Deep Deconstruction of 4D: The Design and Future of the Synthetic Asset Track

Summary of main points:

secondary title

Summary of main points:

1. The synthetic asset track has a huge imagination, it is possible to realize real cross-chain, and the product is extremely scalable.

4. Mature synthetic asset products can exponentially increase the influence of DeFi.

prologue:

secondary title

prologue:

The synthetic assets to be analyzed in this issue are known as the most complex and difficult to understand track in the DeFi field. Therefore, any link in the article should not be missed. The author will try to use a more straightforward description to reduce the difficulty of reading. Do not mix excessively obscure algorithmic formulas. However, to understand the synthetic asset track, you still need to have some knowledge of some infrastructure products and basic concepts.

The advantage is that this article will explain various types of DeFi products in the process of analysis, which will help readers with poor foundations to obtain a comprehensive understanding at one time.

The positioning of this article is not an investment research report. It is actually a solution research that is more biased towards product design. It is relatively boring, but useful.

This article will mention a number of solutions to problems related to synthetic assets. If you have any objections, please contact the author for discussion.

After all, "Battle is the primary productivity of product managers."

first level title

01 What are synthetic assets?

Let me briefly introduce what synthetic assets are and what problems they solve.

1. What is cross-chain? What problem does it solve?

First of all, let us think about such a question: what is cross-chain doing? Why cross-chain?

I believe that many people will quickly give me the answer - to break the blockchain island, the blockchain world needs to communicate with other worlds (draw a big cake)

Yes, due to the isolated island problem in the blockchain, people are eagerly looking forward to the emergence of a blockchain world that can be decentralized, censored-free, and can trade everything.

Therefore, ecosystems such as Polkadot and Cosmos have become more and more concerned. Up to now, although there is still not much substantive progress, the above-mentioned projects have established sufficient value consensus in the secondary market.

However, since the development of cross-chain technology, there are many problems whether it is the notary mechanism, the side chain mechanism or Polkadot's relay chain + parachain + bridge chain model.

Either it's not decentralized enough, or it's too difficult.

2. Synthetic assets may be the most feasible cross-chain solution

Since the current cross-chain solutions are not enough to make sense, is there any way to make the blockchain world break the island of value?

The goal of synthetic assets is to trade any asset. Although the current synthetic solution cannot share attributes with real assets other than value fluctuations, from the perspective of demand, most users often only have Enjoy the benefits of price fluctuations.

Therefore, the author boldly believes that synthetic assets may be the most feasible and decentralized asset cross-chain solution at present (information cross-chain is not within the defined scope)

3. How are synthetic assets made?

(1) Overcollateralization model

Strictly speaking, the pioneer in the field of synthetic assets is MakerDao, because the dollar represented by DAI is essentially an on-chain synthetic form of off-chain assets.

Users obtain the price of USD/ETH from an external decentralized oracle machine by mortgaging ETH, and use a 150% over-collateralization model to create a USD stablecoin——DAI

According to the above figure, we can clearly see that MakerDao has synthesized USD stablecoins on the chain through a set of over-collateralized models. Since the price of DAI does not fluctuate much, when the price of collateral falls, the collateralization ratio will become smaller. At this time, when the mortgage rate triggers the liquidation threshold, the collateral will be publicly auctioned in the market, and the auction robot will help the mortgager repay the debt and take away the mortgager's collateral.

The orange part is the liquidation process:

The above is the complete process of mortgaging and synthesizing U.S. dollars. Since this is the case, we can find that as long as the external oracle machine can obtain stable asset quotations in a decentralized manner, we can theoretically synthesize any asset.

This is what Mirror does. On the synthetic asset project Mirror, users can mortgage UST (a semi-algorithmic stablecoin in the Terra ecosystem) to generate a variety of synthetic assets. Users can trade multiple synthetic assets including stocks, gold, etc. on Mirror's built-in AMM.

(2) Global debt model

Synthetix, the largest project on the synthetic asset track, has a slightly different solution from MakerDao and Mirror. In addition to synthesizing certain assets in the form of over-collateralization, Synthetix has also established a new global debt mechanism based on the quotation transaction model. Synthetix users can first synthesize the US dollar stable currency sUSD, and then use sUSD to trade without slippage and unlimited liquidity into any synthetic assets supported by stocks, foreign exchange, etc.

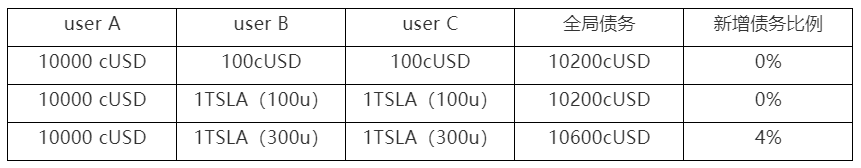

This global debt model is also the most complex part of synthetic assets. Let us understand the global debt model in this way.

If we are product managers, the demand is to create a trading market for synthetic assets that does not count liquidity and relies on external quotations. What should we do?

First of all, we need to understand that if the price comes entirely from external quotations, it means that the trading market has no pricing power, and no pricing power means that the trading needs on the platform need to be as similar as possible to the trading needs of the external market. Only in this way can it be guaranteed that there will be no premium loss in the internal market.

Synthetix does this: it borrows from the quotation-driven model in the traditional trading model, a large market maker provides quotations to the market, and the counterparties of buying and selling users are market makers rather than each other. Synthetix will not officially play the role of this large centralized market maker. So, his solution is global debt:

for example:

Assuming that user A and user B pledged USD 1,000 of cUSD respectively, the current global debt is USD 1,000 + USD 1,000 = USD 2,000. And user A has created a Tesla stock worth $500. A day later Tesla stock rose 100%. The overall debt becomes $1,500 + $1,000. At this time, when A and B want to redeem their assets, they need to share the extra debt of 500 US dollars, so user A has a profit of 500-500/2=250 US dollars, while user B has a loss of 500- 500/2=250 US dollars.

Here is the debt position model commonly used in traditional synthetic asset projects.

4. Problems with synthetic asset tracks

But whether it is an over-collateralized model like MakerDao or an over-collateralized + global debt model of Synthetix, there are actually many problems. When discussing, we subjectively divide synthetic asset products into the above two types.

(1) Problems with the pledge loan model

The model of mortgaging ETH to borrow DAI is an over-collateralized model, and there may be various demands:

A. Users do not want to sell ETH, but they are short of money at the moment. So just do this. Essentially, you are bullish on ETH and short on synthetic assets. Because if the user is just short of money and doesn’t look long on ETH, he can sell ETH immediately. If the synthetic asset is a volatile asset such as TSLA, XAU, etc., the users of the synthetic asset should essentially be bullish on the collateral and bearish on the synthetic asset. The possibility of such demand is low, and the best way is to set the collateral as a stable asset like Mirror. In this way, the risk of price fluctuations faced by users of synthetic assets will be greatly reduced.

B. To be short of a certain asset, you can use other methods with higher capital efficiency. The form of over-collateralization is really not enough character. Therefore, the real demand of most issuers of synthetic assets should be arbitrage.

There are two types of arbitrage here. The first is to arbitrage the platform currency through mortgage mining, and the second is to synthesize assets according to the price of the oracle and then arbitrage the premium in the external trading market.

Specifically as shown in the figure:

Taking DAI as an example, when the demand for DAI in the blockchain world rises, the DAI/USDT transaction pair will generate a premium, such as one DAI=1.1USDT. At this time, ETH is used as collateral to synthesize DAI and exchanged for 1.1 times USDT in the secondary market. When the supply of DAI increases, the price will return. At that time, 1.1 times of USDT will be exchanged for DAI and the debt will be repaid to obtain profits.

This is just the simplest example, and there are more arbitrage variants, so I won't repeat them here.

From this example, we can see that under the pledge lending model, the prices of synthetic assets in external exchanges on the chain can easily generate a premium, and this part of the premium may be the source of motivation for most mortgagers.

MakerDao is okay, it only needs to maintain the liquidity of the DAI currency. However, every time Mirror launches a new synthetic asset, it must maintain the liquidity of one more asset, otherwise, there will be huge arbitrage space in the external market with scarce liquidity.

Therefore, we can see that there are a lot of trading pairs encouraged by Mirror’s liquidity mining. This will seriously increase the operational pressure on the operations team. In layman's terms, this form is more suitable for some more "rich" teams. In the process of contacting many investors, many people also think that the synthetic asset track needs more financing.

This is indeed a problem, but it is not necessarily correct, because this problem basically only affects the synthetic asset project of the pledged lending model.

C. The over-collateralization synthetic model has a global liquidation risk under extreme market conditions. Taking 312 in 2020 and 519 in 2021 as examples, when the collateral drops sharply in a short period of time, the collateral liquidation speed will exceed the user's added Collateral or speed of debt repayment. The act of liquidation itself will also exacerbate the price drop of collateral. When a large amount of collateral is liquidated in a short period of time, assets with less liquidity will be more affected.

And this global liquidation risk is especially serious when both collateral and synthetic assets are volatile assets. Therefore, the minimum mortgage rate of most products will be set relatively high, and in order to deal with the occurrence of death spiral events in the liquidation mechanism, delayed quotation or partial liquidation is often adopted.

(2) Problems faced by the global debt + pledge loan model

This form essentially turns all mortgagors into "market makers" as described in the quote-driven model. The mortgagor becomes the counterparty of the trader, and the mortgagor is also betting on the profitability of the trader while making the mortgage. When the trader's income is negative, the mortgager, or the user who issued cUSD, will be relieved of his debt. When the trader's income is positive, the debt of the staker, or the user who issues cUSD, increases.

1. Most of the mortgagors and traders coincide, users who make correct judgments earn less, and users who do not operate may lose money.

2. The difficulty of adding new transaction targets will be greatly increased, which will affect the scalability of transaction targets

3. The problem of frontrunning transactions caused by completely relying on oracle machine quotations is serious

Is this reasonable? We can't help asking the question?

The original intention of users to trade synthetic assets is to trade various valuable assets on the chain without censorship, without supervision, and in a decentralized manner. The purpose of the synthetic asset protocol is to bring more valuable asset targets to the blockchain world.

But if users need to bear this "debt risk", why do users go to these platforms to synthesize?

This is also the current dilemma these synthetic asset protocols are facing. When the market sentiment is relatively strong and the price of the platform currency and liquidity incentives are abundant enough, debt risk is not the focus of users’ consideration. However, when the price of the platform currency itself is frustrated, The liquidation risk would be catastrophic, as collateral prices fall and synthetic asset prices rise instead. Other users who have synthesized stablecoins cannot escape the punishment of global debt.

https://blog.synthetix.io/debt-hedging-refresher-for-snx-stakers/

We have observed that some global debt-based synthetic asset projects with poor initial liquidity have encountered similar problems in the early stages of establishment. And the largest global debt synthetic asset project - Synthetix has been trying to solve this problem through various methods.

https://sips.synthetix.io/sips/sip-181/

We have seen various solutions from SIP.

This blog goes on to explain and alert users to the volatility of debt.

https://gov.indexcoop.com/t/iip-25-synthetix-debt-pool-mirror-index/1104

This proposal proposes to use the share of open positions and the global liquidity of synthetic assets as a reference dimension, and add a premium to the price provided by the oracle machine, so as to balance the debt and reduce the risk of front-running transactions.

Also, the Synthetix community once proposed to create a debt mirror index asset

A five-part index (wBTC, wETH, DAI, DPI, and LINK) will be created to simulate the composition of the debt pool* (10% reduction in USD).

In short, the purpose of this mirror index is to hedge the volatility brought by global debt, and some people even propose to replace sUSD with sDEBT.

This shows how big the impact of the debt volatility problem is.

(3) Problems faced by the track as a whole:

In addition to the specific problems faced by these two types of synthetic asset projects above, there are some other problems faced by the overall track.

A. The product logic of the synthetic asset project is too complex, and the contract interaction cost and user experience cost are high.

Taking synthetix, the largest synthetic asset project, as an example, when you open the PC-side official website of synthetix, you will find it difficult to directly find a place where you can trade synthetic assets. This is because synthetix separates the transaction of its own synthetic assets from another ecological project Kwenta. Separating the issuance and transaction of assets is a poor experience for new users. Moreover, the logic of synthetic assets is more complicated, and the interaction cost of contracts is higher. However, this problem has been improved a lot as Synthetix has been migrated to layer2 recently.

B. Asset scale is limited

The mainstream synthetic asset projects are all issued by the platform currency mortgage, even the UST adopted by Mirror is also issued by the LUNA single currency mortgage. As a result, the issuance scale of synthetic assets is greatly limited by the market value of the platform currency. And the cost of iteration is very high, and the scalability is extremely poor.

Just imagine, if the mission of a synthetic asset project is to introduce off-chain assets to the blockchain world, but the scale that can be introduced is always less than one-fifth or even one-eighth of the market value of the platform currency, this is unacceptable.

C. The overall openness of the product is poor, and the debt risk has a great impact

Although most synthetic asset projects have the same trading functions as Uniswap and other DEXs, the trading experience is relatively better. But the asset type is less open. Unlike Uniswap, which is completely free, the trading targets of synthetic assets have very high requirements. This is mainly because the transaction model adopted by synthetic assets is a global debt model. In this model, any new transaction target will have an impact on the existing debt pool, so it is difficult to achieve sufficient openness, and often requires the form of community governance to add new transaction targets.

D. The transaction model is too complicated and the threshold for product use is high

Users who participate in the issuance need to bear higher risks than other loans, such as stable currency and other over-collateralized models. Because, the factors affecting collateral liquidation include global debt in addition to the price of collateral/synthetic assets. This makes the user's participation threshold higher. In a mature issuance and trading model, users should not consider other risks other than price fluctuations of trading pairs.

Although there are still several major problems in the synthetic asset project as mentioned above, if the above problems can be properly solved. The advantages of synthetic asset projects will also be particularly large.

Due to the complexity of the synthetic asset itself and the special transaction model. Synthetic asset projects often have the ability to form their own ecology.

As shown below:

A. The issuance of synthetic assets can actually include a complete over-collateralized stablecoin issuance module

As shown below:

B. The mortgage issuance module of synthetic assets is also similar to the over-collateralized lending model.

Based on the same flow chart: only new deposit pools need to be added, and the issued synthetic assets and liabilities are replaced with funds from the actual deposit pool. And charge additional loan interest.

C. The trading of synthetic assets is actually a DEX with a better experience than other products such as Uniswap, because no additional liquidity is required, market makers are not required to participate in market making, and transactions have no slippage. Taking the average slippage of 1% and the latest 24-hour transaction data as an example, under the same transaction volume, the synthetic asset trading model can reduce the slippage loss of nearly 30 million US dollars for users.

D. Synthetic asset projects can easily derive leverage and contract trading products due to their quotation transaction model and the global debt sharing model of mortgage issuance. Even all kinds of second-class options and insurance products can be born out of this system.

Taking Synthetix as an example, its strong scalability helps its ecology not only limited to the issuance of synthetic assets, but also includes the Kwenta exchange mentioned above, the Dhedge asset management agreement, etc.

But such scalability cannot be maximized on Synthetix. The main reason is that the sunk cost of the product itself is too high. The initial design limited Synthetix's growth and was difficult to change. In the next chapter, we will carefully analyze the problems and our solutions here.

To sum up, the synthetic assets of self-contained ecology cannot be understood simply as a certain DeFi project. High scalability is enough to help synthetic asset projects have greater potential than other types of projects.

6. Combinability of synthetic assets

A huge advantage of DeFi products that differs from traditional financial products is composability. Each DeFi project can complete more complex functions through contract calls and maximize capital efficiency.

Therefore, to judge the potential of a track, the composability of the track must be considered.

Compared with other tracks, synthetic asset products become more combinable due to their unique product functions.

for example:

A. The slippage-free quotation transaction model is very suitable for helping internal assets such as BTC, ETH and other mainstream digital asset transactions in the AMM system to reduce slippage. For example, Curve reduces the slippage of large transactions of DAI/BTC through the form of DAI (stable currency)/sUSD (1:1 exchange)/sBTC (no slippage)/BTC (1:1 exchange).

C. The process of asset synthesis is essentially the same as that of mortgage lending, so in some other use cases, synthetic asset projects can also play the same role as loan products.

If the synthetic asset track can solve the existing difficulties, then there is reason to believe that synthetic asset products will have great potential to detonate the market.

first level title

02 Feasible solutions and ideas

1. Each key component of a modular synthetic asset

Taking the most complex Synthetix's global debt model as an example, we can break down the following diagram into four components:

With this kind of modular thinking, we can understand the thinking and impact of the solution more clearly.

2. Backtrack the problem and propose a solution

(1) The product logic of the synthetic asset project is too complex, and the contract interaction cost and user experience cost are high.

This problem is not serious at the moment. Although looking back at Synthetix's sip history, you will find that Synthetix has put forward many ideas on reducing contract interaction costs, but the essential problem is that the efficiency of layer1 is too low and the cost is too high.

When the main function is migrated to Layer2 or other lower layers with better performance, there is no problem.

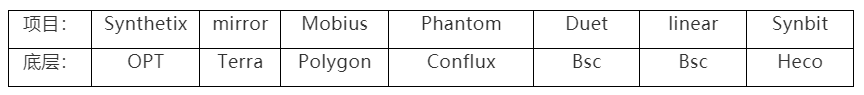

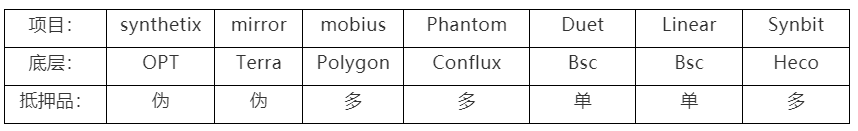

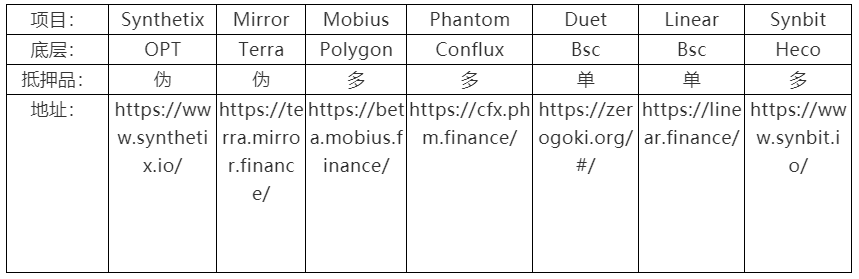

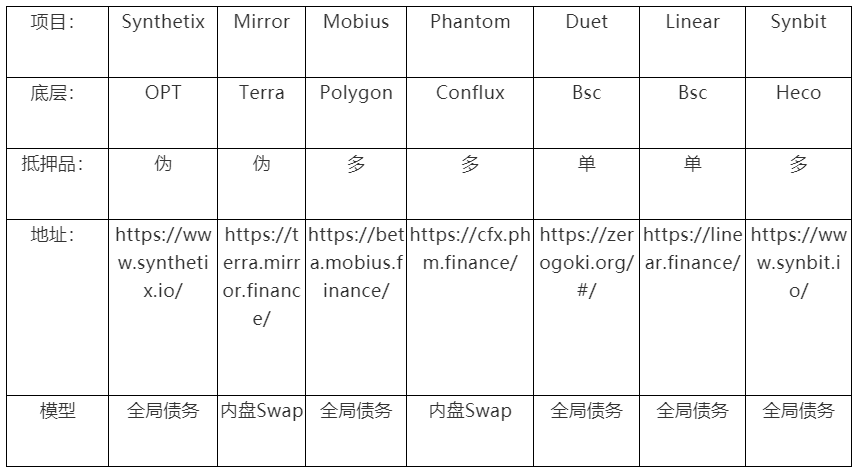

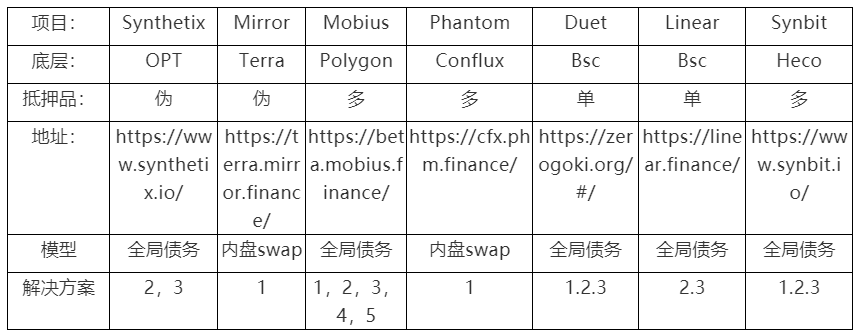

And this is evident in emerging synthetic asset projects. The following summarizes some of the synthetic asset projects that Prophet has researched:

(2) Asset scale is limited

The solution to this problem is actually relatively simple, choose a high-quality reality to support multiple collaterals: but it needs to be pointed out that in the global debt pool mode, the newly added collateral must have the same positioning as the platform currency and Share the same debt pool.

Because only in this way can it be guaranteed that the synthetic assets issued by the new collateral are expanding the overall asset scale, rather than betting against the original debt pool.

https://sips.synthetix.io/sips/sip-97/

The new collateral of synthetix faces the problem I mentioned. The collateral issued by ETH and BTC is essentially a mortgage lending behavior. The global debt pool of snx lends sUSD to the debt pool of ETH and BTC.

Then, even if new collateral is added, the asset size of the new collateral must still be smaller than the market value of SNX * the minimum mortgage rate.

For details, please refer to this sip.

As for the reason why synthetix does not add actual multi-collateral, according to our research, the token contract of snx is highly coupled with the main contract, and there is "technical debt" that cannot be executed technically.

In addition, other collaterals should be external assets with less volatility, rather than internal synthetic assets. It is because external assets are helpful to asset size.

The collateral conditions of other products are as follows (the multi-collateral model that does not substantially help the asset size is recorded as false)

(3) The transaction model is too complicated, and the product usage threshold is high

This problem is the most frustrating problem that the author has encountered in the process of using it. Most of the UI quality of synthetic asset projects is poor. Clear use of zoning.

In my opinion, a synthetic asset project should divide the functionality of the product into three very clear areas. The division of these three areas is based on the user portraits that the synthetic asset project will face.

Essentially, a synthetic asset project should have three types of users:

The first type of users are asset issuers and mortgagers. They capture the arbitrage space brought about by the rising demand for cUSD by assuming the risk of debt fluctuations issued by mortgages.

The second type of users are traders, whose needs are to purchase synthetic assets on the synthetic asset platform.

The third category is miners, whose purpose is to obtain rewards through mortgage or transaction behavior.

In some cases, the attributes of these three types of users may overlap, but it should be more reasonable to smooth out the relevant UI design logic based on such portraits.

I have posted the address of the specific situation of the above project, you can study it yourself

(4) Internal market premium caused by no pricing power

In the fourth section of the first paragraph of this article, we discussed the internal market premium of synthetic assets brought about by the over-collateralization model. There are two ways to solve this problem:

A. Increase the liquidity of internal trading pairs. When the liquidity is greater, the premium impact caused by the same volume of internal demand will be smaller. This solution is consistent with the idea of expanding the overall asset scale. Increasing the value base can reduce the impact of individual operations.

B. Create a larger arbitrage space, prompting arbitrageurs to smooth out the premium

This scheme is similar to the market maker incentive plan and liquidity mining incentive plan of centralized exchanges. The arbitrage cost of arbitrageurs can be reduced through the form of tiered handling fees, which is essentially reducing market-making costs for "market makers".

Or incentivize the arbitrage behavior of arbitrageurs in the form of token incentives.

(5) Debt fluctuations caused by no pricing power

The picture above shows the transaction model adopted by these projects: it can be seen that most projects adopt a global debt model similar to Synthetix. The benefits of this trading model are obvious. But we have mentioned the problem again and again:

There are roughly five possible solutions:

1: Expand the overall asset scale

For example, if the cUSD position on the platform accounts for a larger proportion of the total holdings, it means that other synthetic asset positions have less impact on the overall debt. Therefore, expanding the overall asset scale is essentially reducing the impact of individual debt changes on global debt.

As shown in the figure, when cUSD holds a large position, even if cTSLA rises by as much as 200%, the impact on global debt is still small.

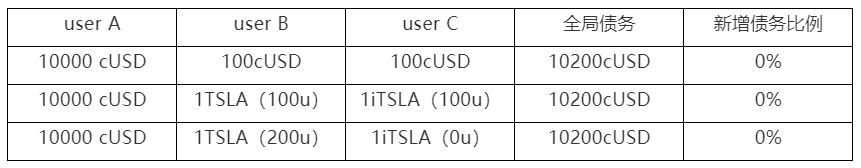

2: Provide the function of reverse assets or short selling to adjust the net position of the platform

Because the reverse asset is essentially the counterparty of the forward asset, when the net position is infinitely close to 0, it means that no matter how the price of the synthetic asset on the platform changes, no new debt will be added. Because all long position changes are hedged by short position changes.

As shown in the figure, if there are three types of synthetic assets and debts in the platform: cUSD, TSLA, and iTSLA, then TSLA=iTSLA. Then: even if TSLA increases by more than 100%, it will have no impact on the global debt.

3: Adjust the net position in the form of economic incentives

When the TSLA position held by userB is much larger than the iTSLA position held by userC, the balancing effect of iTSLA becomes negligible. Therefore, economic incentives are very intuitive and can be flexibly adjusted according to actual conditions.

The significance of doing so is essentially to create arbitrage space.

Arbitrageurs can purchase short position assets on the synthetic asset platform and purchase equivalent long deposit assets in the external market for hedging. The obtained platform currency incentive-handling fee loss is the final risk-free income.

4: Dynamic handling fee + holding fee rate

Through the previous solution, we can clearly see that the balance mechanism of the global debt has some balance mechanism similar to the price of the perpetual contract returning to the spot price.

Both are to reduce long deposits and increase short positions by creating arbitrage space. The core logic is to hope that the net position will approach 0 indefinitely, or reduce the proportion of the net position in the total position. Because the change of net position is the core that affects the change of global debt. The smaller the proportion of net positions, the smaller the impact on global debt.

Therefore, the dynamic handling fee mechanism is equally applicable to the global debt transaction model as the position fee mechanism.

The only problem is: this increase in fees actually increases the "slippage" in a disguised form, which is not conducive to the interaction between the synthetic asset project and other projects. For example, the large amount of sBTC exchange between curve and synthetix mentioned above is not feasible.

However, the author believes that in the short term, composability with some well-known projects is really important. However, the mission and requirements carried by synthetic assets are unmatched by any other DeFi track project. And this kind of slippage, the smaller the net position is, the smaller the slippage will be. When the asset size is larger, the slippage will be smaller. Composability will also have less impact.

The project party should still think about the problem from a longer-term perspective. From the author's experience, the debt risk suffered by most projects in the early stage is far greater than the impact of composability.

5: Profitability VS insurance pool

In the previous article, when we discussed the global debt problem, we mentioned that "the mortgager has become the counterparty of the trader, and the mortgager is also betting on the profitability of the trader while making mortgages."

This sentence reflects from the side that even if there are only one-way assets in the global debt, the new debt will actually be negative.

This is because, if the time dimension is extended, even if some users can earn profits by holding long deposits, most other users may hold long deposits at high levels and sell them at low positions. Then the global debt will not increase but decrease.

In many mature trading markets, most users actually lose money. If it is possible to provide a betting pool based on the previous phased data after the synthetic asset project data is stabilized.

Users participating in the betting pool can inject cUSD to bet on the global debt changes in the next stage.

If the global debt is increased, then the increased amount is paid to the pool.

If the global debt drops, then the debt that should have been reduced to the mortgager will be rewarded to the users participating in the gambling pool.

The purpose of this is to create a global debt index product, and third-party users can bet on this part of the risk.

The advantage is that to a certain extent, the mortgager does not have to bear as much risk as the mirror, makerdao and other pure over-collateralization models.

These are some of the solutions considered by the Prophet. We reviewed the above projects and noted the adoption of similar solutions below.

In addition to the above projects, UMA is also considered a synthetic asset track. In addition, duet adopts a stable form similar to the algorithm in the issuance model of synthetic assets. The research on this part of the prophet is not in-depth, so I won’t expand it here.

first level title

03 Overview

However, due to the complexity of the overall structure, there are often many technical debts at the beginning of the design due to the lack of experience in the first project. Judging from the current performance, these technical debts have become an important factor hindering the development of these projects.

Therefore, the scalability of architecture design and the scalability of product functions will also be the focus of Prophet's attention in the future.

secondary title

overview

It has been online for many years, and the market size and market value are the first

The second market capitalization, the head of Terra ecology

The Beta version is online, and coins will be issued in September

The Bonflux version is online, and coins will be issued in September

There has been a theft

About SeerLabs:

About SeerLabs:

SeerLabs (Prophet Labs) is a leading institution in Asia that focuses on blockchain market incubation. We have global cutting-edge marketing concepts and growth hackers, and are committed to helping project parties and startups achieve lightning-fast growth. Successfully participated in the incubation of 30+ projects such as Ploygon (MATIC), HoDooi.com, DIA, Paralink, Swingby, XEND Finance, BOSON, etc.

Risk warning: Digital assets are a high-risk investment target. The general public is requested to view the blockchain rationally, raise risk awareness, and establish correct currency concepts and investment concepts.