Qredo Governance Benefits Multiple Parties When Managing Digital Assets

Qredo enables hedge funds, banks, and corporates to overcome the operational challenges and business risks of digital assets through institutional-grade security and granular governance.

The same tools can be configured for anyone—from family and friends, to freelancers and investment clubs.

Read on to join the world's most famous cryptocurrency couple, Alice and Bob, as they demonstrate five ways Qredo's institutional accounts can benefit anyone managing digital assets.

1. Joint digital asset account

Millions of dollars worth of wealth have been lost when the unexpected strikes as digital asset holders fail to prepare for the worst. as the famousQuadrigaCX Case StudyAs shown, the sudden death of a loved one can cause the relatives of cryptocurrency holders to lose their wealth.

In order to jointly control their cash and ensure that one of them still has access to it after a car accident, crypto-loving Alice and Bob might set up a joint digital asset account.

One way of doing this is to share private keys that denote ownership. But this would be a bad idea: if the relationship goes sour, sharing a single private key would allow either Bob or Alice to run off with the digital assets, and to duplicate the private key, having two copies increases the likelihood of theft—just Like a thief might break into a vault and steal gold coins.

On Qredo, Alice and Bob can jointly control their digital assets without sacrificing security. This is achieved by setting up two funds in the Qredo account: the first fund will be a petty cash wallet with a simple signature scheme where a signature from either The fund will be a joint savings account for large purchases, which will require Alice's and Bob's signatures to authorize the transaction (both parties).

2. Encrypted accounts for kids

If Alice and Bob have a kid named Charlie, they might want to set up an account for the kid and teach him how to be a money savvy.

One way is to set up a standard wallet for little Charlie, give him a password, and deposit some cryptocurrency. But what happens when he inevitably forgets his password, or provides his seed phrase to Rover, or sends his password to crooks?

Blockchain has no forget password or transaction dispute buttons. So there is no way to recover the assets.

On Qredo, Alice and Bob can create a shared wallet for Charlie, requiring two family members to approve the transaction (2 out of 3). This means Charlie needs approval from one of his parents to use Bitcoin. (If he loses his password and feeds the master seed to the dog, he can still read into the fund).

3. Investment clubs and shared accounts

When Bob wants to take a vacation, he can pay for the shared vacation with his friends by sharing digital assets.

Or, he could start an investment club in which he and his friends share control of a single portfolio.

Either case can be achieved through the Qredo wallet. All teams contribute funds while minimizing the risk of collusion between any members.

For example, Bob can set up a wallet that requires 3 approvers among 6 friends (3 out of 6). If someone quits the trip, or the membership of the investment group changes, the account can be changed to change the approver without sending the entire balance to the new account.

4. Business and Personal Accounts

In addition to her investment, Alice may also receive digital assets as payment. This may mean she needs to maintain different pools of assets - each under the control of different legal entities and with their own unique tax requirements.

On Qredo, Alice can consolidate all her encrypted sub-accounts into one Qredo wallet, easily managed with the control panel. Then, when tax time comes, she can instantly export individual records to keep her books organized (export coming soon!), or assign viewing permissions for instant access by accountants.

5. DAO Fund Management

If Alice forms a decentralized autonomous organization (DAO), she will need a tool to manage shared custody of funds among members.

On Qredo, Alice can set up a treasury contract secured by multi-signatures, where any transaction must be approved by at least 4 of 7 total signers (4 out of 7). Additionally, assets held in funds can be securely traded on centralized exchanges on the Qredo network and easily deployed in DeFi - enabling DAOs to easily diversify their holdings and allocate assets to invest and earn yield Opportunity.

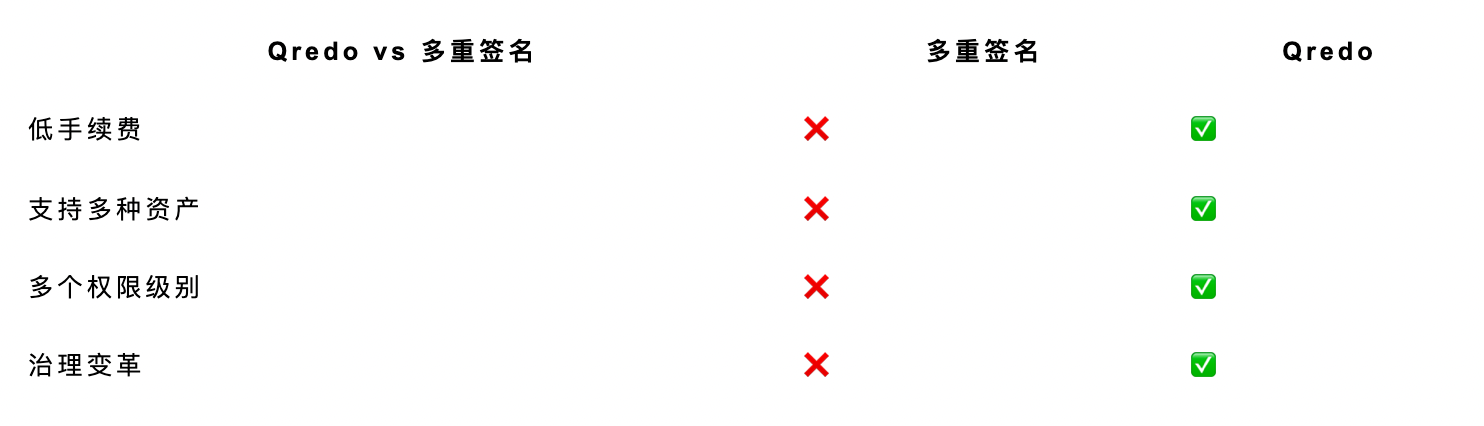

Qredo Vs. Multisig

Compared with traditional on-chain multi-signature schemes, Qredo has several advantages:

Flexible Governance Changes

Unlike on-chain multisig, Qredo organizational accounts can be adjusted at any time. So if group membership changes, new approvers can be added and the quorum size can be changed without sending the full balance to the new account.

zero handling fee

Setting up a multisig scheme with a third-party provider can mean paying expensive fees, and each on-chain transaction costs even more than usual due to the additional complexity. And Qredo offers zero-fee hosting, and even complex governance plans can be set up and executed for free.

Multi-Asset Support

Most multi-signature schemes only support assets on one blockchain, while Qredo's cross-chain MPC supports assets across multiple chains.

Unlimited scalability

Multisig solutions allow only basic approved scenarios with a limited number of participants. In addition to theother rolesIn addition, Qredo organizational accounts allow assigning an unlimited number of transaction approvers.

Qredo vs multisig