinhood app. Why are so many people eager to have a wallet so they can send tokens around? It's clear that people want to move their cryptocurrencies, participate in other cryptocurrency protocols, and store their assets differently.

As more applications strive to meet the needs of users and usher them into new experiences, and as cryptocurrency infrastructure becomes cheaper and easier for projects to use, the path to the next iteration of the internet will become increasingly clear.