What are the application scenarios of Layer2?

Ethereum is the premier infrastructure for open applications worldwide. But due to its unique design, using the network during periods of high demand can be expensive and slow -- after all there is only so much block space available.

That said, Ethereum will eventually scale on the base layer with Eth2, which will greatly increase its transaction throughput. But the expansion of Eth2 will take a long time. Is there any way to avoid waiting so long?

The answer is the 2-layer network (Layer 2) solution.

Layer 2 network solutions are built on top of Ethereum (off-chain, relieving congestion on the main chain), but rely directly on the security and finality of Ethereum to provide near-instant and affordable Ethereum transactions, i.e. transactions such as transfers, Trading or staking.

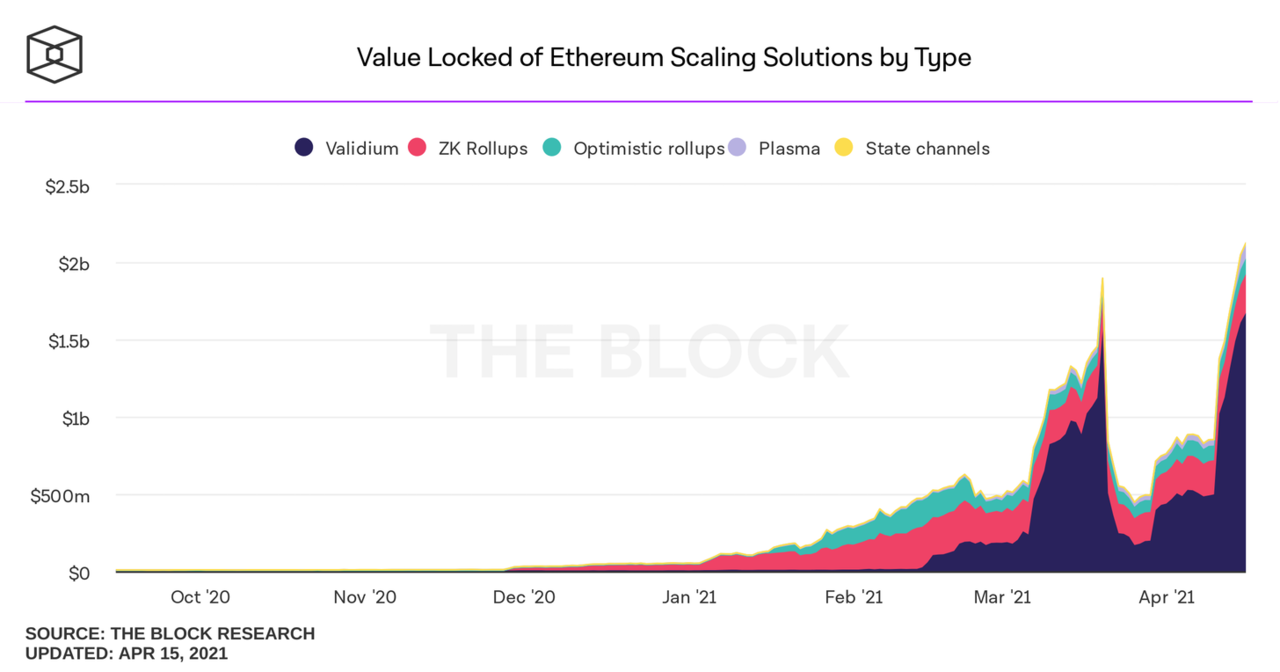

These L2 systems are not just theoretical either, there are already multiple L2 solutions in use and new L2 projects and integrations are being born every day. At the time of writing, there are $300 million worth of cryptocurrencies secured through two major L2 models (ZK Rollups and Optimistic Rollups).

Now is the era of L2 solutions. This article will provide you with 7 solutions to participate in L2, and let you get started👇

1. Use Aave to borrow and borrow on Polygon

Earlier this year, Matic (a scaling project with scaling work around the Matic Plasma chain and Matic PoS sidechains), later renamed Polygon, was launched as part of a move towards an "Ethereum-based Internet of Blockchains".

As part of the rebrand, the team will now be adopting Optimistic Rollups, ZK Rollups, and more.

Shortly thereafter, DeFi lending protocol leader Aave released New Frontiers, a campaign that will see the project adopt a range of scaling solutions so its users can choose. In the same announcement, Aave revealed that the first integration of the scaling campaign is with Polygon’s PoS sidechain.

It is important to emphasize that this sidechain does not directly inherit Ethereum's security guarantees like most L2s, but it does provide L2-like throughput capabilities. In New Frontier, there is a good chance that Aave and Polygon will further harmonize together.

At the same time, users can process Aave loans on the Polygon sidechain at a low price. First, make sure to add the Polygon network to your MetaMask wallet, then go to Aave and click on the "Polygon" Markets tab to view available market opportunities.

2. Decentralized trading

dYdX is a decentralized exchange or DEX known by offering decentralized margin, spot and perpetual trading on Ethereum.

Traders want to trade as quickly and economically as possible. Fortunately, dYdX has just announced the launch of L2 perpetual transactions via StarkWare’s StarkEx scalability engine.

StarkEx is both powerful and flexible, capable of supporting on-chain data availability via ZK rollups, or off-chain via Validium. This engine takes the UX around dYdX perpetual transactions to the next level no matter how much you want to slice. Perpetual products that already exist in the DEX's L2 integration include:

ETH-USD

BTC-USD

LINK-USD

UNI-USD

AAVE-USD

3. Stake SNX to earn rewards

Synthetix is the leading DeFi derivatives project. If an asset exists, whether on any blockchain or in the real world, it can be traded via Synthetix as an on-chain synthetic asset.

At the heart of this powerful protocol is staking, where users provide Synthetix's native token (SNX) to the protocol for pooled collateral. In exchange for this service, SNX earns inflationary SNX rewards as well as transaction fees.

In early 2021, SNX staking will take place on the Optimism team's eponymous Optimistic Ethereum (OΞ) L2, which, as the name suggests, is based on Optimistic Rollups technology.

Users can deposit SNX and migrate their stake from L1 to L2 using the official Synthetix staking dashboard.

In addition, Optimistic has a 7-day withdrawal period. If you are in a hurry to spend money, you need to pay attention to this in advance.

4. LRC rewards

When participating in DeFi, network congestion will lead to higher costs of "receiving food", and all operation costs such as authorization, transfer, and transactions will increase.

But if you use Loopring's L2, it's different.

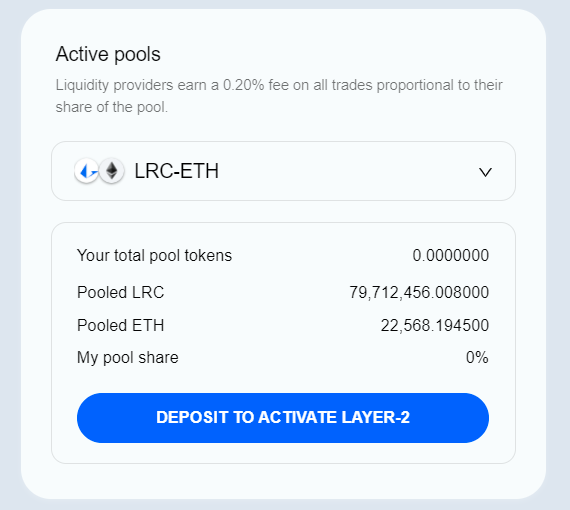

Loopring is an exchange and payment protocol powered by ZK-Rollup technology. The builders of the project created Loopring Exchange to provide users with an automated market maker (AMM) experience with L2 advantages.

Since AMMs rely on liquidity to thrive, Loopring currently holds liquidity mining to attract liquidity providers. Anyone who makes an LP of Loopring can accordingly earn rewards denominated in the project's native token, LRC.

5. Trade with DeversiFi

Powered by StarkWare's StarkEx scalability engine, DeversiFi is an efficient one-stop decentralized exchange that offers a range of services, including decentralized order limits, OTC trading, and free transfers.

This naturally makes the dapp ideal for trading popular DeFi series tokens such as UNI, MKR and AAVE.

Of course, the Loopring AMM mentioned in the previous article can also be used to trade DeFi tokens, so this is not the domain of DeversiFi.

Advanced traders may like DeversiFi as it offers more trading features than a standard AMM, so if you are looking for a trading-focused L2 app, then this is the one to explore.

6. Donate to the Gitcoin project

Backed by open source software (OSS), Gitcoin has recently gained popularity as a tool for getting paid for developers of open source software such as Ethereum and DeFi.

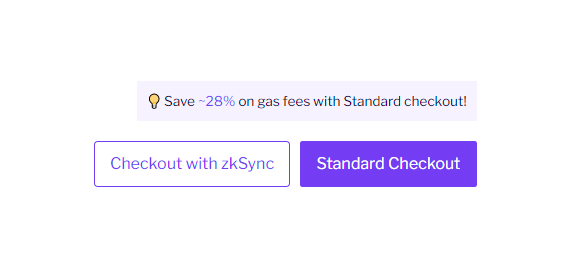

Gitcoin is known for its Gitcoin grants, crowdfunding projects that benefit from Quadratic Funding (QF) and matching donations. It’s worth noting that projects can receive donations via Gitcoin at any time, and amazingly the platform recently integrated support for zkSync so users can save via L2 donations when needed.

The process is simple. Add one or more items, go to checkout, and select the "Checkout with zkSync" option. At this point, you will be taken to the dashboard where you can deposit funds into L2. Can save a lot of gas fees.

secondary title

7. Pay on Superfluid

Superfluid is a money flow protocol that allows anyone to open a flow of payments that send money to them in real time. The protocol utilizes two different scaling solutions, xDAI and Polygon, so users can choose according to their preferred taste.

Users can process multiple incoming value streams through DAO, and reward their contributors with a part of these streams or NFTs, which represent music rights, and pay royalties to NFT holders every year, then Superfluid is achievable application for this purpose.

One advantage of Superfluid is that streams are not locked and can still be freely moved between accounts. And users can also slice the stream as needed, forwarding it to another recipient in any number they choose, effectively creating an interconnected network of wallets that can exchange value in real time.

The golden age of L2 activities has just begun, and now it is continuing to innovate and iterate rapidly. In the future, there will be more powerful functions and feasible solutions to further expand the ecosystem.

The golden age of L2 activities has just begun, and now it is continuing to innovate and iterate rapidly. In the future, there will be more powerful functions and feasible solutions to further expand the ecosystem.

This article is supported by the Roast Boy Creators Alliance.