secondary title

The Lightning Network: Will It Become Cryptography for "The Masses"?

How does Crypto further show the "breaking circle" effect?

Bitcoin itself is the most representative cryptocurrency. In order for the Crypto market to achieve greater market adoption, it is worth paying attention to how BTC moves from "early adopters" to "early masses".

From this perspective, Bitcoin's L2 ecology is a possible direction. In the BTC ecosystem, the only L2 solution of the Lightning Network has a certain degree of scarcity.

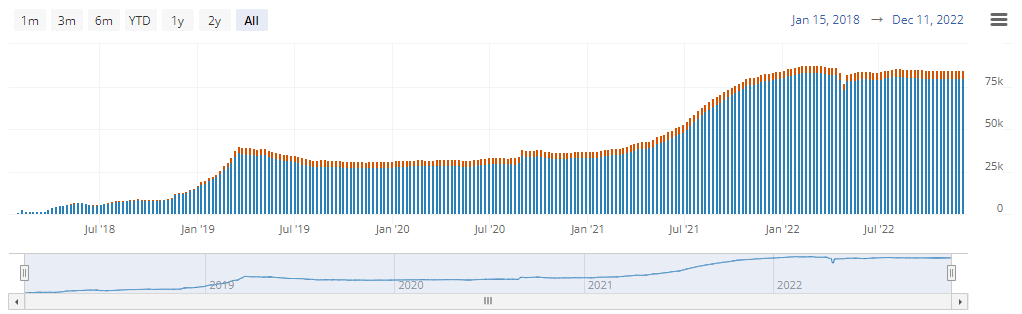

The Lightning Network was born in the era of BTC expansion disputes, and it is an ingenious design based on the restriction that the bottom layer of the Bitcoin network cannot be enlarged. Although the optional development methods and upgrade and optimization space of the Lightning Network are limited, in the landing scenario of Bitcoin payment, the Bitcoin Lightning Network has experienced some data growth trends that cannot be ignored after several years of development.

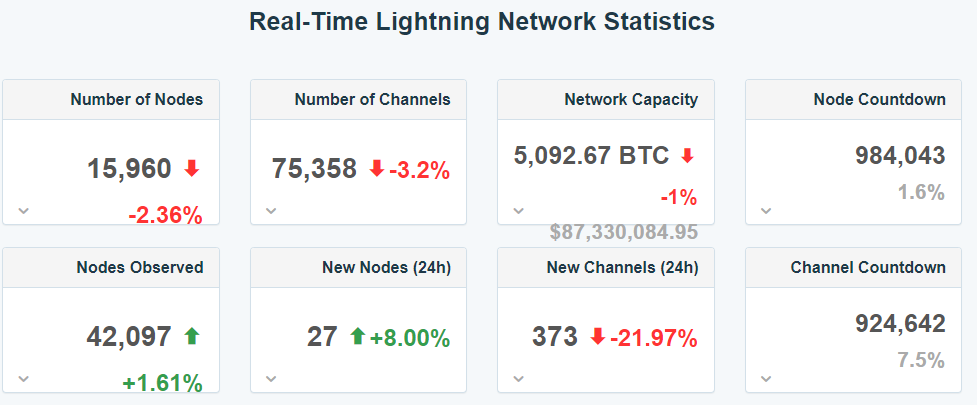

Despite the current bear market, there are more than 5,092 BTC in the Lightning Network channel, which can handle up to about $100 million in payments.

At the same time, there are about 17,000 nodes running on the network, and nearly 85,000 channels connecting nodes from all over the world.

Pushing the time dimension forward, the number of BTCs locked in the Bitcoin Lightning Network has increased from more than a hundred in 2018 to more than 3,000 in the second half of 2021, and then increased to 5,000 in 2022. At the current BTC price, the market value of 5000 BTC is about 86 million US dollars. However, compared with the scale and growth rate of stablecoins, there is still considerable room for development.

Before 2015, the early BTC was first applied to cross-border payments. Facing the high transfer fees, complex payment systems and strict scrutiny in centralized finance, BTC satisfies these pain points well.

Subsequently, BTC derived more other payment scenarios, and penetrated into encryption-related fields that are familiar with digital currency payments, such as electricity bill payment, salary payment, machine expenses, etc. in the mining industry, and more Web2 institutions that are aware of BTC.

In terms of payment tools, the Lightning Network is a clear entry point for Bitcoin in micropayments, and is regarded as a distinctive fill-in market.

Still in its infancy in 2022, the Lightning Network aims to address low transaction throughput and relatively high transaction fees. Not all transactions in the Lightning Network are written on-chain, most payments are made to each other "off-chain", and are only written to the zone in extreme cases or when the payment relationship between two network participants terminates. Blockchain ("Settlement"). The lightning network can be compared to a "recharge card", that is, "deposit money in advance, and then settle in batches".

The Lightning Network is based on two concepts, payment channels and transaction routing:

Payment channel: a payment channel established by the two parties of the transaction, and high-speed settlement can be completed between the two parties established by the channel. In the payment channel, the transaction data during the transaction is not uploaded to the chain, and the payment parties maintain the transaction data. Only the initial transaction that opens the channel and the final transaction that closes the channel needs to be broadcast on the chain. In theory, the TPS of the two settlements is only limited by the speed of network transmission.

Transaction routing: If the number of channels is sufficient, a network will be formed, so that any bright spot in the network can pass through the existing payment channel network and transfer through some large routing nodes to complete the payment. Routing nodes allow payment channels to be connected to form a network.

* The most efficient routing nodes may be satisfied by centralized encrypted payment channels, such as Paypal, apple, etc.

The advantages of Lightning Network payment channels include:

Privacy: No matter how many payments occur in the channel, only one transaction will be sent to the blockchain (two transactions plus the channel opening transaction), which minimizes the footprint on the chain. This kind of privacy is very suitable for miners.

Scalability: The internal transaction of the payment channel does not use the blockchain, does not increase the burden on the main chain, and achieves the expansion effect at the same time; within the range allowed by the channel balance, the payment speed is equal to the speed of message delivery (network transmission speed) , both parties can pay thousands of times per second.

The Lightning Network is the solution most likely to help Bitcoin become a medium of exchange. Any system that needs to wait for transaction confirmations (including many L2 schemes) is hard to beat.

Currently, existing payment channel solutions can be roughly divided into three categories: standard payment channels; zero-configuration channels (introducing trust); and managed payment channels (introducing custodians).

Standard payment channels are private, secure and trust-free, but have delay characteristics and often have poor user experience. At present, the main limitation of the Lightning Network is the economical issue of channel capacity. This kind of usage similar to "recharge card" is not friendly to users, and users need to be online when they want to become nodes and pay/accept."DeFi"At the same time, as the second-tier ecology of Bitcoin, some solutions are working on building Bitcoin-based

Ecology, Bitcoin itself has a high degree of overseas consensus, and has a large-scale asset volume and good liquidity. If the fastness of the Lightning Network is combined with the advantages brought by Dex, it may further bring in huge transaction volume.

Some data from Arcane Research's report can be referred to: As of March 2022, more than 80 million people can use lightning payments on installed applications. Lightning Network users are predicted to reach 700 million by 2030 as the adoption of Bitcoin's second-layer payment protocol continues to increase.

Block CEO Jack Dorsey focused on the Bitcoin Lightning Network in his vision for "Web5". Its payment company Block makes Bitcoin payments, and its Spiral is responsible for the Bitcoin Lightning Network Development Kit LDK and the Bitcoin Development Kit BDK, and hopes to build Create a new economic ecology based on the Bitcoin currency layer.

In any case, integrating payment systems and upgrading business models based on Bitcoin and Lightning Network is a good way to reduce dependence on big technology, big banks and big advertising. BTC Lightning Network transactions may become the simplest solution for Web2, from the existing BTC miners paying electricity bills, Lightning Network rewards and other application scenarios gradually popularized to "the public owns and trades BTC".

secondary title

Arcane Research“Lightning Network Public Capacity surpasses 5, 000 BTC”:https://arcane.no/research/lightning-network-public-capacity-surpasses-5-000-btc

Primary market investment dynamics

Primary market investment dynamics

Last week, there were 23 investment and financing incidents in the primary market, which continued to decrease compared with last week. The tracks with the most financing incidents this week were NFT and Metaverse, Web3.0 infrastructure, and encryption service platforms. Among them, the largest financing came from the digital ecosystem and self-custody platform Bitcoin.com, which announced the completion of the incentive and utility token VERSE pre-sale, raising $50 million in funds.

This week, two mining companies announced that they have obtained financing. Bitcoin mining company 360 Mining announced the completion of a new round of financing of US$2.25 million, which was participated by Luxor and BT Growth Capital; East African bitcoin mining company Gridless completed a US$2 million seed investment , Bitcoin venture capital firm Stillmark and Jack Dorsey's payment company Block co-led the round.