举办Meme黑客松,VC开始追赶Meme浪潮了吗?

原文作者:深潮 TechFlow

通常在韭菜眼里,VC 是镰刀的助推剂,Meme 是反镰刀的大红旗。

以文化和社区驱动的 Meme 往往没有过多的一级投资和大 VC 背书,相对公平和随机的特性,也让“冲土狗”逐渐成为了一场韭菜狂欢 --- 横竖都是割,不如博 Meme 彩票仓。

只是这场狂欢,很久都不属于 VC 了。

拥有顶级预判和视野的 VC 们,自然也看得明白加密圈里的这种风向转变。焦虑也好,思考也罢,也得做点什么,在注意力经济的大浪潮下寻求突破。

最近,Variant 联合创始人 Li jin 就开始了行动,并在自己的推特中写到:

“出生太晚,无法探索地球;出生太早,无法探索宇宙;生而逢时,举办 meme 黑客松”。

这个名为 Memecoin Hackthon 的活动,介绍页面上的举办人就是 Li Jin,并定于 4 月 20 日在纽约 Variant Fund 的总部举行,号召能够构建以下方面的团队参加:

新的模因币,尤其是那些寻求对更广泛的生态系统产生正和影响(Positive-sum)的模因币

流动性层,包括 Telegram 机器人、DEX

使用 memecoins 作为 GTM 策略的应用程序

围绕 memecoin 构建实用程序的应用程序

值得玩味的是,活动中提到了一个词叫“Memefra”,即 Meme 基础设施。让有想法和能力的团队来构建 Memefra,很明显 VC 也欢迎一切为 Meme 创造条件的事物。

生而逢时,一向走高大上基建技术流的 VC 们,真的要开始适时追赶自带土狗气质的 Meme 浪潮了吗?

注意力经济,币圈永动机

事实上,VC 联创办 Meme 黑客松并不是一时兴起,更多的是顺势而为。

VC 投资讲究价值回报,而 Meme 本身具有“注意力价值”。

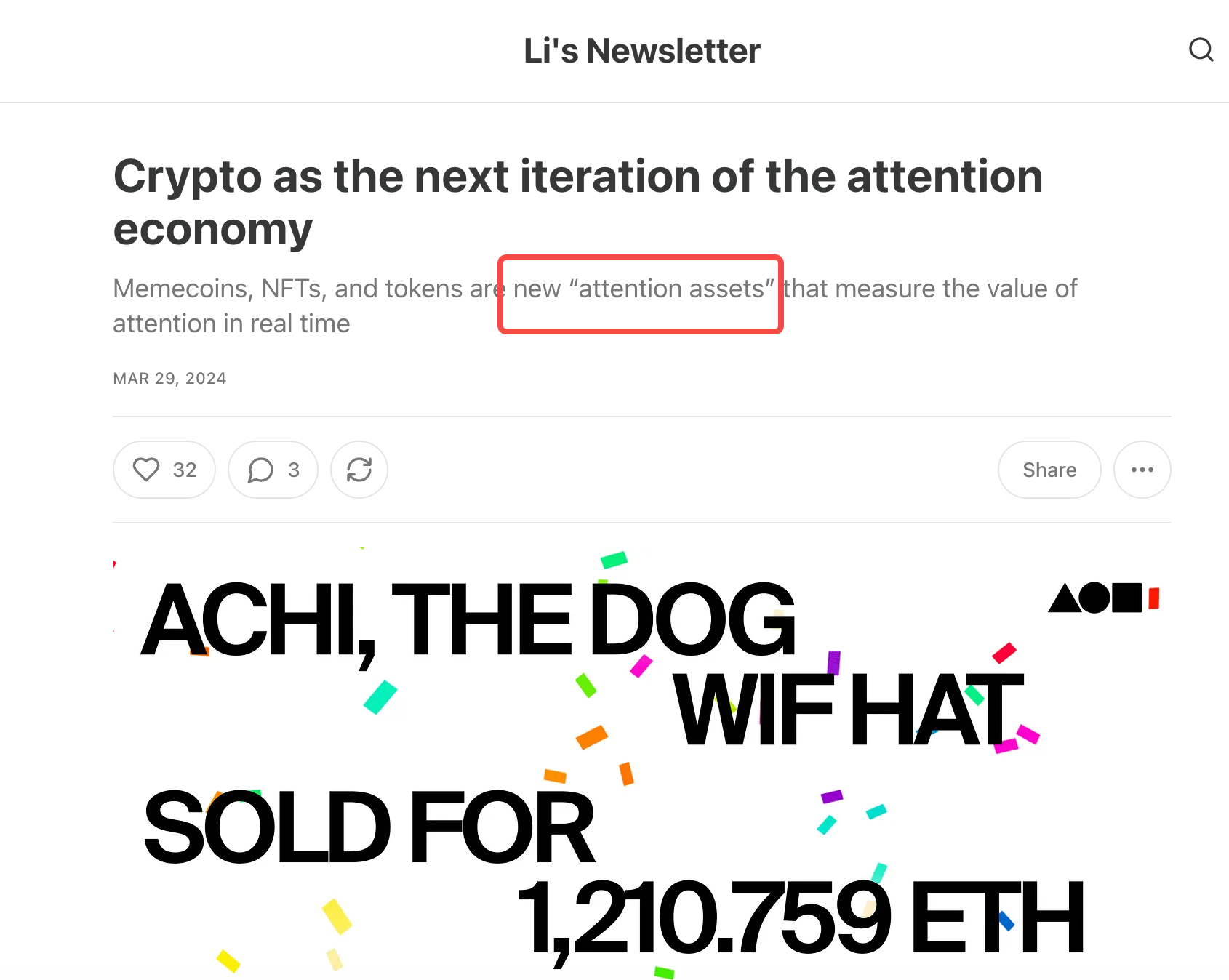

在早前 Li Jin 的博客中,其很敏锐的意识到,Memecoin、NFT 和代币是新的“注意力资产”,可以实时衡量注意力的价值。

丰富的信息会造成注意力的匮乏,因此注意力是一种稀缺资源。但 Web2 主导的广告商业模式,用户注意力带来的价值是被平台收获,而非流向用户。

因此,加密货币可以被视为注意力经济的下一代迭代,具有更加高效的市场。

Memecoin 可以实时衡量和捕获注意力的价值,用户可以投资并拥有注意力资产,以此表达他们对特定 Meme、媒体、创作者或网络是否会在未来获得更多关注和兴趣的信念。

以这种观点来看,VC 也青睐 Meme 币就变得更加合理。

毕竟若能成功投资于能捕获大众注意力的产品(哪怕是 Meme),是相当有诱惑力和说服力的。

在吸引用户注意力的同时,Meme 的出现同样给众多加密项目的营销方法和上市节奏上了一课:

传统模式下,加密项目遵循着“先产品,后注意力”的路径 --- 先通过技术构建一个产品,然后通过营销围绕它构建一个社区,为人所知并逐渐发展;

而 Meme 注意力经济下,加密项目完全可以“先注意力,后产品” --- 通过启动一个与流行的 memecoin 原生集成的项目,新的应用程序/基础设施可以动员 memecoin 的持有者基础,他们可以从他们的代币中体验到更多的实用性。

两种不同的发展思路,显然时代选择了后一种。

无论是怎样的加密项目,本质上都是在吸引注意力,让更多人参与和使用,让更多人与代币产生联系。

在注意力经济的驱动下,币圈走过了很多阶段,从比特币到以太坊,从 NFT 到 Meme,一轮叙事更迭就是一次注意力转移。

因此,VC 围着注意力转,适时做出改变也不足为奇。

用户被 VC 教育,用户也教育 VC

不过你要知道,曾经的加密市场并不是被没有来头的 Meme 狂欢主导,而是遵循传统且严肃的风险投资路径。

早年以太坊刚诞生时, 2014 年就连 Vitalik 也要向各路东西方投资人们做以太坊的项目路演和讲解。

虽然常有币圈老炮们回忆“以太坊当时大伙都看不懂,现在看没投拍断大腿”的感慨,但强如 Vitalik ,加密项目们一直遵循着不变的流程:

先用实力(或吹牛实力)打动 VC 们的注意力,再走向市场,抢夺(或收割)用户们的注意力。

这个路径里,ICO 也好,IEO 也罢,VC 以早期轮次的优势拿到了大量低价筹码,再等到项目走向二级时按不同的解锁条件抛售;其中当然有跟着吃肉喝汤的精明散户,但也不乏大量承接最后一棒的接盘侠。

久了,就倦了;用户在被一轮教育后,也大概能看明白怎么个事了。

所以我们越来越能在新的周期里看到铭文、符文和 Memecoin 这种 VC 不怎么参与、来不及参与或不屑于参与的项目,它们既打破了上述固有的风投流程,更打破了注意力成长的路径:

先用爆拉直接打动用户的注意力,再基于用户基本盘去搞别的事。

用户不是怕暴涨暴跌,而是怕我没有比你更好的机会享受暴涨暴跌,显然 Meme 们给了用户一个相对更近的渠道,哪怕也会被割,但总好过明确为 VC 接盘。

于是在某种程度上,用户们也在反过来教育 VC,大人,时代变了。

看到一场生态链上下游的角色互换很有意思,而这也正是币圈有趣的地方:

互割互伤,互为成长。