PricewaterhouseCoopers report: Cryptocurrency M&A transactions will soar nearly 5,000% in 2021

This article comes fromCryptoPotato, original author: Jordan Lyanchev

Odaily Translator | Nian Yin Si Tang

Odaily Translator | Nian Yin Si Tang

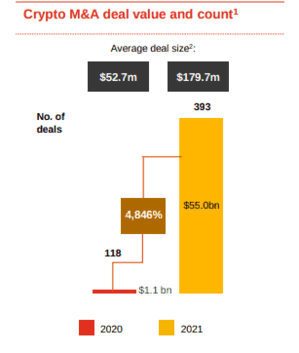

Average size of M&Aincreasetripled from $52.7 million to $179.7 million. The report noted that this substantial increase was associated with large SPACs.

image description

Crypto M&A transactions. Source: PwC

Additionally, M&A deal activity in 2021 is back in the Americas. The region's share of total M&A deals rose from 41% to 51%.

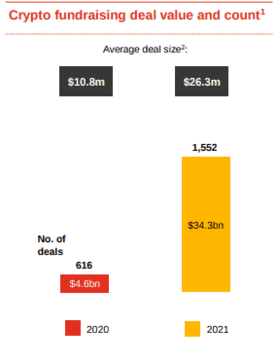

PricewaterhouseCoopers, a multinational firm that provides insurance, advisory and tax services, also reported on cryptocurrency funding. The total value of such deals increased by 645%, from $4.5 billion to $263 billion. The average amount also rose by 143%.

image description

The report also noted that the number of venture capital firms funding cryptocurrency and blockchain projects has increased in 2021, with 49 new funds. The total number of such venture capital institutions is currently less than 500.

secondary title

Trends for 2022

The report expects the industry's momentum to continue, building on the remarkable growth of the past year. Additionally, more VC funds could drive the growth of crypto trading.

The report also noted that a key question is whether crypto companies will continue to use SPACs as funding opportunities. 2021 will see an explosion of special purpose acquisition companies (SPACs), as they offer companies a way to avoid some regulatory scrutiny when they go public.

Other areas of the crypto space will continue to mature in 2022 with the addition of more institutional players. This will be accompanied by more industry consolidation and expansion, the report concluded.

secondary title

The Boom of the Crypto Industry

Just last week, KPMGreleaserelease

published a semi-annual report highlighting global fintech investment trends. The report shows that global fintech financing in M&A, private equity and venture capital will total $210 billion in 2021, with a record number of 5,684 deals. Among them, the encryption and blockchain fields will see the largest growth in 2021.

Additionally, a study published by LinkedIn in Januaryshowshow