The Solana ecosystem has been buzzing lately, and one of the focal points of discussion is Meteora (MET) , a decentralized protocol redefining how on-chain liquidity works. Formerly Mercurial Finance, it rebranded after a market downturn and has now returned with a fresh, modern look as one of the most advanced liquidity infrastructure platforms on Solana, providing core functionality such as trading, yield strategies, and token issuance for a new generation of DeFi users. Meteora's mission is clear: to build a secure, composable, and community-owned foundational layer for decentralized finance.

Unlike other stagnant protocols, Meteora's greatest strength lies in its dynamism. While traditional automated market makers (AMMs) often employ fixed fees and static pools, Meteora leverages real-time data to automatically adjust liquidity and pricing based on market fluctuations. This design reduces slippage for traders, increases returns for liquidity providers (LPs), and creates a more equitable environment for new token projects to launch.

The MET token is currently listed on the XT pre-market OTC market, with the MET/USDT trading pair set to open shortly. The market is closely watching whether Meteora will become a key driver of Solana's next DeFi boom.

Lazy Quick Review | TL;DR

– Meteora (MET) is a next-generation liquidity protocol built on the Solana blockchain that combines dynamic AMMs, yield-optimizing treasuries, and fair launch tools.

– Formerly Mercurial Finance , it rebranded after the FTX collapse with the goal of rebuilding trust and achieving true community ownership.

– Core Features: A dynamic fee mechanism that automatically adjusts fees based on market fluctuations, a treasury where idle funds can be lent out for additional income, and an efficient centralized liquidity pool.

– MET Token: This token combines governance, staking, and revenue sharing functions, with 48% of the total supply unlocked at launch through the Phoenix Rising Plan.

How to Get It: Currently available for trading in the XT pre-market OTC area , with the MET/USDT spot trading pair coming to XT.COM and Solana DEX.

Table of contents

How Meteora works: core mechanics explained

A Complete Analysis of the MET Token Economy: A Deep Dive into Meteora’s Economic System

Meteora's application scenarios and ecological layout

How to purchase MET | Participation Guide

Meteora's Competitive Advantage | Why It Stands Out

Main risks and challenges of MET tokens

What is Meteora (MET)?

Meteora is a decentralized liquidity protocol designed to make liquidity on Solana smarter, more efficient, and more rewarding. As a core infrastructure component of the Solana DeFi ecosystem, it provides critical support for trading, yield generation, and token issuance for projects across the ecosystem.

Originally known as Mercurial Finance , the project was one of the earliest stablecoin AMMs on Solana. Following the 2022 market downturn and the collapse of FTX, the team embarked on a complete rebrand, relaunching as Meteora with a focus on transparency, innovation, and community ownership. This transformation represents not only a renewed philosophy but also an expansion of its mission—from a single stablecoin exchange platform to a comprehensive liquidity engine supporting multiple assets.

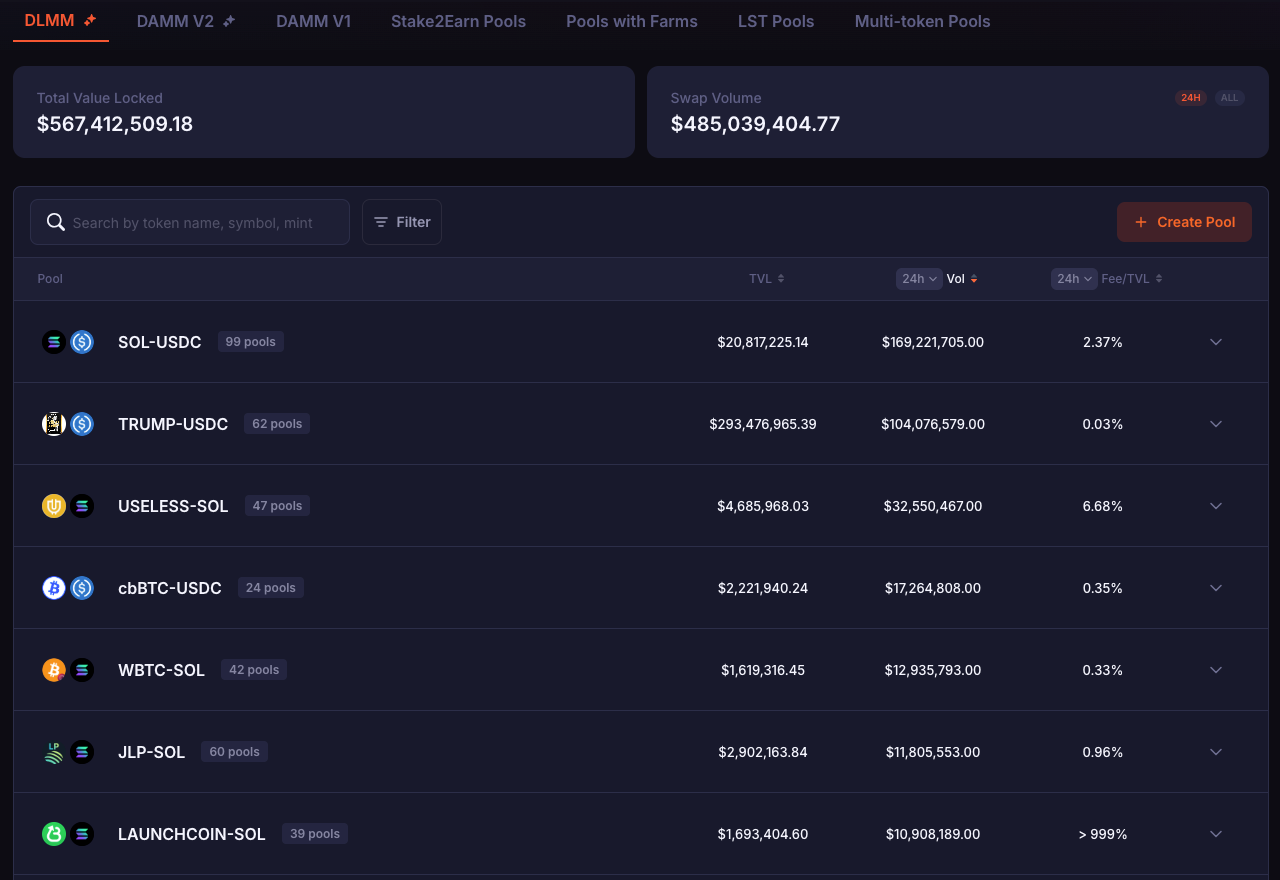

Meteora has launched two groundbreaking tools: the Dynamic Liquidity Market Maker (DLMM) and the Dynamic AMM (DAMM) . These tools automatically adjust fees and liquidity distribution based on real-time market conditions, thereby improving capital utilization, reducing slippage, and helping liquidity providers (LPs) achieve more stable returns.

The core of the ecosystem is the MET token . Holders not only participate in protocol governance, but also share transaction fees and influence future product upgrades. By 2025, Meteora had become one of the most active DeFi protocols on Solana, with daily trading volume exceeding $1.18 billion and total value locked (TVL) exceeding $1.1 billion.

Meteora Team and Strategic Support

Meteora was founded by the core team of Mercurial Finance, who were among the earliest DeFi builders on Solana. They have both a strong technical background and a focus on community-driven growth.

– Zhen Hoe Yong (Co-founder, Project Leader): Responsible for the overall development and strategic direction of Meteora, with an emphasis on transparency and sustainable innovation.

– TRAV (CTO): Participated in the development of Uniswap v3 and Curve, and led the design of Meteora’s DLMM and dynamic fee mechanism.

– ROOK (Chief Operating Officer): Former investment bank and hedge fund manager, responsible for business development, strategic partnerships, and ecosystem integration.

– Ben Chow (co-founder and former CEO): Drives brand reshaping and the “Phoenix Rebirth Plan” and steps down in early 2025.

– 0xM (Advisor/Founding Member): One of the early participants and considered the creator of Meteora’s liquidity model.

Meteora maintains a close partnership with Jupiter, a trading aggregator , with its co-founders Meow and Ben Chow providing strategic support to the ecosystem. The project has received investment from top institutions such as Coinbase Ventures, Jump Capital, and Solana Ventures . It adheres to a decentralized "no equity, only $MET" issuance model, truly returning control to the community.

How Meteora works: core mechanics explained

Meteora is unique in that it completely redefines how automated market makers (AMMs) operate. Instead of relying on static models, it builds a dynamic system that adapts to market changes in real time, fundamentally improving capital utilization efficiency and enabling higher returns for liquidity providers (LPs).

1. Dynamic Liquidity Market Maker (DLMM)

DLMM is the core foundation of the Meteora ecosystem. Unlike traditional AMMs, which evenly distribute liquidity, DLMM adopts a bin-based structure similar to Uniswap v3 and is optimized for Solana 's high-performance network. Limited partners (LPs) can freely set price ranges, concentrating their funds within the most frequently traded areas. DLMM's greatest strength is its dynamic fee mechanism: when market volatility increases, transaction fees automatically increase to mitigate impermanent loss; when the market stabilizes, fees decrease to attract more transactions. This self-regulating system ensures consistently active liquidity and more stable returns for LPs.

Learn more: DLMM Launch Pool (Source: Meteora Docs)

2. Dynamic Automated Market Maker (DAMM v 2)

DAMM v2 upgrades the traditional AMM model. It supports unilateral liquidity, flexible fee tiers, and incorporates anti-bot mechanisms, making it particularly suitable for new token issuances. The protocol sets higher fees during the initial trading phase to prevent front-running, then gradually reduces fees based on market stability, ensuring a more equitable launch environment for new projects.

Learn more: DAMM v 2 Launch Pool (Source: Meteora Docs)

3. Dynamic Vaults

In Meteora, idle liquidity doesn't go to waste. The system automatically lends unused assets to Solana lending platforms (such as Solend or Jet) for additional yield. These vaults are continuously and dynamically rebalanced, combining transaction fees with lending interest to generate higher and more stable returns for LPs.

Learn more: Alpha Vaults (Source: Meteora Docs)

4. Composability and Security

Meteora's modular design allows for seamless integration with other Solana applications. Platforms like Jupiter and Kamino have already integrated Meteora's liquidity pools and vaults, further expanding its influence in the DeFi ecosystem. All contracts are written in Rust and audited by security firms such as Zellic and Bramah Systems. Immunefi also offers a $500,000 bug bounty program to ensure the safety of user assets.

A Complete Analysis of the MET Token Economy: A Deep Dive into Meteora’s Economic System

The MET token is the core pillar of the Meteora ecosystem, running through multiple links such as governance, staking and revenue distribution, providing power for the entire platform.

The "Phoenix Rising Plan" is Meteora's Liquidity Generation Event (LGE), designed to ensure liquidity for everyone. Unlike other projects' common issuance models of low circulation and high valuations, Meteora has chosen a path of complete transparency and broad distribution from the outset. The team has pledged not to sell any tokens during the TGE (Initial Coin Offering), ensuring that value returns directly to the community rather than to insiders.

MET's core features include:

– Governance : Holders can vote on protocol upgrades, fee parameters, and ecosystem collaboration.

– Staking and Revenue Distribution : 10%–20% of each transaction fee will be distributed to MET stakers as rewards.

– Liquidity incentives : DAO can use reserve tokens to reward LPs or fund ecosystem growth plans.

By eliminating token inflation and aligning incentives with real on-chain activity, Meteora has established a sustainable economic system. As transaction volume and fees grow, MET stakers directly share in the platform's profits, aligning the long-term interests of the community and the protocol.

Meteora's application scenarios and ecological layout

Meteora is the liquidity hub of the Solana DeFi ecosystem, providing the foundational support for transactions, revenue generation, and token issuance across the entire network. It is more than just a set of protocols; it is the underlying engine that drives financial activity on Solana .

1. Low-Slippage Swaps

Traders can enjoy a stable and efficient trading experience with Meteora's deep liquidity pool. Spreads remain tight even during volatile markets. Meteora's stablecoin pool aggregates assets like USDC, USDT, and PAI, helping users effectively reduce slippage and improve execution efficiency on large trades.

2. Yield Farming and LP Optimization

Liquidity providers (LPs) can combine Meteora's dynamic liquidity pool with external strategy platforms like Kamino to achieve higher returns across multiple DeFi protocols through compounding returns. The entire process requires no complex operations, automating and maximizing returns.

Try it yourself: Meteora Liquidity Pool (Source: Meteora dApp)

3. Token Launch Infrastructure

Meteora’s Alpha Vault and Dynamic Bonding Curve tools provide a level playing field for new token projects to launch. These systems effectively prevent front-running bot attacks, lock in initial liquidity, and provide priority participation for true supporters.

4. Composability Across Solana

Meteora seamlessly integrates with several core projects in the Solana ecosystem, including Jupiter for transaction routing, Hubble for lending services, and Solend for yield generation. These partnerships make Meteora a plug-and-play liquidity engine, further strengthening the overall vitality of the Solana DeFi ecosystem.

Learn more: Meteora Ecosystem (Source: Meteora Startup Guide)

How to purchase MET | Participation Guide

As of October 2025, users can participate in MET tokens in a variety of ways, whether you want to trade in advance, earn returns, or hold for the long term, there are suitable options.

1. XT Pre-Market OTC Trading :

XT Exchange provides early access to MET through its pre-market OTC trading area , allowing users to obtain MET in advance of the token's official launch. The platform offers a transparent pricing mechanism and a secure settlement process, allowing users to participate with confidence.

Participate now: MET/USDT XT pre-market OTC trading

2. XT.COM Spot Trading Pair (MET/USDT)

Following the official launch, MET will be available for spot trading on the XT.COM platform, with the MET/USDT spot trading pair serving as the primary market. In the future, users will also be able to trade through Solana 's decentralized aggregation platform, Jupiter , where the system automatically searches for the best price and matches through Meteora's proprietary liquidity pool.

3. Providing liquidity

Users can add funds to Meteora’s liquidity pool and earn MET rewards. LP tokens held can also be staked or used as collateral on Solana’s lending platform, achieving multi-layered returns.

4. Community Airdrop

Early supporters and holders of Mercurial (Meteora’s predecessor) token, MER, received a portion of the 48% community allocation in the Phoenix Rising Plan in recognition of their loyalty and participation.

Meteora's Competitive Advantage | Why It Stands Out

Meteora stands out among DeFi projects by seamlessly integrating the industry's most sophisticated concepts with Solana 's high speed and low cost. Building on the success of platforms like Uniswap and Curve, Meteora further incorporates automation, yield optimization tools, and community-led governance to create a smarter and more efficient liquidity layer.

Fundamentally, Meteora focuses on two core goals: improving capital utilization and empowering users . Its dynamic system adapts in real time to market fluctuations, enabling liquidity providers (LPs) to achieve higher returns while ensuring smooth trading. Meteora's community-first approach ensures that platform decision-making power rests with its users, not venture capital firms.

The following is a comparison between Meteora and mainstream protocols:

By integrating adaptive liquidity mechanisms, a fair token economics model, and extensive ecosystem partnerships , Meteora is on its way to becoming a core liquidity hub on Solana. It balances deep liquidity with stable returns, building an efficient and sustainable new DeFi paradigm for traders and limited partners.

Main risks and challenges of MET tokens

Although Meteora excels in technological innovation and community-driven development, users still need to be aware of the potential risks and challenges involved:

– Market Volatility Risk: Since approximately half of the total supply will be unlocked at the time of token issuance, there may be large price fluctuations in the early trading phase.

– Smart Contract Risks: Although Meteora has been audited by multiple security agencies, new features such as dynamic fees and automated vaults still have certain technical complexities and may hide undiscovered vulnerabilities.

– Reputational risk: The project existed as Mercurial Finance in its early days and was involved in the 2025 LIBRA incident. These historical factors may still affect the trust of some users.

– Solana network dependency: Meteora runs entirely on the Solana chain . If the network is congested, downtime or performance issues occur, it may affect transactions and vault operations.

– Governance concentration risk: As MET DAO develops, insufficient community voting participation or excessive concentration of token holdings by large holders may affect the fairness of decentralized governance.

The Meteora team is continuously addressing and mitigating these potential risks through information transparency, independent security audits, and active community governance mechanisms.

The future of Meteora

With the official launch of the MET token and the gradual implementation of community governance, Meteora is entering a new phase. The team will focus on expanding the ecosystem, deepening decentralized governance , and exploring multi-chain scalability. The project's roadmap reflects its commitment to long-term sustainability and continuous innovation.

The key areas to be advanced include:

– Dynamic Bonding Curve 2.0: Introducing a customizable pricing model for new token issuance and collaborative projects.

– LP tool upgrade: Optimized the user interface and added automatic interval management function to make liquidity strategies more convenient.

– Multi-chain expansion plan: Explore deployment on other high-performance blockchains to build a cross-chain liquidity network.

- Governance expansion: Gradually handing over more control to MET DAO , including treasury management, fee distribution, and incentive plan development.

Explore on your own: MET DAO

If Meteora can maintain its current momentum and continue to generate strong on-chain returns, MET has the potential to become one of the most resilient governance tokens in the DeFi space. With its flexible technical architecture, fair token economics, and high level of community ownership, Meteora is poised to become a core force driving the next wave of decentralized financial innovation on Solana.

Frequently Asked Questions about Meteora (MET)

1. What is Meteora (MET)?

Meteora is a decentralized liquidity protocol built on the Solana blockchain . Through adaptive AMM and vaults with lending functions, it makes transactions and earnings more efficient and intelligent.

2. How to obtain MET?

Users can purchase MET in advance in the XT pre-market OTC area . After the official launch, they can also trade it on the MET/USDT spot trading pair on XT.COM or the Solana decentralized exchange (DEX).

3. What is unique about Meteora?

Meteora uses a dynamic fee mechanism, a treasury system for efficient capital utilization, and a fair issuance token structure, making it more flexible and sustainable than traditional AMMs.

4. What is the Phoenix Rising Plan?

This is Meteora’s 100% unlocked issuance strategy, with all tokens distributed directly to the community, ensuring full transparency and widespread ownership from day one.

5. What can MET holders do?

MET can be used for staking to obtain a share of the protocol fees, and at the same time has governance rights and can participate in the future development decisions of the platform through MET DAO .

6. What risks should users be aware of?

Key risks include market volatility, potential vulnerabilities in smart contracts, and reliance on the Solana network. Users are advised to interact only through official channels and be wary of counterfeit tokens or phishing websites.

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, over 1 million monthly active users, and over 40 million users within its ecosystem. We are a comprehensive trading platform supporting over 1,000 high-quality cryptocurrencies and over 1,300 trading pairs. The XT.COM cryptocurrency trading platform offers a wide range of trading options, including spot trading , leveraged trading , and futures trading . XT.COM also operates a secure and reliable NFT trading platform . We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.

- 核心观点:Meteora重塑Solana流动性协议。

- 关键要素:

- 动态AMM自动调整费率流动性。

- 闲置资金自动出借获取复合收益。

- 代币发行48%供应量即时解锁。

- 市场影响:或成Solana DeFi生态核心引擎。

- 时效性标注:中期影响