On February 5th, according to DeBank data, the real lock-up volume of DeFi exceeded 47 billion U.S. dollars, a record high. At the time of writing this article, it was 47.83 billion U.S. dollars, equivalent to approximately 309.5 billion yuan.

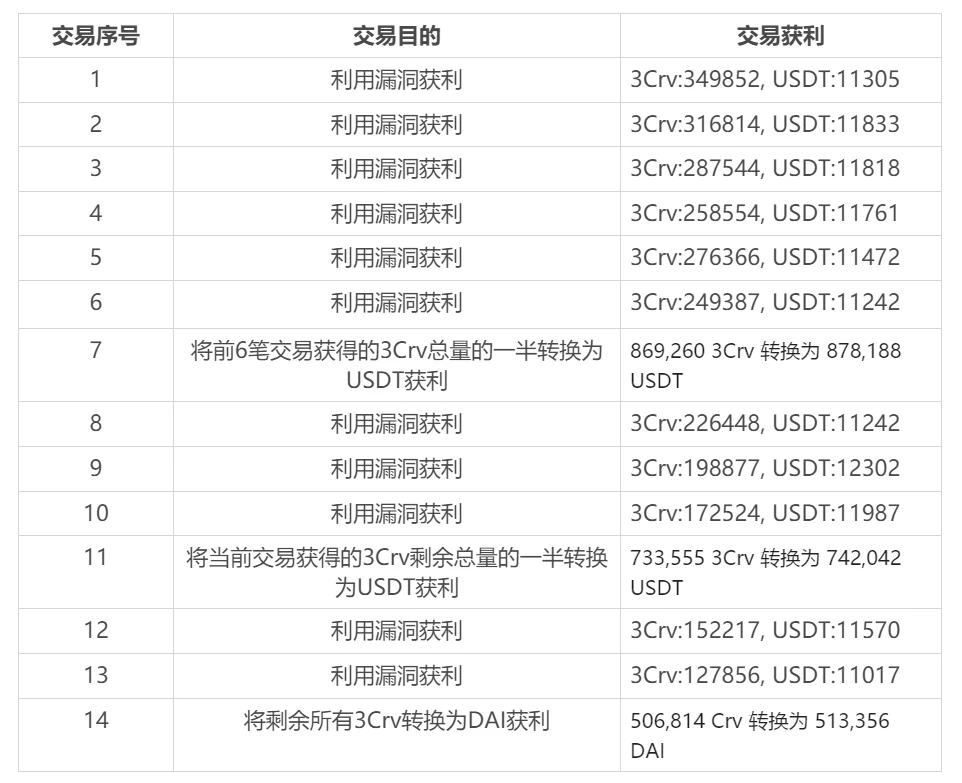

Screenshot of attackers profits

Use flash loans to raise the initial capital needed for the attack.

Using the loopholes in the Yearn.Finance contract, repeatedly deposit and withdraw DAI and USDT from 3crv in order to obtain more 3Crv tokens. These tokens were converted into USDT and DAI stablecoins in the subsequent 3 conversion token transactions. After completing 5 repeated DAI and USDT deposit and withdrawal operations from 3crv, repay the flash loan.

Summarize

Summarize

Interactions in the encrypted world are often accompanied by certain risks, and investing in safe projects will receive longer-term returns.

And high returns must be accompanied by high risks. The outbreak of this vulnerability is also a warning in the DeFi field.