Foresight Ventures: Will the "death spiral" of 2018 reappear in the bear market?

"I don't understand the bull market, but I understand the bear market too much"

0. write in front

0. write in front

Recently, many old friends talked to me about "Dream Back to 2018", and many old leeks began to write "Guide to Surviving the Bear Market". More new friends who entered the bull market in this round are eager to know what will happen to the market. Seeing the eager eyes of these new friends reminded me of myself in 2018 listening to the bragging of the old leek, full of confidence in the future market, but I didn't know that what was waiting for me was a long bear that lasted for 3 years.

secondary title

1. Market overview - the era of mixed fish and dragons and strange powers

The apex of the secondary market appeared in January 2018, and the market value of the entire digital currency market exceeded 800 billion U.S. dollars, about one-third of the ATH in 2021. At that time, the market was flooded with altcoins, and the proportion of Bitcoin reached a minimum of 33.39% on the day when the market value was high. The market was still immersed in the bubble of the myth of ICO making wealth. Looking back at the top 20 currencies by market capitalization at that time, there were all kinds of public chain tokens and BTC imitations, but now only 6 currencies are still on the list, and there are 11 new currencies.

Public Chain/Protocol

image description

Overview of the public chain in the first half of 2018

In such a market environment, investors in the primary market basically open their mouths to the consensus standard, and shut their mouths to TPS. Today, we will study how to solve the asynchronous problem with a directed acyclic graph, and tomorrow we will think about how Byzantine generals can achieve peer-to-peer communication. However, most of the public chains are in the early development stage, and there are very few projects launched on the main network. The first-level investment can only start from the angel stage, but no one knows whether it will be implemented. Such a market environment has spawned a large number of pseudo-technical projects. A white paper and a few consultant platforms can start financing. Project due diligence can only look at technical solutions, but there is no data or developed products to verify. Everyone is looking for the next-generation public chain other than BTC and ETH. Someone told me it was called EOS in 2018.

(Foresight Ventures is still optimistic about the cosmos ecosystem and various new public chains)

image description

Overview of agreements in the first half of 2018

Of course, there are still many teams in these projects that have gone through the hardships of the bear market and are still developing and doing things, and finally settled down to the blue-chip giants we see so far, as well as our commonly used basic components.

chain change

After the wealth creation effect of ICO spread across the country, a large number of companies in traditional industries wanted to use blockchain technology to solve their industry or their own problems, and the trend of "chain reform" rose rapidly. Among them are many insightful people who are full of faith and eager to join the technological revolution, and there are also ghosts and monsters who take advantage of the heat to cut a handful of leeks. The trend of chain reform spans P2P, mobile phones, e-commerce, traceability, AR/VR, SaaS, games and other sectors. Only you can't think of it, and I can't change it. It seems that the emergence of the blockchain can solve all the pain points that cannot be solved online and offline, but for most projects, there is actually only one problem that can be finally solved-the financial problem of the project party.

transaction mining

After a slight decline in market sentiment, most investors began to consider investing in some projects that can generate cash flow, and exchanges became the first choice. The "transaction mining" exchange headed by Fcoin was born. In order to realize the cold start of the exchange, Fcoin issues FT according to the user's transaction volume for transaction incentives. In fact, the annualized rate of return was only 30-40% at that time, but users who had never experienced Yield Farming flocked to it. As the popularity soared, FT tokens rose hundreds of times in a few weeks, and because of the flaws in the design of the mining mechanism, they quickly crash. However, this innovative model has been used, and a large number of exchanges have begun to use "transaction mining" as a selling point to raise funds for platform tokens. Exchanges, like Internet companies, strive for long-term product and operational capabilities, and the discovery and capture of high-quality assets. Most of the follow-up exchanges were short-lived, and only a small number survived.

death spiral

During the two months of sideways trading in the market, the primary market also tried to do some small work: the first is compliance-oriented ST (Security Token) and STO (Security Token Offering), which are simply a form of asset tokenization . The process from Asset backed security to Asset backed token. Owning assets or cash flow as a value support, but it is essentially another form of ICO that is closer to regulation. In view of the downturn in the market at that time, the demand for issuance in the primary market had begun to shrink, so the concept of STO did not become a reality in the end.

STOs, EOS/Tron dApps, and others

During the two months of sideways trading in the market, the primary market also tried to do some small work: the first is compliance-oriented ST (Security Token) and STO (Security Token Offering), which are simply a form of asset tokenization . The process from Asset backed security to Asset backed token. Owning assets or cash flow as a value support, but it is essentially another form of ICO that is closer to regulation. In view of the downturn in the market at that time, the demand for issuance in the primary market had begun to shrink, so the concept of STO did not become a reality in the end.

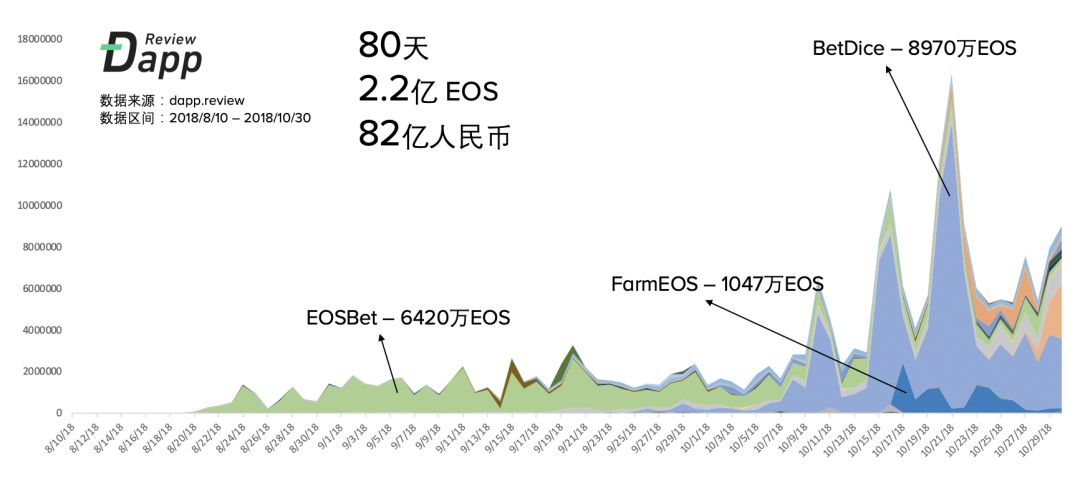

The second is the outbreak of EOS dApp, a large number of games and gambling projects appear on the EOS chain. The EOS dAPP represented by BetDice generated RMB 8.2 billion turnover in two months and attracted hundreds of thousands of users. Decentralized exchanges, wallets, mining robots and other related services built on EOS have developed rapidly, and their popularity has even led to the explosion of EOS RAM. For the first time, the situation where the entire public chain ecology is brought to life by the application side. However, the projects on EOS are mainly based on the attribute of spinach. The transaction volume of spinach dApp accounts for 90% of the total transaction volume, and the life cycle of its users is basically kept within one month. Crashes quickly. Later, Tron also copied the EOS model, trying to continue the glory of EOS, but its user data and activity also fell off a cliff within a few weeks.

As Bitcoin maintained a sideways trading around $6,000 for three months, it quickly fell to $3,000 in November, and the primary market has since entered a stage where there is nothing to speculate, and the most desperate moment is coming.

2. Market participants – stay or leave

exchange

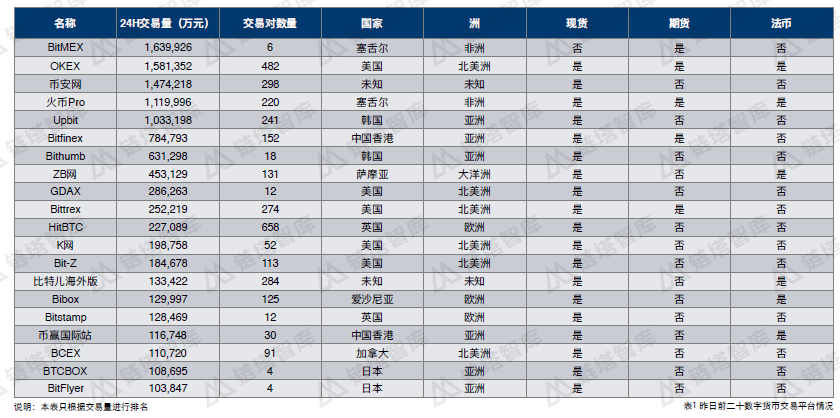

April 2018 Exchange Trading Ranking

April 2018 Exchange Trading Ranking

The picture above shows the trading volume ranking of exchanges in April 2018. It can be seen that BitMEX, which focuses on contract trading, occupies the top spot, followed by the three major domestic exchanges and overseas regional exchanges. BitMEX and OKEX were the places where the contract trading function was launched earlier, and they were also the choices of most people for contract trading at that time. In the second half of 2018, most exchanges began to develop contract trading business. Huobi opened the contract trading zone Huobi DM at the end of 2018, and Binance started the USDT perpetual contract business after acquiring JEX in September 2019. In terms of the spot market, Binance pioneered the Launchpad concept in the first half of 2019, and then major exchanges began to launch their own IEO imitations, resulting in a wave of IEO market independent of the broader market.

In the two years from 2018 to 2019, the top exchanges basically maintained their original status, and Binance gradually climbed to the top of the list through innovative operating methods and management models. For small exchanges, some can continue to earn income by maintaining existing customers, while others will gradually stop their business in the reduction market.

Project side

Top 10 Digital Asset Crowdfunding Projects by Funding Amount in 2017

Top 10 Digital Asset Crowdfunding Projects by Funding Amount in 2017

Here we classify the project parties into projects that have raised funds and have issued coins, projects that have raised funds but have not issued coins, and projects that have not raised funds.

corporate investor

corporate investor

The primary market in 2017 was basically dominated by individual participants, and a large number of Token Funds and traditional VCs began to appear in early 2018. The quality of these institutions varies, some are professional investors from the traditional financial and Internet fields, and the other are early digital currency players and large investors with primitive accumulation. The figure below lists the well-known domestic investment institutions in the market at that time, as well as A16Z, Pantera, Hashed, Kenetic and so on overseas. If we compare it with the current list of investment institutions, we can find that most of the domestic institutions have withdrawn from the stage of history, and the reshuffle of primary market participants is also quite thorough.

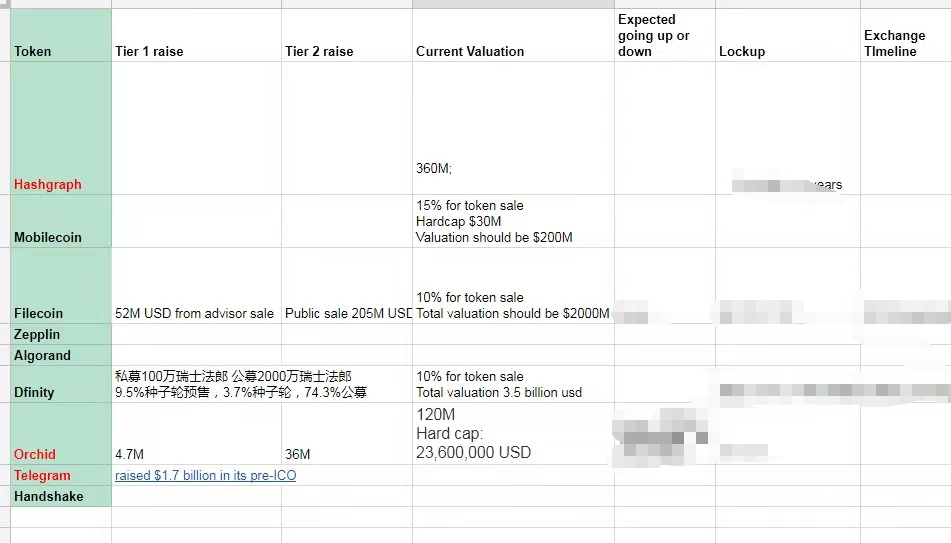

The iteration of institutions was not very obvious in the first half of 2018. In the last wave, everyone basically made a lot of money. As long as they get the quota, they can make money. Fundraising, exiting, and cashing out are not a problem . However, when the market went down, most of the projects broke, returned to zero or even did not issue coins. A large number of institutions without investment capabilities were unable to withdraw from the previous Haitou projects, so the tide of rights protection in the primary market began to rise. A large number of Saft protocols have been resold second-hand, and there are many star projects such as Filecoin, Algorand, Difinity, etc., which have risen thousands of times and hundreds of times. For institutions that still have faith in the market and have investment capabilities, they are beginning to transform. In addition to asking for money from project parties, some funds have begun to find ways to generate cash flow, so secondary asset management and quantitative transactions have become popular choices.

SAFT resold at the end of 2018

Media, community and other service organizations

I started to study in the digital currency market in early 2018. Before entering this industry, I was engaged in securities research. I believed in fundamental analysis and sneered at technical analysis. When I started to invest in the primary market, I started with the principle of the project, and examined the technical solution, consensus mechanism, token model, release rules and team quality of the project. Although I do not come from a technical background, I have read a lot of papers, white papers and technical articles. I have done in-depth study of commonly used solutions on the market, and I am full of longing for the blockchain world.

3. Investment logic—transformation from bureau-making path to research path

I started to study in the digital currency market in early 2018. Before entering this industry, I was engaged in securities research. I believed in fundamental analysis and sneered at technical analysis. When I started to invest in the primary market, I started with the principle of the project, and examined the technical solution, consensus mechanism, token model, release rules and team quality of the project. Although I do not come from a technical background, I have read a lot of papers, white papers and technical articles. I have done in-depth study of commonly used solutions on the market, and I am full of longing for the blockchain world.

Later, when I really devoted myself to the market, I found that fundamental analysis is basically ineffective in an ineffective market. There is no data support, only concepts and theories, how to make investment judgments in this situation? I try to sort out the following logic from limited data and due diligence information:

Later, when I really devoted myself to the market, I found that fundamental analysis is basically ineffective in an ineffective market. There is no data support, only concepts and theories, how to make investment judgments in this situation? I try to sort out the following logic from limited data and due diligence information:

Technical solution: project progress, technical enthusiasm, and technical feasibility;

Market popularity: number of media reports, roadshows, community data, search index;

Economic model: token distribution plan, token function, token unlocking situation, financing and valuation;

Team situation: the background of the founding team, the background of the consultant team, the background of the investment team;However, in the actual operation of most investment funds, this set of investment systems is gradually transformed into two-Tokens and Teams

2. The market is getting better and more effective.

4. What do we get?

By sorting out the investment hotspots, market participants, and investment logic of the bear market, and comparing them with the current market conditions, we can actually easily draw the following conclusions:

1. Market volatility is huge, and investment targets and market participants have undergone a huge reshuffle.The Beta of the industry is very large, but how to keep the profits of Beta through the bear market is difficult, which requires strong investment ability and forward-looking judgment on market trends. More than 90% of incompetent people have been eliminated in the bear market, and more than 90% of unreliable projects have been abandoned by the market. The essence of this industry is what settles down after the big waves wash away the sand.

2. The market is getting better and more effective.With the recognition of digital currency and blockchain technology worldwide, a large number of professional investment institutions and capable industry builders have continuously entered the digital currency industry in the past few years. There are fewer and fewer fraudulent projects, more and more teams doing things, and great changes have taken place in the participants and fundamentals of the industry.

With the recognition of digital currency and blockchain technology worldwide, a large number of professional investment institutions and capable industry builders have continuously entered the digital currency industry in the past few years. There are fewer and fewer fraudulent projects, more and more teams doing things, and great changes have taken place in the participants and fundamentals of the industry.2018 is only the beginning of the bear market. The most painful stage is actually 2019 and 2020. The entire market is in a half-dead state. When market participants are no longer able to expand their business from any angle, the belief in the blockchain will collapse. I believe that everyone who was still in the industry at that time would repeatedly ask themselves these questions: Is Bitcoin a tulip bubble? Will the bull market still come? Most people's hopes are lost in waiting. But during this period, there are always some long-termists who are still working on the project, investing in it, and supporting the project. They also dare to devote their time or money to what they believe in. Some of these people have become top institutions, and some have become blue-chip projects, and the market has rewarded them thousands of times.

5. The Last Story

Finally, I will tell you a short story for everyone: On April 19, 2019, my colleagues and I had a meeting with a curly-haired kid on WeChat. He told me that they were going to be a contract exchange, and after listening to it, I felt that it was no different from the BitMEX model. So I asked him a few related questions encountered by BitMEX, and he didn't have a good answer. I went to their website and looked at the transaction data and saw that there were only a few transactions a day. In addition, the market conditions are very cold, and we no longer plan to invest more in the primary market, so we quickly passed the project. Later, I saw him again on the live broadcast of the hearing in the United States. On the name tag on his chest, there was a line of words "Mr Bankman-Fried".

Chain Tower Think Tank "2018 Digital Currency Exchange Research Report"

Data Sources:

Huobi Research Institute "Global Blockchain Industry Panorama and Trend Report (First Half of 2018)"

Chain Tower Think Tank "2018 Digital Currency Exchange Research Report"

DappReview "80 days, 8 billion, undercurrents under the cold winter - EOS DApp ecological explosion that you don't understand"