secondary title

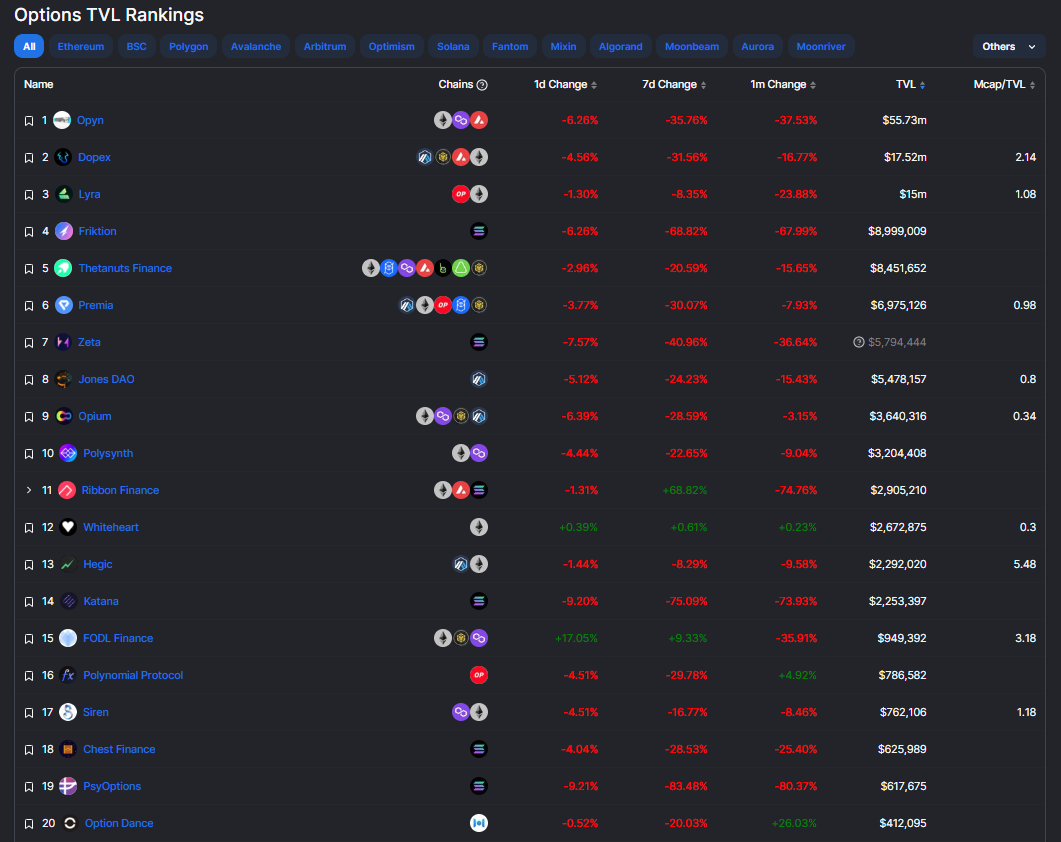

On-chain options protocol: a crowded DeFi sub-track

In a mature trading market, the trading volume of derivatives is often much greater than spot. In the field of Crypto, decentralized derivatives, or on-chain contract transactions, still have a lot of room for development. In this direction, it mainly includes subdivided tracks such as decentralized perpetual contracts, decentralized options, and decentralized synthetic assets.

(Data source: defillama)

(Data source: defillama)

Messari divides on-chain option protocols into two main types: Option Marketplace (option market) and Structured Product (structured product):

text

The Option Marketplace is a protocol for creating actual options contracts and facilitating the buying and selling of options. Liquidity for each option underwritten. According to different sources of funds and operating methods, it can be further divided into Orderbook Marketplace and Liquidity Pool Marketplace. Cases such as Opyn, PsyOptions, and Zeta are based on traditional order book operations; Dopex, Lyra, Hegic, etc. use the method of liquidity pools.

Structured Product (structured product) is based on the Option Marketplace protocol and provides users with a Vault (vault) to deposit funds. Each Vault will implement a predetermined option-based income strategy, package complex pricing and risk management, and lower the threshold for ordinary users to participate in option sellers. (In the Vaults mode, option sellers are allowed to deposit collateral in a vault (Vault), and mint a Token representing option rights at a certain mortgage rate. Holding the Token is deemed to have the right of the option buyer, and will be automatically exercise or expire)

These two categories are also roughly divided into "underlying option products" and "option derivatives". Structured products reduce the complexity of options and improve the liquidity of the on-chain options market. This category is the most adopted method of existing on-chain options agreements, covering DeFi Option Vaults (DOVs), AMM Vaults and Single Staking Options Vaults (SSOV), etc., are regarded by the market as one of the alternatives to liquidity mining.

The options track is currently in its infancy, and the valuation of the primary market is very moderate (the current market value of Ribbon Finance, the leading project in this segment, is only about 100 million US dollars). The design and experience of mainstream products are slightly rough, and the pain point is still trading Depth, hedging risk, capital utilization rate, liquidity segmentation, user experience, etc.

(Ribbon Finance TVL recent situation, data source: defillama)

text

Among the three elements of DeFi "transaction, lending, and leverage", the essence of income aggregation and financial management lies in transaction lending, and top products have already appeared. The essence of futures and options lies in leverage. With the continuous attempts of the encryption native team in decentralized options and the continuous addition of different types of funds, the option protocol on the chain will be a huge track.

Based on the idea of on-chain option agreements, some early and innovative projects worthy of attention are:

Perpetual option protocol Panoptic:

Panoptic solves the problem of insufficient liquidity of on-chain options by building on the Uniswap V3 ecosystem, and optimizes transaction speed and transaction costs. Panoptic allows users to create long and short put or call options for any Uniswap v3 trading pair that exists.

In addition to buyers and sellers, Panoptic has introduced a new role of "liquidity provider". Options buyers and sellers must redistribute liquidity in the Uniswap pool to generate new options. Panoptic uses commissions to motivate users to provide liquidity. improve its capital efficiency.

Leveraged option agreement Levana protocol

Levana protocol is a leverage and options agreement based on the smart contract platform JUNO, which belongs to the Cosmos ecosystem. Levana provides users with leveraged positions of assets through the Levana Leverage Index (LLI) Token. The way it works is: create a fund pool with the planned leverage ratio, and then mint Token (representing ownership of the leveraged fund pool) through the Levana protocol, and the user finally obtains income through the automated market maker.

Levana focuses on open DeFi and launches GameFi products, evolvable NFT, etc. Levana's investment institutions include Animoca, Dragonfly Capital, Parafi Capital, etc., and are incubated by Delphi Labs.

On-chain NFT options trading platform jpeX Finance

jpeX Finance, an on-chain NFT options trading platform, was the winner of the 2022 hackathon. Users do not have to sell the NFT they hold when speculating on NFT, but trade options. Users can speculate on NFTs or hedge expensive NFT exposures by trading call and put options, and participate in the hype of blue-chip NFTs at a cheaper cost.

Options Strategy Platform Jones DAO

secondary title

Primary market investment dynamics

Primary market investment dynamics

A total of 20 domestic and overseas blockchain financing incidents were announced last week, a decrease from the previous week; the total disclosed financing was about 275 million US dollars, a sharp drop from the previous week. There are many investment events in metaverse and infrastructure track.