Top 5 Charts Tracking Bitcoin Adoption

Bitcoin is a global socioeconomic experiment, and for countries like Venezuela, Zimbabwe, and more recently, Bitcoin can be used as a store of value.

On January 3, 2009, the Genesis creation block, which is the first Bitcoin block, was mined. Satoshi Nakamoto also left an excerpt from the front page of The Times newspaper in the creation block:

"The Times 3 Jan 2009 Second bailout for banks imminent"

This is not a coincidence, it is exactly what Bitcoin was created for.

We believe Bitcoin will continue to provide a store of value in the future for those whose savings and assets have declined in value due to inflation.

secondary title

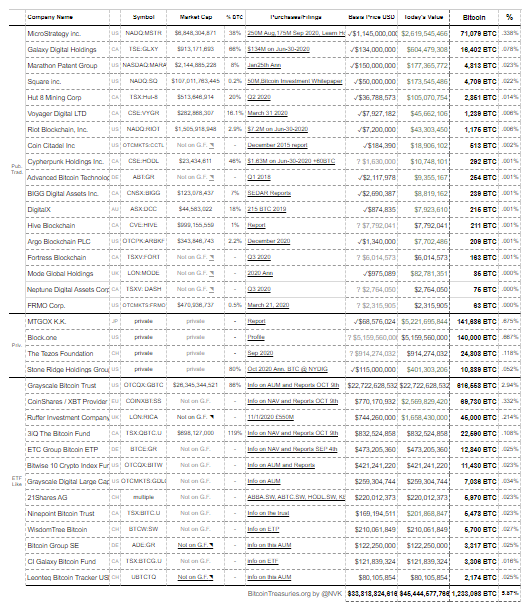

1. bitcointreasuries.org

secondary title

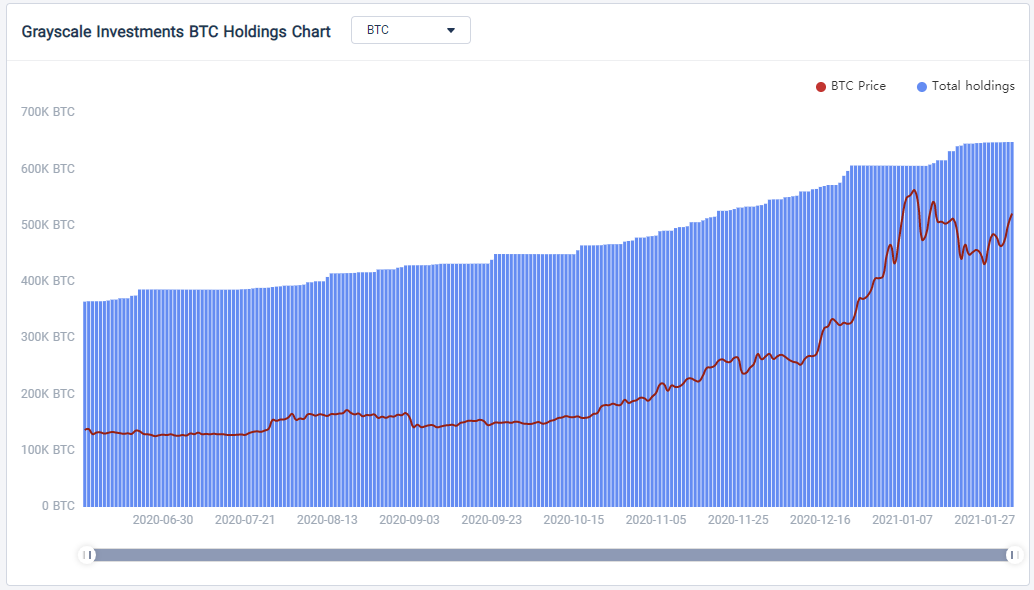

2. Grayscale Bitcoin Trust

As mentioned above, the Grayscale Bitcoin Trust is the largest Bitcoin exchange-traded fund (ETF) product currently available. Investment firms that cannot directly purchase Bitcoin due to regulatory obligations can invest through ETF-type products. Grayscale is a pioneer in this field. The ETF buys Bitcoin on behalf of institutional investors at a slightly higher price.

secondary title

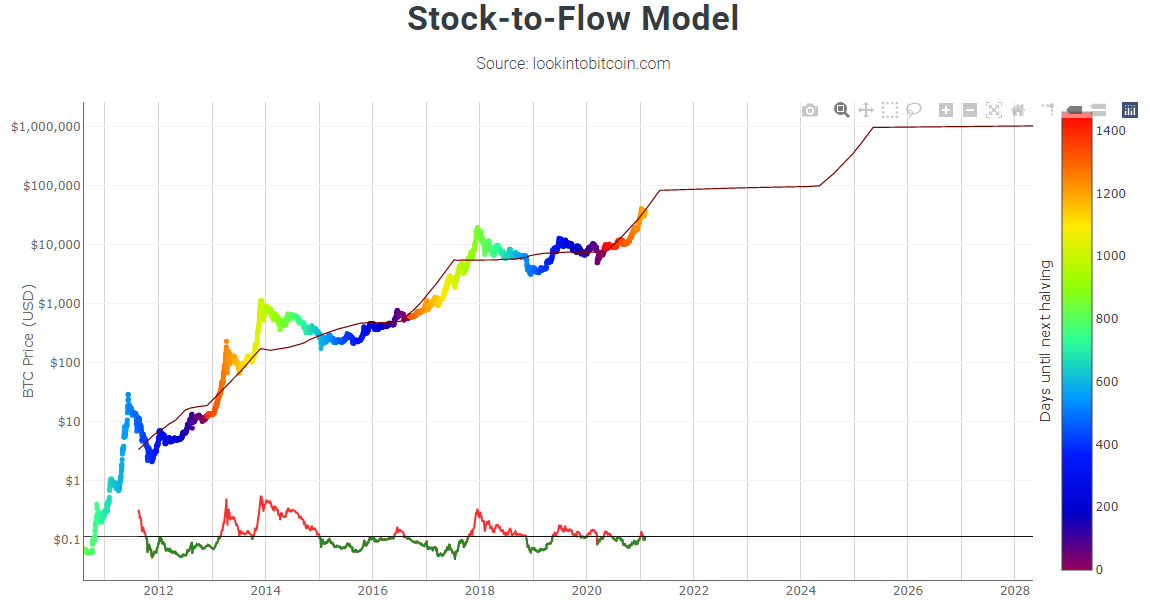

3. S2F model

The stock-to-flow model (S2F model) is used to assess the current inventory of goods (the total amount of BTC currently available) versus the flow of new products (the amount of BTC mined in that particular year).

Basically, the chart shows the expected bitcoin price direction based on the decreasing supply of new bitcoins mined. What to know: Bitcoin’s supply decreases over time, so it’s naturally deflationary.

secondary title

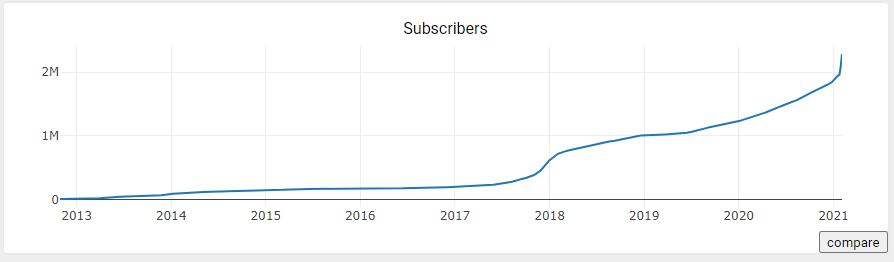

4. r/bitcoin

The r/Bitcoin subreddit is the largest online community dedicated to Bitcoin. It has over 2.2 million subscribers and is currently one of the fastest growing channels on Reddit. This online community shares insights, memes and content about Bitcoin and becomes a vital voice in the Bitcoin community.

secondary title

5. WBTC

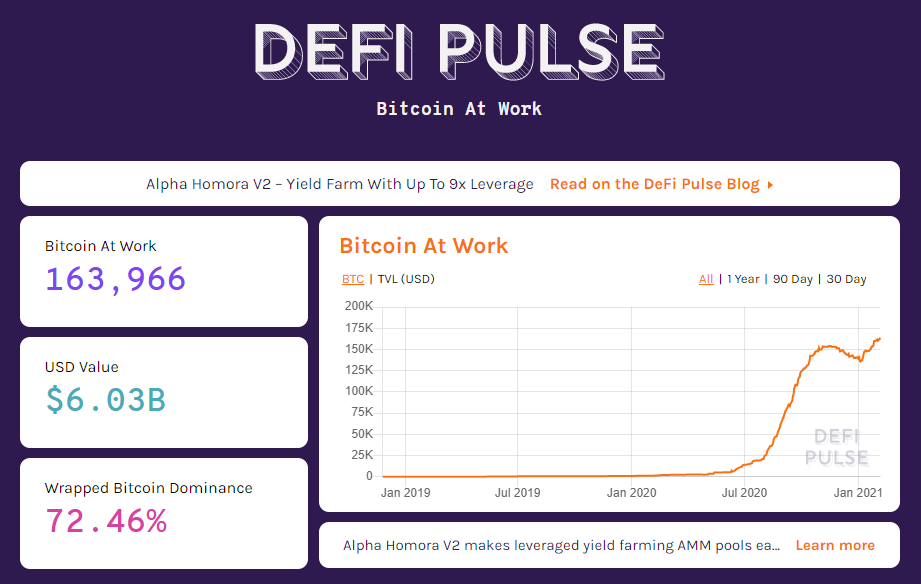

Since Ethereum and DeFi allow individuals to access Dapps and financial services, it opens the door to other use cases for Bitcoin. WBTC issued on Ethereum is a Bitcoin in ERC20 format.

The figure below shows the number of issuances of various BTC-anchored coins. As the number of bitcoins on the Ethereum network increases, exchanges will have fewer and fewer bitcoins to buy. This puts further pressure on supply.

The above 5 graphs help you get a good idea of the current state of Bitcoin adoption, and these data are updated publicly and can be viewed at any time. The landscape of Bitcoin is changing rapidly, I believe these 5 data can provide a lot of important information.

Article reference:

Article reference: