Interview with Yvonne: How Does USDD, Aiming to Be the "Interest-Bearing USDT," Achieve Its $10 Billion Goal?

- Core Viewpoint: Stablecoins are the core narrative of Web3 in 2025, and USDD challenges the leaders with its robust mechanism.

- Key Elements:

- USDD employs an over-collateralization and PSM mechanism to ensure security and stability.

- Launches interest-bearing products like sUSDD to provide sustainable yields.

- Multi-chain expansion strategy is successful, with TVL nearing the $10 billion target.

- Market Impact: Intensifies stablecoin competition, pushing the industry towards a balance between robustness and yield.

- Timeliness Note: Medium-term impact

Looking back at the recently concluded year of 2025, one of the few narratives in the Web3 world that remained "resilient throughout the year" was stablecoins.

Traditional finance and CEX giants, DeFi majors, and emerging yield protocols have all entered the fray—some leveraging resources to focus on payments and connecting Web2 and offline traffic, while others concentrate on innovation to provide native crypto users with more flexible and reliable capital operation spaces and mediums.

The era of a hundred stablecoins contending is reminiscent of the "Groupon wars" of the internet age: capital provides the power, and users reap the benefits.

On December 12, USDD launched on Binance Wallet Yield+, introducing a 30-day, 300,000 USDD incentive program. The sUSDD TVL surpassed $150 million within a day, showing a strong push to "hit year-end KPIs."

Odaily took this opportunity to discuss with USDD's Head of Communications, Yvonne Chia, covering topics such as the stablecoin industry's capacity and current saturation, user-side selection considerations, and USDD's advantages and future momentum. Below are the highlights of the Q&A:

Q1: Could you please briefly introduce yourself, covering your work experience since entering the industry and your main responsibilities at USDD? What is the approximate size of your department, and what are the internal divisions of labor?

I am Yvonne Chia, currently serving as the Head of Communications for USDD, dedicated to closely connecting the project's vision with the global community. I have been closely following the latest developments in the crypto industry and firmly believe that stablecoins are key to building a stronger, more inclusive financial system.

Q2: From the internal perspective of a stablecoin "practitioner," what is the expected industry size (capacity) for stablecoins by the end of 2026?

Growth forecasts for stablecoins have been very optimistic. For instance, not long ago, U.S. Treasury official Scott Bessent predicted the market size could reach $3 trillion by 2030, while Citi estimated $4 trillion. These forecasts highlight the vast untapped potential in this space. We see a growing demand for reliable digital dollars and believe stablecoins like USDD will play a crucial role as the ecosystem continues to evolve and mature.

Q3: In the long term, what is the demand ceiling for stablecoins? What key factors determine their growth rate?

Rapid growth often comes with higher risks. Some stablecoin projects, in pursuit of scale and yield, may overlook risk management and capital adequacy, leading to liquidity issues or stability declines, which in turn affect user confidence. Stablecoins need to find a balance between price stability and reasonable yield. Only projects with robust risk controls, sufficient collateral, and transparent operations can maintain this balance, earn long-term trust, and sustain development in a fiercely competitive and ever-changing market.

Q4: Currently, has the stablecoin market entered a "red ocean"? Are we facing a situation with too many issuer brands competing for existing users and funds?

In recent years, the stablecoin market has indeed experienced rapid growth with a surge of new products. Some projects were launched to compete for existing users with short-term high yields, but unfortunately, not all have a solid foundation to support long-term stability and trust. Recent de-pegging incidents highlight the risks when a stablecoin's underlying mechanisms and risk management are inadequate. This also reminds us that sustainable growth must be built on fundamentals like USDD, which has solid mechanisms and robust risk management, not reliance on short-term high APYs.

Q5: From a user's perspective, what are the considerations for choosing which stablecoin to use?

From a user's perspective, choosing a stablecoin essentially answers one question: Can it "hold steady" at critical moments?

This is precisely why USDD consistently adheres to the philosophy of "Stability Breeds Trust," prioritizing stability and security, and building sustainable yield mechanisms on this foundation. We are committed to being a trustworthy stablecoin choice for users across different market conditions.

Q6: In terms of security (strong backing, ample policy resources, long-term stable operation), yield (emerging high-yield stablecoins), and convenience (integrated ecosystem, yield scenarios, circulation scenarios), what are USDD's weapons for challenging the "established leaders"?

Choosing a stablecoin hinges on whether it can deliver stability, security, and transparency, truly meeting user needs, not just on its size.

First, regarding yield, while leveraging advantages like the USDD PSM's 1:1 USDT/USDC lossless conversion with no lock-up period, we also launched a Yield Bearing product—sUSDD—in Q4 2025. Users can convert USDD to sUSDD with one click, earning passive interest with auto-compounding. At launch, the annualized yield reached as high as 12%, attracting nearly $100 million in TVL. Furthermore, sUSDD can be used in on-chain scenarios, such as providing liquidity on Uniswap and PancakeSwap, with lending functionalities planned for the future. This means users holding sUSDD not only benefit from its investment returns but can also engage in other applications based on their preferences.

When comparing stablecoins, one shouldn't just look at market share but also whether the stablecoin genuinely meets user needs. Take USDT, for example. It is the market leader in terms of liquidity, depth, and use cases, but it is centrally controlled by Tether, carrying significant centralization and freezing risks. More importantly, Tether was exposed this year for investing part of its collateral in assets like BTC and gold to generate yield, exposing users to risk without distributing any interest—an extreme asymmetry between risk and reward.

In contrast, USDD offers a great solution for beleaguered users, both in terms of its decentralized nature and the product itself: freeze-resistant, auto-yielding, and withdrawable at any time. The entire process is lossless, requiring only minimal gas fees. From this perspective, USDD can be seen as a "yield-bearing version of USDT."

Q7: Specifically regarding security, how does USDD ensure users feel confident about converting and depositing?

USDD has a robust security framework. First, USDD employs an over-collateralized debt position (CDP) model. Users mint USDD using TRX / sTRX / USDT at different minimum collateral ratios, ensuring each USDD is backed by sufficient assets (see the Vaults page for details). Additionally, through the Peg Stability Module (PSM), users can swap USDD for other stablecoins at a 1:1 ratio with zero slippage. During market volatility, arbitrage opportunities help automatically correct the price. Furthermore, if the collateral ratio falls below the required level, the system automatically initiates public auctions to liquidate collateral assets, maintaining price stability without manual intervention. The entire process is transparent, secure, and controllable, ensuring user confidence.

Q8: What is the update frequency for the collateral, Proof of Reserves (PoR), and other metrics displayed in the official website's data section? Is this data presentation audited? Which regulatory bodies oversee it?

Transparency is at the core of USDD's operations. We firmly believe in "user-verifiable trust"—trust is not an empty promise but security that users can personally verify. For example, Smart Allocator investments are managed by an internal team, with all transaction hashes, positions, and yields publicly available on-chain. Users can directly query this on the official website (see the SA001-A details page as an example). USDD's collateral assets are held in publicly verifiable contract addresses, ensuring complete transparency. The financial data dashboard updates key metrics in real-time, allowing users to monitor collateral and PoR data at any time.

Furthermore, USDD regularly undergoes third-party independent audits. It has passed five rounds of security audits by ChainSecurity and CertiK with no critical vulnerabilities and has received a CertiK Skynet AA rating with an 87.5 security score.

Q9: Specifically regarding yield, many stablecoins have subsidy campaigns in their early stages. However, those who have been involved in Crypto wealth management long-term also find that "sustainability is an issue," and the various risks of moving funds around increase. What long-term promises or strategies does USDD have to retain existing users? What is the source of the yield? Will it be expanded in the future?

The primary source of USDD's yield is our Smart Allocator investment program. Smart Allocator is a profit-sharing mechanism that generates returns like interest and platform rewards by strategically allocating a portion of USDD's reserve funds into high-quality projects. The standout feature of Smart Allocator is its focus on sustainable growth rather than short-term high-yield hype. The overall investment strategy is conservative, actively managed by the USDD and JUST DAO teams. Investment platforms undergo strict risk control screening, prioritizing high liquidity and reliability. All investment operations are transparent and on-chain verifiable; users can track each investment in real-time on the Smart Allocator page.

Currently, Smart Allocator's profits have exceeded $8.34 million and are still growing. During the protocol's early development phase, TRON DAO also provided phased yield subsidies to support ecosystem cold-start and user growth. This subsidy is not a long-term dependency and has gradually transitioned back to a sustainable yield structure centered on Smart Allocator.

Additionally, USDD has two auxiliary yield sources: the stability fee charged when minting USDD through the Vaults mechanism and the liquidation fee from collateral vault liquidations.

Overall, this robust yield structure ensures long-term stable growth.

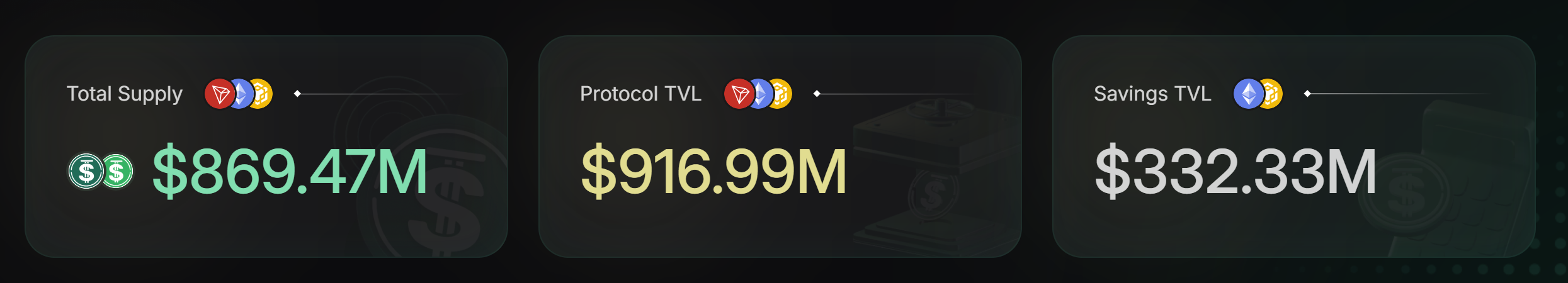

USDD Official Website data as of 11:00 AM, January 7

Q10: Specifically regarding convenience, strongly binding to a specific ecosystem (Tron) and exchange (HTX) in the early stages was a good strategy for cold-start. However, when expanding to competitor platforms and multiple ecosystems (e.g., already launched on Ethereum and BNB Chain) in the mid-term, do you encounter resistance? Whose KPI is the horizontal expansion of the stablecoin? What is the actual partnership process?

USDD's expansion from its initial launch on the TRON chain to its native deployment on Ethereum and BNB Chain has progressed very well. Taking the recent Yield+ campaign launched on a leading wallet as an example, it attracted over 3,000 users in the first week, with sUSDD TVL growing by over 867%. The sUSDD TVL also surpassed $295 million, making it the fastest-growing stablecoin during that period. This fully demonstrates strong user demand rather than resistance.

USDD will continue to drive multi-chain, multi-platform expansion to meet growing user demand.

In addition to product R&D, marketing, and risk control, we have a strategy department responsible for formulating strategies. Besides researching competitors, they also monitor all the latest and hottest trends and platforms in the market, such as PTYT, points systems, and "zui lu" (referring to specific promotional tactics), and then provide executable plans based on specific situations. After internal confirmation, the business development department finalizes the partnerships.

The actual partnership process is as follows: For example, our recent collaboration with a leading wallet took over a month from initial contact to mutual agreement on intent, finalizing details, and actual launch—a relatively long cycle. The most challenging part was the due diligence (DD) phase, as our partners are very reputation-conscious and strictly vet project quality. However, this process is also valuable because passing the DD of a leading platform serves as an endorsement for us. I believe this will reduce resistance in our future collaborations with other partners/communities.

Q11: What are USDD's phased goals?

USDD's current goal is to reach $1 billion in liquidity.

How have we achieved this wave of explosive growth over the past year? On the path to this goal, we experienced a clear period of accelerated growth: early high yields of 20% on the TRON chain rapidly boosted the ecosystem; subsequently, the launch of sUSDD extended yield opportunities to Ethereum and BNB Chain, propelling USDD into a multi-chain development phase. Simultaneously, partnerships with leading exchanges and channels allowed USDD to reach a broader user base.

Driven by these multiple factors, USDD TVL has now exceeded $900 million. Looking ahead to the next phase, USDD will continue collaborating with on-chain exchanges and DeFi protocols, coordinating on-chain and off-chain efforts simultaneously, expanding into a dual-drive model, continuously expanding real-use cases and capital deposits, and laying the foundation for further ecosystem growth.

As a yield-bearing version of USDT, USDD will always provide users with diversified yield methods. Based on this, we have prepared a series of major activities: Following the highly successful first season of the Binance Wallet Yield+ campaign, the project is about to launch its second season. Additionally, we will introduce a new Bitget Wallet campaign with subsidy rewards of up to $100,000 and maximum yields reaching 12%. Please stay tuned to official announcements for participation opportunities.