secondary title

FVM: How to make the storage public chain bigger "cake"

When the popularity of storage + mining gradually returns to rationality, FVM (Filecoin Virtual Machine) has become a new narrative of the storage public chain with high expectations.

The first milestone of FVM has been completed in August. Recently, an important upgrade of the v17 version of the Filecoin network code-named Shark has also been completed. The core of the upgrade lies in the further introduction of FVM. From the perspective of official progress and planning, it is expected that the FVM test network will be launched in February 2023, and the main network will be launched in May.

Referring to the rapid development of the EVM (Ethereum Virtual Machine) track, in the next 1-2 years, EVM will be an important hot spot in the market. As one of the important ecological maps of Filecoin, the "data city" ideally built by FVM has brought greater imagination and can adjust the current inflation of the FIL ecosystem.

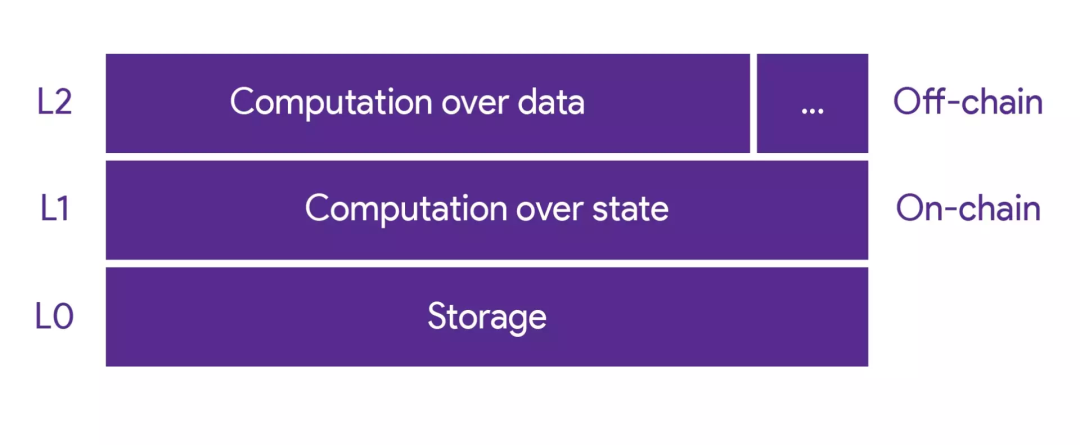

FVM is a virtual machine that supports EVM launched by Filecoin. FIL aims to create an Ethereum-like public chain and translate a large number of Ethereum applications to the FIL ecosystem.

More specifically, FVM is a WASM-based multi-language execution environment (officially defines each environment as an Invocation Container, that is, an invocation container), and adds smart contract deployment functions (called actors) to the Filecoin distributed storage network , no matter what language the actor code is based on, as long as it can be compiled into WASM binary code, it can run in FVM. Therefore, Filecoin can support multiple virtual machines, such as launching MoveVM and so on.

(*Of course, due to the feature differences between languages, when compiling to WASM coding, it may cause some problems to the underlying operating environment, which will consume additional resources, increase gas, run faults, etc.)

Filecoin is based on the IPFS protocol, adding actors (which can be regarded as smart contracts in FVM) and forming a "smart contract + verifiable storage" structure, with data as the basic unit of exchange value, and compatible with EVM, this mode Compatible with "Ethereum + Storage".

This is expected to solve the on-chain storage problem of the public chain. At the moment when a large amount of blockchain data is stored in the centralized Amazon cloud, the entire crypto underlying infrastructure is still highly dependent on centralized services.

At present, there are not many L1s that can insist on "verifiable storage". Verifiable storage is an important data structure of blockchain storage, which allows a light node to query the state of the chain from a full node it does not trust. The most important link in blockchain trustless. (Since accessing verifiable storage is slower than direct access to the database, some blockchains sacrifice verifiable storage for better performance)

FVM has given the storage public chain "how to make a big cake" space, builds Dapp on the storage public chain, and the FIL storage layer contacts the FVM contract layer, based on Filecoin's own data storage characteristics, to carry out differentiated competition on the public chain . Based on data characteristics, more complex products that FVM ecology can build include but are not limited to:

Data DAO

Retrievability oracle / Oracle-less access to data

Permanent storage contract / storage endorsement

Undercollateralized lending market for storage providers

ETL pipelines (data integration pipelines that collect data from different data sources)

From the perspective of the track, DeFi Dapps in the FVM ecosystem may attract more attention faster, which can provide more liquidity for the existing majority of storage providers, and provide more mortgage lending methods for Token holders, more directly Meet the existing needs of the Filecoin ecosystem.

secondary title

Primary market investment dynamics

Primary market investment dynamics

Last week, there were 23 investment and financing incidents in the primary market, and the disclosed financing amount exceeded US$270 million. The largest funding round came from crypto market maker Keyrock, which closed a $72 million Series B round led by Ripple.

Last week, the most investment and financing events were in the direction of infrastructure, with a total of 7 cases. Among them, Fleek, a Web3 developer platform, completed its A round of financing of 25 million US dollars, led by Polychain Capital; the popularity of the security service track is increasing. and identity verification platform FrankieOne raised $30 million in Series A funding led by AirTree Ventures and Greycroft;