OKEx Redefines Transactions and Interprets the Three Models of Unified Accounts

secondary title

Three modes to solve transaction pain points in an all-round way

OKEx unified account redefines transactions, it is by no means an empty slogan. Its appearance will completely solve many pain points that plague investors. According to the simulation disk page, OKEx unified accounts are divided into simple transaction mode, single-currency margin mode, and cross-currency margin mode. These three models will be aimed at traders of different levels and cover different levels of trading needs.

The simple trading mode is mainly for beginners who are just getting started. Such users have insufficient understanding of market risks, and lack sufficient understanding of the mechanism and application scenarios of leveraged products. They often do not have sufficient risk management and control capabilities, and a good trading mentality. The simple transaction mode of the unified account only supports spot transactions and option purchase transactions, making sufficient risk isolation and providing a simpler and lower-risk trading environment for novice users. As we all know, the risk of spot trading is relatively low, and options are also known for their never liquidation mechanism. The two business lines included in the simple transaction model are undoubtedly the most suitable for novice users.

The single-currency margin model is mainly for users with sufficient trading experience and some institutional users. The single-currency margin model supports derivatives business lines such as spot, leverage, and contracts, and supports margin sharing between single-currency positions. That is to say, the single-currency margin model optimizes the original account model and integrates different accounts of various business lines and currencies into one. On the one hand, users no longer need to transfer cumbersome funds between accounts, reducing operating costs and improving transaction experience. On the other hand, users can realize margin sharing in a single settlement currency dimension, and transaction risks are measured by assets. For example: in the single-currency cross-margin mode, the user's BTC delivery contract and perpetual contract margin are shared, and the user can better implement trading strategies such as cross-market hedging, and greatly improve the utilization rate of their funds.

The cross-currency margin model is mainly for mature high-level traders and institutional users. The business lines supported by the cross-currency margin mode are consistent with the single-currency margin mode, but a cross-currency cross-margin mode is provided to support margin transactions in the asset pool dimension. That is to say, users are supported to use non-mainstream assets as collateral in the form of mortgage loans. Although the logic and algorithms behind it are very complex, the front-end operations for users are very simple. In this way, users can not only do cross-market hedging, but also conduct cross-currency margin transactions, thereby improving the user's capital utilization rate and reducing the user's transaction loss when swapping positions across currencies.

In addition, the unified account has two very attractive functions: First, the unified account supports real-time settlement. The income obtained by users' margin transactions can be transferred out and realized in real time, which also helps to improve the utilization rate of funds. Second, the unified account can customize the page layout, so as to configure the page that best fits its own trading strategy and attention information. It can be seen from the demo disk page that the unified account currently supports two layout modes: the classic layout is designed for professional traders who need complex trading functions and analysis tools; the option layout is optimized to improve performance, reliability and speed. At the same time, users can also independently create layouts and customize the combination of charts, depth, transactions, positions, orders, assets and other information.

According to the above introduction, we can summarize the advantages of the unified account as follows:

1. Optimize the account, simplify the operation, reduce the user's understanding cost and operation cost, and improve the smoothness of the transaction;

2. Realize the margin sharing of single currency across business lines and cross-currency margin sharing, improve the utilization rate of funds, and facilitate users to hedge.

secondary title

Unified account, born for trading

Because the design scheme and logic algorithm of the unified account are too complicated, it needs a deep technical background and a strong team to support it. Even for OKEx, which has always dominated the industry with its products and technologies, it is not an easy task. Because the unified account carries a major mission, its goal is to optimize the trading account structure that has existed for several years and solve the long-standing trading pain points. It is reported that in order to accomplish this industry feat, OKEx has come up with the industry's top luxury lineup, and many experts at home and abroad have jointly built a design plan, and then OKEx's technical team took several months to build it.

For OKEx, the unified account solves the trading pain points such as complicated accounts and limited capital utilization, and greatly improves the user's trading experience. It is a blockbuster product that makes the platform realize a leap. From then on, OKEx is bound to continue to lead the industry with its products and technologies that have been leading the industry for more than a year, and will gain more traffic under the influence of the oligopoly effect.

For the entire industry, the advent of unified accounts is also of far-reaching significance. In a market full of competition, there are always only a few examples of bad money driving out good money. Only a platform with a solid foundation and a foundation based on products and technologies can become the winner after the big waves wash away the sand. OKEx is the first to launch a unified account, which is bound to trigger a wave of account optimization in the industry, triggering many platforms to imitate. If you don't choose to chase, it is only a matter of time before you lose the competition. This healthy competition driven by OKEx will improve the trading environment of the entire market, ultimately promote the technological progress of the industry, and make all users a real beneficiary.

Adhering to the concept that products are king, insisting on practicing internal strength is certainly a long road of firm belief, but the rewards of persistence are also rich. OKEx is a living example: since its establishment, OKEx has always placed product technology and user experience at an important position, devoted itself to building an industry-leading technical team, continuously improved its technical level, and continued to polish products with an attitude of excellence, and successively launched Lightning System, counter system, brand-new risk control system and other blockbuster products create the industry's top trading experience, and the system performance also leads the industry.

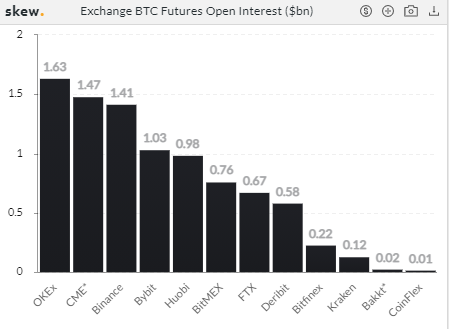

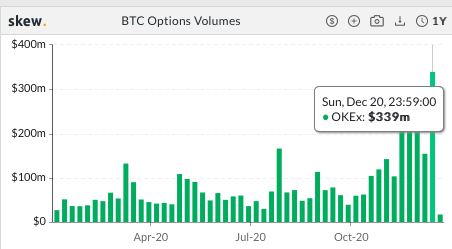

With the advantages of products and technologies, OKEx has achieved many remarkable achievements: for example, OKEx is the first one-stop trading platform in the industry, with the most comprehensive trading matrix and rich trading options. OKEx is also the first trading platform in the industry to maintain stability and smoothness in several extreme market conditions. When the unified account is officially launched, OKEx will become the first exchange to support cross-business lines/cross-currency mixed margins of the five major business lines. These achievements are also reflected in the data of OKEx's various business lines. For example: Skew data shows that OKEx's BTC contract positions have always ranked first in the industry, and OKEx's options trading volume has also broken through a new high.

The unified account is not only a heavy weapon for OKEx to continue to lead the industry, but also the starting point for the transformation of the industry's trading system. Let us wait and see how the unified account will lead the industry.