Original Author: Cabin Crew, Cabin VC

After the upgrade of Ethereum Shanghai is completed, the pledge rate of ETH can be regarded as the risk-free national bond rate of Ethereum. Based on this interest rate, a variety of LSDFi agreements have been derived, which have gained a lot of exposure recently, including: interest rate swaps Market Pendle; LSD income aggregators Yearn, unshETH; LSD liquidity solutions Aura, LSDx Finance, etc. Among the many LSDfi protocols, 0xAcid provides the highest rate of return. Currently, the pledged APR issued by wETH is about 90%, which is much higher than the 5% -20% APR provided by other protocols. This article will introduce in detail how 0xAcid does it The highest yield and what are the risks.

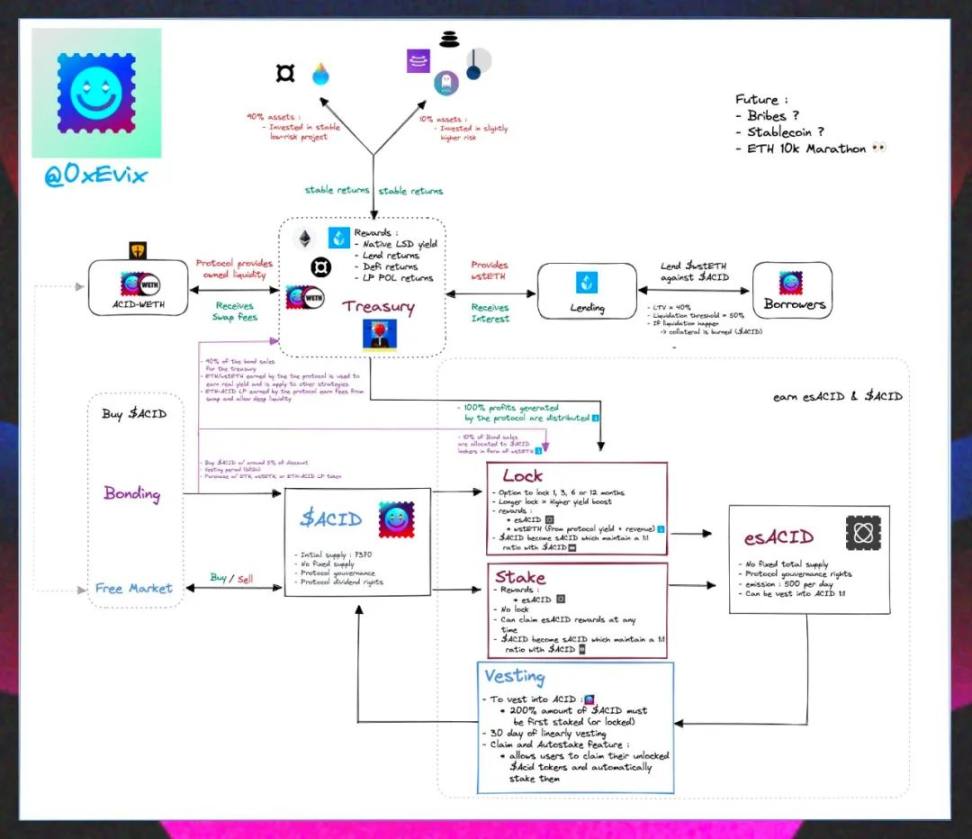

1. 0xAcid Mechanism

0xAcid is a protocol designed to maximize returns on LSD assets (stETH, rETH, fraxETH, etc.), currently deployed on Arbitrum and Ethereum. The treasury strategy invests LSD assets in other DeFi protocols in pursuit of the highest rate of return, and stratifies users according to different income targets, providing a rate of return much higher than other LSD protocols.

image description

(Source: Twitter @0x Evix)

1. ACID & esACID

ACID represents the claimed share of treasury assets. When ETH reaches $10k, the treasury will convert all LSD assets into wETH and distribute them to all ACID holders in proportion, so the value of ACID is fully supported by the ETH in the treasury .

ACID has two output methods: buying Bonds and esACID vesting.

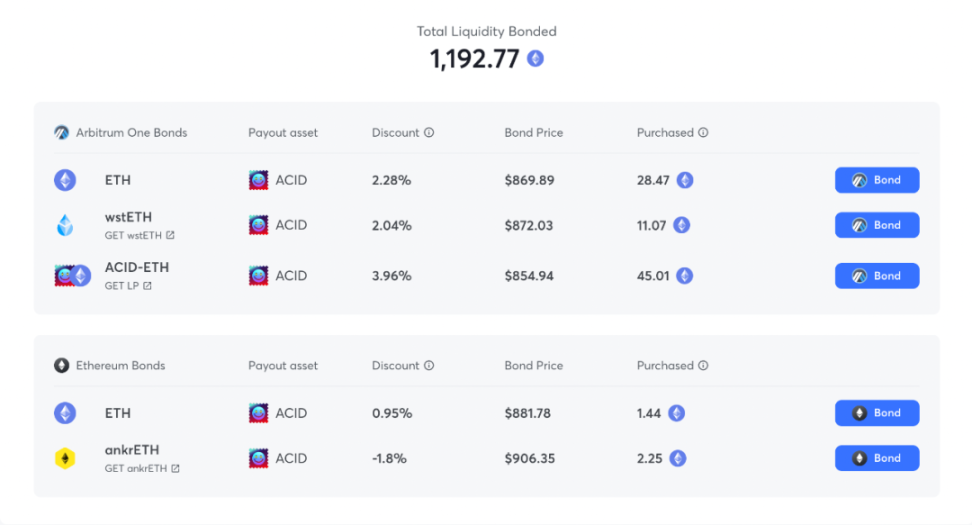

image description

(Source: 0 x Acid official website)

esACID is an ACID that is being vested or to be vested. It is only produced through Locked ACID and cannot be transferred or traded. Attributing esACID to ACID requires locking at least 2 times the amount of ACID, which will be linearly converted to ACID within 60 days.

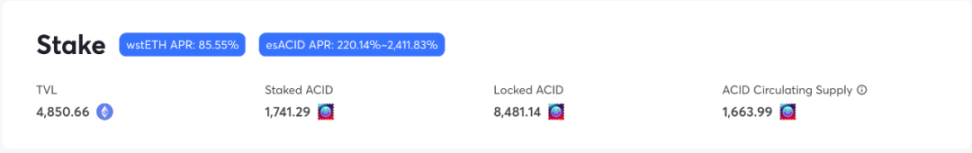

2.Locked ACID & Staked ACID

ACID holders can choose to pledge or lock two ways to obtain different types of benefits:

Locking ACID as Locked ACID can get esACID emission rewards. Currently, the output of esACID is 500 pieces/day, and the emission of esACID can be modified through community proposals. The longer the lock-up period, the more esACID emission rewards you get. At present, the APR locked for 1-12 months is around 220% -2400%. In the future, with the reduction of esACID emissions and the increase of the number of Locked ACIDs, the locked APR will gradually decrease;

Staking ACID as Staked ACID will obtain two benefits: all the benefits obtained by LSD assets through the treasury strategy and 10% dividends from Bonds sales, both of which are distributed in the form of wETH. The current ACID staking APR is about 90%. The pledged ACID can be canceled at any time and enter circulation.

image description

(Source: 0xAcid official website)

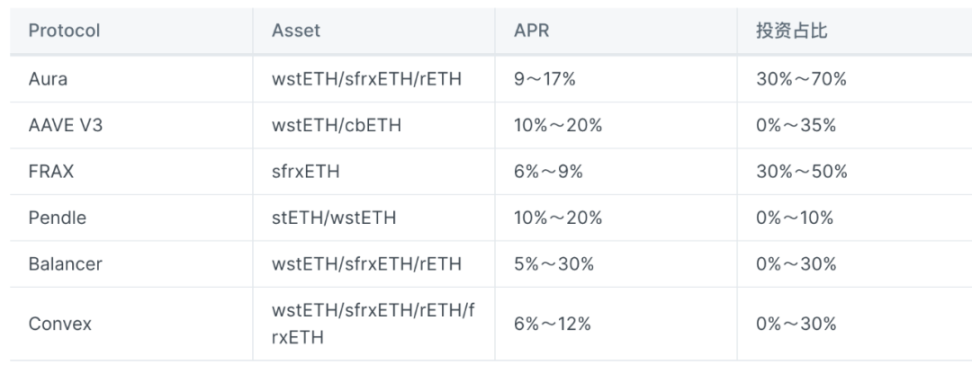

3.Treasury

The ETH and wstETH raised through Bonds sales will use treasury strategies to pursue high returns in DeFi protocols while giving priority to security, and 90% will be invested in projects with relatively stable returns and low risks (Aura, Frax, Curve, Convex, Balancer, etc.) , 10% will be invested in projects with slightly higher risk and stable returns (AAVE, Pendle, etc.).

image description

(Source: 0xAcid Docs)

100% of the income obtained by the treasury strategy will be allocated to Staked ACID.

4.Lending

Users can lend wstETH by staking ACID, and obtain leveraged income through revolving loans similar to AAVE. The maximum lendable value of wstETH is 40% of the ACID value of the collateral, and the liquidation threshold is 50%. After the liquidation is triggered, the agreement will directly destroy the ACID as collateral, which will not cause selling pressure, but will help the price of ACID increase due to the reduction in circulation.

This is different from most lending agreements, because in 0xAcid, the counterparty of user lending is the agreement, and the wstETH in the agreement treasury is accumulated through the sale of Bonds, so liquidation is equivalent to destroying Bonds and can reduce ACID circulation. 100% of the interest paid by users on loans will be allocated to Staked ACID.

5.PCV

The more ingenious design of the 0xAcid mechanism is the protocol's own liquidity (PCV), that is, Bonds sales support payment in the form of ACID-ETH LP. After the agreement receives these LPs, it will be locked into the liquidity pool, and the agreement will be continuously accumulated through Bonds. own liquidity. In addition, a small portion of funds can be injected into the ACID-ETH liquidity pool through proposals to improve the liquidity of ACID.

Through the PCV mechanism, the 0xAcid protocol has become the largest liquidity provider, which can obtain most of the handling fees and liquidity incentives, and by locking liquidity, it reduces the risk of panic and stampede during the price downturn.

2. Analysis

OxAcid is sold through Bonds, accumulating ETH from users, and using this part of ETH to participate in LSDFi to obtain real income. The ACID returned to the user is divided into two types: Locked and Staked. Locked users are equivalent to giving up the real income right of LSD assets, and accumulate the amount of ACID through a method similar to lock-up and slow-release mining to obtain a larger proportion of the treasury Fund claim share; while Staked users receive 100% treasury strategy benefits and 10% Bonds sales revenue, they also passively dilute the share of ETH principal. The expected benefits and risks of the two can be analyzed through simple estimation:

1) Staked ACID income = treasury ETH total amount * strategy average return rate + subsequent Bonds amount * 10%

According to the current staking ratio of 14.8% and the average APR of 8% in the treasury strategy, if it is expected to recover 100% of the initial ETH investment within one year, the daily Bonds sales need to reach 50 ETH, a total of about 18,000 a year ETH (At present, Bonds has accumulated about 1,200 ETH in about a month since 0xAcid was launched, with an average of 40 ETH per day). In this case, about 1/3 of the ETH income comes from treasury strategy, and about 2/3 of the income comes from Bonds dividends. The remaining ACID is the net income. In theory, the FDV of ACID = the total value of treasury ETH. With the release of esACID, the holding share of Staked users will be diluted. It is estimated that the final currency-based APR of Staked users is about 19%, which is still higher than the returns provided by most LSDFi protocols. The premise of obtaining this benefit is that 50 ETHs are added to the treasury every day.

Considering the worst case scenario, assuming that no new ETH enters the treasury in the future, based on the current pledge ratio and treasury rate of return, it will take about 2 years to recover all the initial ETH investment. In this case, the final currency-based APR of Staked users is about 1.5%, which is far lower than the returns provided by other LSDFi protocols.

2) Locked ACID income = (initial ACID number + esACID cumulative emission reward) / total ACID supply * total treasury ETH * 2 - initial ETH investment

According to the current Locked ACID ratio of 71.3% and 500 esACID emission rewards per day, if 50 ETHs are added to the treasury every day for one year, the currency standard APR of Locked users is about 17%; considering the worst Under normal circumstances, no new funds enter the market, and Locked users will even lose 3% of the principal in ETH after one year

Note: The above calculation is based on the premise that the total market value of ACID is equal to the total value of ETH in the treasury. In the early stage of the project, due to the expected income, ACID FDV will be slightly higher than the value of ETH in the treasury. As the price of ETH approaches the liquidation value of the treasury $ 10 k, this price difference will gradually disappear.

3. Summary

0xAcid is a relatively alternative LSDFi protocol with a very sophisticated mechanism design. First, it sets a major premise: Ethereum will reach $10k, and then all ETH in the treasury will be distributed to ACID holders to attract ETH long-term holders. For users who expect to obtain more ETH shares, they can transfer the pledged income of ETH to participate in lock-up mining; for users who expect to obtain higher pledged income, they need to bear the risk of the principal ETH being diluted.

Although 0xAcid provides the highest LSD yield in the market, the income is real, but the principal will become "unreal". Both rates of return are based on the amount of new entrants, so they have the Ponzi property. Participants are equivalent to betting that 0xAcid can attract more ETH and that ETH will reach $10k in the future, which is suitable for long-termists with high risk appetite.