With recent PCE inflation and ADP employment data falling short of expectations, the market has fully digested the panic caused by the Fed's hawkish September rate cuts. Liquidity has rapidly recovered, and investors have reaffirmed their expectations for two rate cuts this year. This optimism has also brought me significant rewards, thanks to an interesting project, NFTStrategy, which has seen a 20-fold increase in value in just one month. Although the investment amount was small, I have some insights to share. In short, NFTStrategy leverages the low liquidity of NFT assets and clever DeFi design to create a Degen strategy for an on-chain NFT vault, similar to MicroStrategy. This project is a perfect opportunity to relive the financial innovations of the DeFi Summer of 2020.

NFTStrategy Project Background: TokenWorks

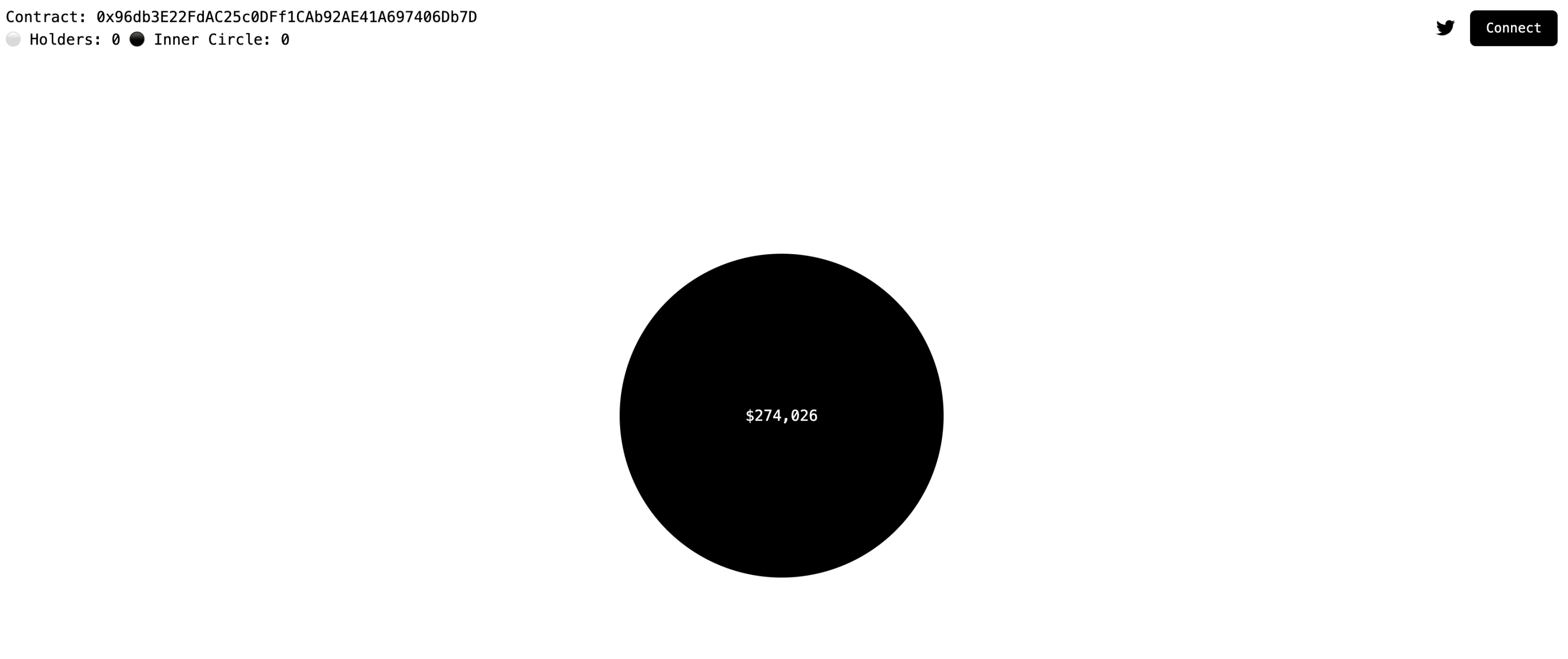

Before introducing the project's mechanics, let's briefly explain its background. Behind NFTStrategy is TokenWorks, an anonymous team focused on token design and experimentation. Founded in 2024, I became interested in the team relatively early on, inspired by a MEME token called PVP, their second project. In fact, since October 2024, before launching PunkStrategy, the team had launched a total of 10 DeFi projects, all focused on Ponzi-style token economics. Their first and most notable project was Circle (O), an ERC-20 MEME token on Shape. They capitalized on the fact that Shape's L2, a platform focused on the NFT market, lacked a DEX or tradable token assets at launch. Therefore, they deployed the MEME token and forked Uniswap V2 to provide a trading platform. They also designed a minimalist trading website, with the token's market capitalization determining the size of the circle displayed on the website.

Subsequent projects have incorporated interesting designs around the creation, issuance, and trading mechanisms of tokens. For example, in the PVP project, anyone can "raid" the wallet of a PVP token holder. The raid is essentially a timed auction with a starting price of 0.001 ETH. If no one bids against you within the specified time, you will receive all the PVP tokens held by your raided wallet, while the raided wallet will receive your bid.

From the design of these projects, we can see that the team is very good at the innovative design of the MEME token economic model of the community fair launch type (Fair Launch). In fact, this type of innovation is very common in the DeFi Summer stage. People identify trading opportunities from different interesting Ponzi models and profit from them.

While most of these projects have failed, the TokenWorks team has continuously accumulated community influence and built a scalable cold-start seed user base. This is crucial to the success of Fair Launch projects. In most Ponzi schemes, if the number of early participants is too small, it can easily be monopolized by a few clever "whales" after launch, disrupting the pre-defined game dynamics and making the risk for latecomers extremely high.

In addition, from the archived documents we can see that the team is also constantly accumulating experience in dealing with on-chain snipers, how to mobilize the dissemination effect of KOLs through mechanism design, and how to expand the influence of tokens. In general, the author sees the image of a team that is relatively long-term-oriented, good at summarizing and reviewing, and has a strong ability to withstand setbacks.

The TokenWorks team's launch of PunkStrategy on September 6th marked a new beginning in this story. The subsequent launch of NFTStrategy, a product that templated and platformized PunkStrategy's token mechanism design, saw its price surge over 20-fold in less than a month.

GMGN data shows that PUNKSTR token holdings are relatively evenly distributed, with the largest holding address accounting for 3.05% of the total. The top 20 holding addresses have all achieved unrealized profits exceeding $1 million, demonstrating the strength of this wealth-creating effect. However, such a high level of unrealized profits, relative to liquidity of only $4 million and a market capitalization of over $200 million, is still a significant risk. However, judging by price trends, investor enthusiasm appears to be growing. So, what are the mechanisms that give this model such magic? Let's take a closer look.

NFT Strategy's DeFi Innovation

In fact, the mechanism of NFTStrategy is relatively simple. First, NFTStrategy is essentially an NFT treasury. By issuing corresponding tokens and using the transaction fees generated by the tokens on Uniswap V4, it purchases blue-chip NFTs as treasury reserves to support the value of the tokens. The project's operating logic is roughly as follows:

Users purchase cryptocurrencies called "Strategy Tokens," such as PUNKSTR (for the CryptoPunks collectible series). Every time someone buys or sells one of these tokens, the system charges a hefty 10% fee. This fee is divided into several parts:

- 80% is automatically deposited into the vault to purchase NFT floor-priced assets in the series (such as the lowest-priced Punks);

- 10% will be rewarded to the original NFT creator or project;

- 10% will be used to buy back and burn tokens, reducing market supply and thus supporting token prices. It’s important to note that PunkStrategy’s strategy is slightly different, with 20% of the tokens belonging to the team.

When the fund pool accumulates to a certain level, the system automatically buys NFTs from the market and re-lists them for sale at a slightly higher price (1.2 times the original price). If these NFTs are sold, the ETH used to buy back the tokens is destroyed, forming a "flywheel" cycle: active token trading → fee collection → NFT purchases → NFT sales → token buyback and destruction → increased token value potential → attracting more transactions.

This model creates a dynamic linkage between NFT and tokens, and allows holders to indirectly participate in the profit fluctuations of the NFT market without directly holding NFT.

In addition to the basic flywheel, NFTStrategy also designed a Dutch auction issuance mechanism to mitigate on-chain snipers. Initially, the token transaction fee is 95%, and then decreases by 1% every minute until it reaches a minimum of 10%. This mechanism effectively prevents snipers from exploiting the script's speed advantage to jump the gun at the beginning of the issuance, ensuring equal entry opportunities for early participants.

Next, I will explain the reasons for buying at that time. There are two specific points:

First of all, I believe that NFTStrategy is essentially very similar to MicroStrategy's BTC treasury strategy. Both target markets with liquidity mismatch problems and widespread attention. MicroStrategy targets the inefficiency of funds from traditional financial markets to flow into the cryptocurrency market, and the cryptocurrency market has a broad retail investor base, which will help to achieve rapid dissemination of the mechanism based on network effects. NFTStrategy, on the other hand, targets the high-priced NFT market. Due to the non-homogeneous technical characteristics and high unit prices, ordinary cryptocurrency investors cannot purchase it. However, at the same time, holders of blue-chip NFTs generally have extensive influence on social media, so it can quickly reach this group of people and use their influence to achieve rapid dissemination.

Secondly, in terms of the launch method, NFTStrategy adopted the Fair Launch fair sale method and has a good anti-sniper design, which makes the early chips distributed more evenly. Under the premise of a relatively healthy turnover rate, the price trend will be more stable. Moreover, due to the low initial liquidity, as long as the trading volume can be guaranteed, the small purchase volume brought about by the accumulation of repurchase funds brought about by the high 10% handling fee can effectively drive the price up, resulting in a good wealth effect and the ability to quickly attract speculators to participate.

As for the risks, they mainly come from the end of positive feedback brought about by two factors:

The decline in the price of treasury NFTs: This is relatively easy to understand, because as a value support, if the price of the reserve NFT falls, it will lead to a decline in the intrinsic value of the token. However, I believe that this risk is not high at the moment. First of all, due to the low liquidity of blue-chip NFTs, the turnover is not frequent and the price fluctuations are not drastic. Secondly, most NFTs are denominated in ETH. As long as the price trend of ETH rises, it will also lead to an increase in the value of NFTs. This is also a clever point. Finally, the main source of funds for the current repurchase of Strategy tokens comes from the accumulation of handling fees (1% of each transaction), rather than buying low and selling high for NFTs. Even if the price of NFTs falls, as long as the overall trading volume can be guaranteed, the power of repurchase will effectively drag down the price.

Declining trading volume: This is the biggest risk I believe. As a token's influence grows, liquidity on external exchanges increases. For example, CEXs will list the token, and other DEXes will attract liquidity providers. This migration of liquidity will disperse trading volume to other trading platforms. Strategy tokens receive a 10% share of transaction fees through Uniswap V4 hooks. This will prevent them from profiting from turnover on other exchanges. As transaction fees decrease, buyback power will erode, significantly reducing the token's appeal and setting the stage for a negative feedback loop. Therefore, observing liquidity and trading volume is the most crucial factor in determining a token's trading value.

- 核心观点:NFTStrategy项目通过创新机制实现20倍涨幅。

- 关键要素:

- 10%交易手续费驱动NFT金库循环。

- 荷兰拍发行机制防止狙击抢跑。

- 蓝筹NFT储备支撑代币内在价值。

- 市场影响:推动NFT金融化创新,吸引投机资金。

- 时效性标注:短期影响