Primer

Primer

More than half a year has passed since the 2019 summary. After experiencing ups and downs, my mood has changed a little. Even if I gnash my teeth to the end, it will not help, so I have to keep my head down. The following will review the ten questions left at that time, and list the directions worthy of attention in the second half of the year.

Issue review

[Half a year ago, I paid attention to the ecological development of Polkadot and Astro Boy, and switched back to the application of Ethereum. Be optimistic about the development of blockchain P2P. Defi, Cefi, and fi that can make money are good fi. ]

Other than Bitcoin are all altcoins, none of them can fight

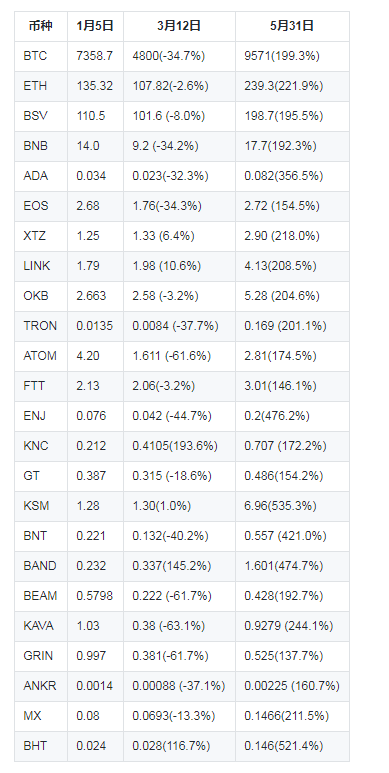

I selected the prices of three time nodes (January 5/March 12/May 31) to make a simple comparison

Currency January 5th March 12th May 31st

If you can’t outperform BTC, then buying Altcoin is meaningless. Bitcoin can play a lot, mainly concentrated in NFT/oracle/DEFI/POLKADOT, which are actually all around the ecology of Ethereum, that is, the focus at the beginning of the year several fields.

Dapp cannot bring a prosperous ecology to the public chain, and the story of the public chain is almost over

The Dapp situation in the first half of the year was as predicted. Crude Dapps cannot be accepted by the market. The so-called explosive growth of the number of Dapps cannot bring prosperity to the public chain ecology. There are very few boutique game Dapps, lottery Dapps have lost their luster, and Defi Dapps have appeared in line with market demand, and even spread to non-Ethereum public chains.

The liquidity of assets is extremely important, and I would rather give up the first-mover advantage to maintain liquidity

Liquidity traps have always existed. High locked-up POS public chain/low circulation initial project/circulation market value is not equal to the total market value. The market price obtained by low circulation rate cannot reflect the market value of the project itself. This is the case with UMA of IUO, JST, and various Defi This is true for governance tokens and early Fil. Low circulation rate is easy to blow bubbles. As the circulation rate increases or unlocks, Hold is not a wise choice, and liquidity risks must be paid attention to.

All decentralized platforms are another hub

There is no absolute decentralization, and many blockchain projects are chanting the slogan of decentralization as another center. The ideal blockchain can only find a balance in front of the iron fist. The DForce incident made everyone think about Defi at a deeper level, and it is better to do things centrally.

The future of NFT represents the imagination of Token

There are still very few scenarios where NFT is applied. The future of NFT cannot be simply equivalent to the future of Enjin. Enjin is one of the standards of NFT. Just like the future of the mobile phone industry was not equal to the future of Nokia ten years ago, the innovation and development of NFT will be unexpected.

Defi/DAO, do we really need this Decentralize?

Decentralization is an ideal blockchain surrounded by a center, and we need a balance between decentralization and centralization.

The virtual market value of PoS-like coins needs to be vigilant. Is it the real market value under the high pledge rate?

No, absolutely not. However, POS/Staking is a good means of blowing bubbles. Users sacrifice liquidity to earn interest. The project side reduces the circulation and the demand for buying is greater than selling. The final market value is inflated, and the market’s ability to undertake the project itself is insufficient.

Do private transactions need an anonymous technology currency/mixed currency Dapp or an opaque large pool of funds?

The performance of the privacy and anonymity sector is not outstanding. The Gate N incident will make mainstream voices resist the development of anonymous coins. Anonymous transactions are a demand. Sometimes it is not necessary to go to a certain chain alone. Maybe wait for the existing chain to upgrade and add the ZK anonymous function Just like Tron 4.0.

Will there be a stable currency that can surpass USDT in all aspects in 2020?

No, as shown in the figure, other stablecoins were left far behind. USDT ranked among the top three in market value, and began to go out of the circle to open the road to digital dollars.

Will the magic of halving still work in 2020?

nothing now

Looking forward to the second half of the year

IPFS

The transaction is the price difference between the future price and the current price. We can obtain the price difference from the perspective of direction, time, price and quantity. Simply put, how can you make money?

Filecoin itself does not need to be introduced too much. The project that breaks the existing blockchain pattern is here. The beneficiaries after the launch are divided into the following categories:

Exchange (handling fee caused by trading volume)

Mining (selling mining machines/cloud miners/mines)

Wallet (user growth/ecological application entrance)

Application developer (ecological development express)

Direction of attention:

platform currency

platform currency

FIL mining machine, forward call option

FIL

FIL application token, betting on leading applications

Friendly reminder: FIL futures/mining machine, do not step on the pit when the water is deep, pay attention to Math Wallet (already supported FIL testnet), Interstellar Vision for professional information.

In addition to Filecoin, decentralized storage projects can also pay attention to Storj, Sia, and Arweave. The first two are old coins, and Arweave will have more opportunities. Arweave completed $8.3 million in financing in March. Investors include a16z, USV and Coinbase, so while paying attention to Filecoin, Arweave will also deploy other storage projects.

DEFI

"Arweave Mining Tutorial" recently updated

The farther away knowledge is from realization, the wider it will be disseminated.

DEFI is currently a widely spread story. No matter what public chain you are, you start with a DSR stable coin, and then you take it away with Uniswap and Lend.

LINK

BAND

BNT

KNC

NEST

LEND

SNX

Get rich via prequel:

COMP

MKR

DF

UMA

JRT

JST

Getting rich is passed on later:

Defi governance token

Extra chapter on Getting Rich:

Non-Ethereum Defi

Why is it divided into before and after and outside the story? First of all, everyone knows that the story of public chain + Defi can be told, and it has been proven in the market that Defi has been told early and spread widely. From a rational point of view, once it is overheated, it is time to leave. When everyone knows about Defi, the story of Defi is actually over. The sequel is another story of Defi, a story with less logical logic. Will the value of governance tokens appreciate as the scale of Defi applications grows? Should Defi projects with low valuations and no one care about them be sought after with the development of Defi?

The reason for the appreciation of Defi tokens should be that it is widely used, the overall data continues to grow, and its functions are constantly iteratively updated. Instead of simple substitutes that have not been updated for a long time, these undervalued Defi applications have complete functions but low usability and poor market competitiveness, and eventually cannot avoid the fate of being eliminated by the market.

polkadot

kava

tron

On the contrary, it is an opportunity for non-Ethereum public chain Defi applications. The mature growth route and development logic of Defi can still make sense in the New World, just like after the three major platform coins have generally exploded, some special platform coins can also shine. At the moment when Ethereum Defi is exploding, it is better to focus on the unexplored new continent, and there will be a lot of treasures buried deep in the ground waiting to be discovered.

ETH 2.0

"One Leaf Obstacle, Defi Outside Ethereum" has been recently updated.

The focus of the second half of the year is still on Ethereum. Although the launch time of 2.0 is undecided, the upgrade of POW coins with the second market value to POS is not a trivial matter. The current gas fee remains high, which is not good for the entire ecology in the long run. It may increase income for miners, and it is not a small cost for ecological users.

It is expected that Phase 0 will be launched in the third quarter of this year, and everyone can pledge 32 ETH to become a verification node to obtain income.

The number of pledges is a multiple of 32, the working cycle is at least 9 days, and the release time takes 27 hours.

It is estimated that the annualized rate will be 3%-5%, and the income of the genesis block will be 20.3%.

So who's going to grab the cake? Possible beneficiaries fall into the following categories:

Exchange (natural Soft Staking, ETH is in the hands of the exchange)

POS mining pool service provider (entrust ETH, Staking on behalf of, ETH is in the hands of the mining pool)

Server provider (rental server, agent maintenance node, ETH in your own hands)

Wallet (on behalf of Staking/service entrance, multiple options)

ETH

Direction of attention:

Staking as a Service Token

Platform currency (like HPT)

Polkadot

Cross-chain

Cross-chain

governance

governance

Staking

Easy to upgrade

progressive security

NFT

The above are the keywords of Polkadot. The meaning of cross-chain is not just to cross over the assets on BTC or ETH, but to build a more flexible blockchain environment for developers based on the cross-chain structure. It is an experience different from the existing blockchain.

There is too much history to trace back about NFT. The current NFT is only an art belonging to a small number of people, and the future is unknown.

On May 6, 1840, the world's first postage stamp was issued in England: Penny Black. During Queen Victoria's reign, Sir Rowland Hill devised postal reforms that solved the problem of paying for freight. Before then, only the recipient could pay for shipping when the mail arrived. Hill invented a system that would pass this fee on to the sender. He made sure to pay the 1p fee and suggested a sticker card be affixed to the letter as proof of payment.

During the second half of the 1800s (when images were rare compared to today), postage stamps were considered the collections of nobles and kings. Every significant family has a collection and is proud of it.

Life is about collecting: we collect all the time, even if we don't realize it. Even simply recording the highlights of our lives represents a form of collecting, sorting, dividing and preserving.

Summarize

Summarize

Two or three years ago, Defi gained a very high market value relying on simple functions and not-so-great data. After a long period of dormancy and suffering, it is now radiant and sought after by the world. What remains unchanged is that most people in the market have still not tried a Defi application, and the voices of early chasers in the industry are quite different. Although the Defi concept has performed exceptionally well in terms of price, for the early pursuers of Defi, this is the beginning of the revival.

In a forest ecosystem, its edge (forest margin) is often distributed with more abundant animal and plant species than the interior of the forest, with higher productivity and richer landscape.