Weekly Editor's Picks (November 29 - December 5)

- 核心观点:加密货币成年轻群体重要政治资产。

- 关键要素:

- AI独撑增长,市场非基本面驱动。

- 机构预测显示监管环境持续改善。

- MicroStrategy债务风险集中于2028年。

- 市场影响:增强资产政治属性,关注长期风险。

- 时效性标注:长期影响。

"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes a lot of high-quality in-depth analysis, but these may be hidden in the news feed and trending news, and you may miss them.

Therefore, every Saturday, our editorial team will select some high-quality articles worth reading and saving from the content published in the past 7 days, bringing new inspiration to you in the crypto world from the perspectives of data analysis, industry judgment, and opinion output.

Now, let's read it together:

invest

Economic Truth: AI Drives Growth, Cryptocurrency Becomes a Political Asset

The market is no longer driven by fundamentals;

AI capital expenditure is the only pillar to avoid technological decline; the bottleneck of AI is not GPUs, but energy.

A wave of liquidity is expected in 2026, but the market consensus has not even begun to price it in yet.

The wealth gap has become a macroeconomic obstacle forcing policy adjustments;

Cryptocurrencies are becoming the only asset class among young people with real upside potential, which gives them political significance.

2025 Crypto Predictions Retrospective: Top Ten Institutions, Who Understands the Market Best?

The number of predictions is negatively correlated with the accuracy rate; the more you predict, the more mistakes you make.

Attempts to predict specific price points and numbers almost always backfire.

The policy predictions were highly reliable; the improvement in the regulatory environment and the US’s friendliness towards crypto were predicted correctly by almost all institutions and individuals.

The value of these institutions' annual forecasts lies not in "telling you what to buy," but in "telling you what the industry is thinking." We can treat these forecasts as indicators of industry sentiment; however, if you use them as an investment guide, the results could be disastrous.

Also recommended: " Tether's Latest Investment Map: Crypto Still Dominates ", "Full Text of CZ and Peter Schiff's Heated Debate: 300 Million Users Support Not a Ponzi Scheme, but a New Generation of Financial Consensus ", " Full Text of Saylor's Dubai Speech: Why Bitcoin Will Become the Underlying Asset of Global Digital Capital ", " BitMEX Alpha: Funding Rates for US Stock Perpetual Contracts on Hyperliquid ".

Entrepreneurship

After the tide recedes: Which Web3 projects are still making money?

CEX+ on-chain projects (PerpDex, stablecoins, public chains).

Nansen's newly launched 7-day agreement revenue data watch.

Is this a good time to buy at the bottom? In-depth analysis of DeFi tokens with "real returns".

ENA incurred huge costs, but almost all of these costs were recycled to subsidize TVL, so the agreement’s actual “surplus” was negligible.

Pendle's fundamentals deteriorated along with its price. With its TVL plummeting to approximately $3.6 billion, the current sell-off is not a divergence between price and value, but rather a rational market reaction to the shrinking business.

HYPE is a giant money-printing machine, generating over $1.2 billion in annualized revenue, almost all of which is used for token buybacks—but its price already reflects winner expectations and it is currently maintaining growth by reducing fees.

Also recommended: " From ETH to SOL: Why L1 will eventually lose to Bitcoin? "

CeFi

Crypto ETFs see massive capital outflows; how are firms like BlackRock faring?

The decline in fund flows reflects not only investor sentiment but also directly impacts ETF issuers' fee income. The larger the issuance size, the more severe the fall. While issuers cannot prevent investors from redeeming their shares during a sell-off, income-generating products can mitigate downside risk to some extent.

Tiger Research: Strategy's real crisis will come in 2028.

Strategy's static bankruptcy threshold is projected to be around $23,000 in 2025, almost double the $12,000 level in 2023.

In 2024, the company shifted its financing model from simple cash and small convertible bonds to a diversified mix including convertible bonds, preferred stock, and ATM issuances.

Investors holding call options are allowed to redeem them before expiration. If the price of Bitcoin falls, investors are likely to exercise these options, making 2028 a critical window of risk.

If the 2028 refinancing fails, assuming a Bitcoin price of $90,000, Strategy might need to sell approximately 71,000 Bitcoins. This equates to 20% to 30% of its daily trading volume, which would put significant pressure on the market.

Reserves can stop the bleeding in the short term, but they cannot change the fundamental nature of the business model; the predicament did not appear suddenly, but was written into the DNA of the strategy—a long-term reliance on high volatility, high leverage, and high financing.

Risks don't appear out of nowhere, but market prices can make them seem like they have.

MSTR's Tribulations: Short Selling and Palace Intrigue

MSTR's stock price and market capitalization shrank dramatically in the short term, plummeting by more than 60%. Strategy may even be removed from the MSCI stock index. More far-reachingly, it has been drawn into a battle for monetary power.

The power struggle is unfolding on one side: the old system – the Federal Reserve, Wall Street, and commercial banks (centered around JPMorgan Chase); and on the other side: a new system taking shape – the Treasury, a stablecoin system, and a financial system with Bitcoin as long-term collateral.

The methods used to target MSTR are systematic. JPMorgan Chase understands the rules of the game all too well, because they set them. If Wall Street were to loosen even one screw in MSTR, then "price collapse, debt defaults, disappearance of premiums, and index strangulation" would all cause a short-term imbalance in MSTR's structure. But conversely, when the entire chain is in motion, it could become one of the most explosive targets in the global capital markets.

This is the allure of MSTR, and also its danger.

Bitwise Chief Investment Officer: Don't worry unnecessarily, Strategy will not sell Bitcoin.

In the long run, MSTR's value depends on the effectiveness of its strategic execution, not on whether index funds are forced to hold its shares. MSTR's share price falling below net asset value will not trigger a sell-off of Bitcoin. Similarly, debt conversion is not a near-term problem. The company has no maturing debt before 2027, and its cash reserves are sufficient to cover foreseeable interest expenses; extreme scenarios are highly unlikely.

Also recommended: " Stock Price Halved Yet Long-Term Capital Investors Receive: Unveiling Strategy's 'Mysterious Shareholder Group' " and " Nasdaq Accelerates: From 'Soup' to 'Flesh,' Is Tokenization of US Stocks Entering the Decisive Battle? "

Prediction Market

Why prediction markets are really not gambling platforms

The two have different price formation mechanisms (market vs. house), different uses (entertainment consumption vs. economic significance), different participant structures (speculative gamblers vs. information arbitrageurs), and different regulatory logics (financial derivatives vs. regional gambling industry).

Regulatory jurisdiction determines the scale of an industry: the ceiling for gambling is at the state level, meaning fragmented regulation, heavy tax burdens, inconsistent compliance, and the inability of institutional funds to participate, inherently limiting its growth path; the ceiling for prediction markets, on the other hand, is at the federal level. Once incorporated into the derivatives framework, it can reuse all the infrastructure of futures and options: globally accessible, scalable, indexable, and institutionalizable. At that point, it will no longer be a "prediction tool," but a complete set of tradable event risk curves.

For capital, the underlying question is not whether the market can grow; rather, how much it will be allowed to grow.

After the two parties join forces, the most affected will be Polymarket and its "crypto native users," the biggest beneficiary will be the Solana ecosystem, and the long-term beneficiary will be the entire prediction market sector.

Polymarket's window for a comeback is only 6–9 months.

Also recommended: " The Battle for the Future of Prediction Markets: Left is Casino, Right is News ", " Sued in Seven States While Raising $11 Billion in Funding: The Game of Thrones for Prediction Market Star Kalshi ", and " From Ballet Dancer and MIT Academic to 29-Year-Old Female Billionaire: Kalshi Founder's 6-Year Life-Changing Story ".

Airdrop Opportunities and Interaction Guide

Interactive Tutorial: 9 Highly Funded and Popular Projects with Open Testnets

Ethereum

Ethereum will undergo these major changes in 3 days.

A detailed explanation of the nine EIP proposals in the Fusaka upgrade requires some technical background. The core changes revolve around scaling, opcode updates, and execution security.

Also recommended: " Trend Research: From Public Chain Infrastructure to Global Financial Ecosystem, Ethereum's Value Leap ".

Multi-ecosystem

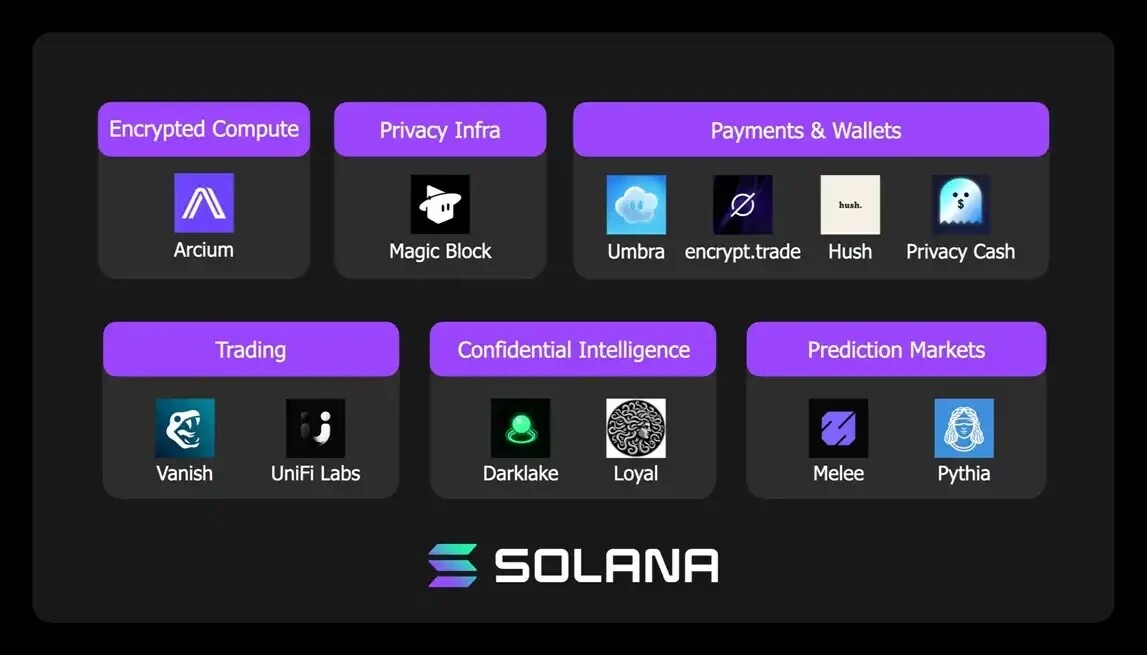

Solana officially named 12 noteworthy new projects.

Safety

Anthropic, a leading AI company and developer of the Claude LLM model, today announced a test that uses AI to autonomously attack smart contracts.

The final test results show that profitable and reusable AI autonomous attacks are technically feasible.

Weekly Hot Topics Intensive Review

Over the past week, the market rebounded after another dip ; the central bank held a meeting to crack down on speculation in virtual currency trading , emphasizing the risks of stablecoins; HashKey Holdings passed the Hong Kong Stock Exchange hearing and officially launched its listing process in Hong Kong ( Analysis ); Ethereum completed the Fusaka upgrade , officially entering a cycle of two hard forks per year; SEC Chairman: Innovation exemptions for cryptocurrency companies will take effect in January 2026;

In addition, regarding policy and macroeconomic markets, the US SEC Chairman stated that the cryptocurrency market structure bill is about to be passed; US banks are allowing wealth advisors to recommend that clients allocate up to 4% of their assets to Bitcoin ; the UK government will implement new cryptocurrency tax regulations starting in January 2026, strictly investigating tax evasion; the yield on Japan's 20-year government bonds rose 5.5 basis points to 2.88%, the highest level since June 1999; abnormal fluctuations in Japanese interest rates have triggered a global rebalancing ; and the Japanese government plans to uniformly reduce the tax on cryptocurrency asset gains to 20% , with the earliest submission to the Diet for review in 2026.

In terms of opinions and statements, Delphi Digital: The Fed's liquidity buffer has run out, and a key headwind in the crypto market may be receding ; Grayscale predicts Bitcoin will reach a new high in 2026 , refuting the four-year cycle theory; Opinion: Institutional investors are flocking to the Bitcoin retail market , and strong growth may be expected in 2026; WSJ: Investors are worried about a new crypto winter, with some predicting that Bitcoin prices may fall to $60,000 ; "Big Short" Michael Burry: Bitcoin is "the tulip bulb of our time," and a $100,000 Bitcoin is absurd; Arca's Chief Investment Officer: This is the most bizarre sell-off in history, with native investors exhausted and new funds failing to enter ; Peter Schiff comments on Strategy's launch of a dividend reserve fund: Today is the beginning of MSTR's doom ; Strategy CEO: $14 billion in reserves can alleviate selling pressure, and future BTC lending business may be considered ; Strategy CEO: Bitcoin will only be sold if the share price falls below net asset value and new funds cannot be obtained ; Michael Saylor publicly announced Strategy. Financial data indicates an exceptionally healthy capital structure; Nasdaq executives: Pushing forward with tokenized stock plans, SEC approval is the highest priority; He Yi: Prioritizing retail investor interests is Binance's core principle ( first interview since becoming co-CEO ); Arthur Hayes criticizes Monad , warning USDT may become insolvent ; Alliance DAO co-founder: Fee/revenue ratio is an objective indicator for assessing L1 moats ;

Regarding institutions, large companies, and leading projects: Vanguard will open trading for funds related to crypto assets such as Bitcoin, Solana, and XRP; Binance co-founder He Yi has been appointed as co-CEO, with the platform boasting nearly 300 million registered users ; Polymarket launched a US version of its app ; predict.fun, a prediction platform incubated by YZi Labs, will soon be launched on BNB Chain ; CNBC announced the integration of Kalshi prediction market data into its television, digital, and subscription platforms; Sony may launch a USD stablecoin for payments within its ecosystem, including games and anime; Uniswap now supports Revolut for purchasing cryptocurrencies ; Stable launched its token economics model , with its ecosystem and community accounting for 40% of the total supply; Sahara AI reported no unlocking or security incidents, and an investigation into abnormal market fluctuations is underway; prediction market platform Kalshi faces a class-action lawsuit , accused of operating sports betting without a license; Rayls released its token economics ; Rayls launched an airdrop application .

According to data from F2Pool, most older Bitcoin mining machines have fallen below their shutdown price .

In terms of security, Huiwang Payment has only 990,000 USDT left on its blockchain and has stopped users from withdrawing funds ; Yearn's yETH pool suffered a complex attack , resulting in a loss of approximately $8.9 million... Well, it's been another tumultuous week.

Link to the "Weekly Editor's Picks" series is attached .

See you next time~