DeFi Algorithmic Stablecoins: A New Era of Stablecoins|Roasted Star Selection

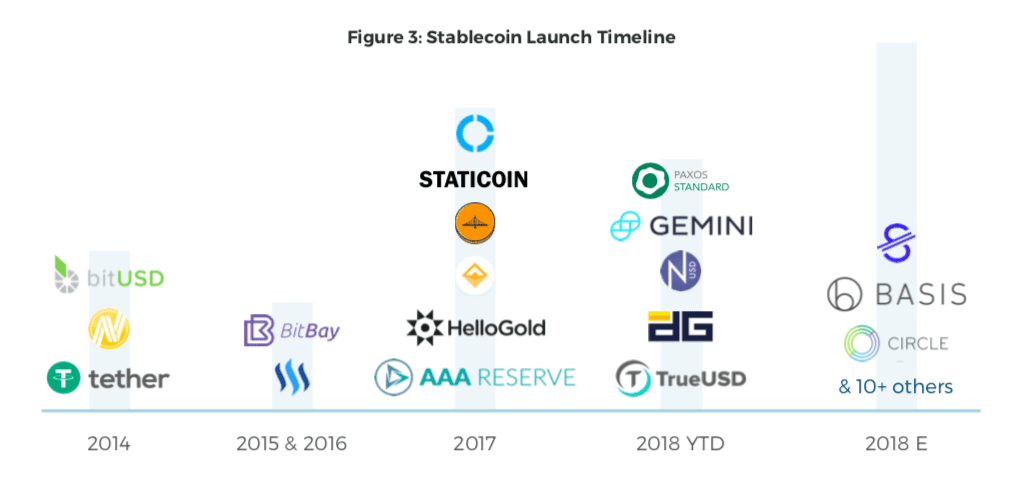

Since 2014, stablecoins have become popular in the currency circle, and the mechanism has become more and more complicated. Recently, many players in the currency circle have become more interested in stablecoins, especially the algorithmic stablecoins that have emerged under the DeFi wave this year, and some new ones. How to play, so we will talk about stablecoins today.

secondary title

1. Ampleforth(AMPL)

This is the first algorithmic stablecoin based on the concept of rebase to balance supply and demand. When the price of AMPL exceeds $1, the protocol will distribute/increase everyone's balance so that they have more AMPL, each AMPL is now worth $1.

We can look at the example given by the official website:

Alice has 1 AMPL in her wallet, worth 1 USD. The demand for AMPL suddenly increased and the market price of AMPL jumped to $2.

The Ampleforth protocol adjusted the supply, and now Alice has 2 AMPL, each worth $1. What is remarkable about Ampleforth is that it is non-dilutive, meaning that when Alice changes, Alice will still keep the same proportion of Ampleforth's total supply in her wallet.

A key aspect of the Ampleforth protocol that stands out is that while more AMPL are created/destroyed, its non-dilutive implications keep users' original ownership forever. However, one of the main problems with AMPL is that it breaks anything integrated into it. Why? Because they modify the supply of ERC20 tokens in a non-compliant way. As a result, AMPL is not very useful in DeFi as a whole, and can cause many problems being used as anything other than a speculative game. In addition, AMPL has a group of early investors who bought AMPL at a much lower than expected valuation of $1, which means that the stablecoin itself is a wealth game for early adopters. As we'll see, this isn't unique to Ampleforth.

secondary title

2. ESD

ESD improves upon the Ampleforth model, which adjusts supply by directing market participants to do what they want.

Also put the information on the official website:

When the ESD premium is traded, the person who "locks" the token will get more ESD when the ESD price exceeds $1, which is easy to solve. This is what creates selling pressure when pegs are trading at high prices.

When ESDs are trading at a discount, anyone who buys ESDs on the open market can lock up their ESDs to earn coupons. Coupons share newly minted ESD on an active basis. This is what causes buying pressure when pegs are trading at a discount, the lower the price of ESD, the higher the discount.

Now, on to the core stuff here, ESD excels at attracting the project and creating a community, as the project started with "anonymous developers" who started the protocol themselves and created a mechanism for a "fair launch" (though , which is not entirely correct).

Until the last expansion stage, ESD has been providing returns of over 1000% to investors and attracting a lot of attention. As a result, the market capitalization grew from $300 million to $550 million in a matter of days. Such growth is clearly unsustainable, and as a result, ESD is on a downward trend, with a death spiral down to $0.30. Will investors feel confident again about higher prices, or will there be another speculative frenzy of stablecoins.

The ESD community is not idle either, they are currently working on ESD v2, the main difference is that the protocol itself will store some kind of reserve that can be used to buy ESD on the open market to drive up the price. If the price is less than $1, it will be up to $1. Reserves in USDC will be built by ESD printers selling USDC's ESD when they are above peg. This second iteration of the currency game is interesting, and there is still a lot of work to be done if one wants to dig deeper.

secondary title

3.DSD

In addition to ESD, I also want to mention DSD, because they provide context for other paths that the protocol may lose confidence. DSD is a fork of ESD, but essentially sped up by shortening the time. This means that anything that happens in ESD, happens much faster in DSD.

Since DSD has been below the peg for some time, the amount of unpaid coupons (which can be redeemed for real DSD when the price exceeds $1) will expire in a few days. Ahead of this deadline, large holders of DSD were selling to lighten their positions, causing the price to drop. In order to preserve DSD, a coalition of buyers came together to take the whale's plate and stop dumping:

Why are they doing this? Because, when the price falls below $1, coupons (debt BONDs) are issued to help reduce the supply in the market, and since these BONDs expire, if the price continues to drop, then these coupons will expire and the coupons will remain Someone will lose money, which will lead to a loss of confidence and quite possibly a very brutal downward spiral.

secondary title

4.FRAX

The newest and strongest contender around the block because it offers something the other competitors don't: some sort of collateral base backing it. The FRAX model claims to be under-collateralized, but a more accurate description is that it is algorithmically collateralized through a two-token system. Here's how it works:

The system starts with 100% collateral, which means that to mint FRAX, 1 USDC is required per FRAX. However, if this is lower than 100%, an equivalent amount of FXS (FRAX SHARE) needs to be deposited. Think about it, instead of depositing 1 USDC, you can deposit 0.9 USDC and $0.10 worth of FXS. It's not really under-collateralized since you still need to deposit at least $1 worth, but it's not over-collateralized.

Now, over time, if the price of FRAX is above $1, the collateralization rate is reduced by 0.25% every hour. If the price of FRAX falls below $1, the collateralization rate increases by 0.25% every hour.

The end result is that the system can be turned into 90% collateral, which means that only 90% of USDC needs to be deposited and 10% of FXS can be created.

However, that's not what helps FRAX keep the peg. The key part here is that anyone who buys and holds FRAX can redeem it for $1 worth of USDC and/or FXS. This means pegs can be stronger because arbitrageurs can buy cheap FRAX when the price is below $1, and then redeem it with $1 of actual collateral. Likewise, if the price of FRAX exceeds $1, you can arbitrage, minting 1 copy of FRAX for $1 and selling it for $1.10 (or the peg price above).

While the FRAX model is indeed moving in the right direction, there are still some major issues:

Currently, FRAX only supports USDC, which means that in some respects it is a wrap of USDC. FRAX v2 attempts to add volatile currencies by introducing FRAX bonds.

FRAX cannot be effectively used for leverage (like MakerDAO or ARCx) because depositors are not guaranteed to receive the exact amount and type of collateral they stake. Assuming FRAX aims to be the main MoE exchange coin, this is probably OK. However, like other coins, the primary beneficiaries of the FRAX stablecoin are FXS holders who will increasingly be able to mint FRAX with their FXS.

secondary title

5. ARCx

While ARCx is not intended to be an algorithmic stablecoin, it will attempt to take lessons from all of the above and incorporate them into a new stablecoin model that can increase productivity by issuing credits against different types or new types of DeFi collateral . The idea here is, can you integrate algorithmic monetary policy into a credit issuance tool to create a new use case?

Unlike existing algorithms, this is a fundamentally different model as it serves a completely different purpose, not a speculative game, but a way to unlock liquidity for various assets. The future is a multiverse of stablecoins, and the winners will not go all out.

In our research so far, we have narrowed down three different levers to maintain the peg rate, and we will try to test this approach to the peg rate in the coming weeks and months. The leverage is as follows:

Interest Rate - The cost of borrowing/minting stablecoins. Similar to most DeFi platforms.

Savings Rate - The purely inflationary/minting rate assigned to users who lock STABLEx (stablecoins) into savings contracts. In a way, when pegs trade at a premium, this becomes a negative interest rate paid to borrowers, or encourages borrowing within the system.

System arbitrage - Basically, the protocol itself can take STABLEx out of the water, which can then be sold to USDC to build a native reserve. These reserves can then be used to buy back STABLEx when trading at a discount. Fundamentally, the protocol is to trade with the system participants themselves to help maintain price parity.

So far, STABLEx pegs trade at a discount for the following three reasons, which are worth mentioning because they confirm the theories we all know about stablecoins so far.

Existing yield farming contracts also require limited partners to provide debt. Buying STABLEx from Uniswap and becoming an LP will not work. We did this on purpose to encourage the growth of STABLEx's native supply and to test the basic premise of minting stablecoins with idle assets. However, it prevents "ape" behavior, which means you are running a damping experiment. When we launched LINKUSD, the price experienced a peak due to buyers of STABLEx farming ARCx.

Forcing minters to be LPs can boost growth, but leads to the problem that when users fall below the peg exchange rate, users' incentive to repay their debt is broken, as users will lose their ARCx rewards and be "slashed", and also Just lost all rewards. Synthetic asset yield incentives can often conflict, and protocol designers should proceed with caution.

Using a constant product curve (such as Uniswap or Balancer) will always produce unstable pegs. We learned this after migrating LINKUSD (our first stablecoin) from Balancer to Curve. Stability is a function of the primary liquidity source algorithm. This has been spotted by many over the past few weeks, expect more migrations in the coming weeks.

While it's easy to view all of these stablecoins contradicting each other, I actually believe they can and should all coexist. Not all stablecoins are created equally, nor are all stablecoins used for the same purpose.

Reference:

https://defiweekly.substack.com/(Kerman Kohli)