secondary title

ZK-KYC: a strong competitor in the direction of compliance

Compliance is an important topic as many Web 2 legacy organizations transition to Web 3. The traditional financial market is huge, but the security and trust infrastructure of the on-chain market is still not ready.

The KYC track of the DApp on the chain is expanding. For the large-scale funds of traditional institutions, KYC is the only way for them to safely and smoothly enter the Crypto field. Institutions and individuals who pass KYC can jointly release in this emerging field fluidity.

Events such as Tornado cash supervision have brought thinking to the Crypto market, and projects based on KYC services are also updating and iterating. For a long time, projects in the KYC field have found a balance between the dilemma of "user privacy" and "user authentication". With the improvement of the maturity of zero-knowledge proof and the enhancement of technical universality, ZK-KYC, a subdivision of ZK, is receiving more attention.

(https://eprint.iacr.org/ 2022 / 321 )

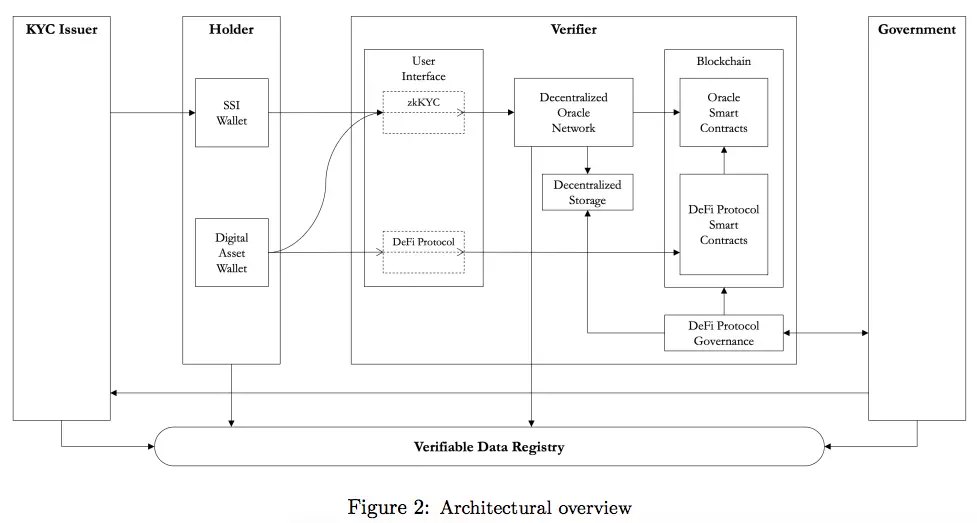

In September 2021, the "zkKYC in DeFi" paper outlined the ecosystem for implementing ZK-KYC solutions in DeFi:

For the purpose of regulatory transparency, ZK-KYC in DeFi does not require any personally identifiable information to be shared with DeFi protocols. The zkKYC solution introduces the KYC issuer and the decentralized oracle network (DON) as key components through DID and zero-knowledge proofs. "KYC Issuer" verifies an individual's identity without touching the user's digital asset wallet information (or DeFi activity); while the DeFi protocol interacts with the user's digital wallet without knowing the user's identity. In some cases, only designated governing entities (government agencies in the picture) have access to suspected user identities.

"ZK-KYC and ZK Authentication Process" has a more accurate definition of ZK-KYC: the process of making an authentication judgment on a customer without knowing any direct information about the customer is called zero-knowledge knowing your customer, that is, ZK- KYC (Zero Knowledge-Know Your Customer).

(*Other related definitions include: the technology of making judgments in the case of zero knowledge is called ZK authentication technology (Authentication Technology), and the process of using ZK authentication technology to complete the authentication of customers, assets, events, etc. is called ZK authentication process (Authentication Process).

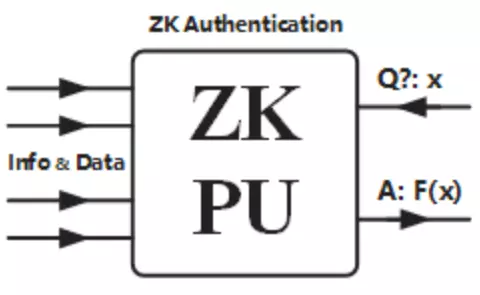

The paper further explains how the ZK authentication process works:

The zero-knowledge authentication processor ZKPU (Zero Knowledge Processing Unit) needs to process the input information and check it with the established pointer Protocol, increase the data dimension of the user's basic public key, and realize the credit enhancement of user-related assets and Credit verification and other information work.

The design of this core link is often complicated, and the technologies that may be used include but are not limited to: edge computing, blockchain protocol, ZK authentication algorithm, encryption algorithm, asynchronous computing, etc. The form of ZKPU is also very diverse according to the application scenario, such as algorithm function , on-chain nodes, oracles, etc.

The design of the ZKPU needs to:

1) prove the validity of its authentication question, and guarantee

2) It will not be leaked or hacked to obtain actual data

The final form of ZK-KYC will be able to include personal privacy, meet regulatory needs, and create a compliance environment for DeFi protocols. Users who can verify whether they are whitelisted or not. Subsequently, a DeFi protocol cooperates with the KYC issuer (or service provider) to prove that it complies with the regulation with the zk proof presented by the user, and allows the user to use the protocol. This approach is also easy for Web 2 institutional parties to accept.

In addition, there are also worthy of attention in this track: decentralized KYC NFT provider IdentDeFi, on-chain zero-knowledge proof identity platform 0 xHonym, etc.

References:

zkKYC in DeFi: An approach for implementing the zkKYC solution concept in Decentralized Finance:https://eprint.iacr.org/ 2022 / 321

secondary titlehttps://mp.weixin.qq.com/s/ 9 LtNJACyW 9 m_n_wCJdGxMA

Primary market investment dynamics

Primary market investment dynamics

Last week, there were 23 investment and financing events, a slight increase from the previous week; the NFT and Metaverse track picked up, and 7 financings were announced. Among them, Metaverse UGC platform YAHAHA completed a $40 million A+ round of financing, which was jointly funded by Temasek and Alibaba. Lead the vote.

In the mining ecosystem, Arkon Energy, a bitcoin mining startup, raised $28 million, led by Blue Sky Capital;