防亏钱指南:需要克服的10大心理偏见

原文作者:Koroush AK

原文编译:深潮 TechFlow

你最大的交易错误不是技术性的,而是心理性的失误,这些偏见摧毁了无数交易者。

不惜一切代价避免以下几点:

1.锚定偏差(Anchoring Bias)

交易者专注于一个价格(锚),这可能会影响他们的决策。

如果交易者 A 在 BTC 价格为 52, 000 美元时加入加密货币,那么 61, 000 美元的 BTC 似乎很昂贵。

如果交易者 B 在 BTC 价格为 71, 000 美元时加入加密货币,那么 61, 000 美元的 BTC 似乎很便宜。

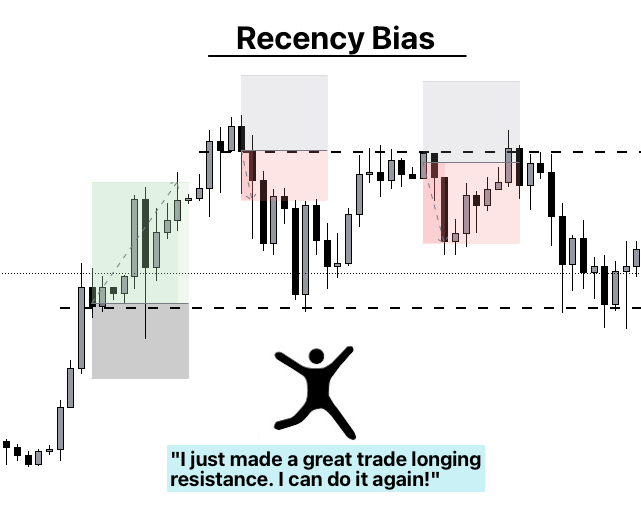

2.近期偏差(Recency Bias)

这是对最新信息的记忆最深刻并重视这些信息的倾向。

交易者可能会将最近交易中的信息带到下一笔交易中,这可能导致过度自信和损失。

3.厌恶损失(Loss Aversion)

交易员对损失的感受比对收益的感受更强烈。

损失 100 美元的痛苦可能大于赚 100 美元的快乐。

这种偏见可能导致交易员过早放弃获利,因为他们担心这些收益会变成损失。

4.禀赋效应(Endowment Effect)

当交易者持有某项资产时,他们往往会高估其价值。

这种情感上的依附使得他们难以在亏损时出售,甚至难以按公平价格出售,因为他们更多地依赖自己的期望,而非市场实际情况来判断资产的未来价格。

5.从众心理(Herd Mentality)

无论是盲目跟随大众还是刻意反其道而行之,都存在风险。

要坚持自己的交易计划,避免因大众的行为而冲动行事。

只有在进行客观的市场情绪分析时,才应考虑大众的行为。

6.可得性启发(Availability Heuristic)

交易者往往对情感上最强烈或最近发生的信息给予过多的重视。

例如,即便市场状况已经改变,但近期的市场崩盘可能会让交易者过于谨慎。

7.幸存者偏差(Survivorship Bias)

系统性地高估成功的概率。

我们常看到的是成功的故事,而失败的故事往往被遗忘。

8.框架效应(Framing Effect)

信息的呈现方式会影响决策。

交易者的情绪和自信心会影响他们的风险评估。

积极的情绪可能导致低估风险,而消极的情绪可能导致高估风险。

9.确认偏差(Confirmation Bias)

交易者倾向于寻找支持其信念的数据。

如果你看好某项资产,你会寻找所有支持该资产看涨的信息,而忽略看跌的数据。

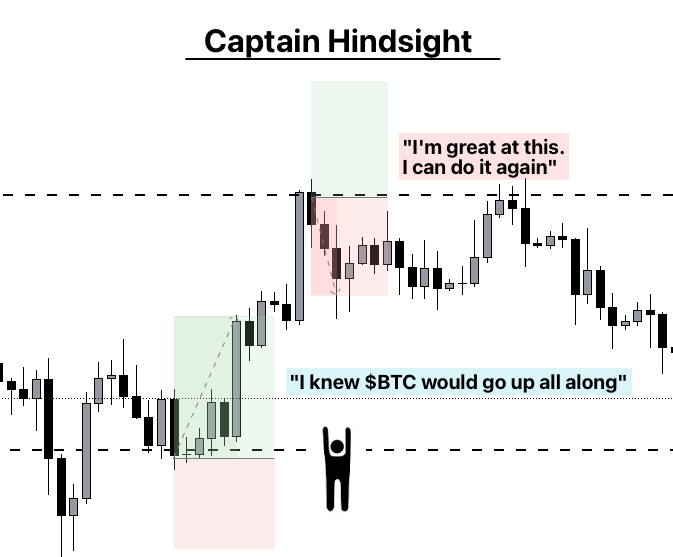

10.事后诸葛亮(Captain Hindsight)

事后看来,一切都显而易见。

事件发生后,交易者常常觉得自己早已预见了结果。

这种偏见会导致对未来预测的过度自信,并对自己的交易能力产生不切实际的期望。