Stablecoin Odyssey 2026 · Hong Kong

In 2025, stablecoin transaction volume reached $46 trillion, evolving from a crypto tool into a global settlement layer. From issuance to payments, the ecosystem is becoming a river of value flowing into the real world. On February 10, 2026, Stablecoin Odyssey was held in Hong Kong, concurrent with the Consensus conference, bringing together builders, issuers, and infrastructure providers to explore new financial directions driven by stablecoins.

Agenda

13:00 – 13:30|Boarding the River

Check-in & Ecosystem Positioning

Attendees check in and mark their position within the stablecoin industry chain, establishing clear coordinates for subsequent cross-sector communication.

13:30 – 13:45|Setting the Course

Opening Remarks & Panoramic Overview

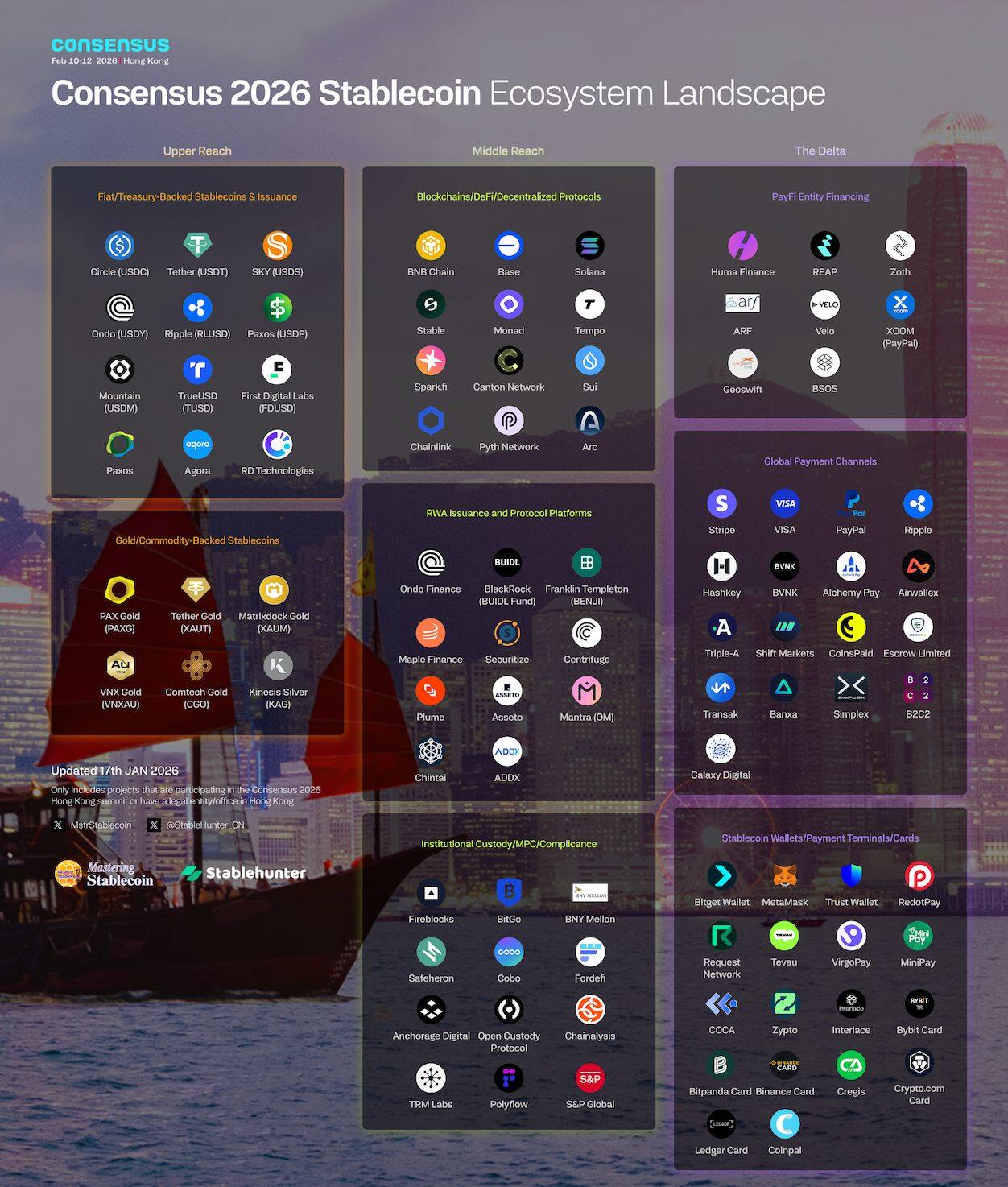

The host presents the "2026 Hong Kong Stablecoin Panorama," clarifying the core themes and discussion framework of the event.

13:45 – 14:30|Shaping the Source

Roundtable 1: Infrastructure: Building Payment Public Chains for the Agent Economy

Exploring how payment public chains evolve into universal settlement layers and support the collaborative operation of individual, enterprise, and agent economies.

14:30 – 15:15|Structuring the Flow

Roundtable 2: DeFi & CeDeFi: How is Money Actually Made? — The Sources of Yield and Risk Boundaries in On-Chain Finance

A discussion revealing the real economic logic behind DeFi and CeDeFi yields—distinguishing sustainable income from structural design, and understanding systemic risks.

15:15 – 15:30|Riverbank Interlude

Mid-Session Tea Break & Networking

Provides attendees with an opportunity for light networking and initial connections.

15:30 – 15:45|Keynote Speech

15:45 – 16:30|Fueling the Current

Roundtable 3: RWA: New Financial Infrastructure, or a More Mature Narrative? — Asset Tokenization, Distribution Capability, and Trust Boundaries

Challenging whether RWA is solving real-world problems or merely repackaging existing solutions—examining the boundary between its structural value and speculative hype.

16:30 – 17:15|Powering the Delta

Roundtable 4: Stablecoin Payments: Real Adoption in Emerging Markets

Moving beyond theory to examine the real adoption of stablecoins—why users choose crypto channels over banks, and whether these use cases can scale.

17:15 – 17:20|Arriving at the Open Sea

Summary & Transition

The host provides a brief summary of the day's key points and guides attendees into the free networking stage.

17:20 – 18:00|Entering the Open Sea

Free Networking

The formal agenda concludes, transitioning into free networking and in-depth connection time.

Speakers & Attendees

100 upstream, midstream, and downstream stablecoin industry players and practitioners based in Hong Kong or traveling to Hong Kong for the event.

The following list is for reference.

Organizer

- Mastering Stablecoin: A research-oriented media platform focused on the stablecoin sector, providing in-depth interviews, long-form analysis, and industry playbooks through podcasts, articles, newsletters, and social media channels.

- Stablehunter: A tool that makes the risks of on-chain assets understandable, helping users comprehend, compare, and allocate on-chain stable assets by transforming complex DeFi yield mechanisms into a decision-making system based on risk structures.

Title Sponsor

- Interlace: A global virtual card issuance platform and leader in Web3 payment infrastructure.