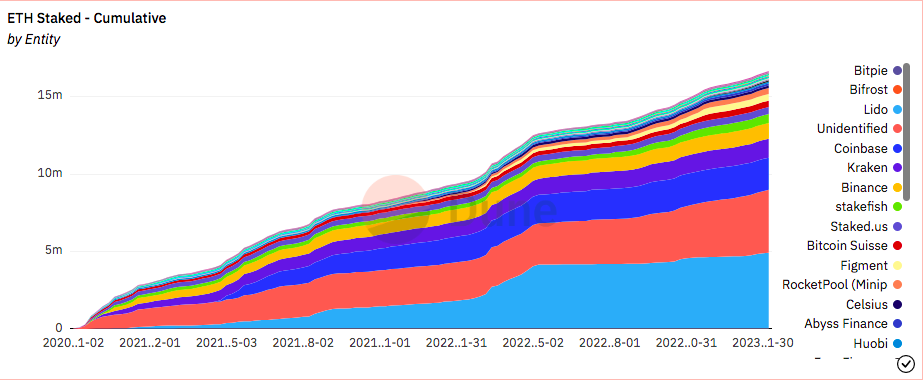

Last week, the Ethereum Shanghai upgrade originally planned for March was postponed to the first half of the year, and the era of free Ethereum withdrawal will come later than expected.

image description

(https://dune.com/hildobby/eth 2-staking)

The LSD project aims to create higher returns above the base rate of return, and is a hot topic this year. The market has responded positively to this upgrade expectation, as can be seen from the recent LSD (Liquid Staking Derivatives) market. At present, the staking solution based on DVT technology can redistribute nodes and improve the stability of verification nodes, which has been widely discussed (represented by SSV).

This track is based on Ethereum, an important infrastructure upgrade, and it is a relatively certain track this year. The Shanghai upgrade has a long-lasting impact on the Ethereum ecology. It is expected that after the second hype in this sector, the popularity of this track will be transmitted from the upstream pledge sector of LSD to the downstream application sector, and more combinations of pledge certificates and DeFi will appear.

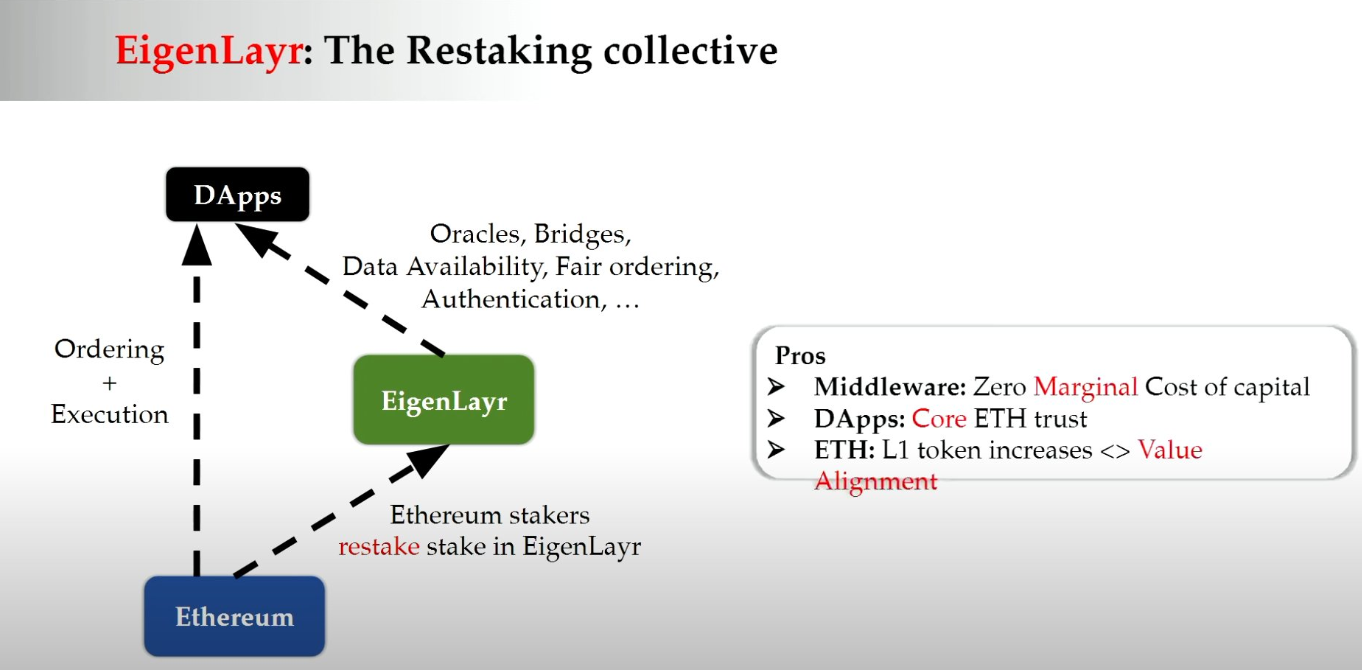

In the middle and even the second half of this year, Re-staking in this track can continue to be mined. Under the concept of re-staking, it is possible to re-pledge the pledged ETH and solve the trust and security of the non-settlement layer Dapp, represented by EigenLayer. At the same time, EigenLayer is also one of the extensions of last year's hot concept "modular blockchain".

The development of EigenLayer and its downstream protocols deserves further attention. Eigenlayer can be classified as one of the innovative narratives of the LSD track, allowing staking users to repeatedly pledge funds to other projects in addition to PoS staking, essentially improving the capital efficiency of staking ETH (such as stETH or rETH).

How to realize this "matryoshka"?

EigenLayer introduces the Re-staking model: the protocol creates an optional middle layer, on which users are allowed to deposit pledged ETH into smart contracts, agreeing to grant EigenLayer additional execution rights. That is: transfer the management rights of the pledged ETH to EigenLayer to obtain more benefits.

Such a network can be regarded as a collective sub-network that voluntarily chooses to join Re-staking among many Ethereum pledgers and validators, sharing security with Ethereum.

Opt-in in this network will have many consequences: for example, providing additional verification services will be able to obtain additional verification benefits. A Token has multiple roles, it can be both a pledge Token and a verification Token.

In the re-staking pool, ETH Stakers in the following three modes can voluntarily join EigenLayer:

(1) Directly re-pledge the ETH pledged on the PoS chain through EigenLayer;

(2) Liquid collateral tokens including ETH (such as ETH/USDC LP Token)

(3) LP Token containing stETH

image description

(Picture from EigenLayer: ETH pledged now is mainly used for execution / ordering; after Re-staking, ETH pledged can be used for DA / Fair ordering / Authentication / oracles / Bridges, etc.)

In this way, the security of Ethereum can be shared downstream of EigenLayer, allowing many middleware to provide corresponding services based on the verification network, including new side chains and L1. The cost of this verification service has been greatly reduced.

From the user's point of view, other applications or services can be maintained while staking ETH. Users can obtain more incentives while taking more punishment risks, so as to realize "one pledge, multiple benefits".

For other third-party agreements, EigenLayer provides an Ethereum security network module that can be "purchased" (or "rented") in the open market, which can save the process of generating and maintaining trust internally.

This will bring heavier financial implications to ETH. It can be expected that in such a network, the package of benefits after holding stETH has increased: such as the rewards of other middleware brought about by leasing security.

Cooperation with the LSD sector will have more potential. EigenLayer's Re-staking downstream agreement can focus on FXS, Rocketpool, etc., its potential partners and cooperation expectations can continue to pay attention, as well as the progress and technical maturity of the EigenLayer project itself.