secondary title

New public chain track: review, summary and prospect

At the end of 2022, it will end with the consensus that "the encryption market has entered a cold winter". In the flow of capital in the primary market this year, investment institutions are more focused on infrastructure Infra and applications, and the new public chain is the focus.

The public chain has never been absent from any round of bull market. The new public chain in the last round of bull market has undertaken the overflow funds of Ethereum and achieved a wave of good gains. But at the same time, the elimination rate of this track is extremely high. Judging from the current market demand, the rapid development of concepts and applications such as DeFi and NFT has been putting forward higher requirements for the public chain.

As the dust settles on the merger of Ethereum, the L2 track intensifies the competition for public chains, and the new public chain and sub-new public chain need to be conceived with different structural logic and application scenarios.

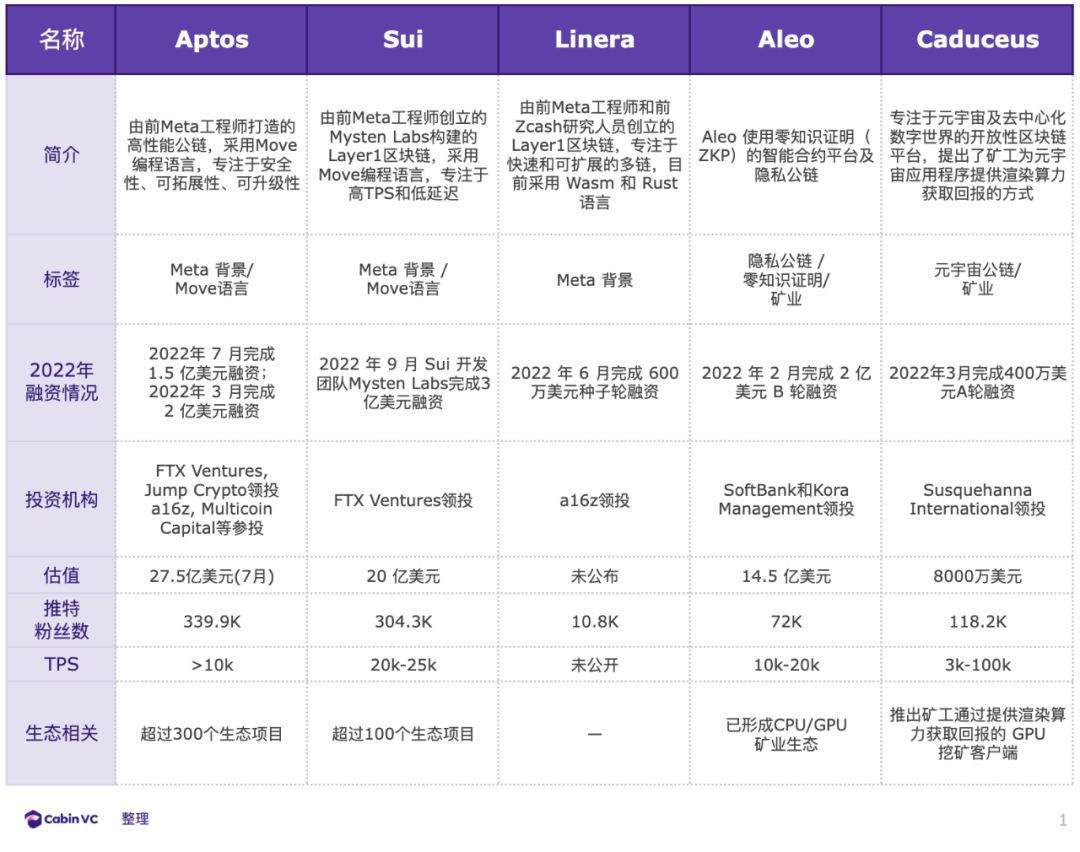

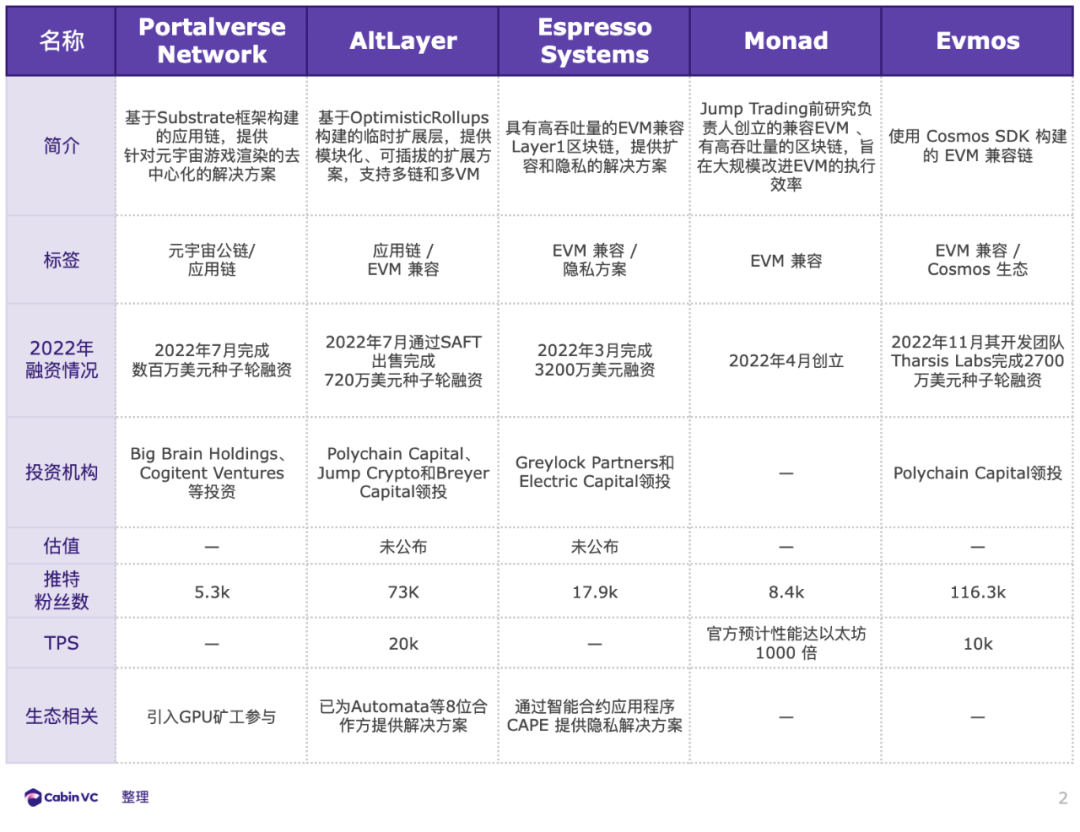

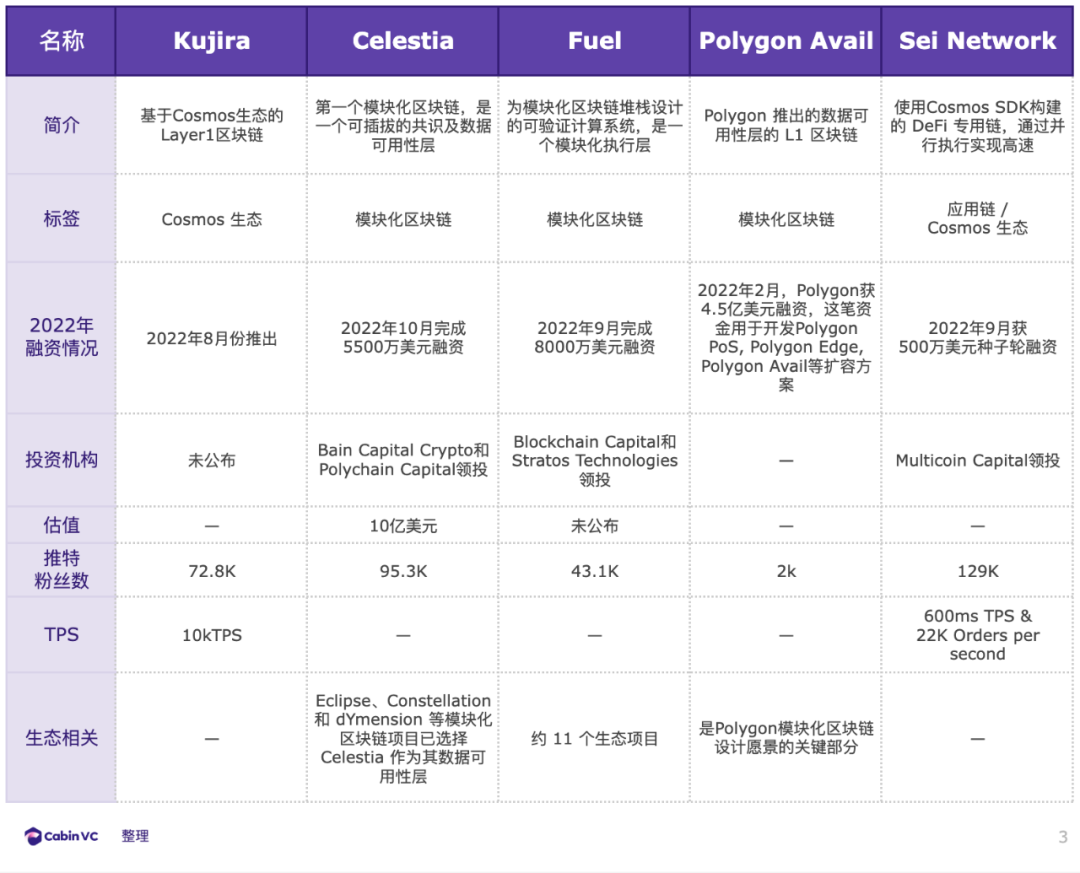

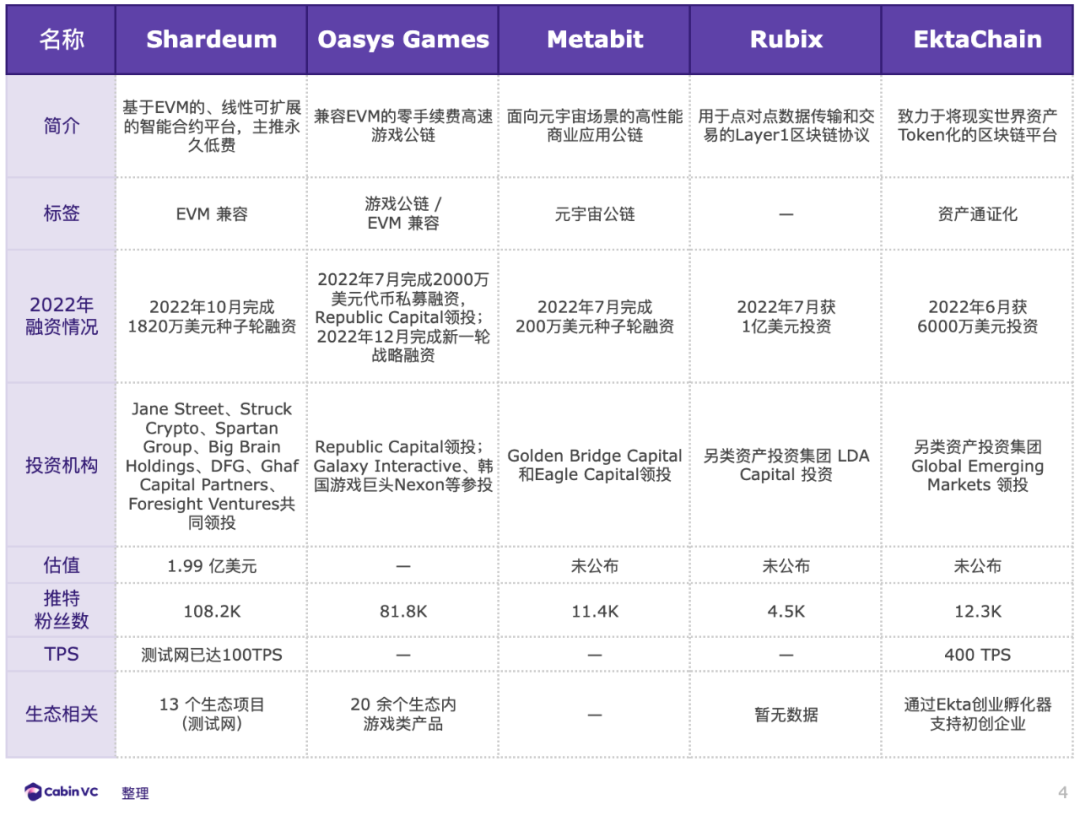

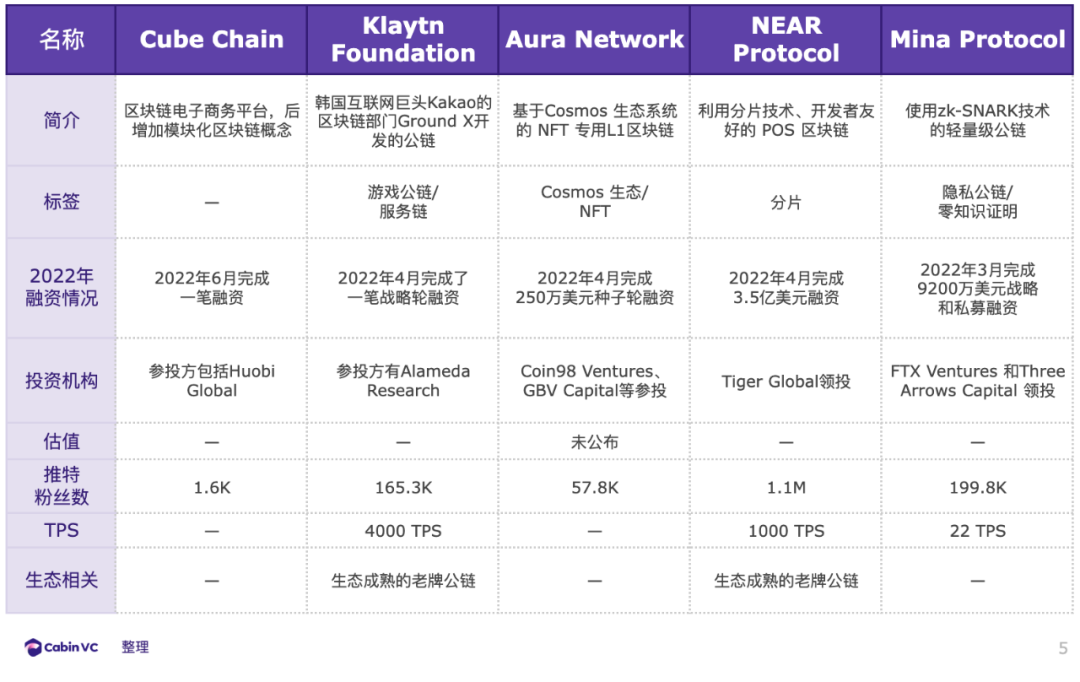

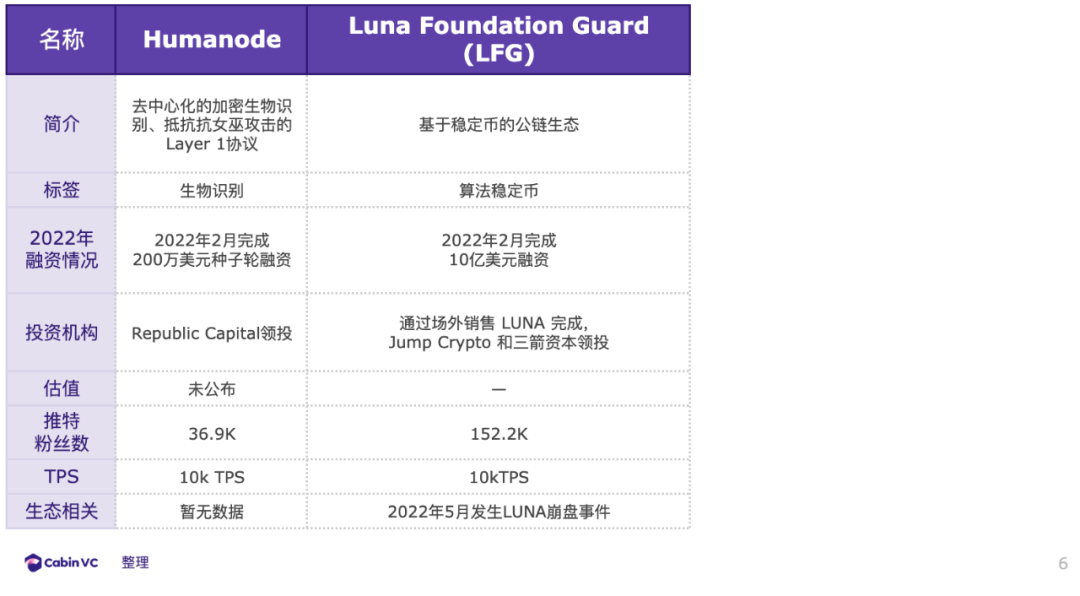

This track is still full of more possibilities. Cabin sorted out the L1 public chain projects that received financing in 2022, and made a conclusion from them:

In the previous rounds of cycles, the public chain, as the core layout direction of the infrastructure in the industry, belongs to the core narrative of the industry.

In the last round of bull market, most of the new public chains have technical advantages such as high throughput and low cost. Concepts such as DeFi, cross-chain, and exchange public chains have further reconstructed the valuation logic of the public chain ecology. Investment institutions have a high degree of recognition of the smart contract platform, superimposed on the factor of "infrastructure public chain projects can hedge risks with higher beta emerging projects", and the public chain is developing rapidly driven by capital and demand. The public chain projects that have entered the TOP 20 by market capitalization are changing frequently, and the trend of differentiated competition between emerging public chains is gradually emerging.

From a technical point of view, the innovations of previous public chains are mainly in the three directions of consensus mechanism, programmability, and scalability. In the next round of the public chain cycle, how to meet more vertical application scenarios and market demands through breakthroughs in the above three aspects will be the key to the breakthrough of the new public chain.

In terms of consensus mechanism, the PoS mechanism, which was born in 2012, solved the problem of excessive energy consumption of PoW through equity accounting. It is also the consensus mechanism adopted by most new public chains. variant. At present, innovations in the consensus mechanism are not dominant. For such innovations, refer to the Avalanche avalanche consensus in the previous round as an example.

In terms of programmability, the main consideration is how the smart contract platform builds the application layer. Ethereum uses a virtual machine and the Solidity programming language to implement smart contracts. Among the new public chain tracks organized above, the Move language has made a breakthrough at this level, providing a more secure, friendly, and scalable development language. In the second half of 2022, the hotly discussed new public chains include Aptos and Sui, two Diem-based Move language public chains.

In terms of scalability, the main factors are throughput (tps) and gas costs, which are also just-needed factors in many application scenarios. In the new public chain track sorted out above, the concept of modular blockchain, EVM compatible public chain, Cosmos ecology, application chain, zero-knowledge proof public chain, etc. all need to be innovated on the basis of strong scalability. Including game public chains and Metaverse public chains with high-frequency interaction requirements, these scenarios are extremely sensitive to Gas costs.

In addition to the above three technical directions, new public chain ecological application ecology and value capture are important considerations, which mainly include:

Gas fee (transaction fee/storage fee)

Vertical application scenarios (such as NFT / DeFi / games, etc.)

Liquidity solution (whether it is an exchange public chain/Market Maker)

payment scene

How to motivate users to hold for a long time (PoS / business related to centralized institutions / Meme sentiment, etc.)

Under the background of the coexistence of multiple chains, the differentiated competition of new public chains is becoming more and more obvious, and the vertical application scenarios of public chains are an important focus. For example, in the last round, it was the Flow public chain that was the first to meet the NFT application scenario. From the perspective of vertical application, the aforementioned game public chain, metaverse public chain, zero-knowledge proof public chain, and privacy public chain all work from this perspective.

What deserves special attention is the public chain track based on zero-knowledge proof. In 2022, Aleo, the first high-performance public chain with a POW-like mechanism that adopts zero-knowledge proof, has gained popularity. Innovate in the incentive model and introduce the broad prospects of "ZK Mining".

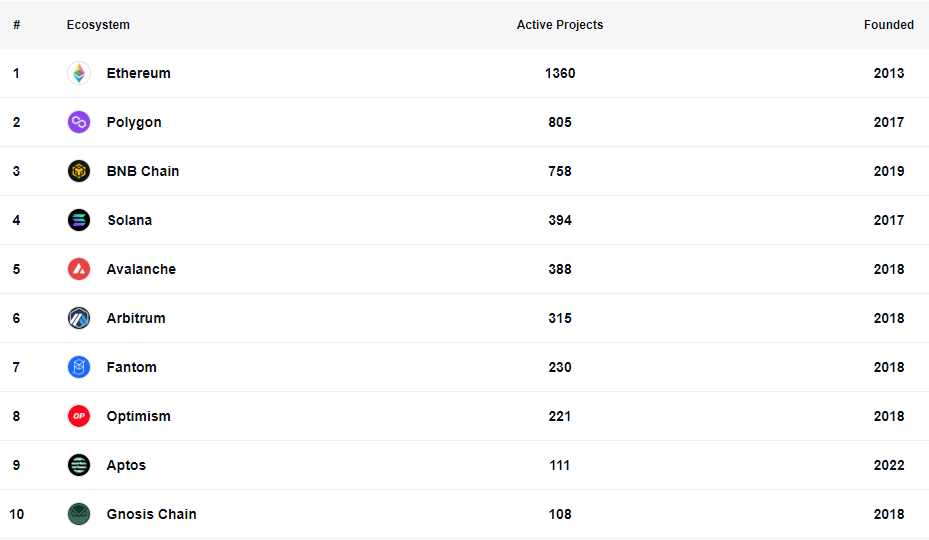

It can be seen that the ecology of the new public chain track in this round is developing extremely fast. Judging from the existing active applications, among the top ten public chain ecology, the new public chain Aptos has entered the ranking:

The new public chain also includes the L2 public chain ecology. L2 has the ecological advantages of Ethereum, and has the characteristics of low fees and high throughput. It forms a direct competitive relationship with non-Ethereum public chains and intensifies the competition situation of public chains.

Under this kind of competition, it is expected that in the next 1-2 years, while Ethereum will still maintain a certain market share in the market, other public chains will subdivide long-tail users.

secondary title

Primary market investment dynamics

Primary market investment dynamics

A total of 7 blockchain financing incidents at home and abroad were announced last week, and the fundraising in the primary market dropped to freezing point.

Last week, the project with the largest amount of investment was the Web3 Twitter marketing platform Twity, which received US$6.5 million in financing. The track with the largest number is the GameFi track, and projects that received investment include the chain game Flappy Moonbird ($6 million), the strategy card game Magic Fantasy ($3 million), etc.