secondary title

Sui's application segmentation track: NFT and GameFi

In the next public chain development cycle, there are two main layout ideas for the new public chain: an EVM-compatible L1 that can undertake the overflow of Ethereum, and a public chain with unique technologies or innovative architectures.

In order to welcome the big explosion of Dapp, the public chain with a specific track direction in value narrative or private domain service will receive more attention.

In the last round of public chain development cycle, Flow can be regarded as one of the public chain representatives featuring service subdivision track. With the adaptation of Flow in NFT application scenarios, its development is closely related to B-end institutions and traditional industry resources. It has become one of the most distinctive public chains. However, there are still deficiencies in the demand for NFT and GameFi on the To C side and small and medium-sized institutions.

Sui, the language-based public chain of Move, is making efforts on the NFT and GameFi tracks. For a public chain to stand out, it often requires a killer DeFi, or a killer GameFi.

In Sui, state storage is defined as Objects. Each Object has a unique ID in the Sui execution environment, and can be identified and associated by checking whether the transaction uses the same Objects. Each Object essentially has its own independent ledger.

Sui's core technology is designed around the smallest storage unit Object, and there is no such concept as "account". Object (which can be understood as "object" or "asset") can be roughly divided into:

immutable assets (similar to contracts)

A single asset (can only be modified by its specific owner)

Shared assets (can be modified by multiple owners)

Sui has key innovations in areas such as consensus mechanisms, transaction processing channels, and on-chain storage. The Move language improves network scalability by improving execution efficiency by executing independent transactions simultaneously through parallel execution. The Move language used by Sui changes Diem's core storage model and asset permissions, defines the above state storage model, and makes its Object-oriented features more prominent.

(*Narwhal may represent the latest variant working on a high-throughput consensus algorithm that achieves a throughput of over 130,000 transactions per second over the WAN)

(Image source: Sui white paper)

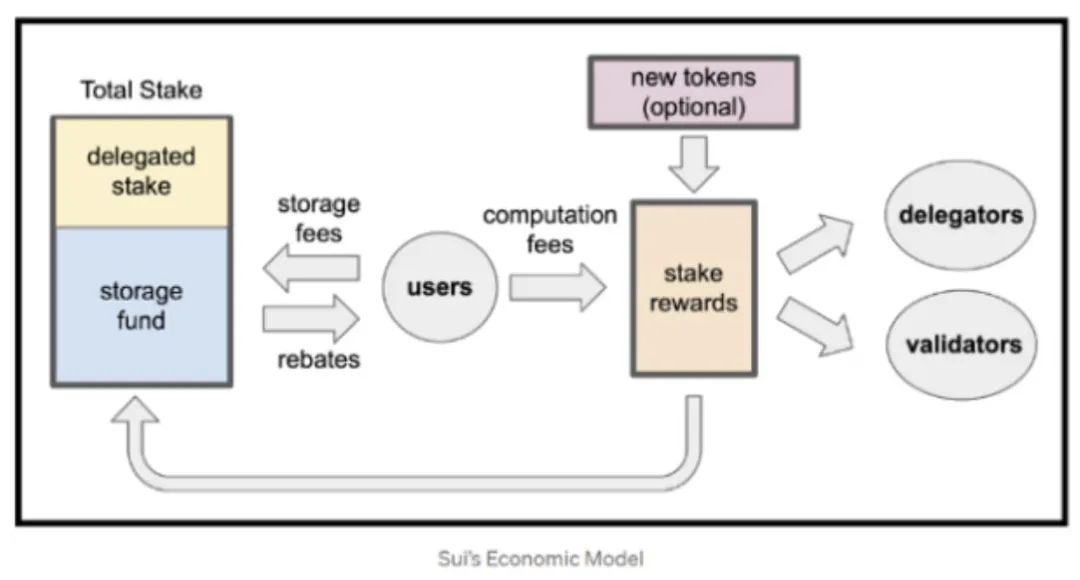

Therefore, in Sui, users need to pay Gas fees for execution and storage separately. The Gas fee in the Sui economic model includes transaction fees and storage fees. The Object storage model is redesigned and a Gas voting mechanism is introduced to maintain a relatively stable Gas fee during congestion.

image description

(*The storage fee is used to deal with the problem of full node state explosion, which is set by Sui’s governance. The storage fund will be used to adjust the equity of future validators, and the reward will be increased as the actual storage demand grows.)

This design demonstrates Sui's feature of "returning data storage rights on the chain to users", which can meet the aesthetics of many Web3 commercial scenarios.

The application scenarios that Sui can naturally meet include games, social networking, DeFi, etc., all of which have high requirements for low latency and high throughput.

Based on Sui, the implementation of assets on the chain will be more abundant. Taking the NFT scenario as an example, developers can implement dynamic NFTs that can be upgraded, bundled, and grouped in specific ways, such as gameplay-based avatars and customizable changes. As the behavior of NFT changes, corresponding feedback can appear on the chain.

Sui’s latest medium gives more interpretations and ideas: for example, it can create and distribute assets in batches, or game developers can airdrop new items to all players; they can bundle and sell products in the market, or add product accessories; and Set restrictions on NFT, such as "characters must reach level 60 before they can be equipped."

secondary title

Primary market investment dynamics

Primary market investment dynamics

A total of 29 domestic and overseas blockchain financing incidents were announced last week, with a total disclosed financing of approximately US$370 million, a sharp increase from the previous week.