1. Trade frictions escalate again, with three signals triggering market volatility.

In just one week, the market went through the entire process from China's escalation of rare earth controls → Trump's tariff threats → Vice President Vance's easing of his stance.

China strengthens rare earth export controls

In early October, China's Ministry of Commerce announced tightened export controls on rare earth elements, superhard materials, and core raw materials for lithium batteries, explicitly adding certain high-performance rare earth magnets and semiconductor equipment raw materials to the approval scope. This move directly hits the vitals of the US semiconductor and high-tech industry chain and is seen as a "reciprocal countermeasure" to the US semiconductor equipment export blockade.

Trump threatens 100% tariffs

In mid-October, Trump announced he would impose a 100% tariff on Chinese goods, tightening export restrictions, effective November 1st, in an attempt to gain leverage through extreme pressure. However, this move is facing institutional challenges: the US Supreme Court is currently hearing several cases challenging the legality of the president's unilateral tariff increases. If it rules against him, Trump's tariff weapon could become completely ineffective.

Vice President Vance sends a signal of rationality

Amid market tensions, Vance publicly stated that Trump "values cooperation with China" and hopes to resolve differences through negotiations. This conciliatory statement led to a rapid rebound in US stock futures and cryptocurrency markets, and a short-term recovery in risk appetite.

in conclusion

The three signals converge to a clear conclusion - Trump's TACO model of "talking but not fighting" is being constrained by reality, and the intimidation-based deal is on the verge of failure.

2. MSX Research Institute’s Viewpoint: Under triple constraints, the “crying wolf” strategy fails

Law: The Supreme Court is the institutional valve that determines whether "TACO" can continue

Lower courts have already expressed negative opinions on the large-scale tariffs imposed under IEEPA. If the Supreme Court ultimately confirms that the president does not have the authority to impose tariffs of this scale without congressional authorization, the feasibility of Trump's use of "unilateral executive threats" to change trade rules will be significantly reduced, fundamentally weakening the market transmission mechanism of "speaking as deterrence."

Industry: Rare earth control constitutes a substantial and reciprocal countermeasure

China's global dominance in rare earth mining, separation processing, and magnet manufacturing gives it physical leverage over the US in semiconductor and high-end manufacturing. In the short term, it will be difficult for the US to establish complete substitution capabilities in heavy rare earths (dysprosium and terbium), refining, and magnet manufacturing. Large-scale substitution and recycling will take years to achieve.

Market: From "frightened" to "learning" - Taco's marginal effect declines

The history of multiple rounds of "threat-and-concession" has made the market numb to verbal threats: investors have gradually turned their attention to legal trial nodes and industry data rather than individual remarks.

It can be seen that Trump’s call for the TACO model seems to have been forced. The starting point of all this was the announcement by China’s Ministry of Commerce to strengthen control over rare earths. So what is the current situation of the global rare earth environment?

3. The Contest between Technological Barriers and Industrial Resilience

China's escalating countermeasures and technological blockade

- Item control is refined: All foreign magnets and semiconductor materials containing ≥0.1% of Chinese heavy rare earths require export licenses, covering all high-end dependent products.

- Technology export freeze: Core technologies and drawings for rare earth mining, separation, and magnetic material manufacturing are included in a control list to block the US and Europe from obtaining advanced technologies.

- Control of secondary resource recycling: China controls 70% of the world's rare earth waste recycling technology. Banning technology exports will prolong the reconstruction cycle of the US and European supply chains.

The Real Dilemma of Reconstructing the U.S. Rare Earth Industry Chain

- Gap in heavy rare earth resources: Heavy rare earths (dysprosium and terbium) account for <5% of the proven reserves in the United States, while China's heavy rare earth reserves account for more than 70% of the world's total. Even if the United States restarts light rare earth mines, it will not be able to meet the demand for high-end magnetic materials.

- Processing technology gap: American ore still needs to be shipped to China for separation and processing. MP Materials' annual output of NdPr oxide is 6,000 tons, which is only 1/5 of that of a single rare earth plant in northern China.

- Policy implementation bottlenecks: US environmental regulations and community resistance result in new mine construction cycles lasting 10-15 years, requiring huge capital investment; China's mine cycle is only 3-5 years.

Phased breakthroughs and limitations in the development of alternative technologies

- Performance gap: The magnetic energy product of Germany's VAC heavy rare earth-free NdFeB magnets is 15-20% lower, which cannot meet the needs of high-end aviation, wind power and other scenarios.

- Mass production bottleneck: The annual output of Niron Magnetics' iron-nitrogen permanent magnets in the United States is only 5 tons, and Japan's Proterial's neodymium-free magnets are still in the laboratory stage, and the cost is more than three times that of China's neodymium iron boron.

- Technology path dependence: Production equipment still needs to rely on Chinese companies (80% of the world's rare earth processing equipment is manufactured in China).

Partial repair and substitution attempts of the supply chain

- Cooperation between US and European companies is accelerating: Critical Metals and REalloys have reached an agreement to supply 15% of the rare earth concentrate from the Tanbreez project in Greenland to the United States, but the ore still needs to be shipped to Malaysia for processing.

- Inventory cycle adjustment: Tesla, Siemens Gamesa and other companies increased inventory (from 2 months to 6 months), easing short-term supply pressure, but rising costs led to a 1-2 percentage point compression in profit margins.

- Price transmission mechanism: The increase in rare earth prices has been partially passed on to end products. For example, the cost of permanent magnet synchronous motors has increased by approximately US$800 per vehicle, resulting in a 1.2% increase in the price of Tesla Model Y in the Chinese market.

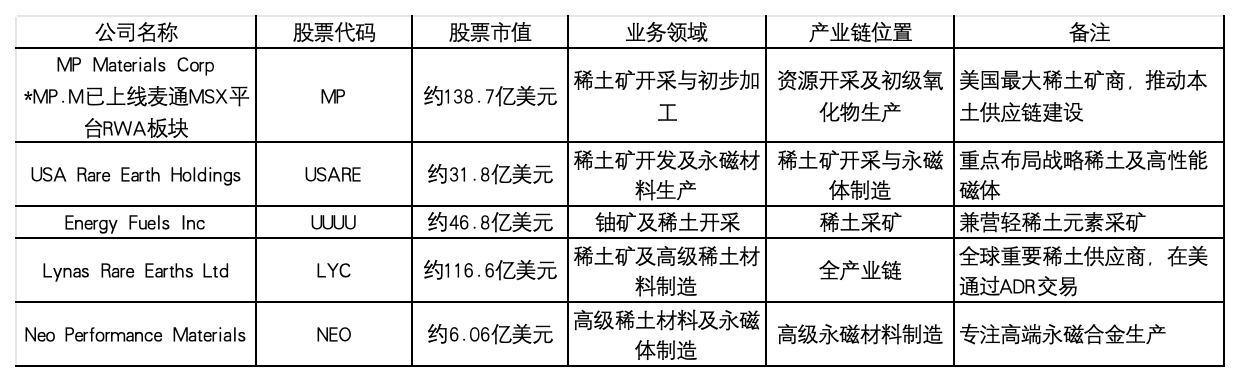

As the Sino-US rare earth dispute heats up, upstream rare earth/permanent magnet replacement stocks in the US stock market have attracted attention. The following are related stocks:

IV. Conclusion

- Trump's "TACO" strategy has encountered a triple backlash from the legal, industrial and market aspects, and the "wolf cry" game is unsustainable.

- The Supreme Court ruling will become a watershed in tariff strategy, and China's rare earth export controls are the starting point for substantive negotiations.

- Short-term fluctuations, structural differentiation, and the dominance of legal variables will become the keywords of the global market in the coming months.

- Investors should respond to policy fluctuations with "tactical flexibility + strategic determination" and find growth opportunities amidst contradictions.

Conclusion : Policy noise fades quickly, but structural logic endures. When the "crying wolf" game fails, the real market trend has just begun.

- 核心观点:特朗普关税威胁策略正失去市场效力。

- 关键要素:

- 最高法院审理关税合法性案件。

- 中国稀土管制击中美国产业链。

- 市场对口头威胁逐渐钝化。

- 市场影响:短期震荡加剧,风险偏好波动。

- 时效性标注:短期影响