The logic behind deep grilling ETH, DAI, and MKR|Roast Star Selection

secondary title

ETH: digital gold

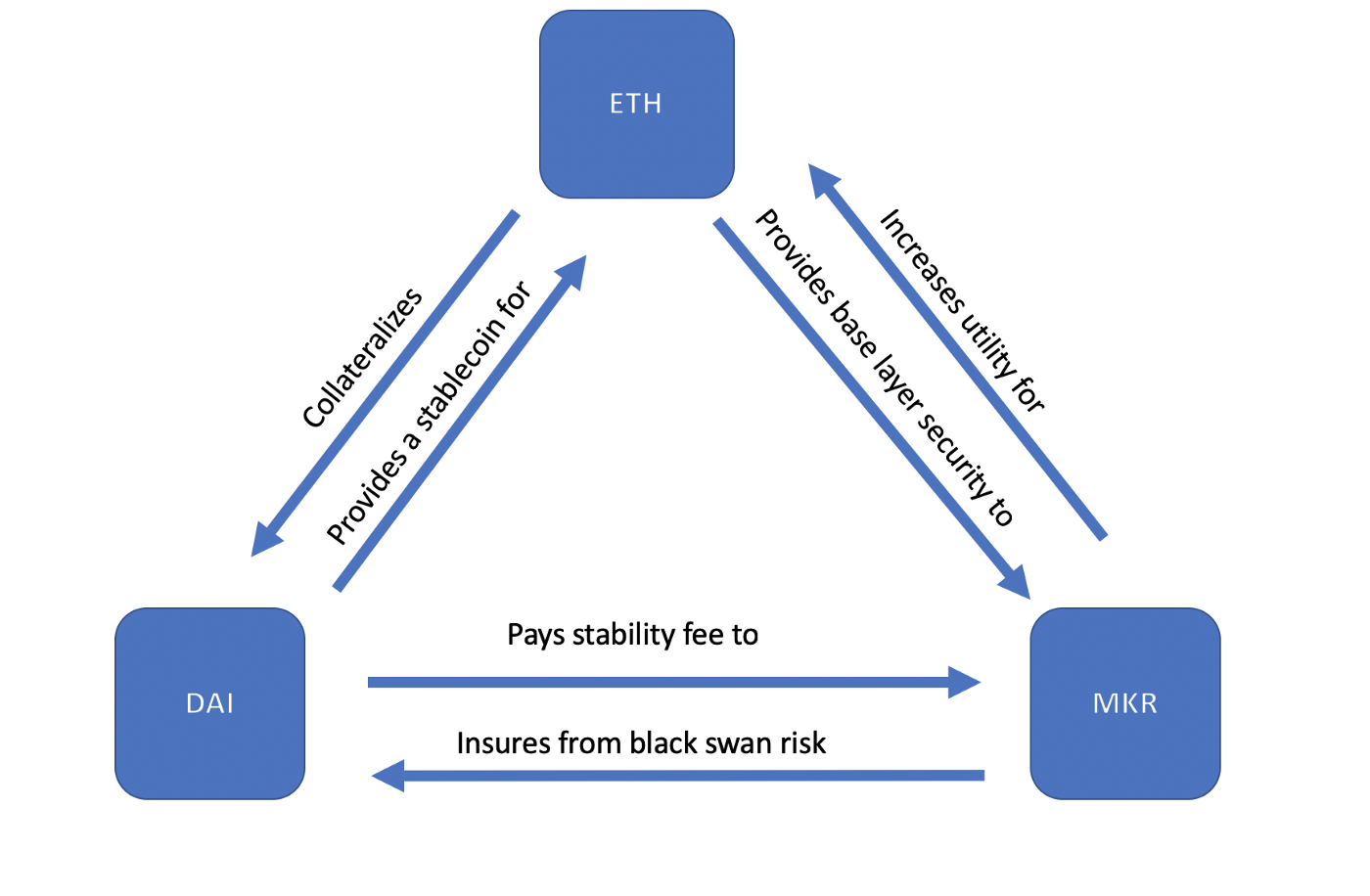

In short, understanding the value proposition of ETH is a must-do endeavor. Like Bitcoin, Ethereum is competing to be a store of value/digital gold, although many believe that ETH is only used to pay gas fees. Let me tell you what I think. Ether is a digital commodity that can exhibit many characteristics of an ideal currency, so it can be used to make money, which is already in DEX (ETH is the main base token), Maker (CDP creators believe that ETH is valuable, so they allow them to exchange Some evidence is seen in Augur (where ETH is the only token that can be wagered).

As ETH monetizes in the future, it is bound to experience high volatility. The rise and fall of prices are affected by investor confidence, which is inevitable.

secondary title

DAI: payment method

Many in the cryptocurrency community recognize that we need censorship-resistant payment methods.

Despite its modest success as a medium of exchange (and in rare cases a unit of account), ETH is now too volatile to be used as a universal payment method, so stablecoins like DAI It is very suitable for this role. While DAI is neither digital gold nor censorship-resistant like ETH, it has carved out a niche for itself and continues to grow (currently ~$75 million in circulation).

secondary title

Manufacturer: Insurance

Unlike DAI, fiat-backed stablecoins such as USDC have a very simple and centralized stability model. The issuer holds USD in its bank account and redeems the stablecoin for USD 1 upon request. If USDC falls to $0.10, there is no problem, just send USDC to CENTER (the parent organization behind USDC), and they will redeem it at a price of 1 USD. This process is called recourse or convertibility and is guaranteed by CENTER (and its associated banks).

Another way to look at this is that USDC is backed by U.S. dollars. And since the dollar is not (and cannot be) a blockchain token, the process must be centralized. But as long as the collateral doesn't fail (why? It's neatly tucked away in the bank), there's really no reason for USDC to drop to $0.10. If it does, arbitrageurs will buy cheap USDC and redeem it for $1. It should be clear that USDC does not track the U.S. dollar as long as there is collateral.

But what if it suddenly doesn't exist? For example, what if Coinbase (a founding member of CENTRE) lent dollars to other investments that legally failed? What if Coinbase goes bankrupt? What if the bank behind Coinbase goes bust? What if a person can't use their USDC at all?

I would like to highlight two risks here. The first is if Coinbase has enough collateral, but USDC is still falling. This is an irrational market risk, and we cannot underestimate the existence of this risk. If USDC keeps trading at a discount, something goes wrong and Coinbase will (or rather, should) shut down USDC and refund everyone their tokens in USD. While such a disjointed price is highly unlikely, it could still be due to liquidity constraints or insider knowledge of some impending regulatory action or even some imminent exploitation of a loophole. On the other hand, although USDC whose price continues to rise is an unlikely risk, it also needs attention.

The second risk is counterparty/collateral risk, which is the point at which the dollar doesn't really exist anymore. Without sufficient reserves, investors are unlikely to continue to have confidence in the recourse mechanism (and thus, USDC cannot maintain its peg). To assuage investor concerns, Coinbase conducts regular audits to provide full transparency and demonstrate solvency.

In general, USDC mitigates these issues by centralizing operations. On the other hand, DAI has to deal with both risks (irrational market risk and counterparty/collateral) without sacrificing its decentralization. Irrational market risk is countered with incentives, if DAI drops to $0.10, CDP owners will buy cheap DAI and pay back their outstanding loan in cents. If DAI rises above $1, the CDP creator will issue more DAI and push the price lower. In theory, this could happen before the arbitrage disappears. But what if it continues? What if someone were to exploit a vulnerability or conduct a Soros attack? In these cases, if DAI continues to trade at a discount and, crucially, the collateral is fully present, a global settlement/emergency shutdown will be triggered. 1 DAI can then be redeemed for $1 worth of collateral. The "market manipulator" will lose a significant amount of money and can then re-initialize the MakerDAO system (if the community so chooses).

The risk of this collateral is tricky to deal with, which is what we end up with MKR tokens. MKR is a governance token issued on the Ethereum blockchain. In the event of a sudden drop in collateral value, MKR tokens are minted and sold to raise funds to cover the shortfall, and the collection of MKR holders can be thought of as both a governor and an insurer. To provide "catastrophe" coverage, they charge a premium (in the form of a "stability fee"). These "governors" want to optimize risk parameters in order to maximize returns while maintaining the integrity and stability of DAI.

There is still some debate about how decentralized MKR is, with some arguing that MKR holders are centralized, and others arguing that the incentive structure is an exception.

secondary title

The logic behind ETH, DAI, MKR

secondary title

The Future of DAI: Commodities and Credit

The above model is feasible in the short term, but we also have to speculate about the future. Specifically, if ETH is positioned as "money", what happens to DAI in this case?

First, it's important to note that there can be many different versions of DAI, each of which can be anchored to any asset, stable or unstable. Coincidentally, since the U.S. dollar is currently the most stable and common global currency, the U.S. dollar was chosen as the anchor asset. Under this framework, current DAI should indeed be considered usdDAI. However, it is possible to create euroDAI, ¥DAI, s&pDAI, btcDAI, and ethDAI, and the operation is also very simple. As long as there is a price anchor, an iterative version of DAI can be created.

The U.S. dollar is not infallible, and even the strongest fiat currencies tend to crash from time to time. If the U.S. dollar fails to maintain its dominance as the global reserve currency, it is unlikely that usdDAI will continue to prosper. It's still worth a dollar, and a dollar may not be worth that much just in actual terms of purchase. Recall that the purpose of encryption is not just to put the US dollar on the chain, and the US dollar is not considered stable because it is easy to depreciate at will. The birth of digital gold is a response to the inflationary nature of fiat currencies. Therefore, although DAI can function well today, many other factors need to be considered, such as wealth preservation, value storage, etc.

Then the question then becomes "Does DAI (any variant) make sense in a world based on cryptocurrencies rather than fiat currencies?" If ETH is to be stable and used as a unit of account, what use would DAI be? If USD-based DAI is obsolete, what about variants based on other pegged coins?

The conclusion we draw here is that there are still many scenarios for DAI, especially DAI anchored to ETH (ie ethDAI), similar to how usdDAI is anchored to USD. So the question is, if we already have ETH, why do we need ethDAI? If usdDAI is to chain usd, then ETH already has the inherent chaining properties of cryptocurrencies.

To answer this question, MakerDAO needs to be introduced. The key value proposition of MakerDAO is not porting off-chain assets into tokens (thus creating a stablecoin), but rather operating as a permissionless credit facility where users can use their collateral to create leverage (until launch, of course). After the collateral, there will be more options). We have two fundamentally different but useful forms of money in ETH and ethDAI: commodities and credit.

The prototype of commodity money is gold, but over time we have seen many different variants: silver, oil, pearls, bitcoin, ether. These goods command a monetary premium not on the basis of their intrinsic value or utility (e.g., gold for jewelry or wire), but rather because they embody ideal characteristics of a hypothetical ideal money (scarcity, fungibility, durability, etc.).

Credit, on the other hand, is a time-dimensional form of value, and by taking a loan against an existing asset, you are essentially extracting its future expected value into a form that can be used today. In general, it is difficult to make commodity money and credit money interchangeable with each other (so the two forms are distinct). Credit is a form of value created on the spot based on demand. Assuming that commodity money has a fixed supply (or is sufficiently scarce), it is very difficult to obviously mint other credit currencies that are denominated in the commodity. If I wanted to take out a loan on my home, it would be hard for the bank to come up with some gold or ethereum out of thin air. (Though it's much easier to use fiat currencies like the dollar, where the credit created by the central bank is instantly swappable with the rest of the money supply). Thus, ethDAI, a synthetic version of ETH that closely tracks prices, seems to be a good solution. ethDAI is the credit currency of ETH's commodity currency.

The vision of ETH and DAI is a bit out of line from the current development, but I believe that this is the natural development path of the ecosystem. ETH is digital gold (eventually a digital sound currency for store of value, medium of exchange and unit of account). ethDAI is a digital credit that utilizes existing assets in a personal portfolio (excluding ETH), and MKR is a governance/insurance hybrid that maintains the stability and integrity of ethDAI.

* One thing to note: users don't mortgage ETH to borrow ethDAI, just like they don't mortgage USD to borrow DAI.

Because the only way to issue new ETH is through block rewards. However, just as a thought experiment, it is conceivable to envision making MakerDAO implemented at the protocol level, allowing real ETH to be issued as locked collateral. However, the governance system would have to be very strong to impose this risk on the entire Ethereum ecosystem.

This article is translated from: Scalar Capital, the original author:Cyrus Younessi