The world map of DeFi

It has become a consensus that the cryptocurrency field is gradually growing in developing countries (emerging economies). What we want to talk about today is the DeFi sector in this field.

Compared with developed countries, the demand for DeFi in developing countries is actually greater. However, due to the limitations of some objective conditions, such as currency depreciation, network inconvenience, etc., the application of DeFi has not been well attracted to those who need it most. User. This article is supported by the Baked Boys Alliance.

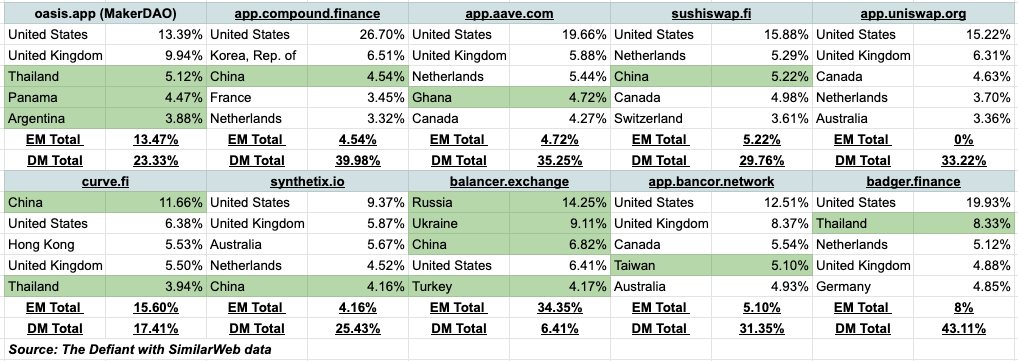

According to statistics from SimilarWeb, the current traffic ranking of all DeFi DApps last month only accounted for 10% in developing countries, while developed countries accounted for 28%.

The top 5 traffic sources among the top 10 DeFi protocols come from DeFi Pulse

This statistic only analyzes 10 of dozens of protocols, and summarizes the top five traffic sources, but it is also enough to reflect the problem of insufficient development of DeFi in developing countries. Emerging economies have the highest number of users on Balancer, 34%, and Uniswap has the least number, as all major traffic sources come from developed countries, with the U.S. topping eight out of ten projects.

secondary title

DeFi, the trend has come

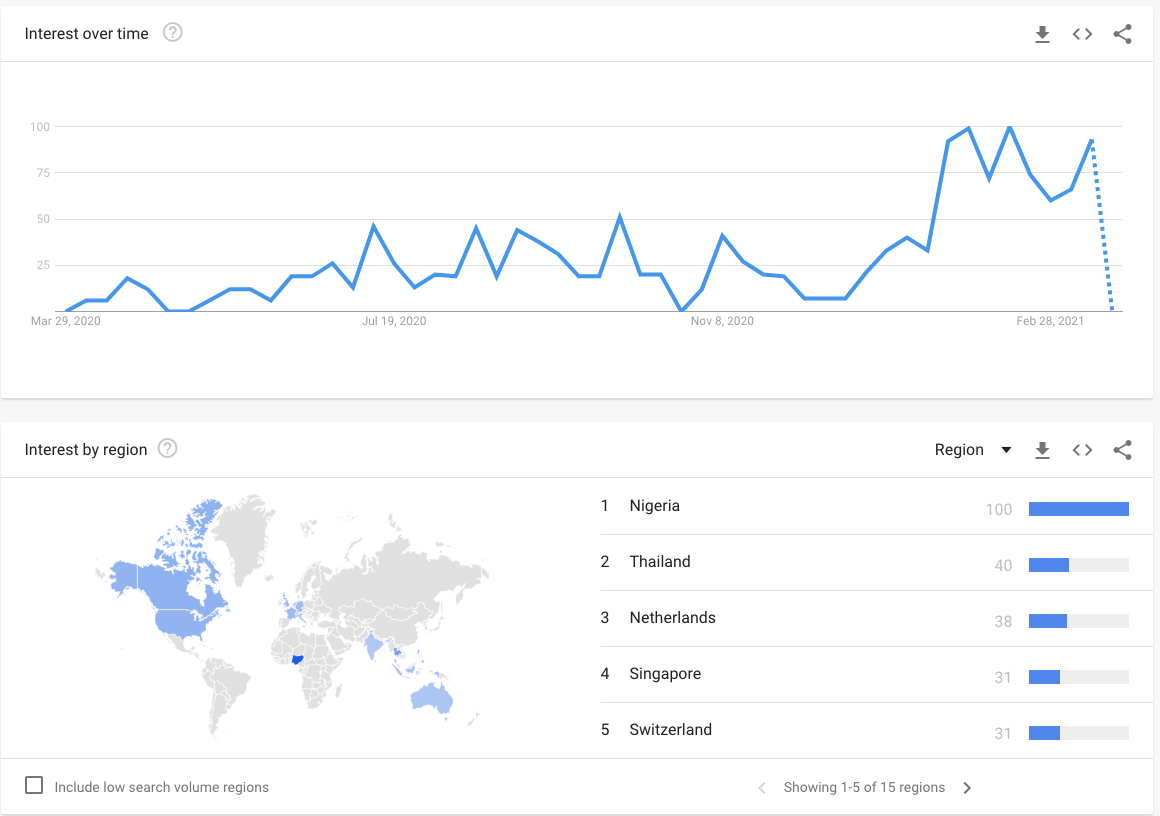

Although more users on DeFi come from developed countries, it can be seen from Google Trends that people in developing countries are also increasingly interested in DeFi. As of March, Nigeria and Thailand were the two countries with the most searches for “decentralized finance” in the past 12 months.

Ugochukwu Aronu, founder of Xend Finance, said that due to issues such as currency devaluation, DeFi has aroused the interest of many young people in Nigeria, "these people like to try new things." According to the World Population Review, the average age in Nigeria is 18.1 years and in the United States it is 38.1 years.

* Xend Finance is a platform that supports credit unions in African countries.

secondary title

Bitcoin Portal

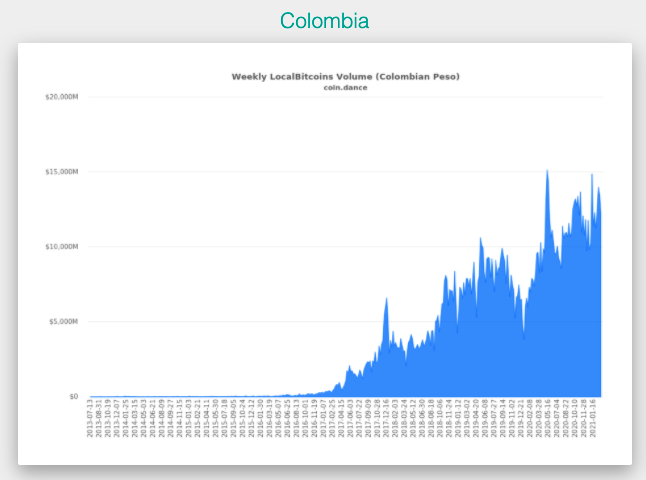

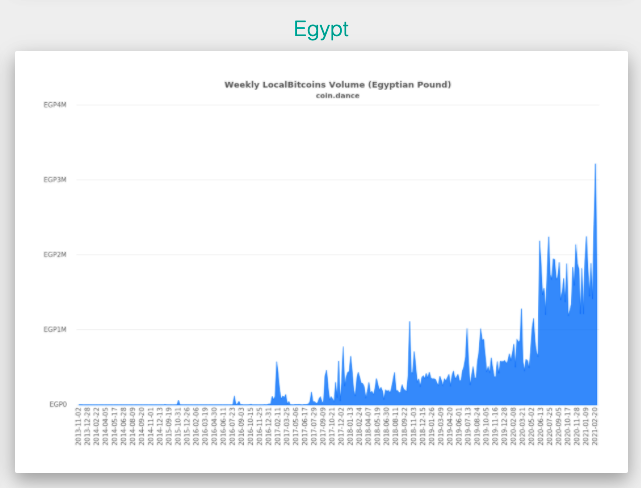

Increased Bitcoin adoption should be a major sign of DeFi adoption, as the most popular cryptocurrency is often the gateway for users to other cryptocurrencies and DApps.

A spokesperson for Bitcoin Beach, a Bitcoin town in El Salvador, told The Guardian (The Defiant) about the cryptocurrency economy, "We will see a wider and bigger DeFi within 6 months."

Ethereum layer 2 and other lower gas layer 1 may help countries with lower GDP per capita use DeFi.

secondary title

regulatory uncertainty

A stricter regulatory environment may also drive DeFi adoption in developing countries.

The U.S. Treasury Department's FinCEN introduced legislation in December that would require money services businesses to comply with enhanced "know-your-customer" and record-keeping requirements, including the names and addresses of counterparties. Integrations with custodial platforms such as Coinbase may not be legal since DeFi protocols cannot provide any. U.S. President Joe Biden has since frozen all pending regulations from the Trump administration, including the FinCEN proposal, but the ambiguity has made it difficult for DeFi services to confidently move forward.

The Financial Action Task Force has also drafted a travel rule, the committee's 38-country membership is hardly in the developing world, and the guidance will require virtual asset providers (VASPs) to communicate with other VASPs and Other VASPs share information about their customers.

secondary title

Pave the way

Investors and entrepreneurs are looking to meet the demand for financial services in emerging markets, Aronu, founder of Xend Finance, is one example.

“One of the things we’ve been able to do for them at Xend Finance is create a system where credit unions can put their money together and keep it in our system,” Aronu told The Defiant.

Originally from Nigeria, Aronu is no stranger to inflation. The country's consumer price index rose 16 percent in January. The depreciation of the Nigerian naira exchange rate has in part exacerbated the popularity of cryptocurrencies in the country.

secondary title

mobile drive adoption

Karthik Bupathi, founding partner of venture capital firm Arcanum Capital, launched a $10 million venture fund last month focused on supporting blockchain technology development in emerging markets. He stated that the DeFi revolution in emerging markets will be mobile.

The penetration of smartphones with internet connections is soaring among the underbanked. According to a GSMA report, smartphone penetration will reach 80% globally by 2025, and countries contributing to this growth include India, Indonesia, Pakistan, and Mexico. India has the cheapest mobile broadband prices in the world, according to the BBC.

“There is a market for people to build their own front-end/UI/UX, specific to their target market,” Bupathi, who is betting that winning DeFi apps will be launched on mobile platforms, told The Guardian. “We’re looking for people with projects that can expand some of the services currently covered by these base agreements, and really believe there’s a lot of growth opportunity for UX-focused projects as well, especially from a revenue generation standpoint.”

secondary title

Going to DeFi

A common line between Aronu's products and Bupathi's vision is to build on top of established DeFi protocols, and trying to compete with Aave or Compound's deep liquidity may just be ineffective. Winning in emerging markets could mean bringing users into the existing world of DeFi through demographic-specific user experiences.

Those with mobile phones but no traditional banking services may miss out on DeFi entirely.

Aronu, whose brother has been working in the medical field for the past three-and-a-half years in the United States, said: “Since then, I don’t remember going to the bank to save money, everything is done through cryptocurrency. It makes Life just got so much easier."