Summit AscendEX 2021 Annual Summary: Multi-chain Future and Web3.0 Paradigm Shift

Original source: Summit AscendEX

At the beginning of 2022, AscendEX hopes to review with you the amazing development of the cryptocurrency industry in the past year, as well as the application and evolution of cryptocurrencies around the world. As a cryptocurrency trading platform connecting the CeFi & DeFi fields, Summit AscendEX has become a solid link between users, institutional investors and DeFi protocols. Thanks to this, we hope to review some data and information related to the development of the encryption industry in the past year based on the development highlights of AscendEX in the past year. At the same time, we hope to share with you our views on the future development of the encryption market through our unique insights into market conditions and trends.

first level title

Market Highlights

Based on the rapid increase in the scale of institutional participation, the growing maturity of the emerging Layer1 public chain network, and the extensive integration of Dapp and virtual reality, crypto market participants firmly believe that the crypto industry will shape a new world pattern in the future.

first level title

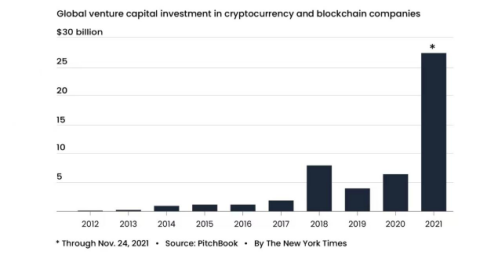

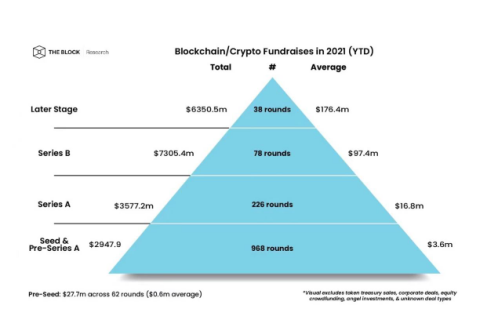

Institutional participation

In the third quarter of 2021 alone, venture investors deployed about $8.5 billion in cryptocurrency startups, the largest quarterly investment amount ever in the crypto space. Today, many venture capital firms have billions of dollars in crypto assets under management. This investment trend clearly accelerated in the fourth quarter. In addition, the number of encrypted unicorns will surge to more than 60 in 2021, covering exchanges, infrastructure companies, game companies and other tracks. Venture capital companies always make capital investment around the development of talents, and similarly, talents will also move closer to the center of capital. This forms a reflective closed loop and a broad pool of talents, and gradually promotes the development of the entire industry.

first level title

Enter the multi-chain world

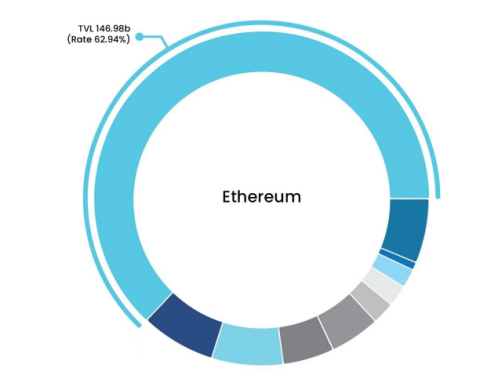

After the "2020 DeFi Summer", attention and innovation around DeFi have shown explosive growth. This type of growth has mostly happened on Ethereum. Just a year ago, Ethereum accounted for more than 97% of the total value locked (TVL) of all crypto projects. In a year of development, emerging public chains and DeFi protocols have matured rapidly, forming a pattern of coexistence of multiple interoperable blockchains today.

As a pan-chain platform, with the development of the multi-chain world, Summit AscendEX will continue to provide support for the diversification of L1 ecology and applications.

(Link to graphic — https://defillama.com/chains, labels/keys can be found dynamically on the website)

image description

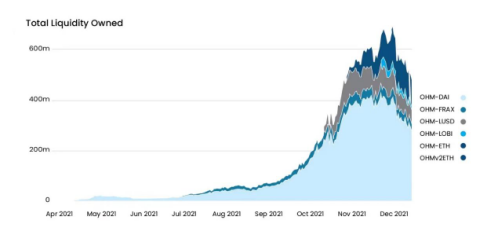

liquidity war

While interoperability helps to tightly integrate the multi-chain world, the fact is that interoperability also drives the intensity of the battle for liquidity in various L1 and decentralized applications. Liquidity comes from the attention and assets of developers and investors. With the emergence of competition between L1 and L2, liquidity will be the hottest commodity among protocols, and each protocol will provide more and more unique incentives to attract liquidity.

However, given the propensity of DeFi liquidity providers to make profits, TVL is actually a low-performance protocol evaluation benchmark.

For example, the main driving force for different L1 TVL changes comes from a dozen (or more) "ecosystem funds" initiated by developer foundations including Polygon, BSC, Avalanche, Harmony, Fantom, etc. Changes in TVL have occurred countless times in 2021 in the following way: L1 or L2 networks bootstrap capital to launch an "ecosystem fund" that is used to fund developers building applications on their chains and provide liquidity to native protocols of users provide rewards. Most eco-funds are built to solve the "chicken and egg" problem at the same time - providing funds for builders and rewarding users. Protocols that implement liquidity mining to bootstrap liquidity are beginning to realize that financial incentives alone are not enough to bridge the gap between speculators and users. The phenomenon of profit recovery (total locked value outflow) after the liquidity mining program ends has driven innovation in the way liquidity is attracted, including liquidity held by protocols, which will be discussed in the “DeFi 2.0” section below.

While TVL has become a popular metric for gauging the success of a DeFi protocol compared to the broader ecosystem, there are still some pitfalls and limitations to this approach. TVL is simply the total dollar value of collateral deposited to a given network (Ethereum, BSC, etc.) or application (UniSwap, AAVE, etc.). Since collateral assets are transitioned from one protocol to another in a dynamic form. As a result, DeFi-native currency markets tend to double-count liquidity.

Let's take the situation described by CoinMetrics as an example:

After users deposit $1,500 worth of Wrapped Ether (WETH) to Maker, they can receive a $1,000 DAI (150% collateralization ratio) loan.

The user then deposits this newly minted DAI token, along with another USDC worth $1,000, into the Uniswap V2 USDC-DAI pool. In return, users will receive LP tokens, which represent a $2,000 stake in the pool’s liquidity.

- Source: https://coinmetrics.substack.com/p/coin-metrics-state-of-the-network-0c0

In short, the flexibility of most DeFi applications makes it easy for assets to be re-hypothecated and double-calculate TVL across multiple protocols. Although TVL is used as a benchmark for comparison between protocols at a certain time, the ease of leasing liquidity redemption, and the rapid change of TVL in DeFi in the case of falling yields proves that TVL does not reflect the entirety of protocol liquidity Condition.

DeFi 2.0

first level title

(Link: https://dune.xyz/queries/153224/303068)

other development

other development

In addition to the above-mentioned headlines in 2021, AscendEX has also been closely watching the development of other major events. Everyone should have their own opinion on the depth of the market, here we mainly want to briefly highlight the important development trends in the future.

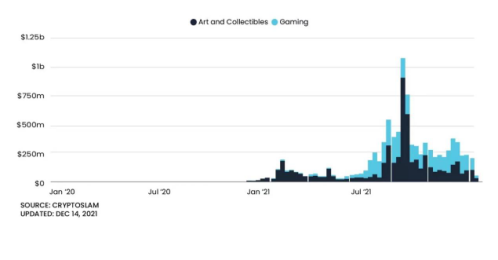

NFTs — While the first NFT token standard, ERC-721, was created in 2018, over the past year NFTs have been widely seen as a major disruptor in terms of digital ownership. Starting with JPEGs and profile pictures, the NFT market has grown rapidly, until now it has gradually covered a wide range of applications. Although the current NFT infrastructure is still in its infancy, they have managed to infiltrate mainstream culture. Such rapid development indicates that they will continue to develop in 2022 and beyond, and become a major contributor to value creation in the cryptocurrency economy.

Web 3.0 - Over the past year, the cryptocurrency industry has undergone one of the greatest rebrands ever, slowly becoming an integral part of the larger Web 3.0 world. Web3.0 is the next generation of the Internet and the future of the Internet. Everything in Web 3.0 is built on the concept of being decentralized, permissionless, owned by users and builders, and connected by tokens.

first level title

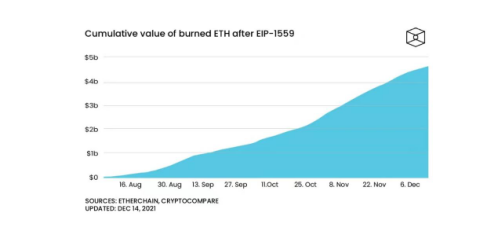

Major Protocol Upgrade

This year, both Bitcoin and Ethereum have undergone two major upgrades - Taproot and the London Hard Fork upgrade (London Hard Fork), both of which are important milestones in the lives of Bitcoin and Ethereum.

Taproot is the latest upgrade to the Bitcoin network, and the most significant in four years. It makes complex multi-signature transactions possible, and makes transaction verification on the Bitcoin network faster and easier. The upgrade also scrambles single-signature and multi-signature transactions together, making it more difficult to identify inputs for transactions on the bitcoin network.

Despite the size, value and degree of decentralization of the Bitcoin and Ethereum networks, they have proven themselves to be resilient while maintaining the ability to improve and upgrade as the broader ecosystem continues to innovate rapidly .

first level title

extended solution

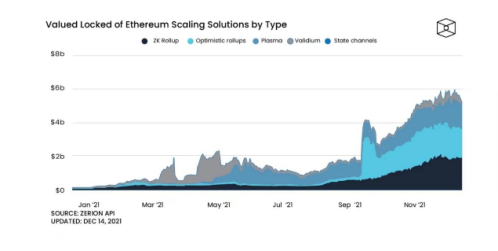

In addition to the above-mentioned protocol upgrades, scalable solutions to mitigate the shortcomings of on-chain transactions have also become a key theme in 2021.

On the Ethereum network, many scaling solutions have been launched, including solutions using Optimistic Rollups, ZK Rollups, Validium, and Plasma technologies, which have driven the growth of the Ethereum Layer 2 network and successfully gathered billions of dollars in TVL. While the Arirum project based on L2Optimistic Rollups technology retained the top spot with over $2.5 billion TVL and a 41% market share, ZK Rollups scaling solutions are increasingly being used. Today, among the top 10 scaling solutions ranked by TVL, 4 solutions use ZK Rollups technology, 4 use Optimistic Rollups technology, and 2 use Validium technology. As various scaling solutions mature and develop, we expect more and more centralized and decentralized players in the cryptocurrency ecosystem to start using these solutions. Even if the merger of Ethereum and the sharding and transition of ETH 2.0 are coming, the continued growth of alternative L1 public chains and the development of L2 solutions will continue to squeeze the development space of Ethereum. We expect the dominance of Ethereum L1 to decline in the future.

first level title

While opinions still differ on the exact role the DAO will play, it is clear that it will continue to evolve and gradually build a future of distributed collaboration. Most DAO tools are still primitive, non-integrated, and in more cases off-chain, and their problems are also reflected in the extreme apathy of voters. Summit AscendEX has been paying close attention to how it will improve the DAO user interaction and participation experience in the future, especially in terms of the innovative D2D (DAO-to-DAO) business model.

first level title

In a very short period of time, we have had mainstream institutions and businesses that have ignored cryptocurrencies begin to embrace a whole new paradigm. To facilitate the Web 3.0 paradigm shift, incumbents in technology, finance, gaming, music, and more have already begun to make strategic moves. Facebook changed its name to Meta; financial technology and traditional financial companies accelerated the integration of encryption tracks; game companies recognized the importance of Play2Earn. All these indicate that enterprises have begun to speed up their competition for their respective markets. Each of these companies will face its own innovation dilemma as they set out to disrupt some of the business models in their respective fields. The question of who will make the transition to the crypto economy successfully, and who will lose out to the crypto-native upstarts, remains to be answered.

first level title

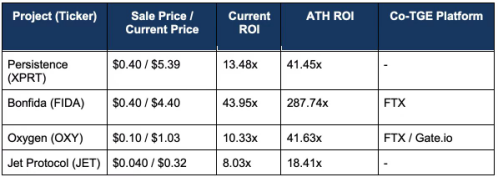

Summit AscendEX is famous for its outstanding performance in the IEO field. We are committed to fulfilling our mission as a trading platform and providing platform users with early opportunities to participate in some excellent ecological projects. The main auction and currency listing projects include Persistence, Bonfida, O2, Jet Protocol and so on. Through the IEO of AscendEX, these projects can obtain sufficient liquidity and obtain efficient price performance. At the same time, this has further consolidated AscendEX's good record in screening excellent projects. According to the historical data of all IEO projects, the current return on investment of AscendEX is 832%, and the average ATH (historical high) return on investment is 4714%.

(Note: The current return on investment is calculated based on the market value on December 17, 2021)

first level title

Directly integrating projects into the underlying infrastructure of centralized exchanges (staking, lending, etc.) is one of the most powerful tools AscendEX provides for listing projects. In the summer of 2021, AscendEX launched a comprehensive profit portal to help users obtain high-yield opportunities in DeFi efficiently and safely. Through AscendEX financial management, users can participate in DeFi to make profits without directly interacting with the Web 3.0 protocol itself. With AscendEX wealth management, the complexity of DeFi is abstracted, allowing users accustomed to centralized exchanges to seamlessly benefit from subtle and complex DeFi innovations. With the rise of decentralized exchanges, Summit AscendEX is excited to seamlessly integrate with the infrastructure of decentralized exchanges. This enables it to provide users with a unified access point to help them easily enter the wider DeFi ecosystem and participate in the DeFi protocols in the ecosystem.

first level title

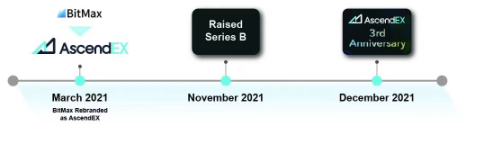

Milestones of Summit AscendEX

As AscendEX has grown into a comprehensive financial service provider, we are doing our best to support various innovations. We are excited that this vision is gradually becoming a reality through various activities we have carried out, including Polkadot slot auctions, second-layer network integration, and many more IEOs!

first level title

Regarding the recent security breaches of Summit AscendEX:Following the AscendEX hot wallet security breach incident (Click to learn more

), we have been working tirelessly to make the right decisions for our customers to minimize losses and resume normal business as quickly as possible. We always take 100% compensation for customers' losses as our top priority, and the platform's trading, betting and mining operations were not affected during the incident until we can safely reopen deposits and withdrawals.