Even micro-strategies are out of ammunition to buy the dip in BTC. How are your DAT stocks doing?

Original author: David, TechFlow

Over the past month, BTC has plummeted from its all-time high of $126,000 to below $90,000. This 25% pullback has plunged the market into panic, with the fear index now in single digits.

But that man kept buying.

On November 17, Michael Saylor tweeted on X as usual: "Big Week".

The subsequent announcement revealed that MSTR purchased another 8,178 BTC, spending $835.6 million, bringing its total Bitcoin holdings to over 649,000.

Don't panic, the biggest bulls are still in the game. But is that really the case?

While Saylor's comment section was filled with jubilation, someone unearthed a key statistic:

The mNAV of MSTR is about to fall below 1.

mNAV, or Market Net Asset Value Multiple, is a key metric that measures the premium of MSTR's stock price relative to its BTC asset.

Simply put, mNAV=2 means the market is willing to spend $2 to buy a BTC asset worth $1; mNAV=1 means the premium has disappeared; mNAV<1 means trading at a discount.

This metric is the Achilles' heel of Saylor's entire business model.

In comparison, when was the last time BTC dropped by 25%? The answer is March of this year.

When Trump announced tariffs on multiple countries, the market was in an uproar, with the Nasdaq plummeting 3% in a single day, and the cryptocurrency market following suit.

BTC plummeted from $105k to $78k, a drop of over 25%. But MSTR was in a completely different situation at that time.

mNAV remains around 2, and Saylor has a whole set of financing tools at her disposal: convertible bonds, preferred stock, ATM issuance... She can conjure up money at any time to buy at the bottom.

What about this time? mNAV has fallen below 1.

This means that issuing stocks to buy cryptocurrencies is gradually becoming unfeasible. For example, if you issue $1 worth of stock now, investors may only be able to buy $0.97 worth of BTC. This doesn't seem like bottom-fishing; it's like losing money.

According to MSTR's Q3 financial report, the company only had $54.3M in cash on hand.

In other words, it's not that Saylor doesn't want to buy at the bottom, but that he might genuinely be unable to buy any more.

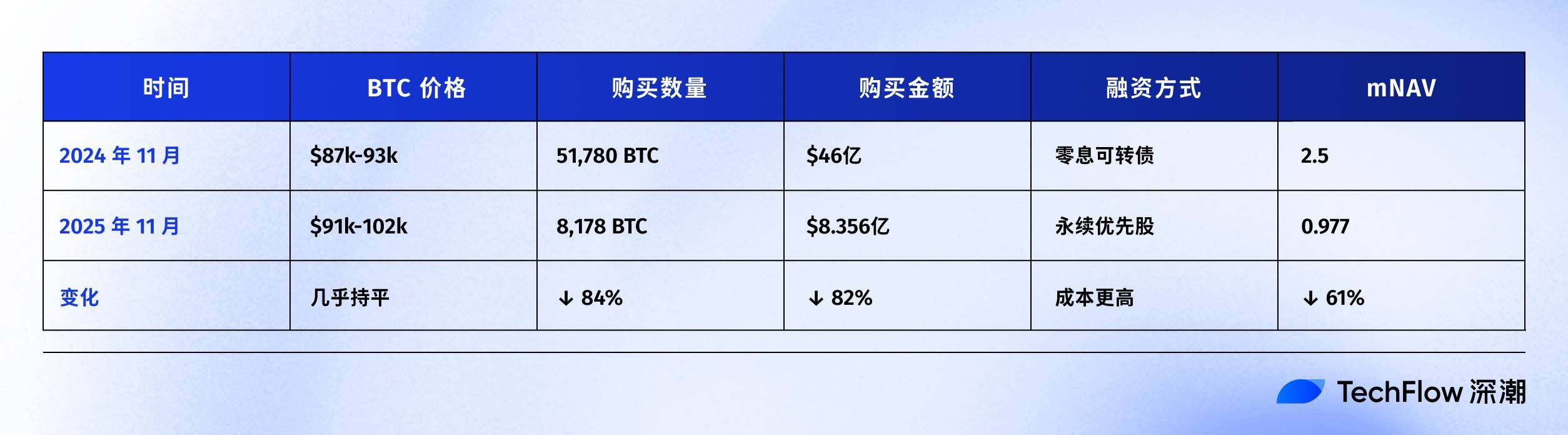

November last year vs. November this year

Don't believe Saylor can't buy anymore? Just take a look at the accounts from this time last year.

In November 2024, Trump was elected, and BTC skyrocketed from $75k to $96k.

What is Saylor doing? Buying cryptocurrencies in large quantities.

Where will the money come from? Issuing bonds. A $3 billion convertible bond, maturing in 2029, and crucially, no interest payments required.

One year later, the style has changed drastically.

Besides price changes, changes in financing methods are also noteworthy.

Last year, Saylor borrowed 3 billion to buy Bitcoin, interest-free, with the loan due in 2029. This is essentially a free loan.

This year, Saylor can only sell one type of special stock (perpetual preferred stock), and will have to take 9-10% of the money from MSTR's accounts each year to distribute to those who buy these stocks.

As conditions worsen, the market may have lost confidence in MSTR and be unwilling to lend him money for free anymore.

However, the real trouble lies in the spiral-like chain reaction when mNAV falls below 1:

Declining mNAV → Weaker financing capacity → Only more shares can be issued → Equity is further diluted → Stock price falls → mNAV continues to decline.

This spiral is happening.

Since the beginning of the year, BTC has only fallen by 4.75%, but MSTR's stock price has fallen by 32.53%.

On November 17, MSTR's stock price hit a 52-week low of $194.54, marking its sixth consecutive day of decline. From its year-to-date high, the stock price has fallen by 49.19%.

MSTR's stock has underperformed BTC by 27 percentage points. The market is voting with its feet; it's better to buy BTC directly than MSTR.

Moreover, in the market in 2025, more and more companies will adopt reserve strategies for Bitcoin and other tokens, and MSTR will no longer be the only option.

With increasing competition and a declining crypto market, why should investors pay a premium for MSTR?

The logic behind the entire micro-strategy model is actually quite clear: continuously raise funds to buy BTC, use the value growth of BTC to support the stock price, and use the stock price premium to continue raising funds.

However, when BTC plummeted and mNAV fell below 1, the cycle became less smooth than before.

In November, Saylor was still buying, but its ammunition was clearly running low.

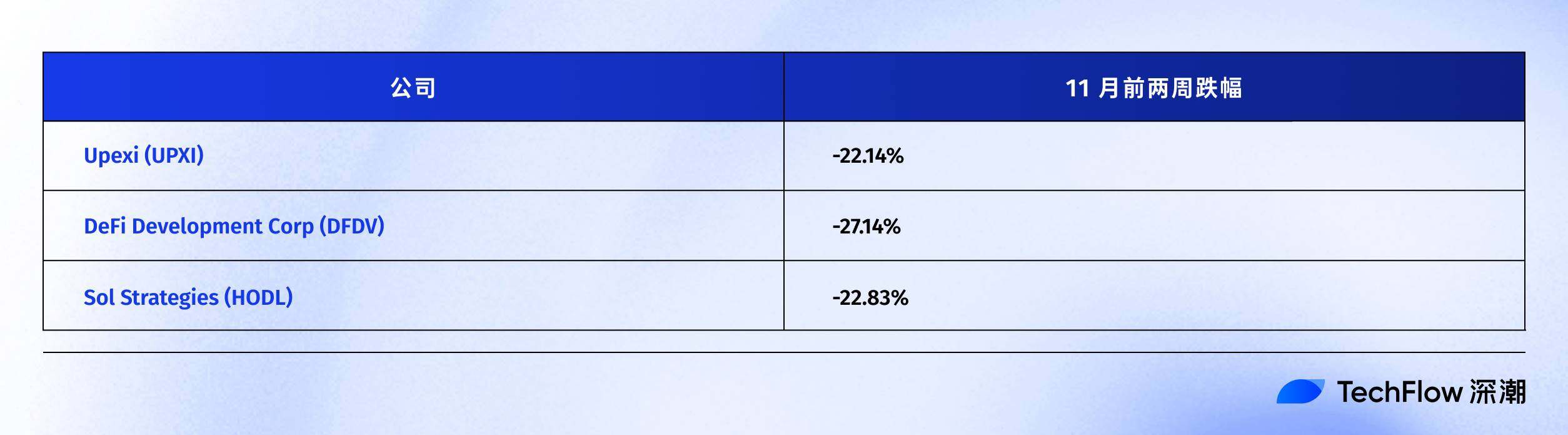

Other DAT companies are also having a tough time.

MSTR's predicament is not an isolated case.

The entire Digital Asset Treasury (DAT) sector suffered heavy losses in November.

First, let's look at the companies that hold BTC:

These companies all operate on a Bitcoin miner + treasury model. In the first two weeks of November, BTC fell by about 15%, but their stock prices fell by more than 30%.

But those companies that hold altcoins are in even worse shape.

Companies holding ETH:

These companies use ETH as a major asset in their coffers. In the first two weeks of November, the price of ETH fell from $3,639 to $3,120 (-14.3%), but their stock prices fell by 17-20%.

Companies holding SOL:

The most bizarre case is DFDV. In early 2025, its stock price soared by 24,506% due to the SOL Treasury strategy. However, by November 17, it had fallen from a high of $187.99 to around $6.74.

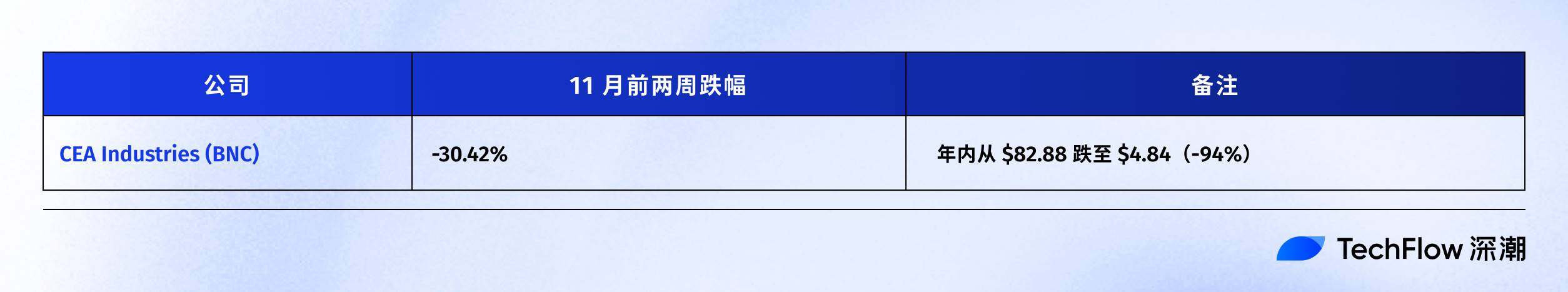

Companies holding BNB:

Why did the price of altcoins like Treasury Holdings fall even more sharply?

The logic is very simple:

In this market correction, BTC fell by 25%, but altcoins such as ETH, SOL, and BNB fell by far more than BTC.

When the assets of a cryptocurrency treasury themselves are more volatile, the stock price will be amplified further. Moreover, altcoin treasury companies also face an even bigger problem: liquidity risk .

BTC is the crypto asset with the best liquidity; even if you hold hundreds of thousands of BTC, MSTR can be slowly sold through the OTC market or exchanges.

However, the liquidity of ETH, SOL, and BNB is far inferior to that of BTC. When the market is gripped by fear, the selling pressure of millions of ETH can further crush the price, creating a vicious cycle.

The sharp drop in November was a comprehensive stress test.

The results are clear: regardless of whether they hold BTC or altcoins, DAT's stock price has fallen far more than its total assets.

Companies that hold altcoins face an even more severe impact.

When the printing press malfunctions

Returning to the question at the beginning of the article: If even Saylor can't be bought anymore, how's your DAT stock doing?

The answer is already clear.

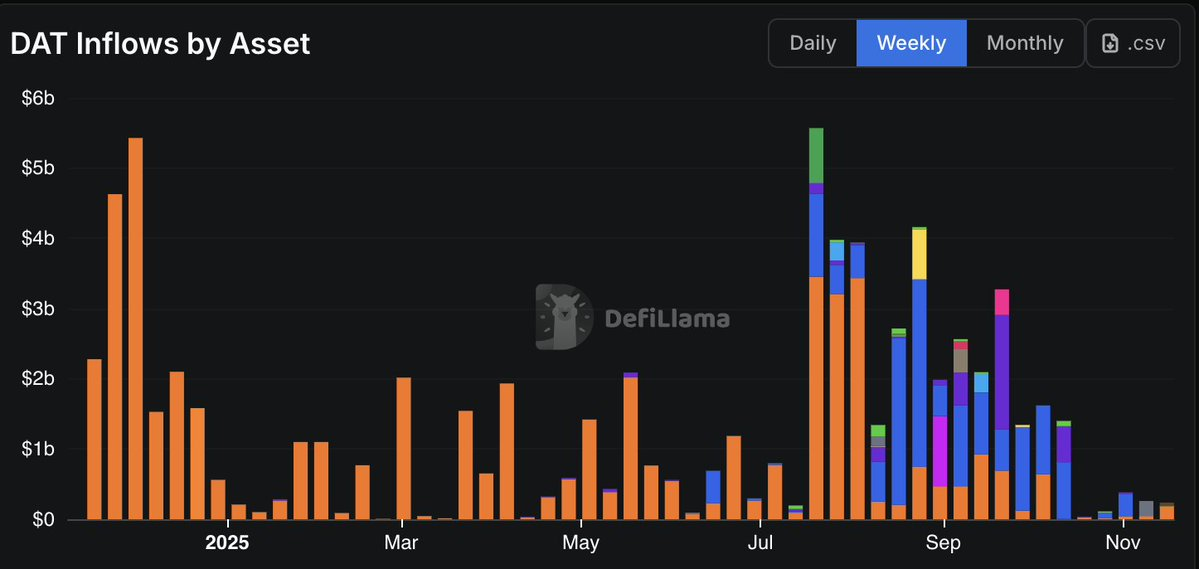

The November market tore away the last veil of pretense for DAT stock. According to the latest data from SaylorTracker, MSTR's Bitcoin holdings have fallen below $60 billion, and its unrealized profit of 649,870 Bitcoins is about to fall below the $10 billion mark.

When mNAV fell below 1, MSTR's "BTC printing press" model gradually failed. Issuing stocks to buy cryptocurrencies was no longer a smooth path; soaring financing costs and insufficient funds were problems Saylor had to face.

Data also confirms this, with funding inflows into DAT companies showing a downward trend, and October's inflows hitting the lowest level since the 2024 election.

BTC mining stocks generally fell by 30%, ETH treasury stocks fell by 20%, and the share prices of SOL and BNB treasury stocks plummeted to an unbelievable level. Regardless of which company you favor, the stock price decline far exceeded the value of the treasury assets themselves.

While the current environment of US stock market investors selling off in an attempt to avoid risk certainly plays a role, the inherent structural problems of the DAT model are becoming increasingly difficult to address in this headwinds.

When the crypto market corrects, the leverage of DAT stock amplifies the decline. What you think you're buying is "BTC exposure with a premium," but in reality, it's a leveraged accelerator of the fall.

If you still hold these stocks, perhaps you should ask yourself:

Are we buying them for crypto exposure, or for the illusion of a premium that no longer exists?

- 核心观点:MicroStrategy融资能力减弱,BTC印钞机模式失灵。

- 关键要素:

- mNAV跌破1,股票融资受阻。

- 账面现金仅5430万美元,弹药不足。

- 股价跌幅远超BTC,跑输27%。

- 市场影响:DAT板块普遍承压,投资者信心受挫。

- 时效性标注:短期影响